Morning Copper Markets

Copper Futures Head for Weekly Decline on Swelling Stockpiles

Copper prices are on track for their seventh weekly drop in the past eight weeks, primarily due to a significant increase in inventories on the London Metal Exchange. This accumulation reflects an ongoing mismatch between supply surpluses and weakening demand from China, the world's leading consumer of the metal. Although the prices are pressured by these rising stockpiles, optimism remains due to anticipated demand and potential upcoming U.S. Federal Reserve rate cuts. Additionally, while China’s imports of unwrought copper and copper products have fallen to a four-month low in June due to high prices dampening demand, the import of concentrates has risen as smelters boost their processing capacities.

Rio Tinto Considers Bid for Teck Resources

Rio Tinto is exploring potential acquisitions, including Teck Resources Ltd., as reported by Sky News. This consideration follows BHP Group's failed attempt to purchase Anglo American Plc. Discussions with bankers have occurred, but it's unclear if Rio Tinto will make an offer for Teck. The mining sector may see more mergers and acquisitions, though deals involving major companies could face strong regulatory scrutiny due to the importance of securing supply chains for critical minerals like copper. Recently, Teck sold its coal business to Glencore Plc, making it a more focused and attractive takeover target. Any potential acquisition would need approval from Teck's major shareholder, Norman Keevil. Responses from Rio Tinto regarding these discussions have not yet been provided.

Biden Defiant About Staying in the Race; Worse Inflation Predicted Under Trump

Despite criticisms and the growing call from his party to drop out of the reelection race, President Joe Biden remains firm about continuing his campaign. Recently, he participated in a press conference that, while strong on foreign policy, did not convince his fellow Democrats of his capability to defeat Donald Trump. Upcoming U.S. producer price data will serve as a significant indicator of pipeline inflationary pressures, which are a central economic concern. Meanwhile, most economists forecast higher inflation, deficits, and interest rates under a potential second Trump administration compared to Biden’s policies, according to a Wall Street Journal survey.

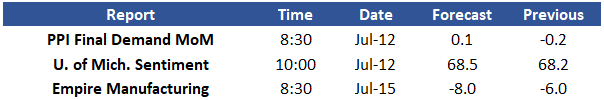

Macroeconomic Data

![]()

![]()

Sources: Bloomberg, StoneX

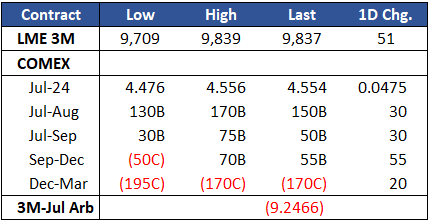

Copper Prices and Spreads

![]()

Sources: Bloomberg, StoneX

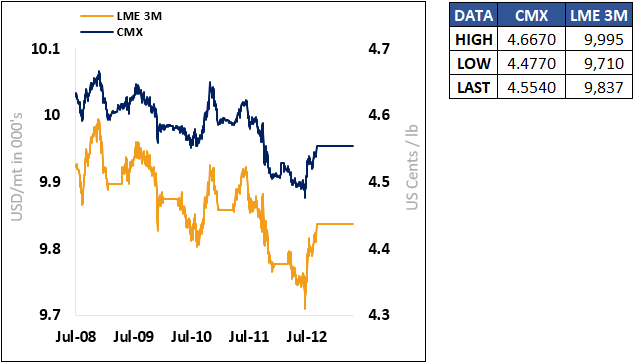

Comex Active & LME 3M – 3 Day Price Trend

![]()

Sources: Bloomberg, StoneX

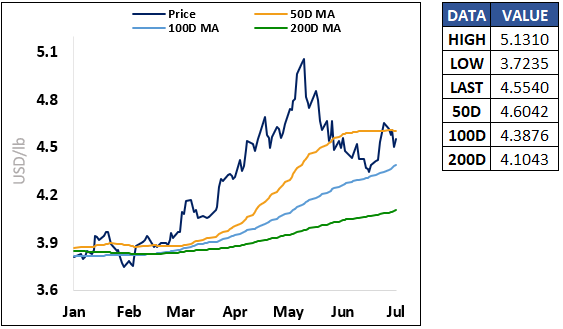

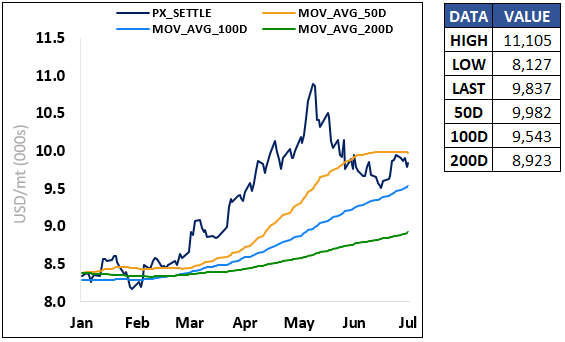

Comex Active Month – 6 Month Price Trend

![]()

Sources: Bloomberg, StoneX

LME Rolling 3M – 6 Month Trend

![]()

Sources: Bloomberg, StoneX

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.