Morning Ferrous Markets

Market Overview

Recent fluctuations in the ferrous markets have been driven by a mix of geopolitical and economic factors, resulting in pronounced volatility. Concerns over China's property market and the reapplication of U.S. tariffs on Chinese steel have added pressure on iron ore and steel futures. Additionally, stockpiling in Chinese ports during a traditionally strong demand season signals weakening demand, impacting global price trends. These developments, coupled with ongoing adjustments in global trade policies and market uncertainties in major steel-producing nations, have tightened physical markets and shaped near-term expectations. In the U.S., the Federal Reserve's favored inflation gauge cooled in April, with consumer spending unexpectedly dropping, supporting plans for an eventual reduction in interest rates. This complex environment forces futures traders and industry stakeholders to navigate regulatory changes, global economic uncertainties, and shifting supply-demand dynamics.

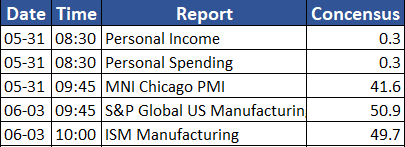

Upcoming Data Releases

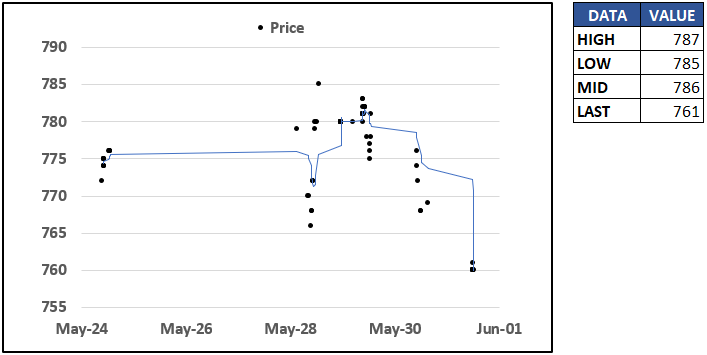

US HRC Steel: Market Dynamics and Price Trends

The US steel market is experiencing downward pressure due to declining benchmark prices, with SMU and Platts reporting drops to $760/st and $750/st, respectively. Nucor's CSP slightly increased to $770/st. The upcoming reapplication of Section 232 tariffs is expected to significantly alter import volumes and pricing structures. The Federal Reserve’s favored inflation gauge moderated in April, with inflation-adjusted consumer spending unexpectedly falling by 0.1%. Wage growth also cooled, contributing to broader economic uncertainties. These dynamics, including the cautious economic outlook and lower consumer confidence, are influencing the North American steel market's direction and pricing. Notably, US HRC prices showed mixed movements: November-24 contracts increased by 1.56% to $845.0 USD/T, October-24 contracts rose by 0.72% to $840.0 USD/T, while August-24 contracts decreased by 1.58% to $810.0 USD/T.

HRC Front Month 3 Day Trend

StoneX & Bloomberg

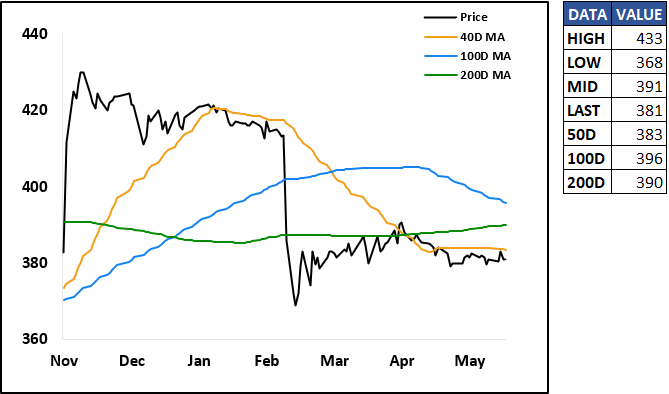

HRC Front Month 6 Month Price Trend

StoneX & Bloomberg

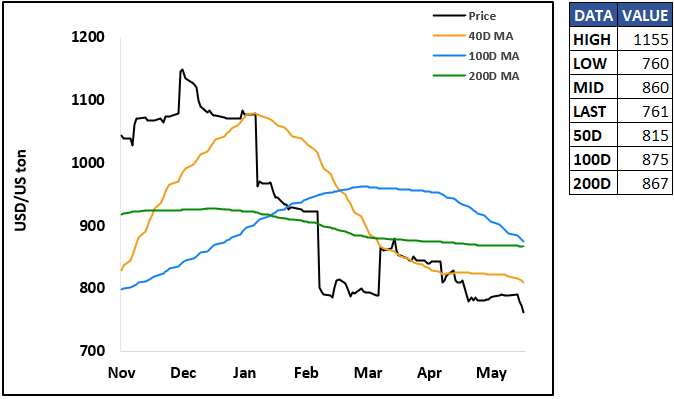

SGX Iron Ore: Volatility, Demand Uncertainty, and Supply Surpluses

China’s steel market faces volatility due to the government's policy to constrain steel mill capacity to conserve energy and reduce carbon emissions. Steel production in China dropped by 10 million tons in the first four months of 2024, impacting demand for iron ore. Despite China’s $42 billion initiative to stabilize the housing market, iron ore prices have continued to retreat. Record iron ore exports from Brazil and Australia in April have exacerbated Chinese iron ore surpluses, pushing futures in Singapore down 3.1% to $115.25 per ton. Additionally, SGX iron ore prices fell by 1.63% to $113.6 USD/MT for July-24 contracts and by 1.6% to $113.6 USD/MT for June-24 contracts. These factors, combined with high inventories at Chinese ports, are creating downward pressure on prices.

SGX Iron Ore CFR China (62%) Futures

StoneX & Bloomberg

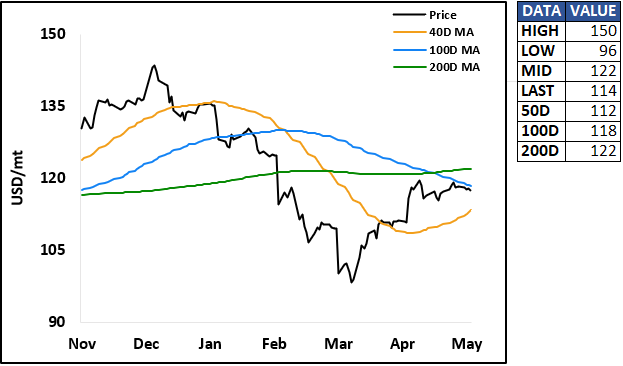

Turkish Steel Scrap: Supply Constraints and Rising Costs

The European steel market, particularly EU steel scrap, is under pressure from tight supply and elevated prices. Despite rising scrap prices by 9% in Europe, industrial profits in China’s equipment manufacturing and consumer goods manufacturing sectors grew significantly, affecting supply dynamics. The utility sector’s profit surged by 36.9% in the first four months of 2024, driven by electricity production. The Chinese market's robust performance, with industrial profits up 4.3% year-over-year, underscores the interconnectedness of global steel supply and demand.

Turkish Scrap 1st Month Futures

StoneX & Bloomberg

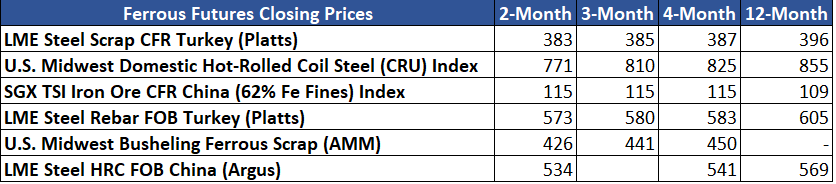

Current Prices

StoneX & Bloomberg

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.