Gold’s role in wealth management

A commodity, a currency, and a hedge against risk

Experts agree that physical gold affords the investor the most flexibility compared to other gold investment options, as it is highly liquid and lacks counterparty risk. It is high-quality collateral especially during times of extreme uncertainty and volatility. Key empirical elements that favor gold include, but are not limited to, its lack of counterparty risk; high liquidity; very low or negative correlation with most other asset classes; ability to hedge inflation and deflation.

While the primary focus of this Paper is to discuss gold’s role as a risk hedge and a diversifier, it is a commodity in its own right with costs of production, scrap recycling and industrial uses. The high-carat investment- grade Jewellery sector is the all-important bridge between commodity and investment — and is a very large component of overall fabrication demand. Investment-grade Jewellery has averaged 45% of global demand (excluding Exchange-Traded Products, or ETPs, and official sector activity) over the past 20 years and global gold Jewellery (i.e., including the lower caratage products in North America and Europe) has averaged 56% of the total. Investment-grade Jewellery plus bar & coin demand has in recent years been broadly steady, but the pandemic meant that the dynamics changed substantially in 2020, with demand slumping in the key countries of India and China, which between them tend to account for over half of the world’s physical demand.

Retail and exchange-traded products: A near constant

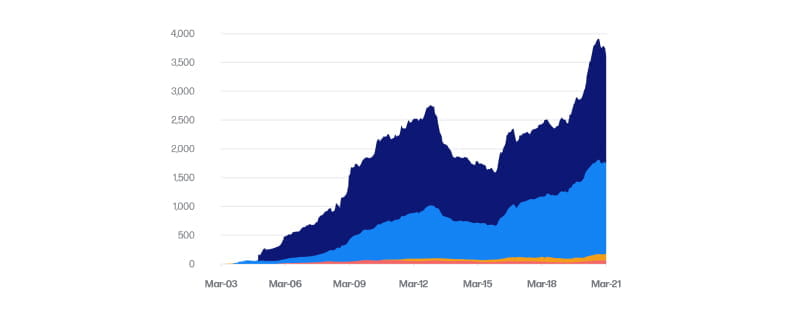

Meanwhile the ETPs consistently take centre stage due to the daily reporting patterns and they can, on occasion, be price makers rather than price takers as they reflect changing investment appetites, at least in the professional sector. At the time of writing, there are 3,554t under management (slightly more than one year’s mine production), which at $1,750 per ounce is worth $200Bn. While ETPs benefit from transparency and (generally) low costs, it can be difficult to access the gold backing them, although there is at least one ETP that gives subscribers the option to take delivery of physical metal.

The official sector and portfolio theory

One of the key parameters informing central bank policy is that of safety, as well as liquidity. While the use of the gold standard was intended to back the money in circulation and thus keep the monetary system under control, since the final third of the twentieth century gold’s role has been geared around its ability to mitigate risk and, notably since the Lehman crisis, a diversifier against dollar exposure.

Central bankers’ views of gold’s role in foreign exchange reserves have been summed up by a former Head of Foreign Exchange and Treasury at the Bank of England: - a) war chest argument; b) a credit-risk-free alternative to holding currencies in reserve; c) security for loans. Within portfolio theory, other elements that apply include (but are not limited to): no counter-party risk; high liquidity; very low, or negative, correlation with most other asset classes; inflation hedging; deflation hedging.

Institutional investors and portfolio theory

Results from an international survey of institutional investors, conducted for this paper, show that two thirds of respondents hold, or have held, gold in their portfolios with a range of reasons for making the investment. Among those who hold gold, the current average proportion of gold in the portfolios has risen. A number of influences were identified, and more than half of the respondents were looking to hedge against the risk of a financial crisis while 67% (they were asked to list all the relevant influences, not just one) pointed to inflation hedging as a key element.

Gold exposure: Now we know why. Here is how.

There is a variety of methods of gaining exposure to gold, including the Over-the- Counter (OTC) market, futures, options, margin trading accounts, ETPs, and (for leverage) gold mining shares. Experts agree that physical gold affords the investor most flexibility, and it is highly liquid and lacks counterparty risk. It is high-quality collateral – especially during times of extreme uncertainty and volatility.

Trading gold through StoneX: A primer

At StoneX, we focus on providing clients full access to both the financial and physical bullion markets. Our global operation services the complete range of market participants and offers full market coverage and trading, via our online trading platform PMXecute (PMX). Market liquidity is provided 23/5 across all metals with the ability to price in multiple currencies and settle physically.

Through our extensive network of market counterparties and bullion inventory held globally, StoneX offers clients unparalleled access to the physical metal markets and products including LBMA ingots, small format bars, coins, exclusive minted products, and refining services. As physical bullion remains a popular alternative asset for investors, StoneX also provides transparent and secure vaulting services. Our custody services are segregated, insured, and tailored to meet each client’s needs.

As a London Bullion Market Association Auction member, a member of the London Platinum and Palladium Market Association (LPPM), clearing and execution Member of CME, Singapore Bullion Market Association (SBMA) and trade member of the Dubai Gold and Commodities Exchange (DGCX) StoneX is uniquely positioned to offer clients a ‘one stop shop’ for all metals-related trading needs.

Part 1: Gold’s history - how did we get here?

For years gold was thought to have been first discovered more than 3,000 years ago in northeast Africa and in Mesopotamia, but there have been subsequent discoveries in Bulgaria, Nubia and most notably a piece of Jewellery found in north east Africa just shy of 6,500 years old. Fast-forward by four thousand years and gold coins were coming into being as a medium of exchange. In fact, despite gold being preferable aesthetically, silver was initially the favored metal for use as a currency, largely because it was easier to find than gold. Also, it was difficult to separate gold and silver from the common electrum alloy that was a major source of gold at the time. In the period 560-550 BCE in Lydia (now Turkey), there was a full-scale gold rush along with the successful separation of the alloy and King Croesus demanded gold coins to underpin his expansionary plans. Eventually silver fell out of favor because it would wear and would tarnish, and gold’s fortunes rose accordingly. The first gold standard came about almost by default in the 17th century and gold continues to retain its role as the only global non-fiat currency.

Gold’s role as a commodity

While the primary focus of this Paper is to discuss gold’s role as a risk hedge and a diversifier, it is of course a commodity in its own right with costs of production, scrap recycling and industrial uses. The high-carat investment-grade Jewellery sector is the all- important bridge between commodity and investment—and as we shall see, it is a very large component of overall fabrication demand.

Supply

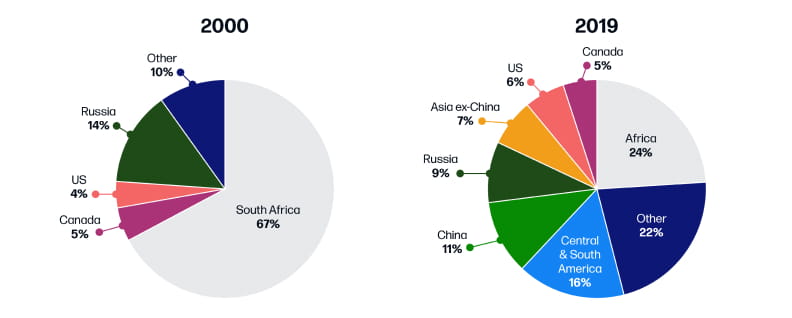

The supply side is obviously dominated by the mining sector. Over the medium term, mine supply has grown by an average 2.2% since 1970, when production was 1,497t, of which South Africa commanded a 67% share at 1,000t. The picture is dramatically different now; South Africa produced just 118t last year and will be down again this year, exacerbated by the virus. The world’s largest mine producer is China with 383t last year (actually the third year of small declines as a result of increasing environmental stringency), with Russia second at 329t and Australia third at 325t. There is then quite a drop to the next, which was the United States at 200t.

World gold mine production

Global production has been broadly steady over the past five years at between 3,400 and 3,500 tonnes annually. The lack of growth stems from the limited capital investment in the sector in recent years as the gold bear market of 2011 to 2015 meant that the mining industry, following a long period of merger & acquisition, had to implement sharp cost cutting programmes to bring down its all- in sustaining costs (AISC), as well as take impairments of more than $100 billion during this period.

The cost curve above was generated by consultancy group Metals Focus for the year 2019. In terms of total cash costs, virtually all assessed mine production was in the money last year, but in terms of AISC, this falls to approximately 90%. The average AISC in 2019 was $918. So in principle, the miners are in a position now to commit capital expenditure; indeed, according to Standard & Poor’s, global financings in the first two months (combined) of 2021 doubled year-on-year to $1Bn, and corporate activity is also expected to start to rise.

While mine supply has been steady, scrap supply is much more variable, driven by the level and/or volatility of the gold price and local conditions among gold holders, usually, but not always in the form of Jewellery. There is, of course, industrial scrap, but this is a small component.

Oscillating between supply and demand in the market are the central banks, who after an extended period of time on the supply side, have since 2010 been net buyers of gold, and recently in some substantial size, hitting a record in 2018 of 657t, and in 2019 at 646t. Buying is still substantial, but considerably lower than in 2019; Russia, the largest purchaser in the first part of this century, suspended its programme once gold had hit the target of 20% of foreign exchange, while China has also not reported any increase in reserves since September 2019; a knock-on effect of this is that official sector net purchases were down to 215t in 2020. A number of other central banks are still buyers and it is believed likely that there will be more, so the outlook is for continued offtake by the central banking sector for the foreseeable future as they diversify away from the dollar and look to mitigate risk; certainly in the first quarter of this year there has been increased interest, including additions from India and Kazakhstan while Hungary is reported to have tripled its reserves in April with the addition of over 60.

Fabrication demand

Moving to the other side of the equation, Jewellery is clearly the majority end-use. At this point we are ignoring investment into Exchange-Traded Products (ETPs) or other products.

Over the past 20 years, global gold Jewellery demand has accounted for, on average, 56% of total demand (excluding ETPs and central bank activity) and price-elastic (investment- grade) Jewellery has averaged 45% of the total demand as defined here. This price-elastic Jewellery is essentially that which is bought in the Middle East and the whole of Asia. It is high-caratage and bought on the basis of the weight of the contained gold, the prevailing price as defined by the LBMA London afternoon price of the previous day, and small fabrication charges. Equally, jewelers will buy pieces back on a similar basis; weight and prevailing price, less a refining charge. Pieces that a jeweler has on sale will already have been weighed and will carry a tag accordingly; they are then reweighed in front of the purchaser and the price is calculated in front of you.

Thus, Jewellery in these areas is a direct form of gold investment and is easily mobilized (see glossary) as a holder knows that he will receive the vast majority of the gold value of the piece on resale.

An Indian bride, demonstrating her wealth

The picture here is of a typical Indian bride. In the past, when an Indian woman married, she brought her dowry to the husband and it became effectively his property, with the exception of gold. That remained in her ownership. This was largely to give her a degree of independence, but in these more modern times it is more of a tradition, representing her wealth and prosperity. As a consequence, an Indian bride will often bring much of her wealth in the form of gold, most of which she will be wearing in the form of Jewellery on the wedding day. Among the richer families, gold bridal belts of three kilograms or more are not uncommon. That is slightly less than 100 ounces of gold.

Dubai is a key element in the logistics of moving gold between Europe, north Africa and South Asia as well as the rest of the Gulf. Equipped with modern airline and secured logistics support, as well as gold refineries, it works as an efficient entre-pôt for the gold trade, as well as feeding its own local citizens and a thriving tourist industry. The region enjoys one of the lowest tax rates on Jewellery sales and there is no tax on bullion sales. The Dubai Gold and Commodities Exchange, the local commodity exchange, operates a shariah gold contract as a benchmark reference price.

In Europe and North America, where Jewellery is in carat form, Jewellery’s role is different. “Carat Jewellery” is less than four nines (99.99%) pure. To be clear, 21, 22, and 23-carat, common in parts of the Middle East and some Asian countries, are obviously “carat” Jewellery, but the purity is high, the buying process is as described above and there is a regular two-way market, with allowance being made for the dilution of the gold with the alloying elements (usually copper at those high levels).

In the Western regions, the value of the gold is diluted considerably further. The Jewellery is rarely made on the jewelers' premises and it is also unusual for any piece to be higher than 18-carat gold. In North America, 14-carat is popular, as it is in parts of Europe, while nine- carat is still common in the United Kingdom.

Nine-carat is nine parts per 24 and therefore only 37.5% gold, with much of the rest being copper. In addition to this metallic dilution, there is a raft of other costs; manufacturing, transport, wholesale mark-up, retail mark-up, VAT and other local taxes. Someone buying a piece of plain nine-carat Jewellery (i.e., Jewellery that is only gold, with no stones set into it) in the UK, for example, can pay anything from four to six times the value of the contained gold. Similar circumstances apply in the rest of Europe and in North America. For this reason, the vast majority of “gold” Jewellery that is in the western hemisphere is thus “adornment Jewellery” as opposed to being a medium of both adornment and investment as it is in much of Asia.

Thirty-five years ago, Italy was the largest individual fabricator of Jewellery. Benefiting from the Italian flair for design, the industry was thriving and supplied Jewellery across the Middle East, North America, and the rest of Europe. Now Italy’s market share is third in line and down to just 6% as the Chinese and Indian markets have taken over, with 53% of the total between them.

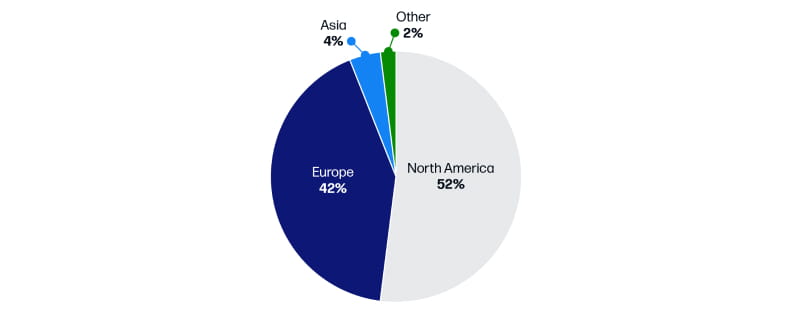

ETP holdings by region - snapshot

Source: World Gold Council, StoneX

That said, Europe is a major center for the wealth management sector, notably in Switzerland, Luxembourg, Monaco, and Liechtenstein. The largest and most sought- after gold refineries are in Switzerland, with three in Ticino and one headquartered in Marin, Neuchâtel. Meanwhile, Germany is a key player in the physical market and is host to refineries in Pforzheim as well as a large number of dealers specializing in coins.

Finally, Turkey, which is the bridge between Europe and Asia, is host to two LBMA- accredited refineries; the Nadir Metal Rafineri and the Istanbul Gold Refinery. The Borsa Istanbul houses the Istanbul Precious Metal Market and refined gold products in Turkey are required to go through this market; the most commonly traded denominations are Borsa accredited brand kilo bars of 99.50% purity, which is commonly referred to as 995.

Retail and exchange-traded products: A near constant

Physical retail gold investment: How it changes in differing financial environments

As noted above, total Jewellery fabrication is 56% of total global fabrication demand (i.e., including electronics, dentistry, bars, coins, medals and other industrial uses, but excluding ETPs and central bank activity).

Investment-grade Jewellery accounted for 45% of overall gold demand as defined here.

Private Investment Demand

EPT Holdings by Region; Evolution

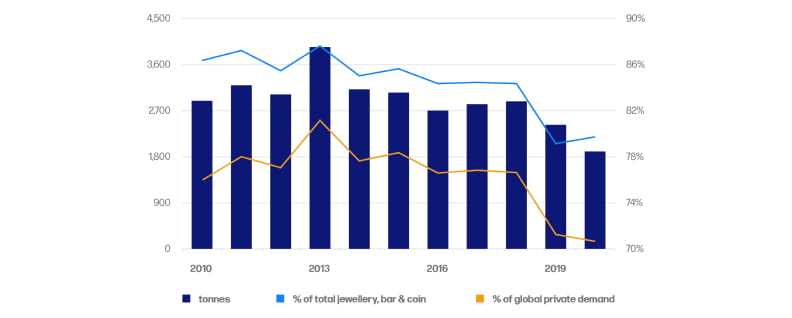

To look at the proportion of total fabrication demand that retail investment comprises, we have to add gold bars, coins, and medals to investment-grade Jewellery. On average, from 2010-2020, net bar, medal and coin purchases comprised 31% of gold demand. So, when we combine these two sets of investment products, we get an average of 77% (differs from the simple total due to rounding error) of total gold demand ex-ETPs and central banks.

As the chart shows, this combined level of private investment activity was on the increase in the wake of the Lehman crisis, and topped out in 2013 when the investment environment changed (more on this in our risk-hedge discussion below) and has declined subsequently. As we see in the preceding paragraphs, over the past decade retail gold investment has, on average, been 77% of total gold demand ex-ETPs and the official sector.

In the unusual COVID-related circumstances of 2020, it stood at just 71% of the total.

With the exception of 2013, when gold came pouring out of ETPs (money managers taking the view that the financial crisis legacy had been worked through) and was absorbed by a voracious appetite among Chinese retail gold purchasers (and some banks, aiming to capture the local price premium), physical investment- grade retail gold purchase over the past decade was broadly steady between 2,700 and 2,900 tpa. That changed in 2019, when the price range changed, from a level that had been based on $1,300 to a range where the lower boundary was $1,500, a shift that took roughly four months, between May and September.

Generally speaking, an upward range change like this (roughly +15% in dollar terms) will choke off demand in the Middle East and Asia until would-be buyers have become used to the new levels. This does not normally take more than a few weeks, but in 2019 the situation was different. The impacts of the protracted nature of the Phase One U.S.-China trade talks extended beyond China across much of the globe, and there was substantial nervousness about spending money on anything, even including gold as an investment.

More recently, the changes in the global dynamics during 2020 were substantial, with clear regional variations; the table summarizes the changes, but within those numbers, there was a 42% drop in Indian Jewellery demand and a 36% drop in Jewellery in Greater China.

Bars and coins in the West did tremendously well, however, with demand in North America tripling and a gain of 67% in Europe, and premia rocketing.

At the same time, ETP activity was picking up, especially in the western hemisphere, and ETP absorption in the first nine months of 2020 was 1,002t (60%) higher than in the equivalent period of 2019. In the final quarter, however, the ETPs went into reverse, shedding a total of 130t (driven mainly in November, by the election of a more inclusive, but not necessarily weaker-willed, President in the United States, along with three successive announcements of new COVID vaccines).

There is an interesting dynamic relationship between the retail investment activity in Jewellery and bar & coin and in investment into ETPs, which we look at more closely after the ETP summary.

Exchange-traded products: The bridge between retail and institutional

The ETPs have gained massive traction since the inauguration of the first funds in 2003 as they form a bridge between physical investment and securitized activity. The major fund (which was actually the second one to come into existence), the SPDR Gold Fund, was devised at the World Gold Council, launched in 2003 and has the largest holdings by far of any individual ETP. The Council’s primary remit was to expand the tonnage of gold purchase across the globe and the results of an extensive research program carried out by the organization determined that there was a broad constituency of potential buyers in the market who were not gold holders because either a) they didn’t understand it and/ or b) were nervous of it; or, c) as institutions (especially among the pension funds), their charters prohibited holding “commodities” and gold, for these purposes, was deemed to be a commodity.

The result of this work was the formation of the gold Exchange-Traded Fund (ETF), which trades as an equity, but which is physically backed by gold. Initially concentrated in North America, there are now in excess of 80 such funds around the globe, although the North American holdings are larger than elsewhere. Exchange-traded products are the favored gold asset in the United States, with many individual retirement accounts (IRAs) preferring ETPs to physical bullion. When physical bullion is the preferred investment vehicle, it tends to be in the form of coins, with a strong leaning towards U.S. or Canadian minted products.

| 2019 | 2020 | t (Charge) |

% (Charge) |

|

|

Jewellery |

||||

| Middle East & Asia | 1,593 | 997 | -596 | -37 |

| Western Hemisphere | 298 | 249 | 49 | -16 |

|

Bar & Coin |

||||

| Middle East & Asia | 589 | 505 | -85 | -14 |

| Western Hemisphere | 182 | 337 | 156 | 86 |

|

Total |

2,364 | 1,839 | -525 | -22 |

The gold backing the non-leveraged funds is allocated metal and the funds’ websites carry lists of bars with their numbers, refiner’s hallmark, and other details. This transparency, combined with the comparative ease with which ETPs can be traded, has been a key to their success. The management costs are broadly competitive with the rest of the market, depending on the providers. The majority of the non-leveraged funds’ expense ratios are between 17 and 25 basis points, although one large fund is at approximately 40 and there are a couple of outliers at above 70.

It is not easy to make a simple comparison with the cost of holding allocated bullion, but the one-year borrowing rate currently stands at approximately 40 basis points. There is no minimum hold period for ETPs, but this does at least give us a comparison. These management fees are in place of the costs of insurance, storage and premia associated with holding allocated gold and are broadly competitive with the bullion market by virtue of economy of scale. ETP owners have title to the equity that they have bought and not to any specific bar; as such they are, unlike holders of allocated gold, not secured creditors over their transacting counterparty.

For much of the time the ETPs are price takers, but there are occasions (2013 was a clear case in point) when they can be price makers and it is arguable that the redemptions in mid-October to mid-November 2020, with 91t leaving the funds over a period 29 days, contributed to a weakening in sentiment as the sales regularly made headlines in the major financial press outlets. This was continued in the first few months of 2021, with a net 190t leaving the funds in the year to 9th April as the price drifted down towards $1,675 before starting to form a base.

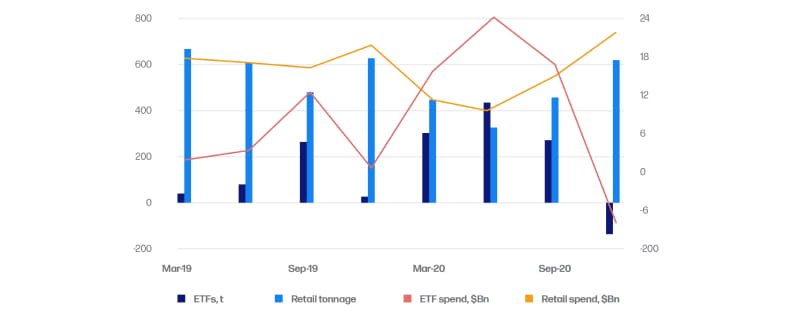

ETPs and the cross-over with private physical retail investment

The fluidity of the gold market is neatly illustrated by the interplay between Jewellery, bar & coin, and the ETPs since the start of 2019. As gold Jewellery fell away in the face of the 15% range-change that gold went through between May and September of 2019, the slack was taken up by net inward investment into the ETPs, at least in terms of tonnage, as shown in the main chart below.

The overall totals over those seven quarters to September 2020 are remarkably stable; fluctuating in a range between a low of 680t in Q4 2019 and 773t in Q1 2020, as ETP interest built up in the face of the virus, but before the full impact of the lockdown was felt in Q2. It was in Q2 that risk-hedging came into the spotlight via the ETPs, with net inward investment of 435t, which was 137t more than the net investment in Q1; while the purchase of investment-grade Jewellery and bar & coin dropped by 147t against the level in the first quarter.

In dollar terms, the story is slightly different, in that expenditure rose overall with the gains in gold's price outweighing any price-elastic responses. The chart shows the different components; “retail investment products” are price-elastic Jewellery plus bar & coin; the dollar expenditure is based on the total tonnage and the quarterly average, which is the closest that we can get. The ETP expenditure is the sum of each net daily dollar flow over each quarter.

The combination of the two elements saw Q2 spend reaching $31Bn, against $19Bn in Q4 2019 and $24Bn in Q1 2020.

The popularity of the ETPs speaks for itself. As we write, there are 3,554t under management, equating to $200Bn in value. In tonnage terms, were the ETPs a central bank, they would be the world’s second largest in terms of gold holdings, ahead of Germany, which holds 3,362t.

The world’s largest holder is of course the United States, which not only has legacy gold standard holdings (we discuss this further in the central bank section), but by definition it cannot hold U.S. dollars in its reserves.

Official sector attitudes toward gold

This brings us to the central bankers and their attitudes towards gold. The primary role of central banks is to husband a nation's resources, and their investment policies tend to be long-term and strategic, rather than tinkering at the edges or looking primarily for capital appreciation. We discuss the gold standard and its legacy in Appendix B; here we bring the situation up to date.

One of the key parameters informing central bank policy is that of safety, as well as liquidity. While the use of the gold standard was intended to back the money in circulation and therefore keep the monetary system under control, since the final third of the twentieth century gold’s role has been geared around its ability to mitigate risk and, notably since the Lehman crisis, a diversifier against dollar exposure.

A central banker's view of gold’s role in foreign exchange reserves is best summed up by Mr. Terry Smeeton, who in the 1990s was the Head of Foreign Exchange and Treasury at the Bank of England. His argument was three-fold: - “First, the war chest argument [our emboldening] — that gold is the ultimate store of value in a volatile and uncertain world... secondly, that gold may be seen as a credit- risk-free alternative investment to holdings of currencies in reserves, and thirdly, as security for loans” (source: Timothy Green, “The Ages of Gold”).

Even so, from 1989 through to 2009 inclusive, the central banks were net sellers of gold, a development that to some extent grew out of their roles as lenders of last resort, who had been supplying liquidity into the gold market to enable the bullion banks to supply mine financing and product stream hedging facilities to the mining industry. Over that period, Official Sector holdings contracted by approximately 7,750t. Since then, however, the perception of elevated financial risk, especially following the Financial Crisis of 2008, has seen a wholesale change of policy and the sector has been a major buyer since 2009; from 2010 to 2020 inclusive, an estimated 4,355t went into central bank coffers. Recently, much of this has been concentrated in emerging market nations, notably in Eastern Europe, but the major buyers, and their reported numbers, over the past decade through to March 2021 have been Russia (1,646t), mainland China (894t) and Turkey, 399t (this figure excludes the gold that the Turkish central bank holds on behalf of domestic commercial banks). The next three buyers are all in Eastern Europe: Kazakhstan, Uzbekistan and Poland, with 626t between them. Mexico and India follow, each of which have added over 100t to their reserves over that period.

At the other end of the scale, net sellers since 2009 have been dominated by cash-strapped distress seller Venezuela with 200t over the period, while Germany has released 44t, very largely as part of its coinage programme.

Gross sales have amounted to 605t, with gross purchases of 4,829t, to give a net increase of 4,224t.

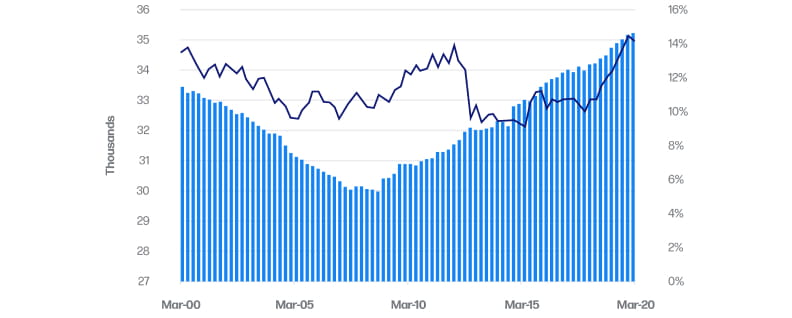

The chart in this section shows quarterly gold holdings and gold as a percentage of gold+foreign exchange combined, valued at the end of quarter price. At the end of 2020 that percentage was just over 14%. This is misleading, however. It includes, for example, the United States, which has a massive gold component of 8,134t, for two reasons: a) by definition, the U.S. cannot hold dollars as foreign exchange; and b) U.S. gold holdings are heavy as a legacy of the gold standard, which effectively came to an end when President Nixon closed the gold window in the United States in 1971.

Official sector gross gold holdings and as a percentage of FX*

*but see the text as this percentage number is skewed

A number of other countries have also been on the gold standard, all concentrated in Europe. If these countries, along with the United States, are stripped out, then the average drops to between 5.0% and 5.5%, which lies well within the bounds that portfolio theory suggests would be a viable weighting for improving risk- adjusted return.

Which brings us to quantitative analytical results with respect to the use of gold in a financial portfolio.

Statistical arguments for gold as a risk-hedge

For many years, gold was regarded primarily as a hedge against inflation. While that argument is still valid (it has been more or less ignored for some years in the west as inflation has been under control), the increasing complexity of the financial sector (quite apart from other elements such as geopolitical risk), has led to a considerable amount of work on risk adjustment, much of which illustrates how the addition of a small quantity of gold to a portfolio enhances the risk-adjusted return. The Lehman crisis intensified this interest.

Key empirical elements that argue in favor of gold include, but are not limited to:

- No counterparty risk

- High liquidity

- Very low, or negative, correlation with most other asset classes

- Inflation hedging

- Deflation hedging

The inclusion of both of the latter elements may seem counter-intuitive, but in fact, gold’s purchasing power is arguably more likely to increase in deflationary periods than during inflationary eras; and in the current environment, there have been arguments from some economists that deflation might be a more likely medium-term outcome from the current crisis than inflation. The proliferation of negative interest rates across Europe is a related issue that is likely to persist for the foreseeable future.

To be fair, the change in the consumer price index in the United States has been negative in just eight months since August 1971 and all eight of these were in one consecutive period from March to October 2009. In Germany, just 12 months fit the criterion, of which eleven were in 1986-1987. If we go further back in history, in each of the four deflationary periods since the 17th century in England, gold has increased its purchasing power by between 42% (1658-1669) and 251% (1920-1933).

In the United States, there have been three recorded deflationary periods — and gold increased its purchasing power in each of them — by between 44% (1929-1933) and 100% (1814-1830). It could reasonably be argued that these results stem from periods when the gold price was fixed, but in her update to Roy Jastram’s book The Golden Constant, economist Jill Leyland notes that while a fixed price could help in the short term, there is a mass of economic experience showing that a price cannot remain fixed in the face of overwhelming fundamental forces.

To revert to the official sector for a moment: the World Gold Council’s 2020 Central Bank Gold Survey (published annually in May) reported that 20% of central banks intended to increase their reserves over the following 12 months and 88% cited negative interest rates as relevant to their decisions, clearly reflecting prevailing conditions. The four traditional parameters were all at the top of the lists, i.e., gold’s historic position and its role as a long-term store of value. No default risk, and effective portfolio diversifier were fourth and fifth. But soaring into third place was performance in times of crisis.

Those key central bankers’ attitudes apply, obviously, just as effectively with other portfolio managers.

Results from an international survey of institutional investors, conducted for this paper, show that two thirds of respondents hold, or have held, gold in their portfolios with a range of reasons for making the investment. Among those who hold gold, the current average proportion of gold in the portfolios has risen. We asked for respondents to choose all motives that applied; 67% cited inflation hedging, followed by 56% looking to hedge against the risk of a financial crisis; portfolio diversity also commanded the same level of interest. Safe haven was next at 44%, while expectations for persistent negative yield in fixed income sector was only a minor player, as was the profit motive.

As far as risk-aversion was concerned, the majority have maintained a steady attitude to risk, while 29% are more prepared than hitherto to take on risk with a view to higher reward and 18% are more risk-averse than they have been previously.

The proportion of gold held in those portfolios ranged from 2% to 20%, with an average of just less than 9%. The majority of those holding higher than the average had increased their holdings over the past five years, and more than 50% of them cited hedging against a financial crisis as one of the key drivers.

Some 80% of those with gold exposure had taken it through ETFs. There was also 60% with exposure to physical bullion and 40% with mining equities. Additionally, of those currently with gold exposure, the vast majority had increased it over the past five years.

These results support the theories generated by quantitative work, as below.

We utilized World Gold Council analysis, looking at gold’s effectiveness in times of stress. The upper chart looks at how the We looked at how ggold’s correlation with the S&P 500 responds to different performance in the S&P, measured in terms of a) all S&P returns, and then with falls of more than two, three and four standard deviations respectively. The work was based on weekly returns from January 1971 to March 2020.

Over the entire period, the correlation was just in positive territory, but only just; at 1% while the two standard deviation falls show a negative correlation of 4%; falls of >3 standard deviations, minus 13% and >4, minus 57%. The WGC also notes that when the equities are in positive territory, gold’s correlation becomes positive also, with a 29% positive correlation when the S&P gains more than two standard deviations, and when the markets are generally in risk-on mode.

There are six Black Swan events (Black Monday October 1987, LTCM, Dot-com, 9/11 and two sovereign debt crises); two recessions plus one pullback; and COVID-19. The price moves are measured over the duration of the spike in VIX in each case.

Gold’s performance was positive in all except two cases. With the exception of the LTCM crisis, when there was a big flight to Treasuries, it was the outperformer. The two exceptions were the 9/11 crisis and the VIX spike during the COVID meltdown. In both of these examples gold was a faller to start with as investors sold positions in order to generate liquidity and because of the potential need to meet margin calls in other assets.

This is not unusual. Gold will frequently be sold when equities are in distress as it acts as an insurance policy as described above. Generally speaking, however, once it has done that job, long positions will be re-established. As the table shows, the February to March falls as COVID took a firm grip, included gold, but its fall was the shallowest and its recovery period was the shortest. In our survey, among the respondents who had ever liquidated gold under duress, twice as many rebuilt positions as soon as feasible, compared with those who preferred to wait for a strategic entry point. Later in the year, gold had momentum taken away on the rolling news of three potentially effective vaccines and risk appetite gained traction.

Meanwhile it is also worth looking at gold’s market depth, which tends to surprise a lot of non-specialists. Average daily trading volumes as of end-2020 were $235Bn for the S&P 500. Gold, at ~$183Bn was ~78% of the volume of the S&P and exceeded T-Bills by 8%. These numbers though include futures exchanges and ETPs. It is fairer to look at LBMA trading volumes, which for the twelve-week moving averages to end-March 2021 showed a daily average of $63Bn. This, though, is an under-estimate as it is only the OTC volumes traded by LBMA Members. On the basis of WGC estimates for non-LBMA OTC average daily trades in this year to early May, we can augment LBMA OTC trades by 73%. It is therefore probably fair to say that OTC trades in gold are currently running in the region $105Bn per day. This is equivalent to 45% of the S&P and 62% of US T-Bills as measured over the course of 2020.

Gaining exposure to gold

As we have outlined in some detail earlier, physical investment is key to the gold market, and substantial tonnage goes into private hands through high-purity Jewellery as well as bars and coins. As tracked by the World Gold Council, the average annual demand in these forms has averaged 2,855 tonnes per annum over 2010 to 2020 inclusive, for an average approximate annual dollar expenditure of $126Bn.

This is only the identifiable physical tonnage in what might be termed “consumer products.” Private investment in bullion form is less easy to track on a dynamic basis because of the confidential nature of OTC transactions, but private investment holdings are estimated by WGC at 44,385t (or 22% of above-ground who also further distributes the responsibility of storage to a Custodian.

Paper gold is viewed as more speculative, albeit accommodating for people who are looking to trade in and out of gold rapidly. A holder of allocated gold is a secured creditor of the house that has custody of the metal. Unallocated gold holders are not secured creditors, and ETP holders are not secured creditors of the transacting counterparty. In building the business argument as to why people should pay more attention to physical gold, there is a substantial case for gold as wealth protection and wealth preservation tool, as well as for wealth accumulation.

Estate planning, leverage and diversification

Physical gold certainly has some advantages for estate planning purposes. A high-net- worth client, for example, might open a joint stocks); at $1,750 per ounce, this is worth $2.5 trillion or roughly 92% of France’s GDP. And then of course we have Official Sector gold holdings, which can also be classed as investment for reasons that we have also outlined earlier. The latest figures put Official Sector gold holdings at 35,219t; at $1,750 per ounce this would be valued at $2.0 trillion.

Over the counter

The OTC (Over the Counter) market allows for market participants to trade directly with each other as principals. The two participants trade bilaterally, which means they agree to a size, price, trading in ounces or kilogrammes and settlement date. Upon settlement, there is an exchange of cash for the metal. The main advantage for investors who participate in the OTC market is the high level of flexibility that is offered as opposed to trading on an exchange where there is less flexibility. London is the global centre for precious metals trading, with more than $60 billion of gold traded each day. The London market also hosts the precious metals benchmarks. The LBMA benchmarks allow for globally recognized reference price, allowing users to buy or sell at the published price.

Once a decision has been made to commence or increase exposure to gold, the investor must next decide the format for that investment, whether to purchase 'paper' gold or the physical asset itself. The typical paper avenues are margin trading accounts, ETPs, and on a leveraged basis, shares in gold mining companies, or the gold futures and options markets.

Experts agree that physical gold not only affords the investor the most flexibility, but it is highly liquid and lacks counterparty risk. It is high-quality collateral especially during times of extreme uncertainty and volatility.

While ETPs, as discussed, benefit from transparency and (generally) low costs, it can be difficult to access the gold backing them. There is, however, at least one ETP that gives subscribers the option to take delivery of physical metal. Another element to be considered is the inherent counterparty risk in the chain of custody. Buying an ETP share involves transacting with an authorised seller. This does not confer direct ownership of a specified gold bar or part thereof; rather, that share is a promise of ownership from the fund's trustee, ownership account with an heir, which means that they do not need to validate the wealth within any jurisdiction where the gold is stored. This can enable a smoother transfer of assets.

In a practical sense, gold bars, unlike property or stock funds, are highly efficient wealth management tools for estate planning. Gold bars are available in many sizes and, as such, are easily divisible, transportable, and highly durable. Many private banks that help clients buy and store physical gold recognize that the client's liquidity can also be maintained via leverage. Hence, many banks will also offer to lend against the bullion, whereas only a few of the private, non-bank firms will provide such a service.

The banks will lend, for example, up to 80% against the value of the gold holding and will probably charge a marginally higher interest rate than for other loans backed by property assets, for example.

A few private precious metals firms are also lending against gold that their clients have bought through them and which they then hold in one of the major logistics companies' storage facilities.

Trading gold through StoneX: A primer from the StoneX Precious Metals Team

Modern trading processes

The modern bullion market is broad and diverse – comprising multiple exchanges, products, and liquidity centers globally. At StoneX, we focus on providing clients full access to both the financial and physical markets. Whether you want to hedge your physical position, take a directional view, or invest in physical metal, we can offer you easy access via our trading platforms and comprehensive network of physical supply chains.

Our experienced team offers trading services to the full spectrum of market participants, including, but not limited to, mining companies, wholesale traders, refineries, financial institutions, Jewellery manufacturers and wealth managers. As a global operation, we ensure our clients get full coverage and universal access to the related financial markets through our offices in London, Singapore, Europe, Shanghai, Dubai, and the United States.

The physical bullion market

StoneX’s Global Precious Metals Trading team offers clients unparalleled access to the international physical markets. Through our extensive network of market counterparties, exchanges, refineries, mints and vaulting/secure logistic capabilities, StoneX is uniquely positioned to offer clients the full range of physical products, including LBMA good delivery ingots, small format bars, coins and exclusive products. We are also able to provide traders and investors same day liquidity for buy-back of physical holdings.

Facilities: Physical metal trading

StoneX operates an extensive wholesale trading program either maintaining or having access to a wide range of physical bullion inventory around the globe. We also offer physical liquidity with buy-back. StoneX’s precious metals teams are located in London, Luxembourg, Frankfurt, New York, Houston, Santa Monica, Dubai, Singapore and Shanghai.

StoneX precious metals products

- Physical supply of LBMA/LPPM accredited brands of gold/silver/PGMs

- Physical supply of Coins, Small Bar and Exclusive Products

- Custody Accounts and Logistics Services

- Liquidity / Buy-Back of physical metals

- Location Swaps across global jurisdictions

- Financing of physical LBMA stocks

- Hedging / Risk Management Solutions

- Electronic Trading (with ability to convert positions to physical at a future date)

- Trading available in multiple currencies

- Market Intelligence

StoneX has been appointed Chairman of the Singapore Bullion Market Association (SBMA) by the SBMA’s management committee since 2017. The SBMA includes bullion banks, refineries, the Singapore Exchange and the World Gold Council.

Memberships:

- London Bullion Market Association

- London Platinum and Palladium Market Association

- Clearing and Execution Members of the CME

- Singapore Bullion Market Association

- Trade Members of the Dubai Gold and Commodities Exchange

- Luxembourg Financial Markets Association

Exclusive mint dealership: StoneX Bullion

StoneX strengthened its physical precious metals offering with the acquisition of coininvest GmbH in April 2019, now rebranded as StoneX Bullion. StoneX Bullion is a leading online precious metals retailer, offering clients the chance to buy, sell, and invest in coins and bars easily and quickly. Authentic and secured, products are sourced directly from world- renowned global mints and LBMA refineries.

Specialized in both private and corporate clients, StoneX Bullion keeps popular bullion products readily available in the US, Europe, and Asia.

With competitive prices, many products can be shipped same-day across the world.

Investment metals and custody services

Many investors and wealth management clients choose to hold physical bullion rather than owning paper or ETP positions. Physical bullion holding remains popular as it affords the investor flexibility and liquidity in their chosen jurisdiction. However, selecting the right vaulting partner can be complicated.

StoneX recognizes the growing trend for investment in alternative assets such as bullion and the need for transparent and secure access to the bullion markets and vaulting services. High quality transportation, vaulting and insurance is paramount for an efficiently functioning bullion market. There are a number of global precious metals logistics firms that ensure the integrity of the market and work with financial institutions such as StoneX to offer a robust logistics and security service network to transport and vault metal safely.

Custody service

- Fully allocated and segregated storage solutions

- Full insurance coverage

- Vaulting solutions tailored to each client's needs

Over the counter (OTC) trading via PMXecute

Through our bespoke trading platform, PMXecute, StoneX provides clients direct access to the OTC Precious Metals Market, with liquidity 23/5 across all metals and the ability to place orders (including LBMA Benchmark Auction Orders) and request payments online. We also give access to pricing via a mobile app and API.

Every trade undertaken on PMXecute creates an unallocated Loco London metal position. The term Loco London refers to gold and silver bullion that is physically held in London vaults to underpin the trading activity in the bullion market. The customer does not own specific bars but has a general entitlement to an amount of metal.

Clients of StoneX may however choose to convert trading positions into physical settlement, i.e., by taking delivery of bars/coins at a pre-agreed premium at an approved location.

The ability to convert OTC market positions into physical metal globally (and vice versa) provides our customer base with the utmost flexibility.

Trading on PMXecute is also available in multiple currencies that include, but are not limited to, AUD, SGD, EUR, USD, GBP.

StoneX is a one-stop shop offering full and uninterrupted access to the bullion market and its related services, including an extensive product coverage, market analysis, and global reach.

Gold’s history: How did we get here?

The oldest gold piece that we know of is a bracelet of almost 6,500 years of age, and the market has evolved since then to the point where many of the world’s central banks use their gold holdings as a means to shore up foreign exchange reserves, often in the face of economic and political crisis.

Gold serves as a commodity with an industrial user base, a key medium for Jewellery, a physical investment medium, a risk hedge and to some extent a speculative medium, notably on futures exchanges, while investment in gold mining equities is another geared form of exposure.

How did gold come to occupy the position that it does?

The simple answer is “by dint of ancient usage” – but what led to that usage in the first place? Its visual attraction is apparent, with its obvious beauty, along with the fact that it is highly malleable and chemically inert; furthermore it was initially readily available in alluvial deposits that made it easy to exploit.

For years gold was thought to have been first discovered more than 3,000 years ago in north- east Africa and in Mesopotamia, but there have been subsequent discoveries in Bulgaria, Nubia and most notably a piece of Jewellery found in north east Africa, just shy of 6.500 years old.

Fast-forward 4,000 years and gold coins were coming into being as a medium of exchange. In fact, despite gold being preferable aesthetically, silver was initially the favored metal for use as a currency, largely because it was easier to find than gold. Also, it was difficult to separate gold and silver from the common electrum alloy that was a major source of gold at the time. In the period 560-550 BCE in Lydia (now Turkey), there was a full-scale gold rush along with the successful separation of the alloy and King Croesus demanded gold coins to underpin his expansionary plans.

Conventional wisdom has it that Julius Caesar was the first leader to have coins minted with his likeness on them, but there is a school of thought that argues that Tissapherens (445- 395 BCE) was the first; he too was a governor of Lydia. Now of course there is a range of legal tender gold coins, but since the gold standard was scrapped and the Bretton Woods system came to an end no country now backs its circulating currency with gold.

The gold standard: A brief overview

JM Keynes’ “barbarous relic” actually came about by default rather than by design in the late 17th century and persisted intermittently in one form or another through to the second half of the 20th century. In the 17th century silver was the primary metal for coinage as gold, once again, was too scarce to support a full circulating coinage system. Silver, however, had its problems because it would wear and lose condition.

Gold was already in use for transitions between finance houses and because of silver’s issues, gold came increasingly into favor. In addition, gold was valued at the English Mint at probably too high a price (the gold:silver ratio was 15:1) while silver was also migrating into India and China, where it carried a higher price than in the West. Attempting to redress the balance, the King of England imposed a maximum gold price of 21 shillings, which is where the term ”guinea” comes from, as it was named after Guinea the country, which was one of the major gold producers of the time.

With this price stipulation, therefore, England found itself, more or less by default, on a gold standard. From then onwards, a large number of countries would also be on a gold standard at one stage or another.

In essence the gold standard works as follows:

“a fixed price for gold, gold coin either forming that major circulation of currency within a country or with notes redeemable in gold, coupled with free import and export and all balance of payments deficits settled in the metal” (Timothy Green, “The Ages of Gold”).

This meant that currencies were convertible into gold and international transactions were settled by the physical movement of the metal. In order to minimize the level of shipments, the Bank of England would adjust its interest rate and the exchange rate would float accordingly, maintaining sterling’s parity with its gold holdings. The major central banks would also lend gold to each other in times of stress.

This all broke down during the first World War, with France, Germany and Russia stopping convertibility almost immediately. Once the war was over, the economic position was such that fixed exchange rates were initially unfeasible. Gold flows re started in 1919, though, prompting suggestions of a fresh gold standard, which was ultimately adopted in 1925, with the United States the de facto head of affairs.

Forty- two other countries were on the standard by 1930, at $20.67/ounce. Official reserves were concentrated in a few hands and a number of these have high levels of gold reserves even now, as a result, which skews the percentage of gold in foreign exchange reserves overall. England came off in 1931 when the Government collapsed amid economic chaos and sterling slumped. European central banks bought heavy amounts of gold from the United States, fearing that the dollar was destined to go the same way, as, effectively it did, when President Roosevelt took the United States off the gold standard in 1933 and brought it back on at $35 in 1934.

The Bretton Woods Agreement of 1944 brought the International Monetary Fund into existence and underpinned fixed exchange rates with a 1% tolerance, against either gold or the dollar.

The devaluation of sterling in 1967 and the slump in the dollar due to the Vietnam war massively increased already overwhelming gold buying around the world and in the end the London gold pool had to be suspended for a fortnight as it was impossible to mobilize enough gold to keep the price where it was. The Swiss banks were quick off the mark in securing South Africa’s mine supply and this was the start of the globalization of the gold banking market.

Glossary

Key terms in use in the markets

All-In Sustaining Costs (AISC)

AISC are all the costs of a mining operation, taken together. The components can vary from company to company, but essentially they include: adjusted operating costs (largely mining/processing, G+A, royalties, production taxes, 3rd party smelting, refining and transport costs), plus corporate or regional administration, reclamation and remediation, sustaining capital expenditure and leases.

Allocated account

An allocated account is backed by a specific bar of the precious metal in question. An investor, therefore, would see a weight list of bars, plates, or ingots on their account, showing their numbers, along with gross weight, fineness, and in gold’s case, the fine content. An allocated account holder is a secured creditor over the custodian bank and in theory were that bank to go under, the customer would be legally entitled to physically remove the bar from the property. The customer would also have to trade in volumes that are multiples of the Good Delivery bar sizes (in this instance 400 ounces with a tolerance on either side).

Barbarous relic

Turn of phrase used by JM Keynes in 1923, not dismissing the gold standard as a useless measure, but pointing out the different financial circumstances and practices that grew up after the First World War; “In truth, the gold standard is already a barbarous relic”.

Black swan

An extremely rare and potentially catastrophic event that is not predicted and which can have very severe ramifications.

Carat Jewellery

Jewellery which is fashioned from anything less than 24-carat gold. The word derives from Greek karation, Italian carati and Arabic qirat, meaning fruit of the carob tree. Carob seeds used to be used in jewellers’ scales as it used to be believed that all carob seeds were of uniform weight.

Custodian

A bank providing safe custody for a client’s holdings. The Bank of England, for example, one of the world’s largest gold custodians, provides safe custody for the United Kingdom’s gold reserves and those of many other central banks.

Deflation

Falling prices in an economy.

Disinflation

A decrease in the rate of inflation.

Exchange-traded product (ETP)

Physically backed by the underlying commodity, ETPs trade as equities and are listed on stock exchanges. They thus allow institutions to gain exposure to commodities without having to enter the commodities sector per se.

Fabrication vs consumption

Fabrication is where gold is fabricated into a finished piece; consumption is determined as being at the point of sale. So while a piece of Jewellery may be fabricated in Italy, it may be “consumed” in the United States, for example.

Four nines

99.99%; the highest purity of gold used in Jewellery. High technology can use gold as fine as six nines, but four is the limit for private use.

Gold window

The “gold window” was another name for the method of gold trading during the period when the dollar was on the gold standard. It was through the window that central banks could convert dollars into gold or other reserve assets and by stopping this (15th August 1971), President Nixon effectively ended the Bretton Woods agreement. The collapse of the London Gold Pool in 1968 meant that there was a “freely floating” gold price, but the official sector continued to trade at $35, offering significant arbitrage opportunities. This also ended when the window was closed.

Kilo

One kilogramme of gold is 32.1507 troy ounces. So at $1,800, a tonne of gold is worth $58M.

Mobilization

The return of metal into the market, such as the sale of investment bars.

Over the Counter (OTC)

A principal-to-principal transaction, the way in which the global precious metals markets operate. Different from trading on the exchanges; all the risks, including credit, are between the two parties to a transaction. A dealer working with a client will tailor the transaction to the requirements of the client, offering different types of metal, value dates and delivery locations. This is therefore much more flexible than exchange-traded contracts. The fulcrum of the OTC precious metals markets is London.

Price-elastic

A commodity whose flows of supply and demand respond directly to price moves, levels, or volatility.

Scrap supply

Metal re-melted and refined from scrapped gold or gold- containing items, such as Jewellery, electronic components.

Swap rate

The rate applicable to a forward transaction; typically, a swap rate is the prevailing interest rate for the period minus the interest rate for lending the metal.

Unallocated account

An entry on an unallocated account is effectively a debit or credit exposure to the institution that is holding the metal. The account holder has a claim on the relevant amount of the metal held by the clearer. This is advantageous in that it means a customer can trade in a specific amount of money rather than specific weights of metal. The customer is, in this case, an unsecured creditor of the custodian, and so if that institution fails, the customer will lose the metal. The LBMA estimates that roughly 90% of all precious metals traded in the OTC market is on unallocated account.

About the author

Rhona O'Connell

Head of Market Analysis, EMEA and Asia StoneX Financial Ltd

Rhona O’Connell has over 30 years of experience as a commodities analyst, and is a recognized authority in the precious metals sector. She has worked as a metals market analyst in many aspects of the industry, including the mining sector; commodities broking at Rudolf Wolff, where she was a major contributor to Wolff’s Guide to the LME; and in the equity markets and investment banking, where at Shearson Lehman she was the Group Precious Metals Analyst responsible for advising a wide range of market participants from trading through equities to corporate finance.

She has held Extel ranking (2nd place) in the gold sector and has been the Association of Mining Analysts “Commodities Analyst of the Year”, is a regular contributor to the media, and has a large number of speaking engagements to her name.

After a number of years running the GFMS team at Thomson Reuters, Rhona is now the Head of Market Analysis (EMEA and Asia) at StoneX Financial Ltd.

Rhona holds an honors degree in Law from the University of Cambridge