FX Weekly Overview: The week's main events

- Bullish Factors

- ECB interest rate cut this week may harm the yield of euro-denominated assets and indirectly strengthen the US dollar against other currencies.

- The Chinese trade balance may reinforce perceptions of a slowdown in domestic demand in the country and negatively impact the performance of risky assets such as commodities and currencies of primary product-exporting countries like the real.

- Bearish Factors

- A slowdown in US job growth could partially revive investor bets on Fed rate cuts and weaken the dollar.

- Brazilian GDP growth in the first quarter could attract foreign capital to the country and contribute to strengthening the real.

- The return of the Import Tax on small purchases in Brazil could slightly reduce fears about the public accounts balance in 2024 and attract foreign investments.

The week in review

During a week of holidays in Brazil and the US, trade was marked by fluctuations in expectations for Federal Reserve interest rate cuts and increased perceptions of risks to Brazil's fiscal and monetary policy management.

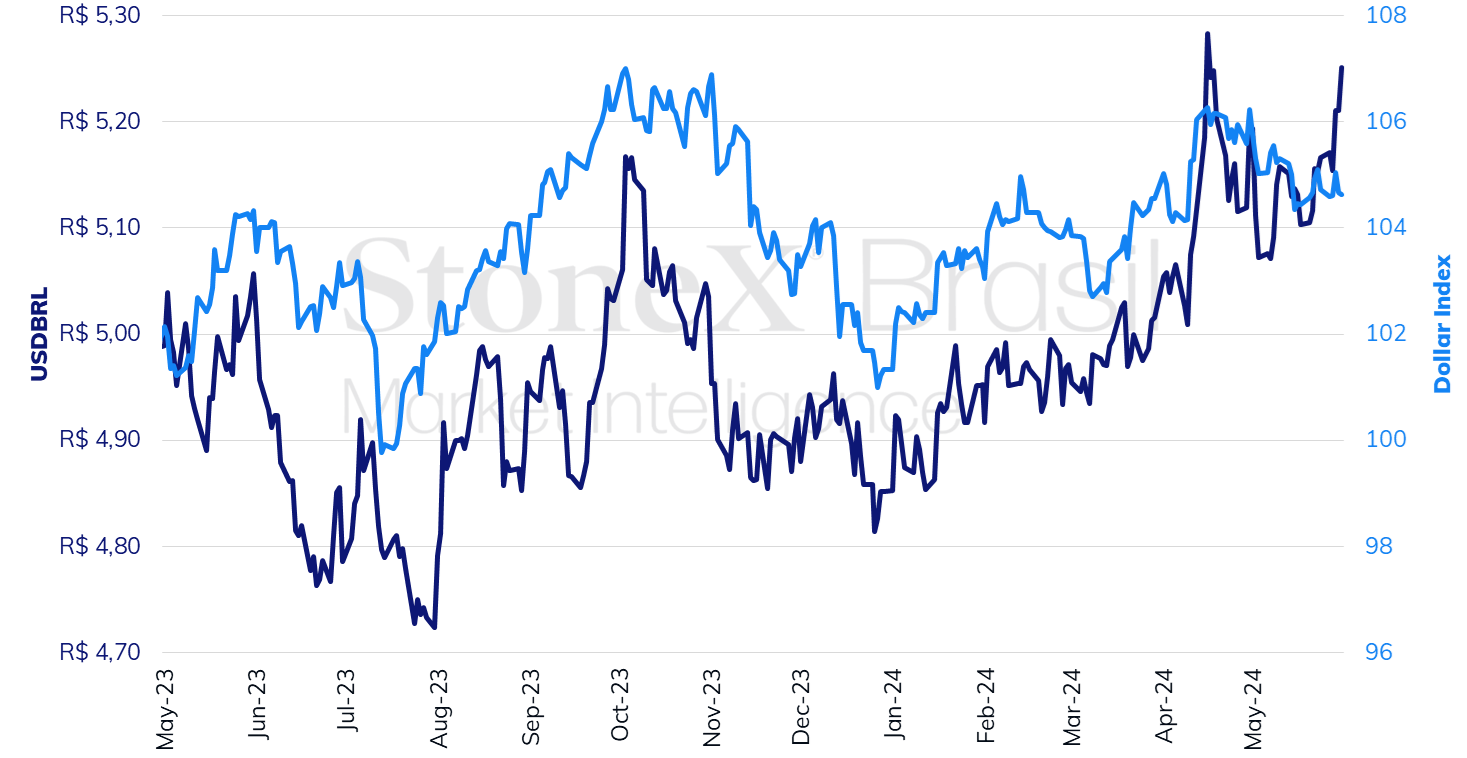

The USDBRL ended the week lower, closing this Friday's session (31) at BRL 5.251, a weekly increase of 1.6%, a monthly increase of 1.1%, and an annual increase of 8.2%. The dollar index closed this Friday's session at 104.6 points, with a weekly variation of -0.1%, a monthly variation of -1.5%, and an annual variation of +3.2%.

USDBRL and Dollar Index (points

Source: StoneX cmdtyView. Design: StoneX.

Most important event: US Employment

Expected impact on USDBRL: bearish

Last week was marked by fluctuations in bets on US interest rates and, consequently, on US Treasury yields, with a noticeable increase during the week following a low-demand auction of these securities, followed by a modest recovery after April's Personal Consumption Expenditures (PCE) index data matched analysts' estimates. This week may bring more fluctuations due to the release of data on US economic activity (PMIs) and the labor market.

The median estimate for the Employment Situation Report shows a slight increase in job creation from 175,000 in April to 180,000 in May. If confirmed, this data remains well below the average between December and March this year of a positive balance of 274,000 jobs and may ease concerns that the US economy is too overheated to allow for inflation stabilization. This, in turn, should increase bets on Federal Reserve rate cuts in the coming months, potentially harming the performance of dollar-denominated assets and weakening the dollar globally.

US PMI

Expected impact on USDBRL: bullish

On the other hand, stronger readings of May's preliminary Purchasing Managers' Index (PMI) measured by S&P Global last week raised estimates for the final May data, particularly the measure released by the ISM institute. Thus, the median estimate for industrial activity shows an increase from 49.2 points in April to 49.6 points in May, while the median estimate for the services sector shows an increase from 49.4 points to 50.5 points during this period. Thus, the improvement in the country's performance may reinforce investor fears that economic activity is too overheated to allow for inflation moderation, further reinforcing the prospect of higher US interest rates for a longer period and strengthening the dollar against other currencies.

Brazilian GDP

Expected impact on USDBRL: bearish

After two consecutive quarters of stagnation, Brazil's Gross Domestic Product (GDP) is expected to have expanded by 0.8% in the first quarter of this year compared to the last three months of 2023, with personal consumption and household income growth outweighing the negative effects of monetary tightening. The number should contribute to attracting foreign investments by showing greater return potential to investors, strengthening the real; however, it may not be enough given the recent loss of credibility in the country's monetary and fiscal policy management.

ECB Interest Rate Decision

Expected impact on USDBRL: bullish

For several weeks, analysts have projected that the European Central Bank (ECB) will start its rate-cutting cycle in its monetary policy decision this week, reducing its base rate from 4.00% p.a. to 3.75% p.a. due to more consistent inflation moderation and weak economic performance in the eurozone. There is more uncertainty, however, about the pace of cuts by the institution, and most investors believe that an additional reduction would only occur at the September decision. In its recent meetings, the ECB indicated it would react to the latest economic data and their effects on the Central Bank's economic projections. In any case, if the rate cut this week is confirmed, it should worsen the yield prospects of euro-denominated bonds and indirectly strengthen the dollar.

Chinese Trade Balance

Expected impact on USDBRL: bullish

In recent months, China's export numbers have shown more robust performance than the domestic demand data, driven by the chips and electric vehicle segments. The partial recovery of global industrial activity also contributes to faster export growth. Thus, the median projection for annual export variation shows an increase from +1.5% in April to +4.5% in May, while the median estimate for imports shows a decrease from +8.4% to +3.2% over the same period. If confirmed, this data could worsen investor expectations for economic growth in the country, reducing the prospects for commodity demand growth by the world's second-largest economy and harming the performance of currencies of primary product-exporting countries like the real.

Import Tax in Brazil

Expected impact on USDBRL: bearish

Scheduled for a vote this Tuesday (4) in the Federal Senate Plenary is Bill 914/2024 (Mover), which establishes financial incentives for the production of less polluting motor vehicles and, among other measures, reinstates the Import Tax at a 20% rate on international purchases up to US$50. The new tax should increase federal revenues and may contribute to meeting the federal government's budget targets, although investors are more concerned with expenditure containment than revenue growth.

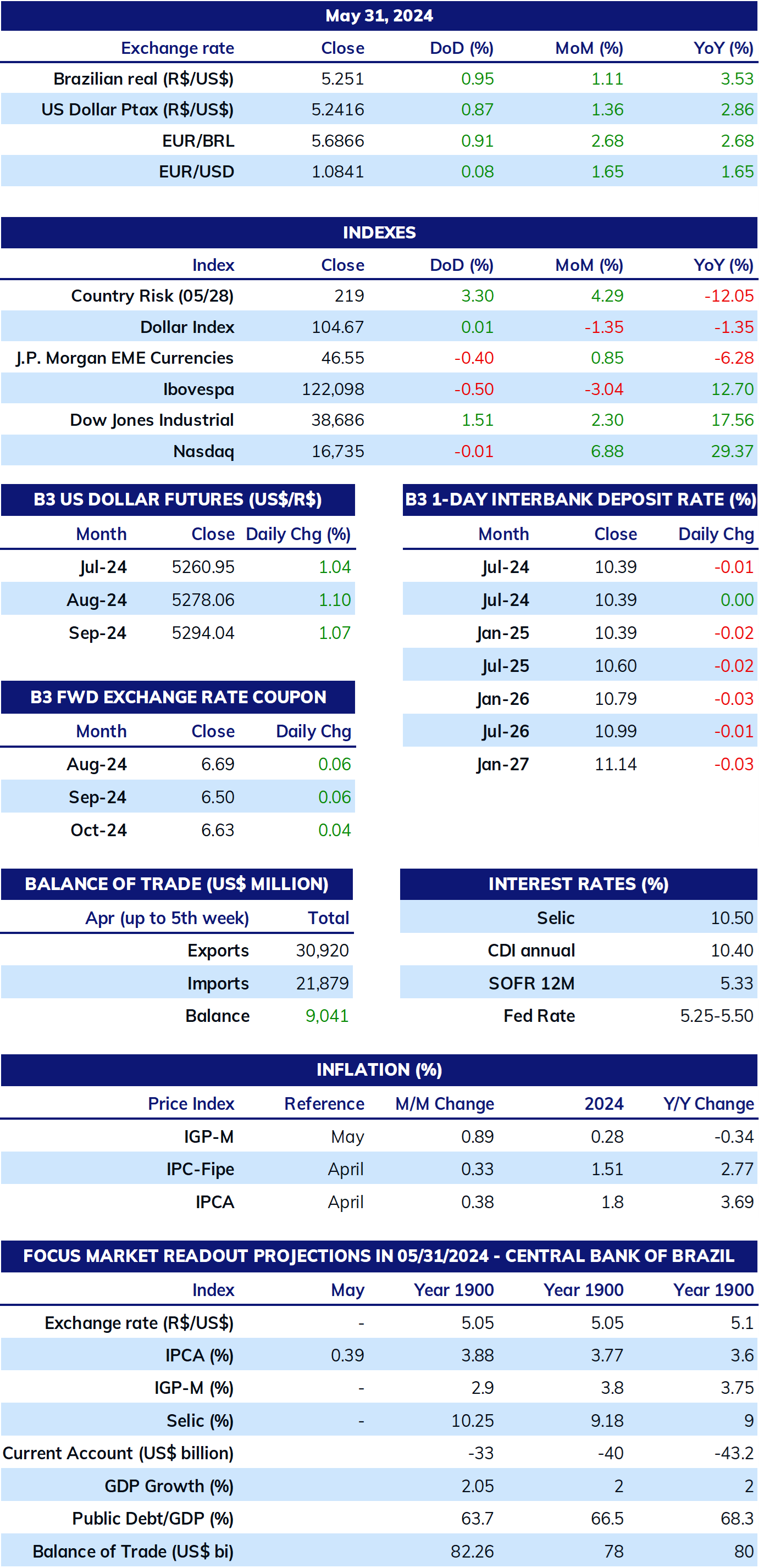

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.