| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.31% | 4.38% | 3.91% | 3.94% | 3.94% | |

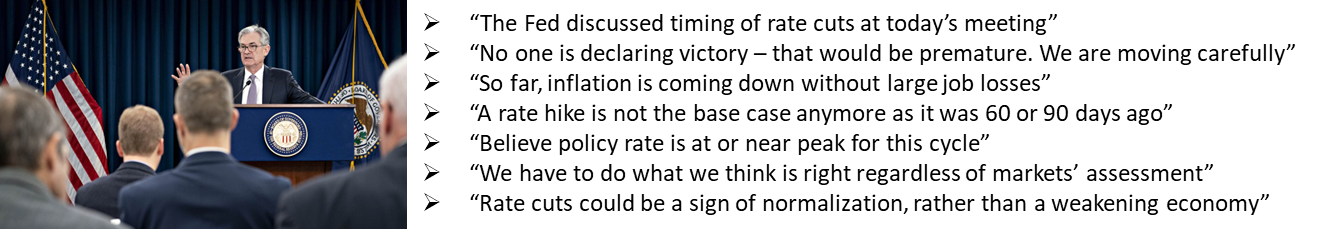

- The Federal Open Market Committee followed through on expectations to keep rates unchanged today, voting 12 - 0 to keep the Fed Funds target range at the current 5.25% - 5.50%

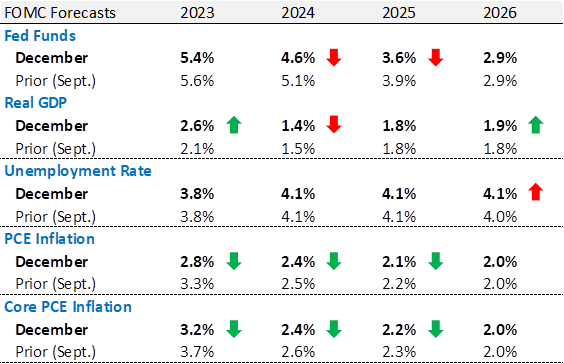

- Their updated forecasts though, took many by surprise with larger than expected downward revisions

- Next year, the Fed now expects rates to end the year closer to 4.6% (implying 3 rate cuts, pulling forward a rate cut that was previously in the 2025 forecast)

- In 2025, the updated Dot Plot shows rates ending the year near 3.6% (now showing 4 rate cuts)

- Thereafter, the forecast converges to the long run neutral rate of 2.50% (unchanged)

- Notably, the 2024 forecasts are much closer together than they previously were – adding to the united front of this FOMC. Yet, three outliers remain: 2 that see rates on hold throughout next year and 1 that envisions rates much lower at 3.8%

- The official statement took a dovish turn as well, adjusting the phrase: “officials will consider the extent additional policy firming that’s needed” to “…the extent any additional policy firming that’s needed”. It’s not much of an adjustment, but dovish nonetheless

- Unsurprisingly, it was all about rate cuts during Powell’s press conference. And the multitude of comments he provided, in an effort to frame the Fed’s stance on rate cuts leaning on the cautious side, fell on deaf ears - markets heard “rate cuts” and that’s all it needed to rally

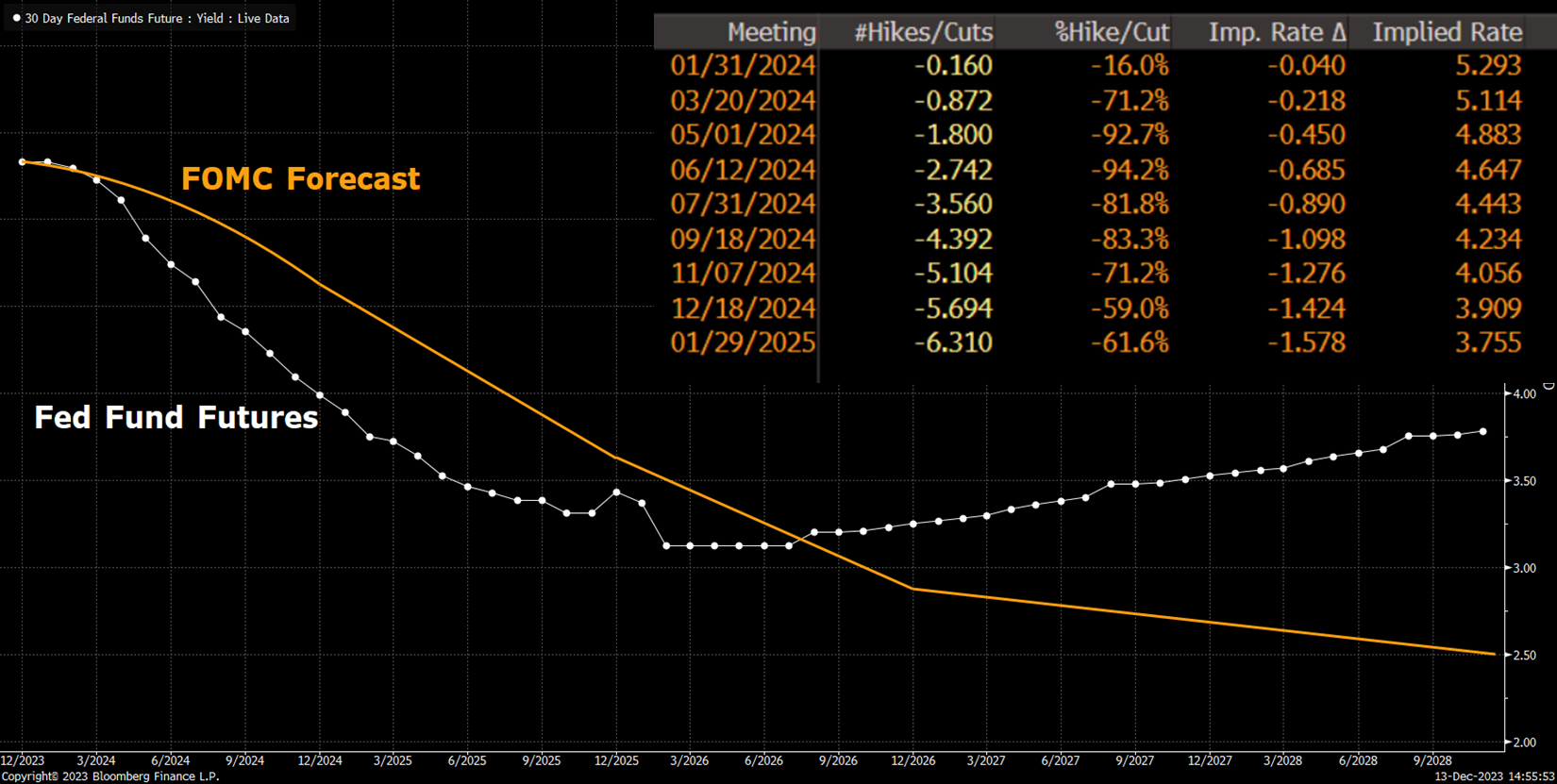

- Treasury yields across the curve fell sharply this afternoon with even more rate cuts than before being priced in

- 2Y Treasury: lower by 25-30 basis points to ~4.45% (the largest single day rally since March)

- 10Y Treasury: lower by 15-20 basis points to ~4.00% (just above its 200-day moving average)

- Built into swap rates: now a 16% chance of a cut priced into the January meeting, a 92% chance of a cut in March and almost 6 full rate cuts priced into futures by year end 2024

- Even after the dovish revision to rate forecasts today, the market continues to price in rate cuts to a degree that looks overly optimistic

- Uniquely though, the optimism in futures appears asymmetrical, as rates <2025 fall below Fed guidance while rates >2025 are well above it with a long run neutral rate closer to 3.50%-4.00%

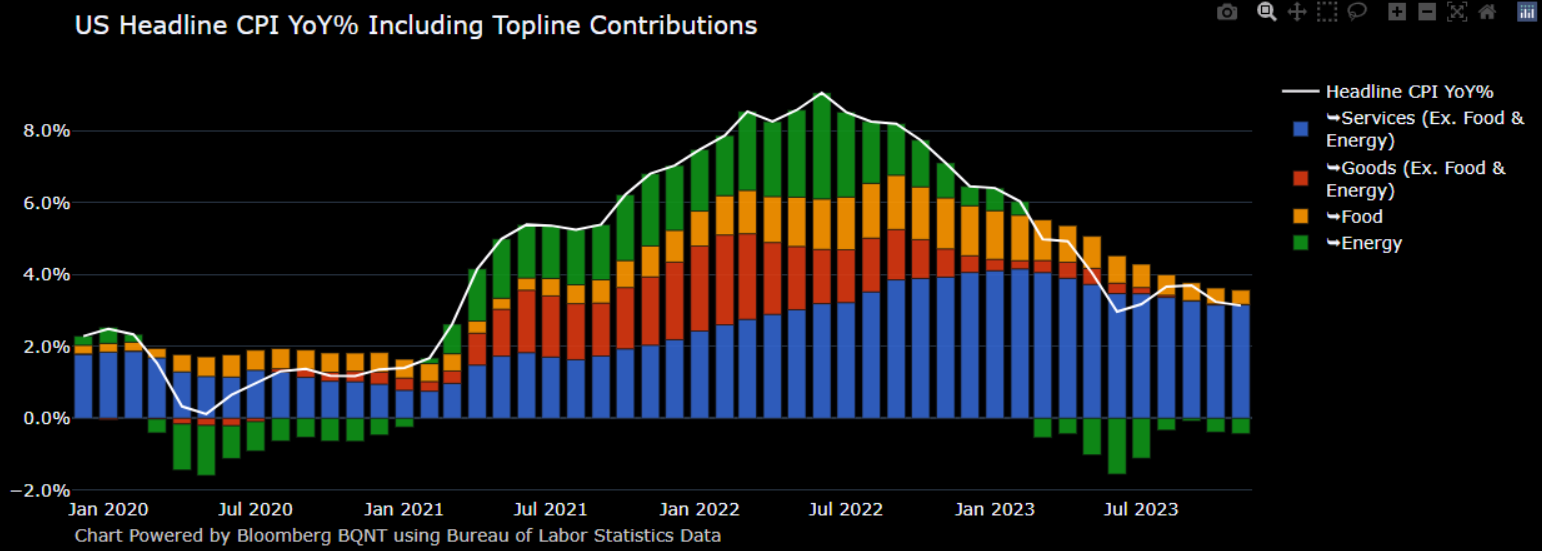

- In that report, consumer prices rose just 0.1% last month (just above estimates but well short of triggering a hawkish response) while core prices rose closer to 0.3% in November (in line with estimates)

- Both of which did very little, if anything, to nudge the annual pace of inflation meaningfully lower. Headline CPI dropped from 3.2% to 3.1% and Core CPI remained unchanged at 4.0%

- Buried in the report were the nuanced details the Fed and rate market loves to dig into:

- Shelter prices moved in the wrong direction (again), rising 0.4% in the month from the slower 0.3% pace in October

- Used car prices unexpectedly rose 1.6% after October’s 0.8% decline. This was the first time those prices ticked up since May

- New car prices, after the end of the autoworkers’ strike, edged lower by 0.1% - matching the decrease in October

- Notably, apparel prices dropped 1.3% last month – the largest decline since May and the largest categorical decrease in CPI outside of energy last month

- Overall, the report mostly reinforced what we already know

- That the inflation story is almost entirely explained away by shelter costs at this point. Energy prices are outright falling, food prices are stabilizing at pre-pandemic levels, goods’ prices have fallen for 6 consecutive months and sits at 0.0% from a year ago

- Shelter however increased 6.5% over the last 12-months, and has accounted for nearly 70% of the total increase in Core CPI

- Yet, the Fed took solace in the fact that at least directionally – everything is moving in the right direction

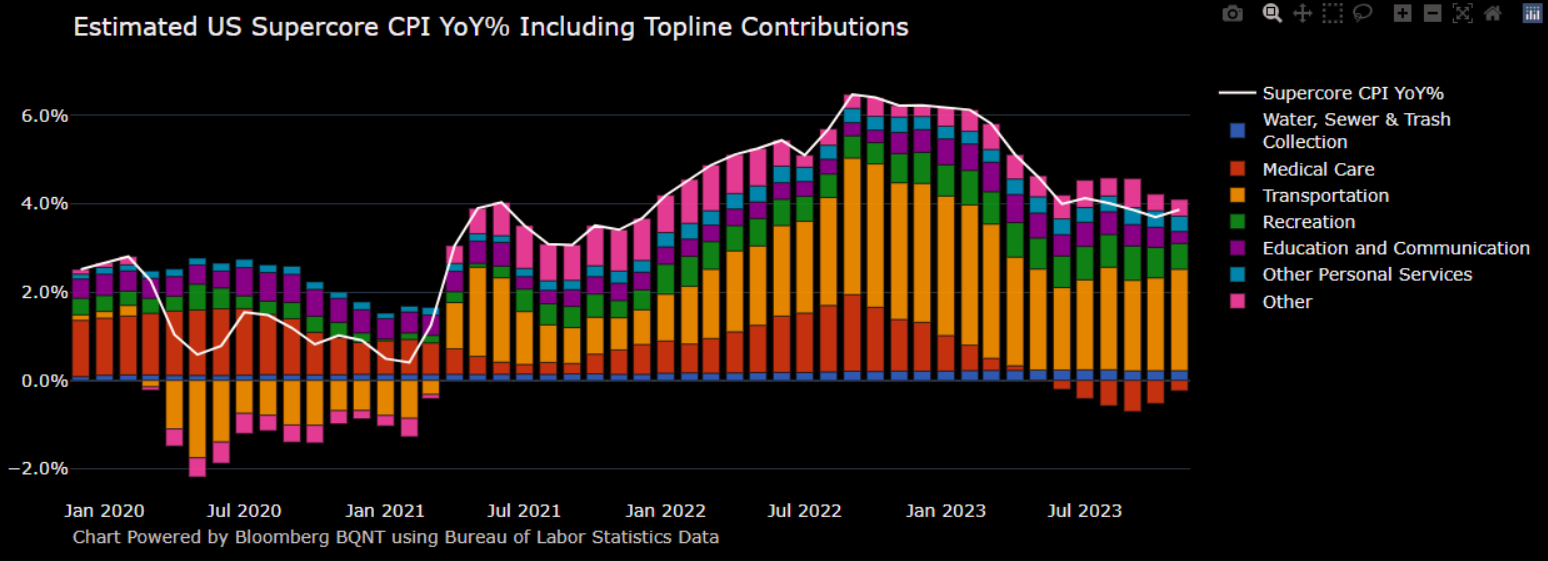

- Core services excluding housing (aka Supercore CPI), perhaps a better look at how wages are keeping inflation “higher for longer”, likely demanded Powell’s attention the most as it rose 0.5% last month. Bringing the annual pace up to 3.93% and only the second time this year that Supercore inflation has sped up (just not enough to require another hike)

- Core goods has reverted to pre-pandemic levels, but the wage-sensitive services categories remain too strong to suggest cutting rates is appropriate as quickly as the market is pricing in

- Powell himself has lamented the stubborn nature of core services inflation at every press conference, including today, and it suggests that the market could be mispricing the timing of rate cuts next year

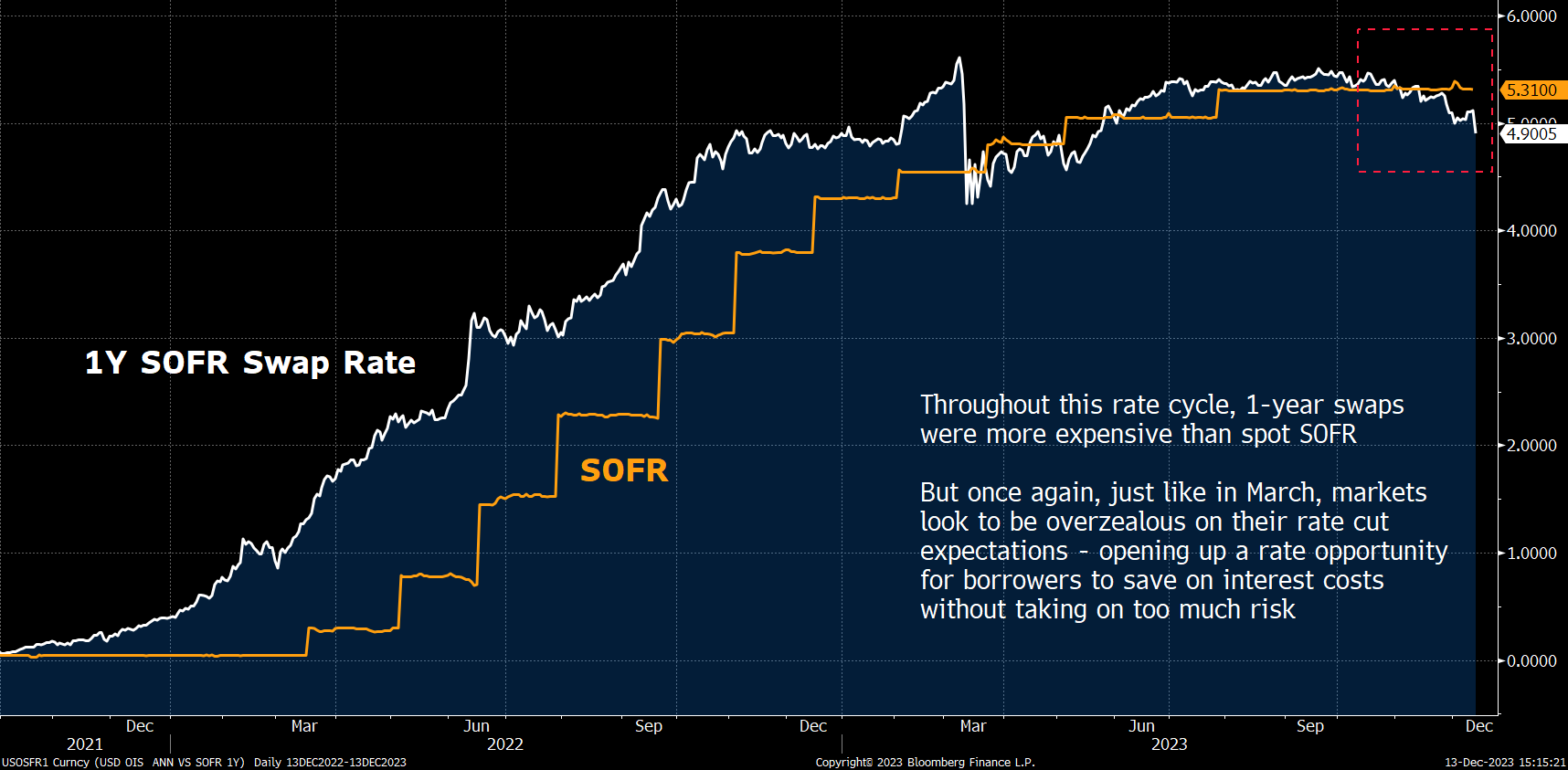

- 1 or 2-year SOFR swaps. And/or a long-put strategy

- SOFR swaps on the very frontend of the curve offer positive cashflows day 1 – something that rarely happens. It effectively allows a borrower to accumulate a cash balance as we wait for the next chapter of Fed policy. Should rates fall, the position can either be liquidated or rolled out to a longer tenor with a cash balance to show for it. It remains an ideal part of the curve to target as it balances positive cashflows and conservative duration risk

- A long-put strategy is the other side of the coin. Unless its strike is deep in the money, the position sits patiently for those rate cuts to happen before positive cashflows begin. It’s often built in conjunction with either a short put or short call to help offset the option premium of the long position, creating a balanced approach with less out of pockets costs to put on

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.