StoneX In Focus: Inflation

A candid Q&A about the prospect of long-term inflation's return to Western economies with Vincent Deluard, Director, Global Macro Strategy with StoneX Financial Inc.

After a decades-long absence, fears of significant and sustained inflation have gripped the markets – spurring volatility and uncertainty. Not surprisingly, economists and market analysts remain divided over whether or not these fears are well founded. We sat down with our global macro strategist, Vincent Deluard, to get a broad overview of the competing inflation narratives, as well as a refresher on the effects that high inflation can have on various sectors of the economy.

Q: We keep hearing that the current inflation debate between economists centers on whether the inflation present in the economy now is “transitory” or “secular” in nature. Can you explain the difference and summarize the arguments?

A: Transitory is another word for “temporary.” The transitory rationale goes like this: As economies have reopened in the wake of the COVID-19 vaccine rollouts, demand overall has come back online faster than supply – especially where lockdowns disproportionately affected supply. In fact, some argue that demand may be even higher now than it was prior to the pandemic shutdown thanks to the flood of government stimulus. Either way, the resulting shortages of some goods have led to higher prices in the short term.

Soaring lumber prices from earlier this year are a prime example. Everyone was stuck at home with government checks burning holes in their pockets, so they decided to undertake long-delayed home improvement projects. Lumber supply at the time could not accommodate the sudden surge in demand so prices shot up. Those prices have normalized since, and that’s the crux of the transitory view – that this process is playing out across the board in our economy and that all such pandemic-driven imbalances will trend back toward normal in a relatively short amount of time, with prices following suit.

Q: What about the secular inflation view?

A: Secular inflation is a longer-term phenomenon driven by long-term trends and/or structural changes in the economy. As an early and ardent secularist, I have argued that a number of significant changes like this may be underway globally, but let’s take the labor market as an example, as most readers can readily relate to it.

Those of us who have gone out to restaurants as part of the “reopening” have probably experienced limited hours, longer waits and slower service at some of our favorite places. That’s because customers are returning at a faster rate than furloughed or laid off employees, and there’s not enough supply in the labor market to replace those workers who haven’t come back. The transitory view assumes that, like the lumber example above, this imbalance will level out because people sidelined from the workforce by the slowdown will eventually return in mostly the same numbers and capacities, and will be willing to work for the same wages. In short, we’ll have essentially the same labor market that we had in 2019.

Secularists aren’t buying it, and here are some reasons why: We have seen plenty of reports that people’s health has suffered during the lockdown. Americans, on average, have gained 20 pounds or more over this time (according to the University of California), while reported rates of depression and addiction are higher. These factors can prevent or delay the return to work for those who are suffering. For others, the combination of a layoff and perhaps the loss of loved ones has prompted them to reassess the value of work vs. taking care of family. Still others have simply spent a year or more successfully making do with less, and thus may be less apt to return to a job or a career that they didn’t like to begin with. All of these factors can affect labor market participation beyond the short term.

Q: Some analysts – and politicians – have suggested that people won’t return to work until the social safety net is scaled back to its pre-pandemic state. Do you agree?

A: The social safety net is a factor, but we’ve already seen a number of states in the U.S. limit or end their stimulus programs, and there has not yet been a rush back to the labor markets in those instances. I would argue that the rise of the gig economy is exerting a larger influence – and that’s an example of a structural change. The last time we found ourselves coming out of a recession, in 2010, you couldn’t just pick up your phone and become an Uber driver, a Door Dasher or an Amazon Turk worker in a matter of days or weeks. These opportunities are reducing the supply of workers looking for traditional employment, which in turn sets the stage for higher wages for those jobs. Unlike most commodity prices, wages rarely ever go down in absolute terms once they’ve gone up. We can probably assume that the companies paying these higher wages will look to pass this cost on to consumers as soon as they’re able.

Q: What economic metrics are market observers monitoring most closely in regard to inflation?

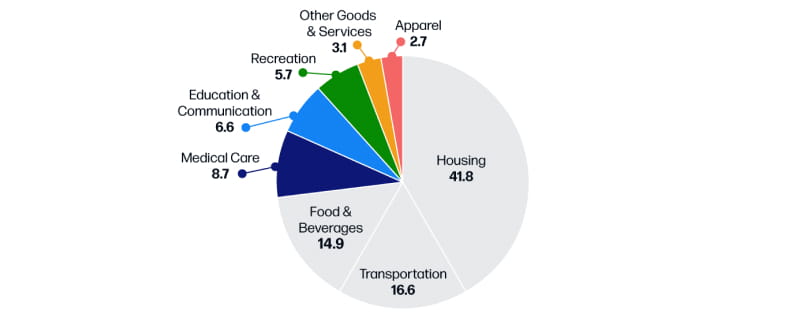

A: The Consumer Price Index (CPI) remains the primary barometer among observers. Lately, it’s been telling us that inflation is here – running at a clip of about 5 percent. But even with the CPI, interpretations of the data diverge along transitory/secular lines. Some proponents of the transitory view have argued that we can’t take the CPI at face value because the data sets we use to calculate it have been skewed by the idiosyncrasies of the pandemic slowdown. This is what the Federal Reserve, a noted transitory proponent, means when it points to “base effects” as the primary cause of current inflation. Paul Krugman, the well-known economist, has gone so far as to suggest we exclude housing, transportation, and food from our analysis of the CPI, because those sectors have been affected most by the lockdowns and re-openings. One could argue that reporting inflation after excluding 73% of the index is like reporting health statistics excluding sick people, but Krugman has a Nobel Prize and most of the rest of us do not.

Components of the CPI Index

Source: Bloomberg

For some market analysts, it may be hard to see commodity prices (including gasoline) falling much this autumn due to the effects of this summer’s catastrophic drought across the West and in Canada, meaning input costs for processors and manufacturers will remain high as well. Meanwhile, increases in the cost of shelter, another major component of the CPI, will likely occur as home prices continue to spike and rents rise once lockdown-era moratoria on evictions end. Even if you strip out housing, food and transportation, you’re left with components like healthcare and education, which tend to be more inflationary than the overall index. These factors may suggest that inflation will at least linger longer than most transitory proponents predict.

Q: Given the divergent interpretations of the CPI, what other metrics are you looking at for clues to how long inflation may persist?

A: Markets operate on psychology as much as anything else, so I am looking at measures of inflation expectation for the future, too. These include the 5-Year Forward Inflation Expectation Rate (T5YIFR) and the 10-Year Breakeven Inflation Rate (T10YIE) – both derived from the yield on inflation-protected Treasuries.

Again, the CPI has told us for months that inflation is already here, but expectation measures suggest that relatively few market observers are overly concerned about it staying around for long. Put another way, the transitory proponents seem to be winning the argument in the court of “market” opinion. However, if the CPI continues to tell the same story through the winter and into spring, and expectation measures begin to align with that story, then we may see prospects for secular inflation accelerate.

Q: Above, you touched on the effects of rising input prices on businesses. What types of companies or industries does inflation tend to hit hardest?

A: Part of it depends on where you sit in the supply chain. For decades now, the benefits of lower input prices, increased productivity resulting from innovation and technology, stagnation in real wages, and decreasing competition brought on by marketplace consolidation have accrued to processors, manufacturers, and retailers.

In inflationary conditions, the reverse is typically true, as inflation shifts power back upstream. Specifically, resource-intensive sectors whose input costs are rising but whose pricing power is weak typically suffer most. Take automobiles: They’re made of commodities (metal, rubber, plastic, etc.) and labor. The rise in the prices of both increases costs for automakers, but the competitive nature of the marketplace limits their ability to pass those increased costs on to consumers.

Beer is another example. It’s very commodity-intensive to brew, package and distribute – but pricing power is very low because most consumers are price-driven – especially those who may be out of work or working less.

To be clear, I am not recommending that readers here sell off any stock they may have in car companies or breweries. I am simply using them as examples based on the historical performance data we have.

Correlation Between Industries’ Returns and Inflation

1926 to Present, lowest & highest values shown

Source: Bloomberg

Q: In that same spirit, which sectors or companies tend to weather inflation better than others?

A: I mentioned earlier that inflation shifts power back upstream in the supply chain. This is because the producers of agricultural and industrial inputs often have some built-in advantages that can enable them to grow their margins faster than their costs grow. Let’s return to the example of automobile manufacturers and their suppliers. If you’re a miner of lithium (for hybrid batteries), copper or even oil and gas, you typically have more fixed assets that you can leverage (mines you already own, facilities you’ve already built, equipment that you’ve already bought) to keep overall costs relatively low – even in a larger context of rising prices. Also, these capital-intensive businesses have relatively few workers so their margins are less sensitive to labor costs. Finally, relatively high barriers to entry at this point in the supply chain can limit competition, which preserves pricing power. This combination of fewer sources of rising costs and relatively strong pricing power with their end customers (in this case, car companies) can benefit those companies who can position themselves to take advantage of it.

Q: Finally, what advice would you give to investors or business owners who are following the inflation narrative with white knuckles and bated breath?

A: I don’t say this out of any sense of false modesty or mischief, but economists don’t have a monopoly on meaningful market insights. Today’s economy is not the one I studied in grad school, and in many cases, reliable data from the late 1960s and early 1970s that my colleagues and I might use for comparisons between then and today is actually very hard to come by.

Economists have developed various theories of inflation over time and most of these models, such as monetarism or the Phillips curve, have broken down. This is because inflation is essentially a psychological and social phenomenon, a mindset which creates its own reality.

Hence, anecdotal evidence from everyday life can provide real clues to where inflation may be heading. If your neighbor comes home with a new car and says he wanted to buy it before prices get too high. If you hear friends or family talking about investing in gold. If you go to a restaurant that’s adding a $3 surcharge on all orders because of higher prices or staff wages, and it’s still full of people willing to pay it. All of these behaviors could be interpreted as meaningful signals because the psychology behind them is the key driver of the outcome.

About Vincent Deluard

Vincent Deluard, CFA, serves as director of global macro strategy for StoneX Financial Inc. A prolific market commentator who’s often quoted in the Financial Times, Wall Street Journal, Bloomberg, Forbes Magazine, and Barron’s, Mr. Deluard earned the Euromoney Padraic Fallon Editorial Prize for his in-depth study of the investment opportunities offered by the European debt crisis in 2013. Prior to joining StoneX., Vincent served as Europe Strategist for Ned Davis Research Group, where he authored weekly publications on European markets, and designed proprietary trading models that combined fundamental, technical and macro indicators to identify major investment themes and market trends.

About StoneX In-Focus

The StoneX In-Focus series aims to provide broad, top-level insights from the company’s foremost analysts into trends and topics affecting the markets over the medium to long term – all in an easily accessible Q&A format.

This commentary is intended for Institutional and Investment Professional Use Only and may not be distributed to the investing public. The views expressed are those of the author and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by StoneX Group Inc. or its affiliates. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results StoneX Financial Inc. a registered broker dealer, member FINRA, SIPC, MSRB, is a wholly owned subsidiary of StoneX Group Inc.

© 2021 StoneX Group Inc. All Rights Reserved.