Weekly roundup for StoneX Bullion 14 July 2024

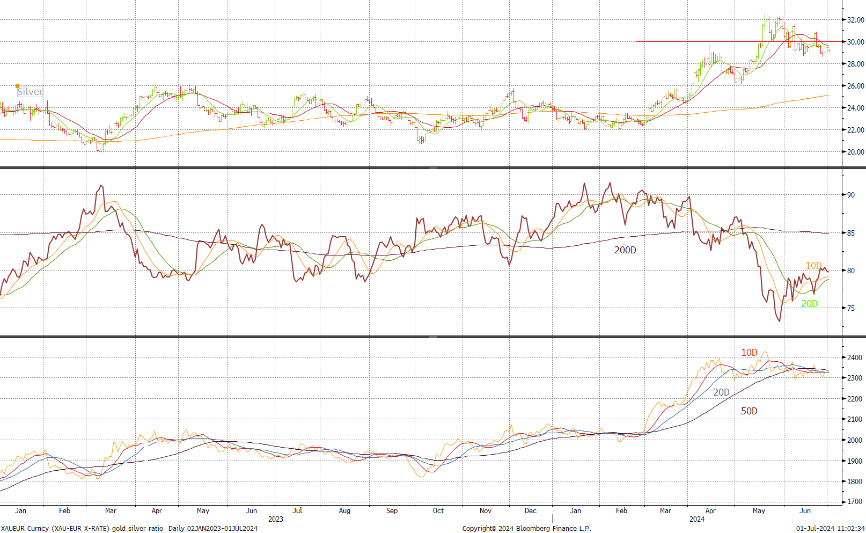

Outlook; with COMEX long gold positions broadly steady and at the same level as end May, and the shorts still historically low at 51t, the net position last Tuesday was 492t, just 13% above the 12-month average and therefore not particularly top-heavy. The overall outlook remains positive on the back of geopolitics (the US is capturing the headlines) and economic uncertainty, the latter particularly in Europe. Silver is still consolidating but the tone remains cautious and is likely to encounter resistance on any approach to $30 (trading at $29.20 as we write).

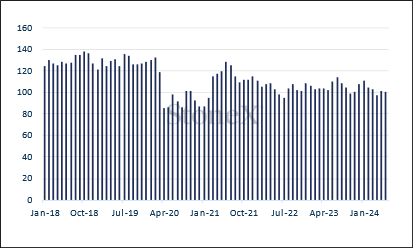

Gold, silver and the ratio, January 2023-to-date

Source: Bloomberg, StoneX

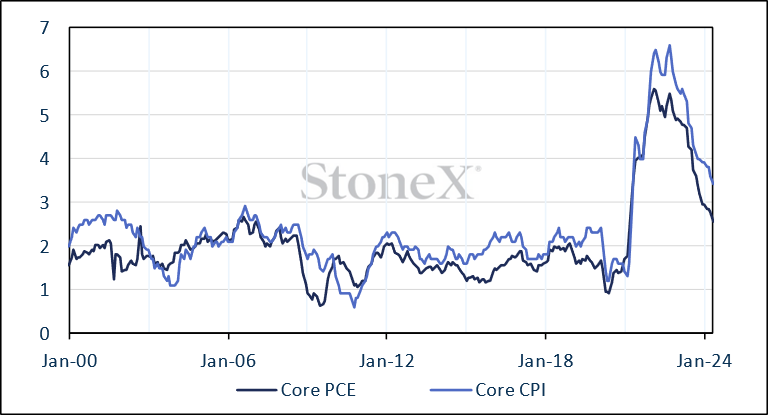

There has been little of much note in the gold and silver markets over the past week, with many stakeholders awaiting the core Personal Consumption Expenditure (PCE) figure from the States at the end of last week. This is one of the most important parameters that the Fed watches and the overall trend is instrumental in determining rate policy; now the focus shifts to the nonfarm payroll numbers at the end of this week, which are expected to show a slower rate of gain this month, with a call of +190k against +272k in May.

The headline PCE came in at 0.0% month-on-month and 2.6% year-on-year, in line with expectations and following 0.3% in the previous month. Core PCE (excluding food and energy) was 0.1% as expected and following 0.2% in May. The core goods number was minus 0.29% while core services ex-housing (56% of the total) was 1.88%, core housing (18% of total) was 0.99%. Our strategists are saying that the core number month-on-month annualises to -0.1% and the Core PCE M/M annualises to +1%.

So these numbers were reasonably benign and will encourage Feed thinking, but they will want to see more before they make any rate cut decisions.

Meanwhile the heat is on in the US Democrat Party following the debate last week and tere is much chatter about the need or otherwise to replace President Biden as the Democrat nominee. This is also likely to keep the markets in limbo.

Will little activity in the markets, an interesting element last week was the release of the World Gold Council’s annual survey of central banks, including, of course, their attitude to gold. A brief summary is as follows: -

There were 70 responses of which 29% plan to increase gold holdings in the net twelve months. This is the highest percentage that the Council has seen since the Survey began in 2018.

Key motivation for increasing gold holdings: -

- Desire to rebalance to a more preferred strategic level of gold reserves

- Domestic gold production

- Financial market concerns including higher crisis risks and rising inflation

Asked about the likely level of reserves to be denominated in dollars five years from now, 49% said “moderately lower”, 18% unchanged, 13% each for significantly lower and moderately higher; and 7% significantly higher

Asked about the proportion of gold in total FX reserves five years hence; 66% expected it to be moderately higher, 18% unchanged, 7% moderately lower, 6% significantly lower and 3% significantly higher.

Expectations for global central bank holdings over the next twelve months; 81% expected an increase, while 29% expected to increase their own reserves in the next twelve months and 3% expected a decrease

The most popular elements influencing reserve management conditions were interest rates and inflation, with geo[political instability coming third.

Asked about relevance of individual factors to a decision about holding gold: No default risk was the highest vote at 49%, followed by performance in times of crisis (47%), historical position 46% and long-term store of value 42%.

De-dollarisation was regarded by 68% as irrelevant. sanctions concerns were also dismissed by commanded 67%, domestic gold production by 63% and anticipation of changes in the monetary system was discounted by 58%.

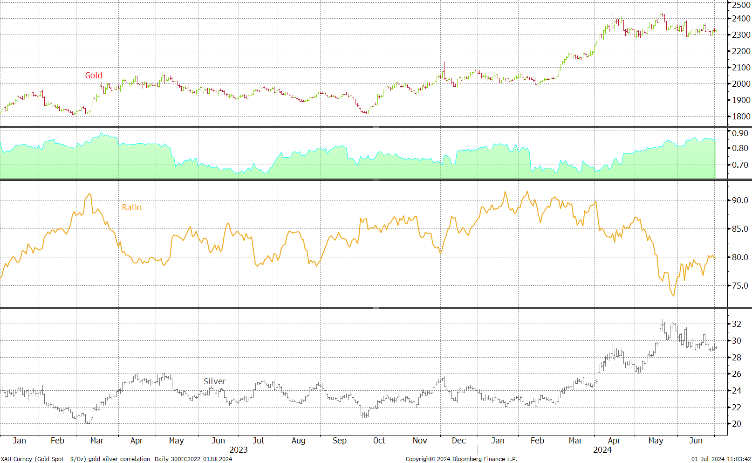

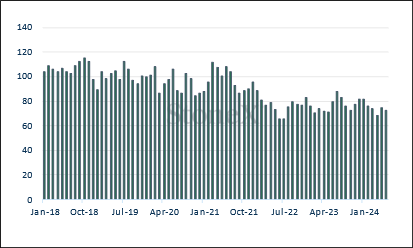

Gold, silver and copper; silver correlation with gold, 0.81; with copper, 0.28

Source: Bloomberg, StoneX

US CPI, PCE

|

Source: Bloomberg, StoneX

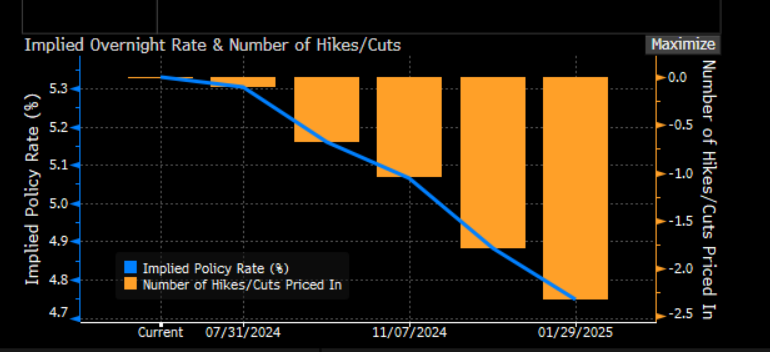

Bond markets’ expectations for the rate cycle; now looking at a 58% chance of a September cut as expectations gradually ease

Source: Bloomberg

US Conference Board Confidence; Expectations

Source: Bloomberg, StoneX

In the background the Exchange Traded Products have been mixed, and reflecting (if not partially directing) the price action in the two metals. Silver has been seeing some light redemptions, but also the occasional heavy day of creation; for example 109t net purchases on25th June as silver dropped from $29.66 to $28.84; this was followed though by three days of net sales, leaving the funds at 21,355t for a year-to-date loss of 415t.

Buyers, meanwhile, have continued to nibble at gold. Over June as a whole the gold ETPs added 14.2t, for a year-to-date fall of 130t to 3,096t (world mine production is roughly 3,700tpa). In the period to 21st June (the most recent available breakdown) North American funds were down by 4.5% or 74.3t, (0.1% or 2.3t), while Europe dropped 6.5% or 90.4t and Asia gained 27.6% or 37.9t.

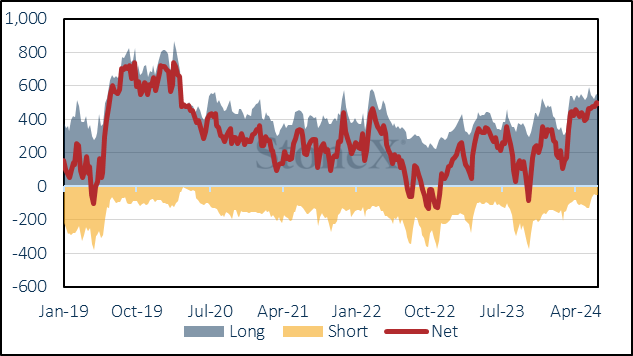

COMEX; sentiment mixed

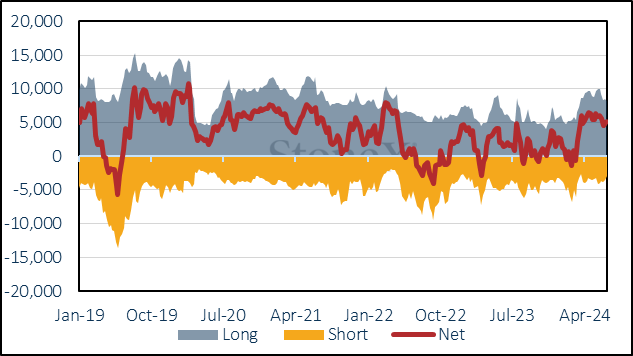

The Commitments of Traders reports show that over the fortnight ( we didn’t have the two weeks-ago figure last Monday due to a Public Holiday in the States) the outright gold long Managed Money position on COMEX rose by 20t or 3.8% to 544t, while outright shorts rose by 7% to 51t. leaving the net at 492t. The outright long, at 13% over the twelve month average, is no longer especially top-heavy. The silver position has continued to see a contraction in outright longs, dropping to 8,189t from 8,392t, but it is still 24% over the twelve-month average, which leaves silver still vulnerable to stale bull liquidation. The shorts continue to contract, falling to 2,989t, the lowest level since late March. This leaves the net position at 5,200t, against a twelve-month average short of 4,211t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

|

|

1 July 2024 |

Previous week |

% change |

Year-to-date |

Range Jan 2022 onwards |

|

Range as % |

|

|

|

|

|

|

Min |

Max |

|

|

Gold (pm LBMA price) |

2,330.90 |

2,335.05 |

-0.18% |

12.74% |

1,628.75 |

2,427.30 |

49.03% |

|

Silver (LBMA price) |

29.37 |

30.44 |

-3.50% |

22.66% |

21.06 |

32.01 |

52.03% |

|

Platinum (pm LBMA price) |

1,012.00 |

998.00 |

1.40% |

2.43% |

850.00 |

1,065.00 |

25.29% |

|

Palladium (pm LBMA price) |

972.00 |

991.00 |

-1.92% |

-11.72% |

872.00 |

1,324.00 |

51.83% |

|

S&P 500 |

5,460.48 |

5,464.62 |

-0.08% |

14.48% |

4,117.37 |

5,487.03 |

33.27% |

|

$:€ |

1.0713 |

1.0693 |

0.19% |

-3.01% |

1.0467 |

1.1105 |

6.10% |

Source: Bloomberg, StoneX

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.