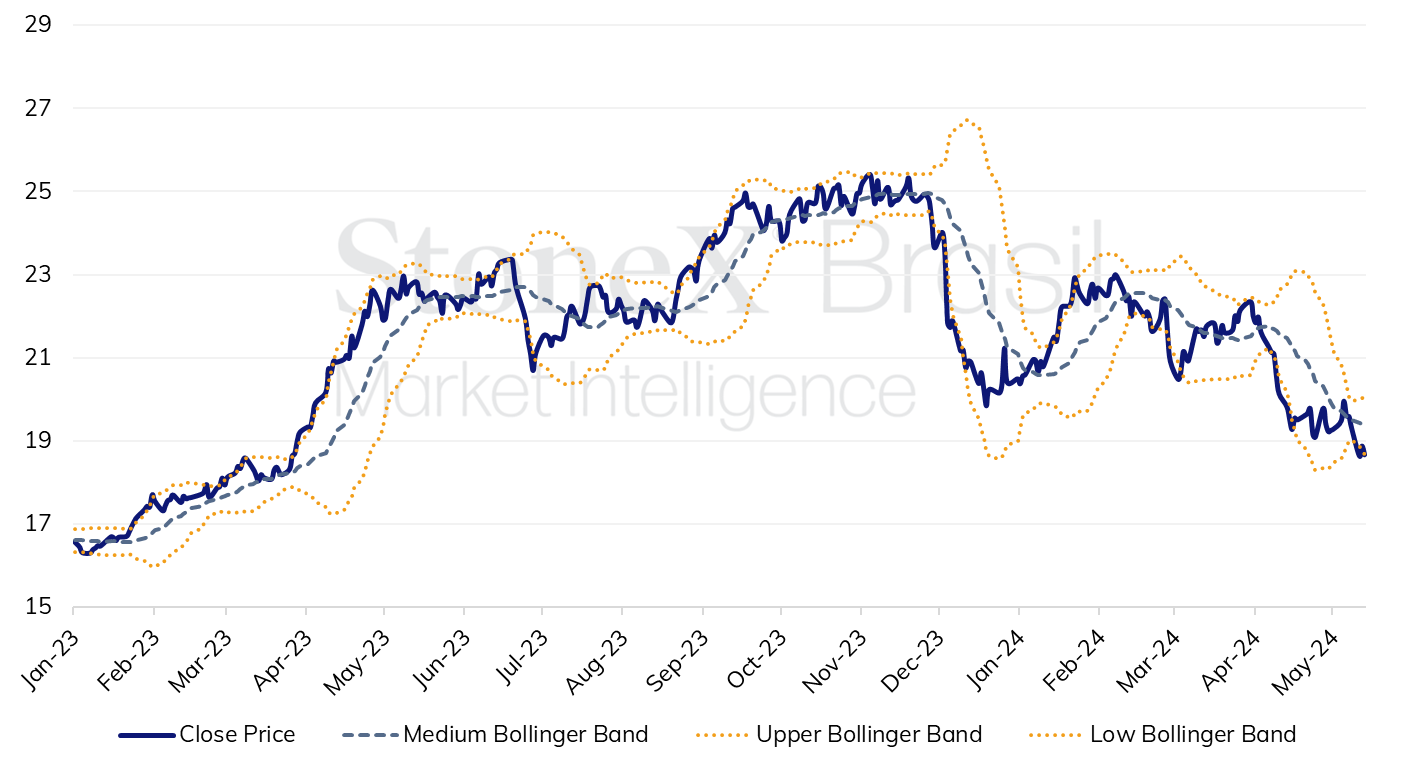

Raw sugar prices, traded on the New York exchange (ICE-US), have been in a strong downtrend since the beginning of April/24. With the start of the 2024/25 crop (Apr-Mar) in the Brazilian Center-South and expectations of a surplus in the commodity's global balance, sugar has been under constant downward pressure related mainly to the fundamentals of more abundant supply, mainly due to high Brazilian exports.

In this context, from the beginning of April 2024 to this writing ( May 16), the raw sugar contract #11 expiring in July/24 (SBN4) has already fallen by 17.9%, consolidating a 10% drop since the beginning of 2024 and resulting in the lowest price since March/23 for the contract (US¢ 18.33/lb).

Raw sugar prices #11 - SBN4 (US¢/lb)

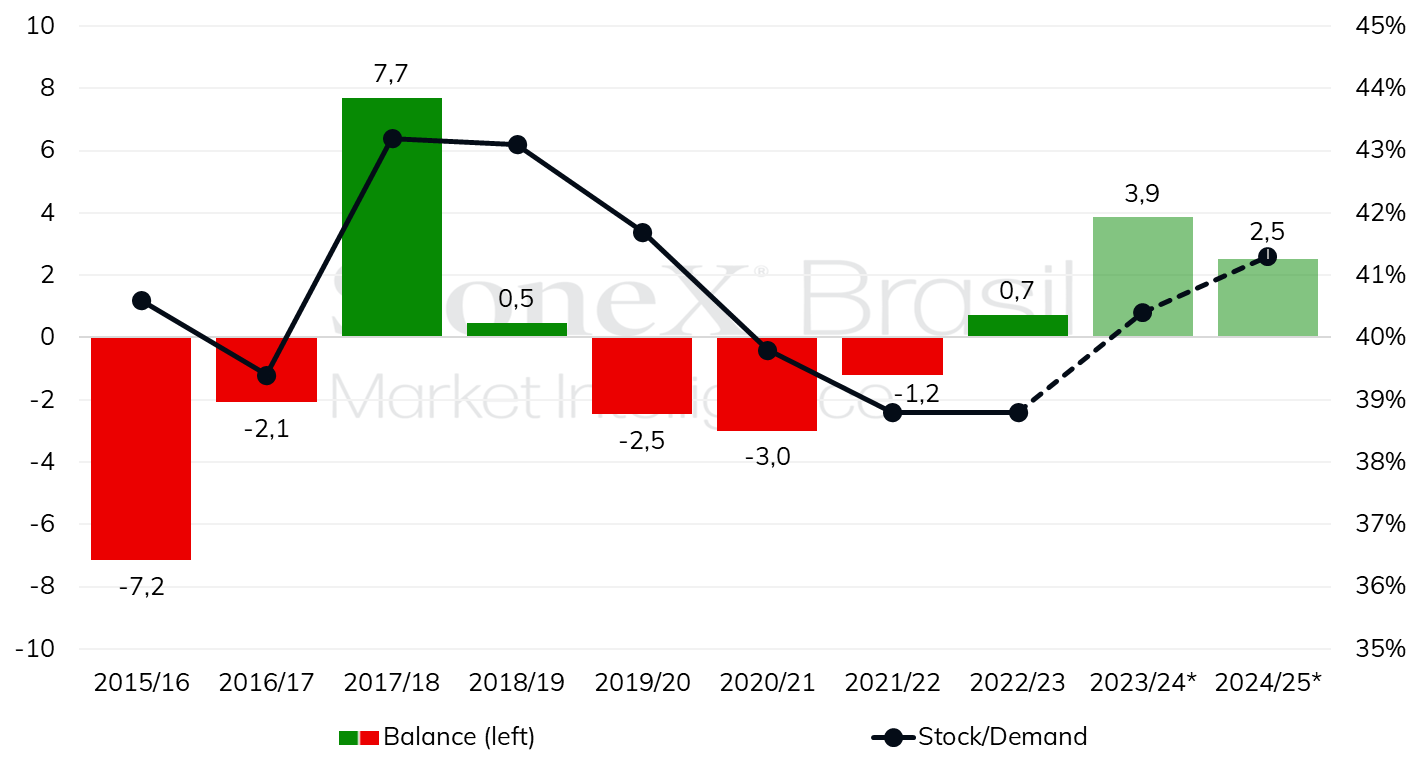

In addition to the more bearish fundamentals related to the high supply in the Brazilian Center-South, the market has also been influenced by prospects for surpluses in the global sugar balance for the global crops 2023/24 (Oct-Sept) and 2024/25 (Oct-Sept). The main reason for this has been, especially in the current crop, the large production and export of Brazilian sugar, which outweighed the El Niño-related falls in Southeast Asia in 2023/24 (Oct-Sept), expected at 3% and 20.7% in India and Thailand, respectively.

Adding the two Asian countries together, the estimated drop in the global 2023/24 cycle is 3.3 MMT, while according to StoneX's estimate, production growth in the Brazilian Center-South over the same period is expected to be 4.5 MMT.

For the next global crop of 2024/25 (Oct-Sept), the outlook is for a smaller surplus due to lower production in the Center-South, but still present, given the recovery of players previously affected by El Niño, such as Thailand, which could see an increase of up to 2 MMT due to increased area and productivity gains.

Global sugar balance (MMT) and stocks/demand ratio (%)

*Estimate and Source: StoneX.

*Estimate and Source: StoneX.

Therefore, the bearish sentiment has made itself clearer to the market, explaining the bearish channel since the beginning of April/24. It is evident that the market is still surrounded by uncertainties, one of the main ones being the performance of the 2024/25 season (Apr-Mar) in the Brazilian Center-South. Between November/23 and March/24, an important period in the crop's development, rainfall was 26.2% below the 10-year average for the period in the sugarcane-growing regions, raising concerns about the crop's production.

However, the first two weeks of the crop have been optimistic for production. Amid the drier weather and the higher productivity inherited from the 2023/24 cycle, last Wednesday (15) UNICA announced a production of 1.84 million tonnes of sugar for the second half of April/24, 65% above the previous year, which further contributed to the drop in sugar seen this week.

As such, in the absence of indications confirming an effect of the drought in the Brazilian Center-South, with sugar production expected for the 2024/25 crop at 42.3 MMT by StoneX, a drop of only 0.2% due to the higher mix and quality of the feedstock (TRS), with the crops in the Northern Hemisphere practically over, sugar should continue to come under pressure in the short/medium term.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.