U.S. Milk Production is Facing Some Headwinds in 2024

U.S. milk production is on a losing streak. After adjusting for leap year, production has been below the prior year for 9 consecutive months (July 2023 to March 2024) which is the longest streak since 2001 and odds are we’ll stay below year ago for another 4 or 5 months. The decline is being driven by a mix of short-term and long-term drivers including high input costs in 2022 and 2023, weak milk prices in some regions, a lack of replacement heifers, a shift in the breed of cows we’re milking and now avian influenza showing up in dairy cows.

You can break milk production down into two basic components, the number of cows being milked and milk production per cow (PPC). The biggest drag on milk production right now is due to a decline in the number of cows in the dairy herd over the past year. The dairy herd in March was down 98,000 cows or 1.0% from the prior year. Higher on-farm costs, especially feed, in 2022 and the first half of 2023 squeezed margins and limited herd expansion. Cheese prices have been relatively weak over the past year, so dairy farmers in regions that produce a lot of cheese have faced pressure on the revenue side too. Compared to a year ago in March, the dairy herd in New Mexico was down 41,000 head, Texas was down 21,000 and Minnesota lost 8,000 head.

Rebuilding the herd is going to be a slow process. The number of heifers expected to calve this year are at the lowest level we have on record (going back to 2003). Thanks to high beef prices and a shrinking beef herd, dairy farmers have increasingly been cross breeding their dairy cows with beef and selling the resulting calves into the beef industry. That has limited the number of calves being raised to replace the existing dairy cows (or to grow the dairy herd). Dairy farmers have recognized the tightness in replacement heifers and are sending fewer dairy cows to slaughter this year, which is helping to hold the size of the herd roughly steady in recent months, but it will be difficult to grow the herd in the short-term.

The second part of milk production is production per cow (PPC). Historically PPC grows about 1% to 1.5% per year as the genetics in the herd improve, facilities improve and management of the cows and farms continually improves. But instead of growing by 1% to 1.5%, PPC was only up 0.6% in 2022, 0.1% in 2023 and it was down 0.1% year-over-year in the first quarter of 2024. We can blame some of the weak growth on high feed costs in 2022 and early 2023 along with some weather issues (especially flooding in California), but there is something deeper happening. Over the past decade dairy farmers have been shifting away from Holsteins, the iconic black and white cows, and moving toward Jersey and Holstein-Jersey cross-bred cows. Jerseys are a little smaller and easier to manage and a little more efficient at turning feed into milk protein and fat, but they produce less milk overall than an average Holstein which is likely slowing the growth in milk production per cow at the national level.

A second (potential) issue for PPC is avian influenza showing up in dairy cows. There were rumors about sick cows in Texas in early March and no one could figure out what was wrong with them. Then in late March the USDA confirmed that these cows had contracted Highly Pathogenic Avian Influenza, which was the first time this disease was found in cows. As of May 7th, 2024, the USDA has found 36 infected herds across 9 states, but the true number of cases is likely much higher. About 10-15% of the cows on infected farms show significant symptoms which include reduced feed intake and a dramatic drop in milk production for 7 to 10 days, and then most of the cows bounce back. There also seems to be some subclinical cases in the herds as well which is likely reducing milk production a little, but the cows aren’t showing significant symptoms. From what we have heard production for an affected farm drops by about 20% for a few weeks before mostly recovering. There is a lot we don’t know about HPAI in the dairy herd like how widespread it has been or currently is, how it is being spread and what the long-term impacts are to the cows and production. For now, it doesn’t seem to be having a dramatic impact on national level milk production, but it needs to be watched carefully.

So, the dairy herd is down from last year and will probably struggle to rebuild. Milk production per cow is weak due to the shift in the types of cows we’re milking as well as some negative impact from HPAI. It is easy to see why milk production has been struggling and why it will take a while for it to recover. What I didn’t mention is that milk production can actually be broken down into three parts, cows, production per cow, and the amount of fat and protein in the milk. Unfortunately, the amount of fat and protein in the milk is not reported as part of the Milk Production report from the USDA you have to go looking for that data from other sources. And what the data shows is that the fat and protein in the milk has consistently been growing over the past 10 years. Those Jersey and Holstein-Jersey cross bred cows produce fewer pounds of milk than Holsteins, but the concentration of fat and protein in the milk is higher. At the end of the day, the fat and protein (and lactose) are the important parts of milk, not the pounds of water that come out of the cow.

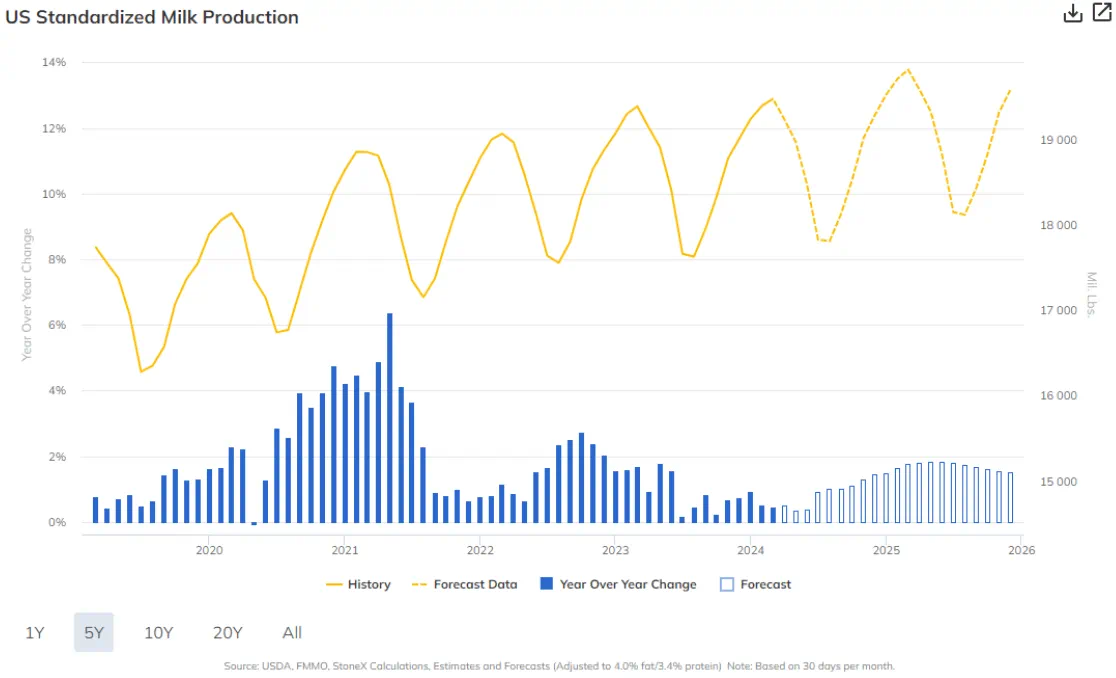

If you look at the production of milk fat and protein coming from U.S. dairy farms, the volume has continued to grow and has been running above year ago levels for the past 46 months, although the growth has been weaker than average. We’ve had a lot of headwinds to milk production, and we are probably looking at below average production growth for the remainder of 2024. But if you adjust the data to reflect the amount of fat and protein in the milk, things don’t look quite as bad.

Stay ahead of volatile dairy markets with StoneX Plus

Keep in front of evolving U.S. milk production activity with a free trial subscription to our interactive data platform, StoneX Plus.

Written by: Nate Donnay, Director - Dairy Market Insight

The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss. Past results are not necessarily indicative of future results.