- FOMC minutes should reinforce the perception of cautious behavior from the Federal Reserve in 2024, consolidating bets for interest rate cuts starting in June and strengthening the dollar.

- Activity and inflation data for Europe are expected to reinforce the perception of economic slowdown on the continent, strengthening the American currency by comparison.

- IBC-Br's increase in December may boost investors' confidence and attract investments to Brazilian assets, strengthening the BRL.

The week in review

The week was marked by the release of mixed data for the American economy, with the Consumer Price Index (CPI) and Producer Price Index (PPI) exceeding analysts' estimates but retail sales falling short of expectations, reinforcing the perspective that the Federal Reserve's interest rate cut cycle will start later, in June of this year.

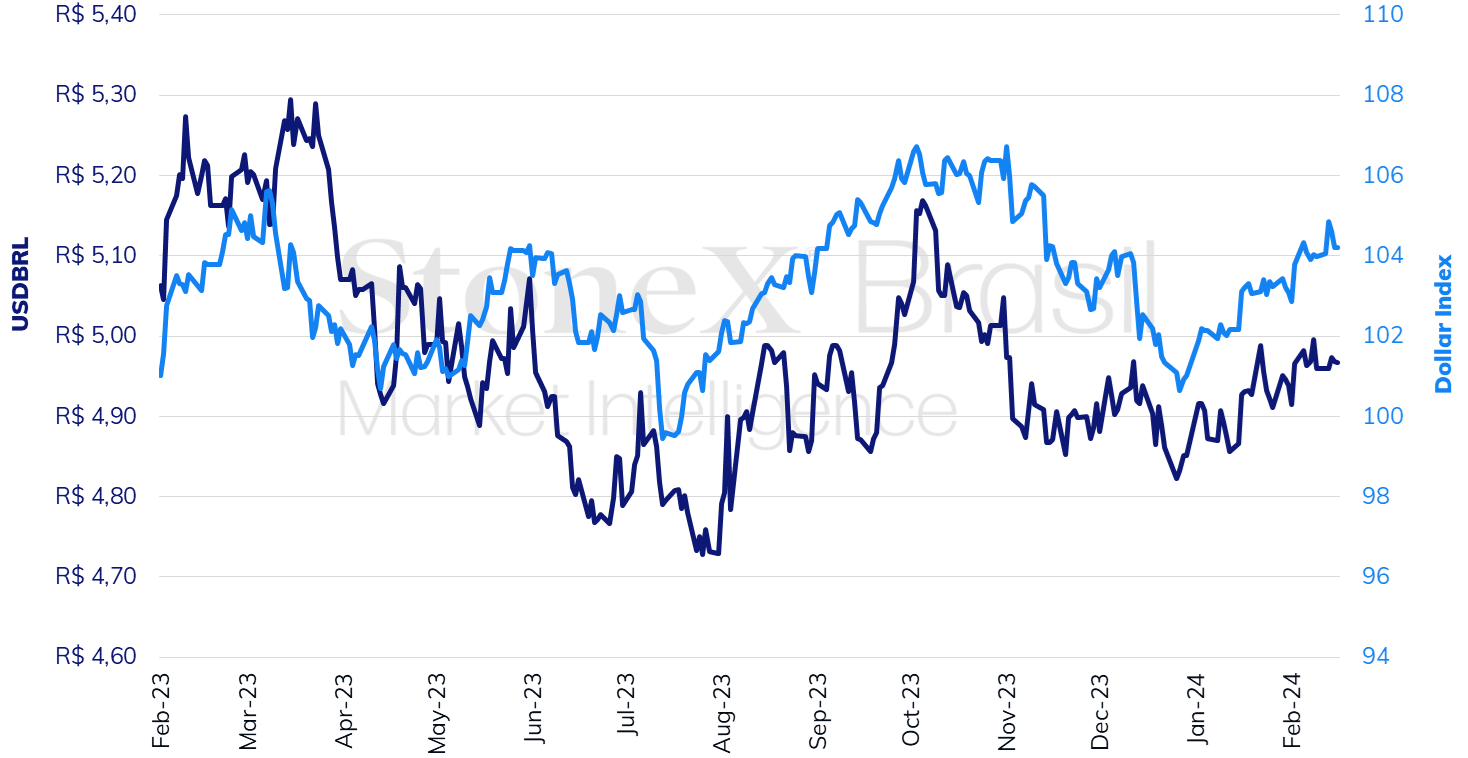

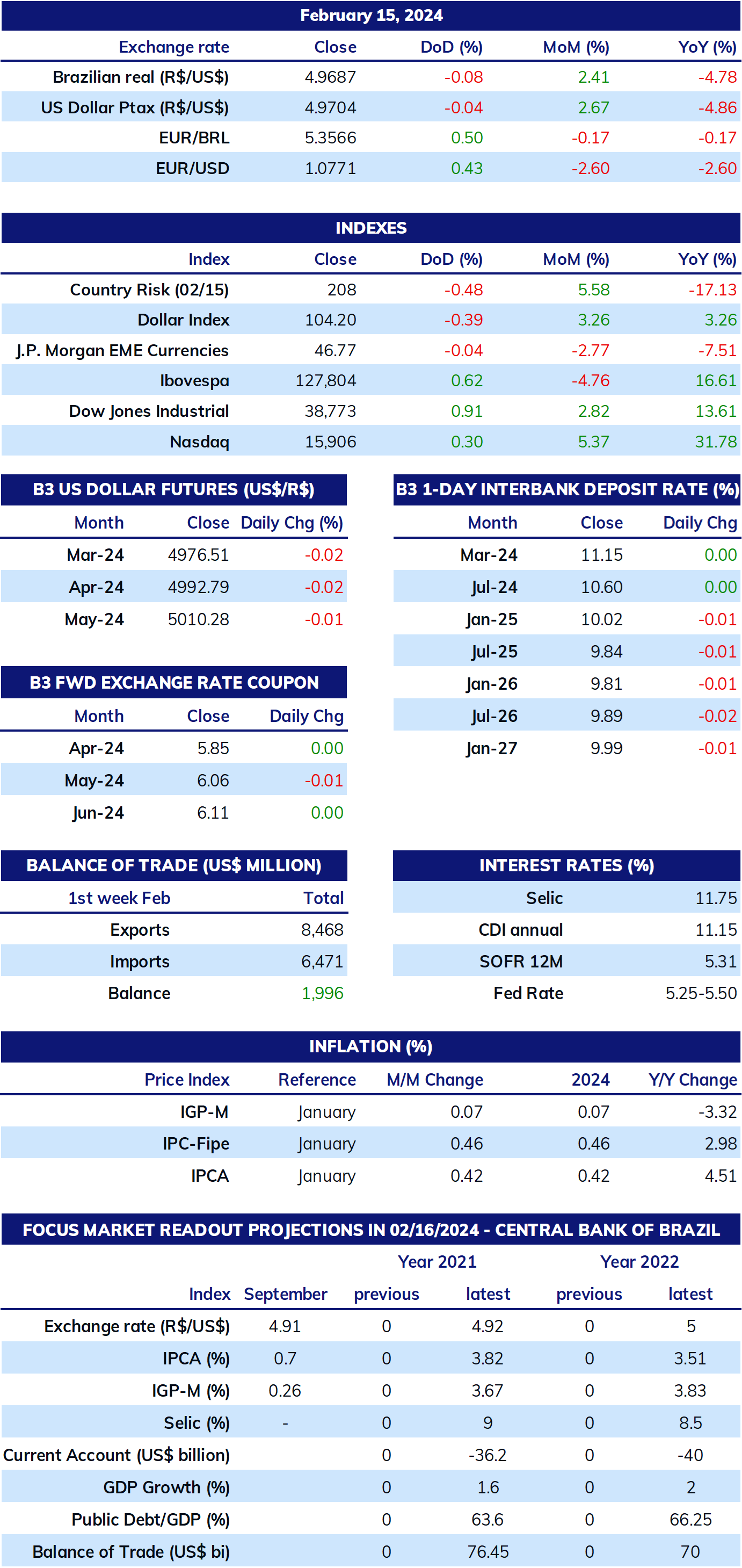

The USDBRL ended the week slightly lower, closing this Friday's session (16) at BRL 4.968, a weekly gain of 0.2%, a monthly gain of 0.6%, and an annual gain of 2.4%. The dollar index closed Friday's session higher for the seventh consecutive week, at 104.2 points, a change of +0.2% for the week, +1.1% for the month, and +3.1% for the year.

THE MOST IMPORTANT EVENT: FOMC decision minutes

Expected impact on USDBRL: bullish

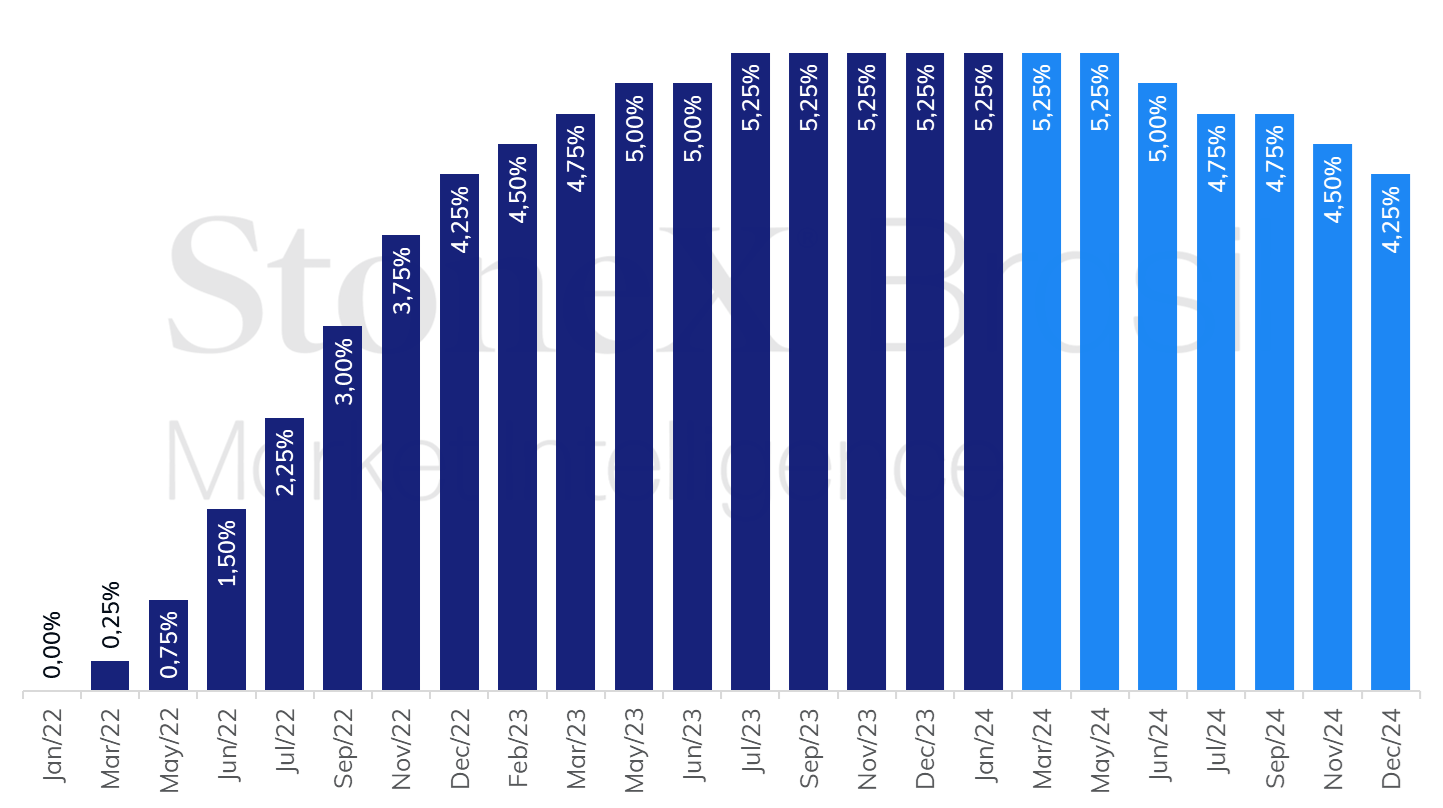

In a week shortened by a holiday in the US, investors' attention is expected to turn to the release of the minutes from the last decision of the Federal Open Market Committee (FOMC). Although the FOMC meeting took place before the release of employment, services, and inflation data above expectations for January, the document may still provide important details for investors about the discussions among its members regarding the criteria required for the start of monetary easing by the Fed, as well as comments on the economic situation and inflation dynamics in the country.

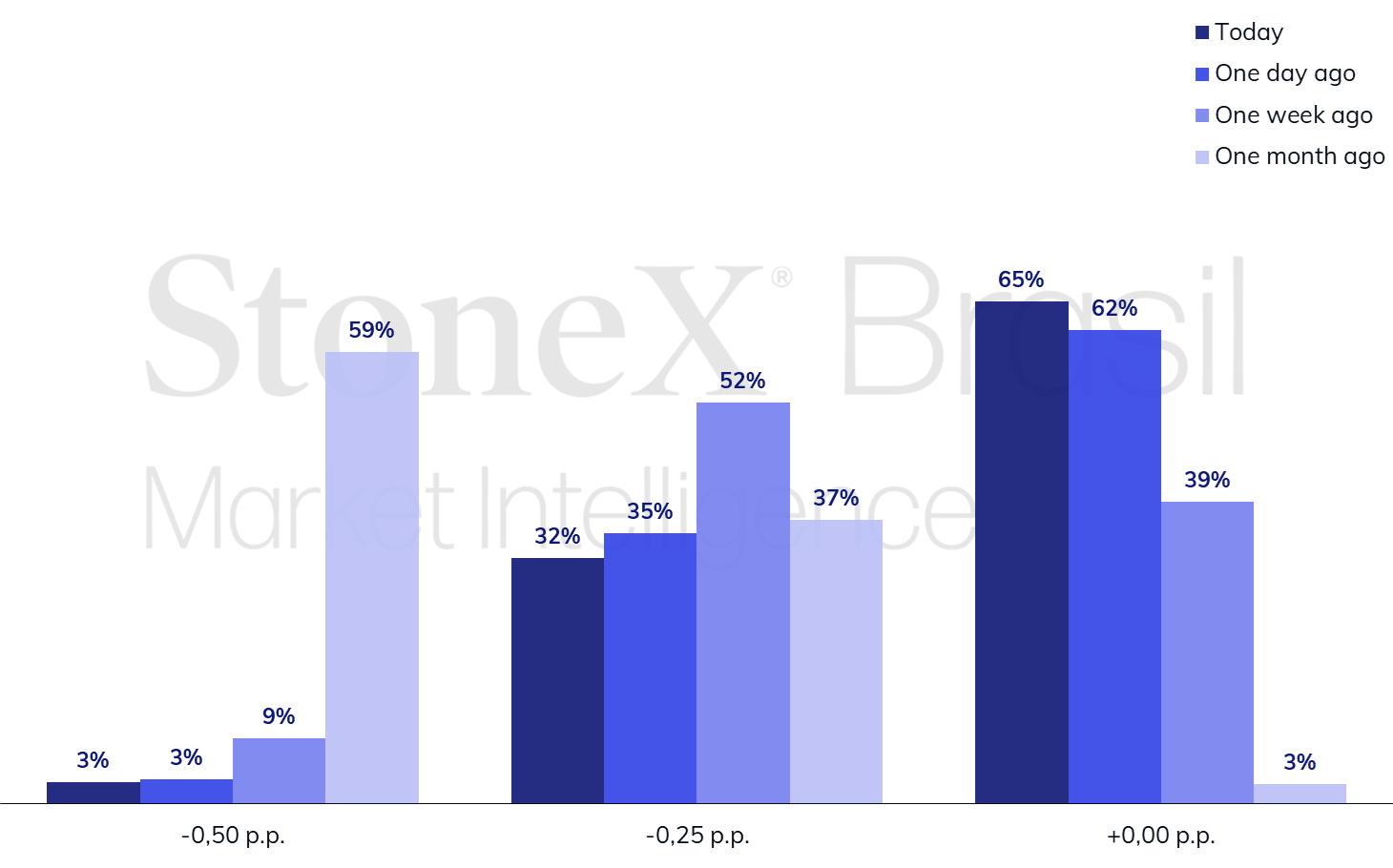

It is worth noting that, in the decision statement and in the press conference that followed, the Committee emphasized the need for price moderation to continue evolving sustainably over the next few months so that there would be the "greater confidence" necessary to start the interest rate cutting cycle. Nonetheless, readings above expectations for job creation and consumer inflation in January led investors to anticipate a more cautious behavior by the FOMC to ensure that price stabilization is still evolving satisfactorily. Thus, investors' bets on the start of an interest rate cut cycle by the Fed have moved even further away, pointing to June as the most likely date.

IBC-Br in Brazil

Expected impact on USDBRL: bearish

After remaining flat in November, the Central Bank's Economic Activity Index (IBC-Br) is expected to have expanded by around 0.4% in December. While manufacturing and the volume of services expanded, retail trade fell short of expectations and declined in the last month of the year. If Brazilian productive activity is expected to show solid growth in 2023, estimated at around 3%, the loss of dynamism in its last quarter is noteworthy.

European economic data

Expected impact on USDBRL: bullish

The United States economy surprised the market by showing resilience in the face of the sharp monetary tightening since 2022. The European economy is suffering the predicted consequences of a set of recessionary policies, with price moderation accompanied by a significant economic slowdown. This week, the preliminary Purchasing Managers' Index (PMI) for the eurozone in February is expected to rebound from January but remain in contraction territory, with a reading below 50 points, for the industrial, services, and composite indices. At the same time, the Consumer Price Index (CPI) is expected to continue its gradual slowdown, dropping from 2.9% in December to 2.8% in January on a 12-month basis, while the core of the indicator is expected to decrease from 3.4% to 3.3% in the same period, also on an annual comparison. In this context, the European Central Bank may be compelled to be the first monetary authority to start a cycle of interest rate cuts among the major economies.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.