FX Weekly Overview: The week's main events

- Bearish factors

- A forecast of mild reading for the American CPI may decrease fears of inflation persistence in the country and increase bets for interest rate cuts by the Fed in 2024, reducing the attractiveness of American bonds and weakening the USD.

- Signaling the federal government's commitment to the fiscal framework partially reduced investors' demands for risk premiums and contributed to the BRL recovering part of the significant losses of the last few weeks.

- Expectation of more favorable data for the Chinese economy may increase growth and demand projections for the country, favoring the performance of risky assets, such as stocks, commodities, and currencies of emerging countries, like the real.

- Bullish factors

- A moderate reading for the IPCA in June could test the recent reprieve in pessimism among investors with Brazilian assets and reinforce inflationary fears, weakening the real.

The week in review

The week started with heightened stress among investors concerning the conduct of Brazilian economic policies, leading the exchange rate beyond the BRL 5.70 level on Tuesday (02). Nonetheless, after the federal government signaled its commitment to fiscal balance, the exchange rate reversed its direction and interrupted a sequence of six consecutive weeks of increases.

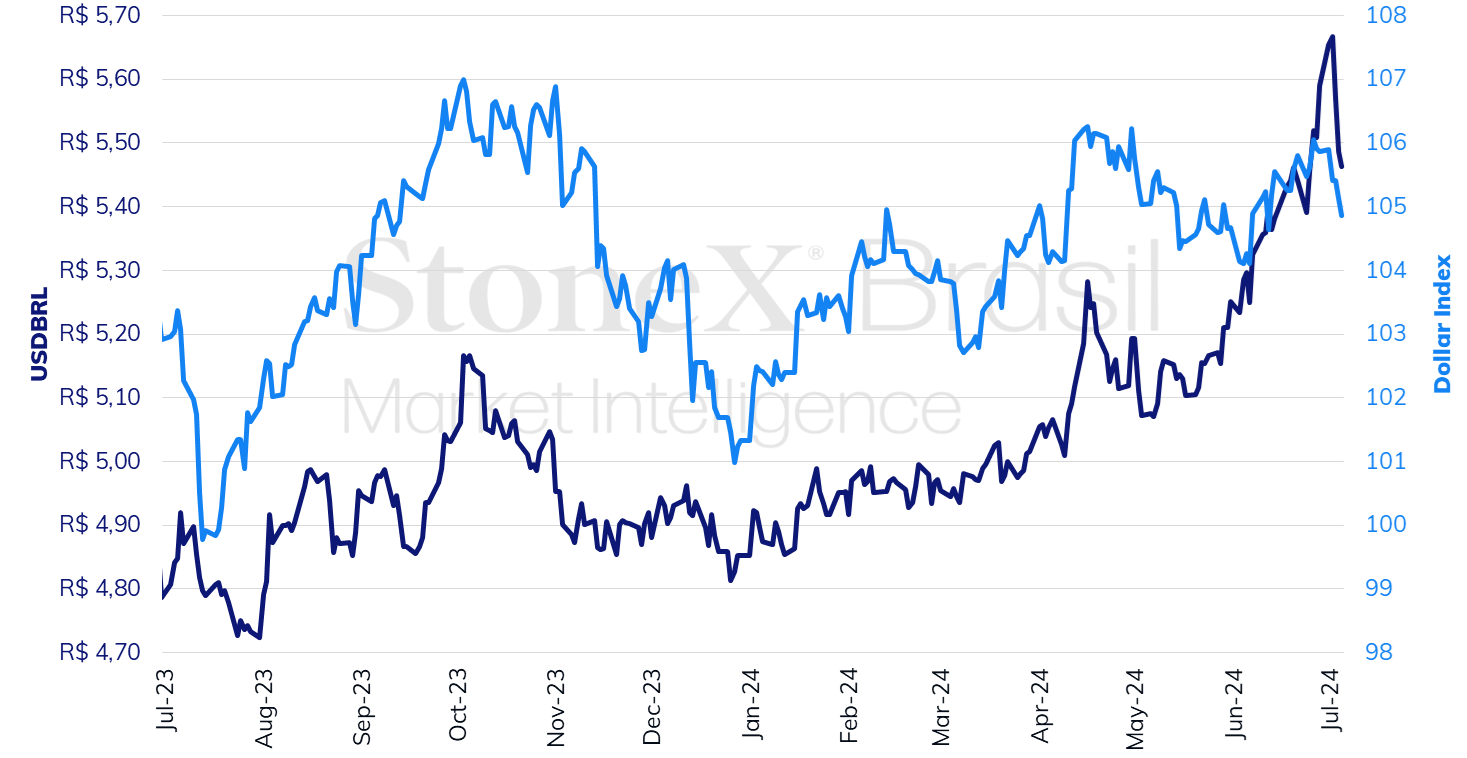

The USDBRL ended the week higher for the sixth consecutive week, closing Friday's session (05) at BRL 5.463, a weekly and monthly decline of 2.3%, but an annual increase of 12.6%. The dollar index closed Friday's session at 104.9 points, with a change of -0.9% for the week and the month, and +3.5% for the year.

USDBRL and Dollar Index (points

Source: StoneX cmdtyView. Design: StoneX.

KEY EVENT: Inflation moderation in the USA

Expected impact on USDBRL: bearish

After a positive surprise in the data for the American labor market last Friday (05), when job creation for May was revised downward and the unemployment rate rose to 4.1%, there is an expectation among analysts of a new mild reading for the Consumer Price Index (CPI) for June. The median estimate expects the headline index to rise from 0.0% in May to 0.1% in June, while the core of the indicator, which excludes the volatile components of food and energy, is expected to remain at 0.2%, aided by a drop in prices of used cars, hotel services, and airfares. If confirmed, these figures would represent the second consecutive month of inflation moderation in the USA and reinforce investors' bets that the Federal Reserve will start a process of interest rate cuts in September due to continuous and sustained price stabilization, weakening the USD globally.

Reprieve in the perception of risks for Brazilian assets

Expected impact on USDBRL: bearish

Last week, the signaling from the Minister of Finance, Fernando Haddad, and the President of Brazil, Luiz Inácio Lula da Silva, about the federal government's commitment to the fiscal framework helped to stem the crisis of confidence among financial market traders regarding the conduct of fiscal and monetary policies and partially reduce the risk premiums demanded by investors for Brazilian assets. Thus, the announcement of a cut of BRL 25.9 billion in public expenses for the 2025 Budget, reports on a thorough review of expenses in the Ministries of Social Development and Social Security, and a favorable technical position after a significant weakening of the real led to the exchange rate going from the range of BRL 5.70 on Tuesday (02) to less than BRL 5.50 on Friday (05).

Still, this level is much higher than the range of BRL 5.00 per USD that prevailed in mid-April, before the federal government's change in budget targets for 2025 and 2026 began the process of worsening expectations for Brazilian macroeconomic variables. Therefore, additional measures will be necessary on the part of the Executive that point to strengthening the autonomy of the Central Bank or to adjusting public accounts so that the credibility of financial agents is restored, which should take some time.

Brazilian June IPCA

Expected impact on USDBRL: bullish

The projections for the June IPCA show a monthly slowdown, dropping from 0.46% in May to around 0.3% in June, but with an increase in the 12-month accumulated rate, from 3.93% to around 4.2%, due to a statistical effect, as this month's reading will replace the deflation of -0.08% from July 2023. Investors will be particularly attentive to service prices, which currently constitute the greatest focus of inflationary pressure within the index, and to food prices, which showed a more significant increase in the May reading. The increase in the annual figure may reignite inflationary fears amid recent rises in inflation expectations.

Inflation and foreign trade in China

Expected impact on USDBRL: bearish

After frustrating data for May, investors are hoping for more positive readings for the Chinese economy in June and a partial recovery of optimism regarding the growth of the second-largest global economy. The Consumer Price Index (CPI) and Producer Price Index (PPI) accumulated over 12 months are expected to increase from 0.3% to 0.4% for the CPI and from -1.4% to -0.8% for the PPI. Additionally, accumulated exports and imports over 12 months are also expected to accelerate, going from 7.6% to 8% for exports and from 1.8% to 2.9% for imports. The figures can contribute to forecasts of demand for commodities by the country and foster the performance of currencies of exporting countries of primary products, such as the Brazilian real.

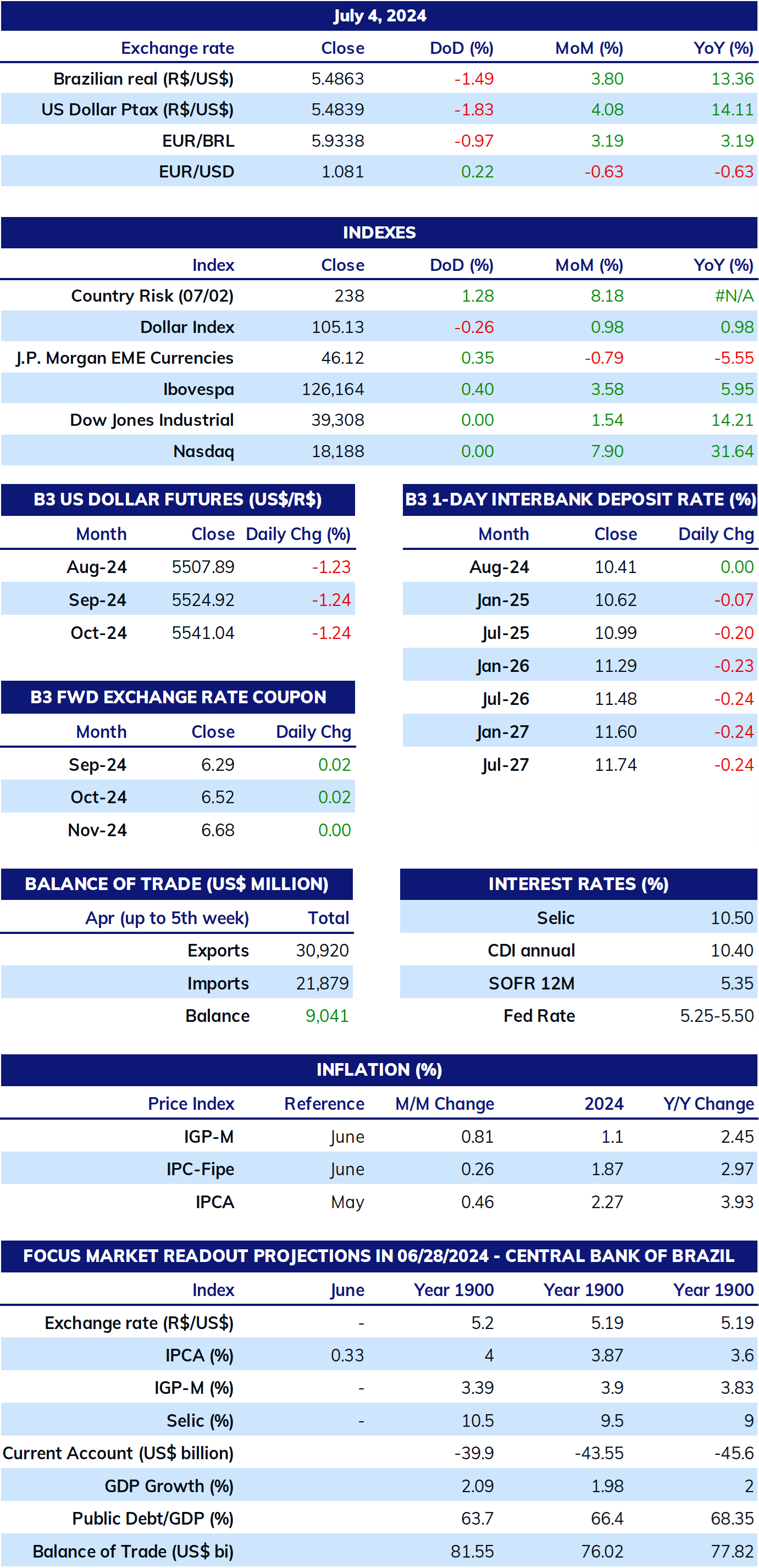

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.