FX Weekly Overview: The week's main events

- Bearish factors

- PCE index for April is expected to temper slightly, possibly partially recovering investors' bets for Fed interest rate cuts and weakening the USD.

- May's PMI in China is expected to grow smoothly, which could raise higher growth expectations this year and favor investors' appetite for risky assets, such as commodities and currencies from countries that export primary products, like the BRL.

- Bullish Factors:

- Fiscal statistics for April may worsen investors' perception of fiscal risks for Brazilian assets, while a milder IPCA-15 may give room for the Central Bank to continue cutting the basic interest rate (SELIC), contributing to weakening Brazilian real.

The week in review

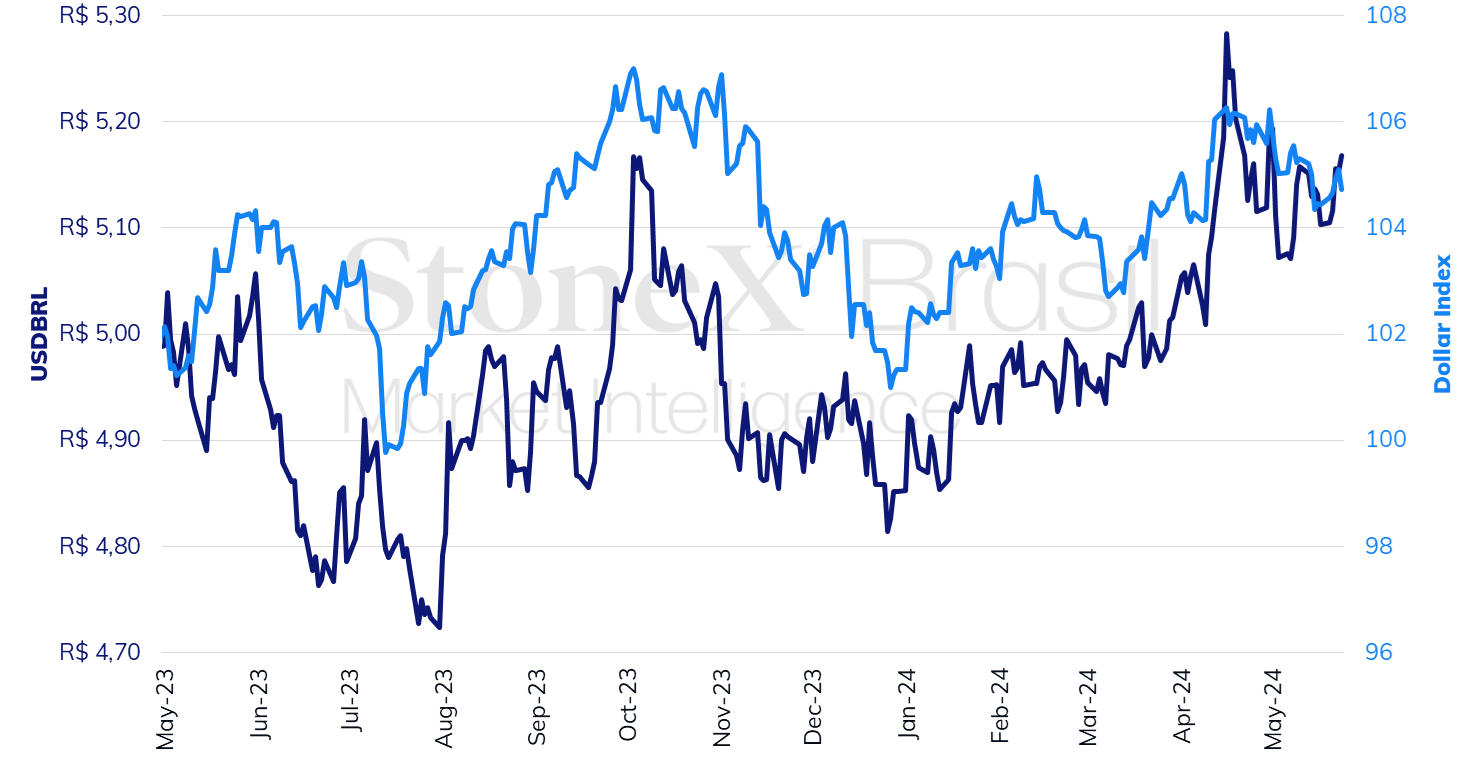

In a week with few indicators, the trade was marked by the publication of the minutes of the Federal Reserve's latest monetary policy decision and the release of warmer-than-expected preliminary economic activity data for the United States, both reinforcing a perception that US interest rates should remain higher for longer and contributing to strengthening the dollar.

The USDBRL ended the week lower, closing Friday's session (24) at BRL 5.168, a weekly increase of 1.3%, a monthly decline of 0.5%, and an annual gain of 6.5%. The dollar index closed Friday's session at 104.7 points, a change of +0.3% for the week, -1.4% for the month, and +3.4% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX.

THE MOST IMPORTANT EVENT: Inflation in the USA

Expected impact on USDBRL: bearish

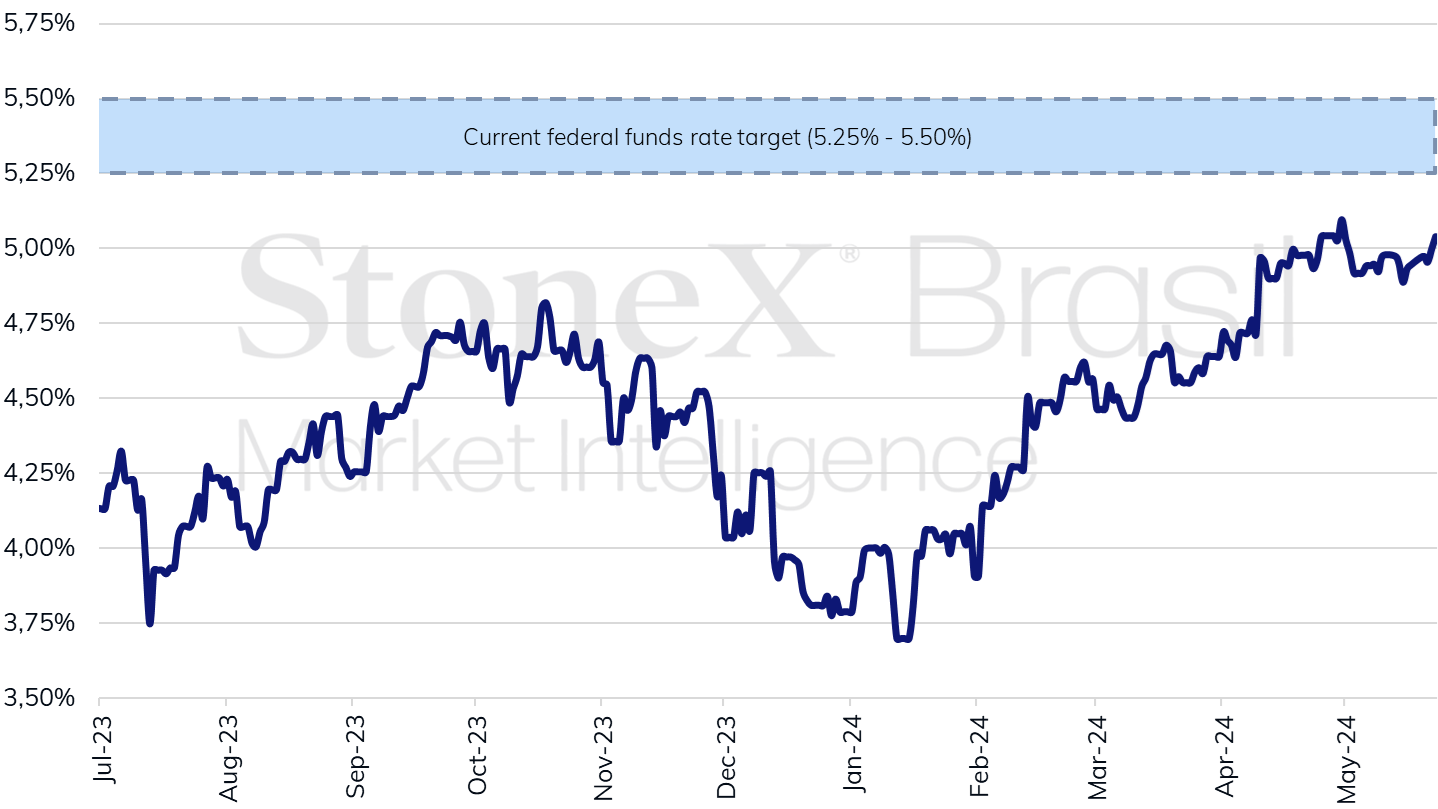

Although the week is shortened by holidays in Brazil and the United States, it will be filled with important indicators. After more heated inflation readings between January and March in the US, the median projections for the Personal Consumption Expenditures Price Index (PCE) for April show a slight slowdown, dropping from a monthly increase of 0.3% in March to 0.2% in April for both the headline and core indicators, which exclude the volatile components of food and energy. The expected drop should influence cooling in airfare prices, industrial goods, and housing costs (rent). Still, although any reduction is welcome, the estimated data would be incompatible with the target sought by the Federal Reserve, of 2% annually, and is not likely to be enough to alleviate fears of inflation persistence in the country. Thus, it is expected that investors' pessimism about the possibility of interest rate cuts will remain high during the week.

If the economic data for April came in softer than expected and helped partially recover the bets for Fed interest rate cuts in 2024, the stronger readings from the May Purchasing Managers' Index (PMI) previews last week reversed this hype, with investors now seeing only one interest rate cut in 2024. In turn, the prospect of higher interest rates for a longer period in the USA favors the yield of USD-denominated bonds and contributes to the strengthening of the American currency.

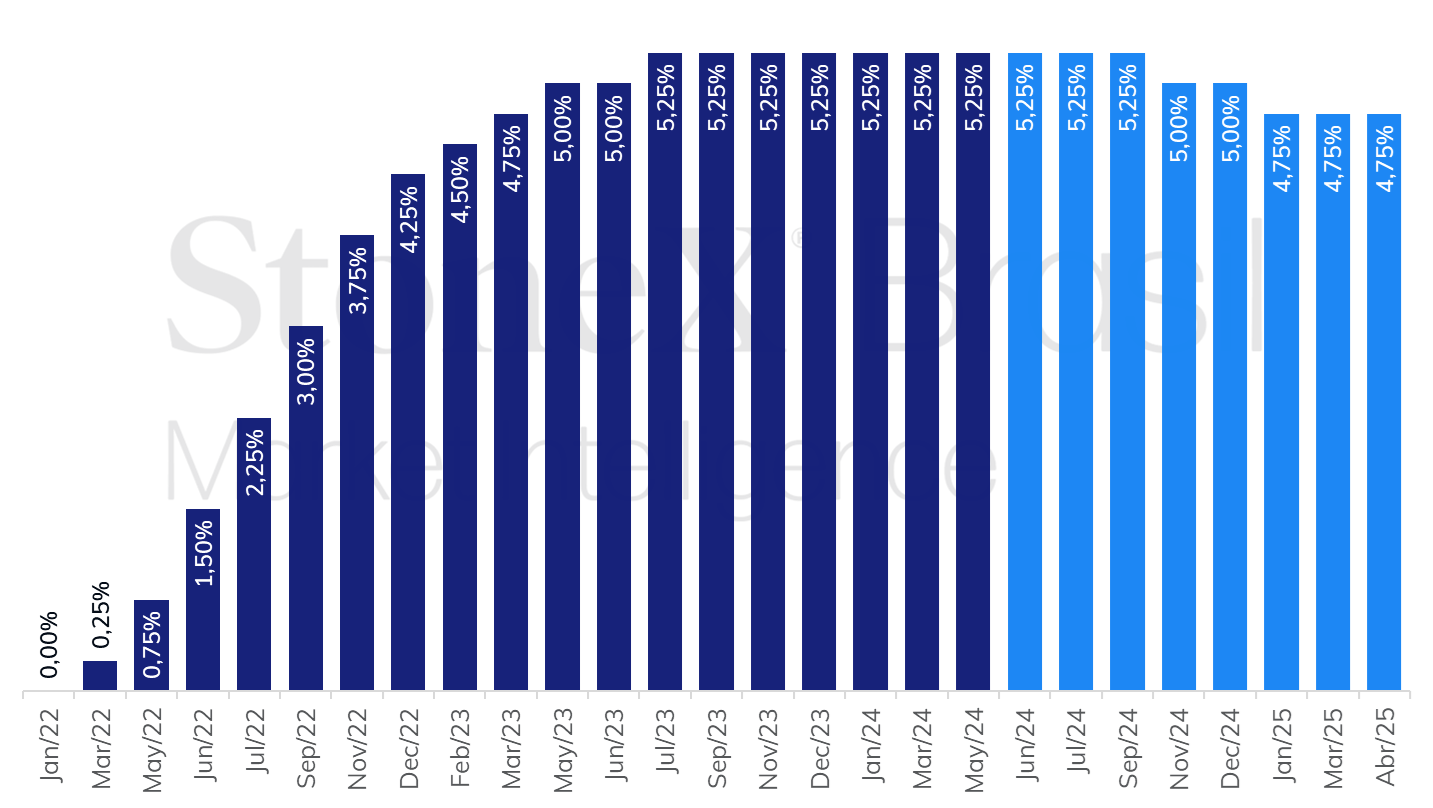

US: History and Expectation for the interest rate - May 23, 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Average expectation for the United States Fed interest rate at the end of 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the average of bets in the future interest market on the indicated date weighted by probabilities.

Fiscal statistics and IPCA-15 in Brazil

Expected impact on USDBRL: bullish

In Brazil, the highlights are the figures for public accounts and the labor market in April and the release of the National Consumer Price Index - Broad (IPCA-15) for May. The IPCA-15 is expected to show a slight increase in the month, from 0.21% in April to around 0.40%, driven by the increases in food and fuel prices, but with the expectation of new soft readings for the prices of services and for the core of the indicator, which excludes the volatile components of food and energy. Thus, it is expected that the indicator reinforces the interpretation that inflation in Brazil continues to moderate gradually and does not pressure the Monetary Policy Committee to act more strictly. The prospect of reductions in the basic interest rate (SELIC), in turn, reduces the expectation for the country's interest rate differential and can contribute to weakening the Brazilian real. In the same vein, fiscal statistics for April should show a slight worsening in the primary deficit, as public expenses are expected to have grown more rapidly than revenues. The perception of fiscal risks associated with Brazilian assets by investors has been higher since the economic team at the Palácio do Planalto reduced budget targets for the years between 2025 and 2027 in April, and this week's data may reinforce that assessment. Furthermore, there are still doubts about the total costs of the emergency measures that will be necessary to mitigate the effects of the floods in Rio Grande do Sul, estimated by the Ministry of Finance, at this moment, at R$ 13.0 billion. A perception of higher fiscal risks, in turn, increases the demand for risk premiums by investors and may decrease foreign investments in Brazil, contributing to weakening Brazilian real.

PMI in China

Expected impact on USDBRL: bearish

This week, the expectations for the Purchasing Managers' Index (PMI) for May measured by the National Bureau of Statistics of China (NBS) is for a slight expansion, from 50.4 points in April to 50.5 points in May for the industrial sector and from 51.2 points to 51.5 points for the services sector in the same period. The economic indicators of the country show inconsistent performance, with some periods indicating more vigorous growth and others suggesting a slowdown in expansion. In general, the industrial sector is benefiting from the growth in exports of products related to chips and electric cars, while domestic demand in the country signals a slowdown in the pace of growth, and some analysts believe that it will be challenging to reach the official target of 5% increase in Gross Domestic Product without new fiscal and monetary stimuli by the government. Still, hopes of a rebound in domestic demand have led the international price of iron ore to appreciate by almost 20% since the beginning of April, which is likely to benefit Brazil's export revenues and contribute to a strengthening of the real.

End-of-month PTAX rate

Expected impact on USDBRL: undefined

Após um mês de abril com forte volatilidade para a taxa de câmbio do real, os intervalos de oscilação se encurtaram durante o mês de maio. Na sexta-feira (31), emenda de feriado, o volume de negócios e a volatilidade devem ser mais elevados dentro das janelas de horários utilizadas pelo BC para o cálculo da taxa Ptax de fim de mês. A Ptax é uma referência divulgada diariamente pelo BC e seu valor de fim de mês é muito utilizado em contratos de câmbio e derivativos. Desta forma, os operadores do mercado intensificam suas operações durante estes intervalos, disputando a sua definição.

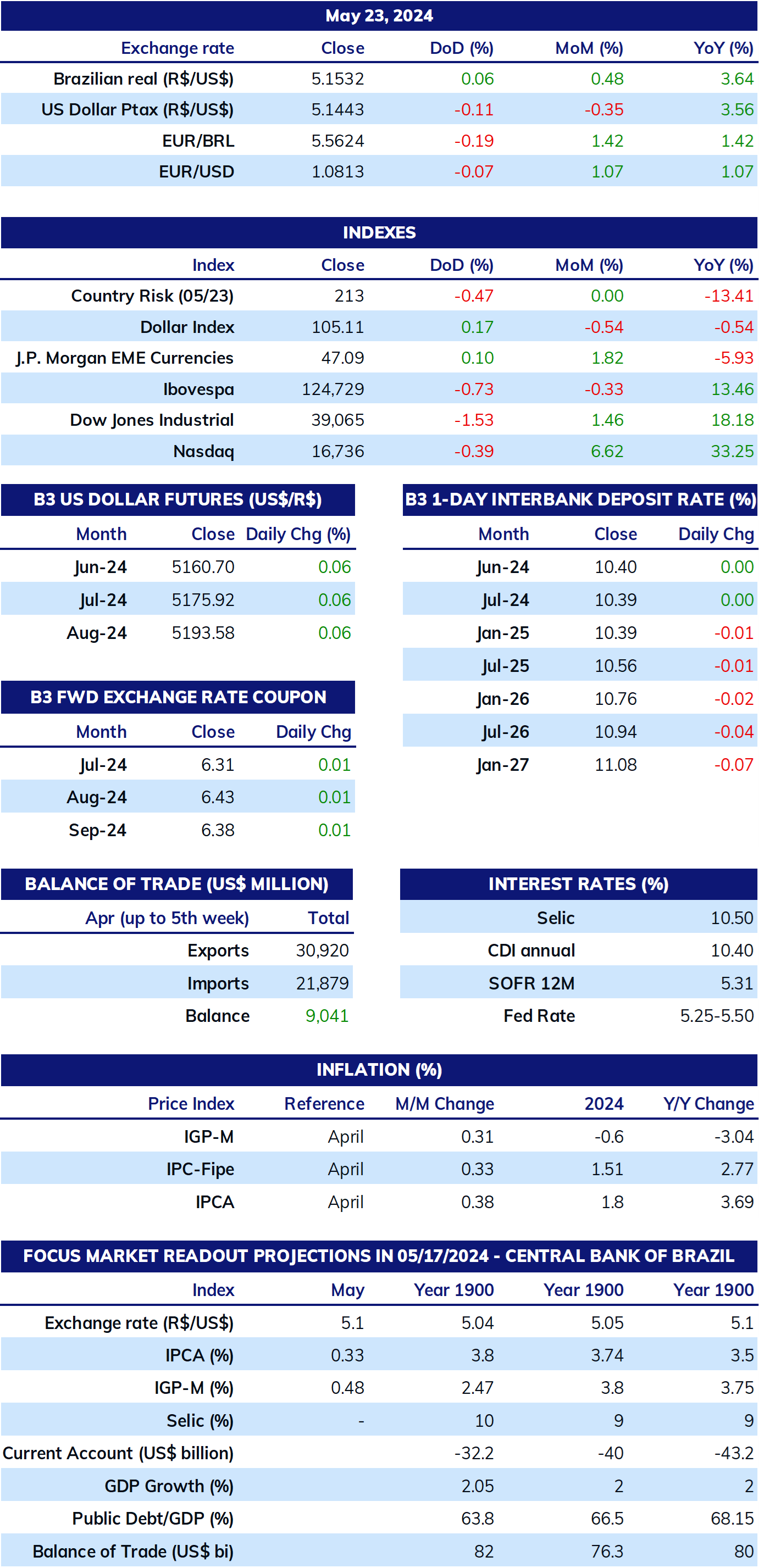

INDICATORS

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.