Morning Ferrous Markets

Market Overview

Recent fluctuations in the ferrous markets have been influenced by a mix of geopolitical and economic factors, leading to pronounced volatility. Concerns over China's property market and U.S. tariffs on Chinese steel have added pressure on iron ore and steel futures. Additionally, stockpiling in Chinese ports during a traditionally strong demand season signals a weakening demand, impacting global price trends. These developments, alongside ongoing adjustments in global trade policies and market uncertainties in major steel-producing nations, have tightened physical markets and shaped near-term expectations in the ferrous metals sector. These elements combine to create a complex environment for HRC steel, where futures traders and industry stakeholders must navigate a landscape marked by regulatory changes, global economic uncertainties, and shifting supply-demand dynamics.

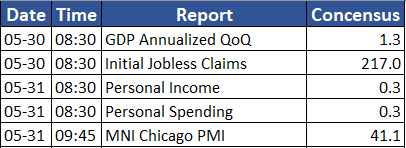

Upcoming Data Releases

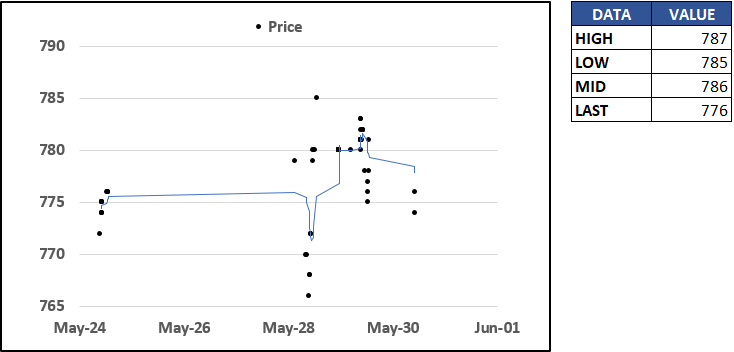

US HRC Steel: Market Dynamics and Price Trends

The US HRC steel market is currently under downward pressure, with benchmark prices showing a decline—SMU reporting a decrease to $760/st from $775/st and Platts to $750/st from $760/st, amidst a slight increase in Nucor's CSP to $770/st. The impending reapplication of Section 232 tariffs, which reintroduces a 25% duty on previously exempt steel products effective July 1, is expected to impact import volumes and complicate pricing strategies. These benchmark prices and regulatory shifts, coupled with a global oversupply of iron ore and economic instabilities in China's property market, fosters a bearish outlook and reflected in technical indicators for US HRC steel—a wedge shape with a downward trajectory over the next 2-8 weeks—a cautious trade signal. Despite increased trading activity week over week, prices are down $3 day over day. Price crossed the 200 day rolling average on April 29 indicating a potential trend reversal to a downward trend.

HRC Front Month 3 Day Trend

StoneX & Bloomberg

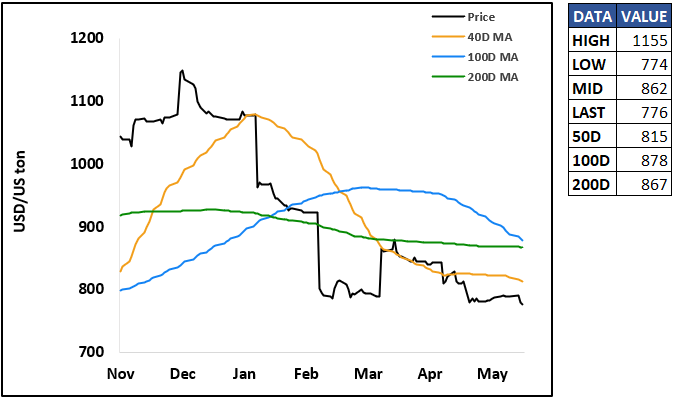

HRC Front Month 6 Month Price Trend

StoneX & Bloomberg

SGX Iron Ore: Volatility, Demand Uncertainty, and Supply Surpluses

Iron ore markets are experiencing heightened volatility, driven by China's faltering real estate sector and global oversupply. Despite China’s $42B initiative to stabilize the housing market, iron ore prices continue to retreat. Recent record exports from Brazil, at nearly 30 million tons, and Australia, nearing 50 million tons, have exacerbated Chinese iron ore surpluses. This surplus, combined with government pledges to constrain steel mill capacity, has pushed Singapore iron ore futures down 3.1% to $115.25 per ton, marking the lowest level in two weeks. Prices in Dalian dropped 2.9%, while steel contracts in Shanghai also declined. The mismatch between supply and demand, with China's stagnant steel production and high inventories, underscores the ongoing challenges in balancing global supply. These dynamics reflect broader market uncertainties and the impact of extensive global supply on pricing dynamics.

SGX Iron Ore CFR China (62%) Futures

StoneX & Bloomberg

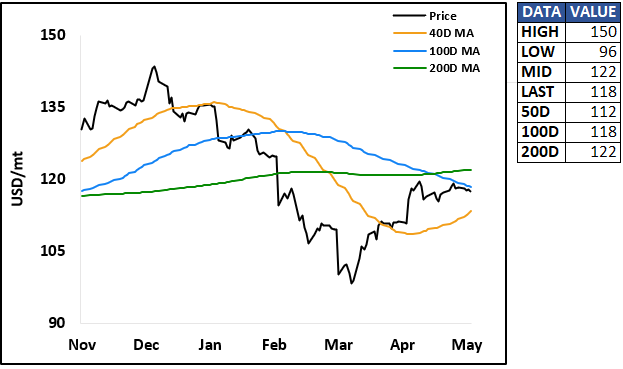

Turkish Steel Scrap: Supply Constraints and Rising Costs

The Turkish steel scrap market is feeling the pinch from a tightened supply that has driven up prices and adversely affected stainless steel spreads across Europe, pushing them into loss-making territory. A 9% increase in scrap prices in Europe, spurred by reduced industrial output and a surge in nickel prices by 21% since March, illustrates the acute supply challenges faced by European producers. This scenario is mirrored in the US, where despite robust apparent consumption, there is a noticeable moderation in demand. Trade activity in all futures contracts have noticeably increased in recent weeks; however price volatility is mild and trading within a 0.50 USD range, while futures contracts inched down slightly through September day over day.

Turkish Scrap 1st Month Futures

StoneX & Bloomberg

Current Prices

StoneX & Bloomberg

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.