Jobs and the Fed, a Cheat Sheet: StoneX Strategy

Key Takeaways

- StoneX’s Kathryn Rooney Vera compares interest rate cut variables

- September’s jobs report will affect Fed action on upcoming rate cut

- Higher jobless rate or lower payroll growth raise odds of a half-percentage point cut

According to StoneX’s Chief Market Strategist Kathryn Rooney Vera, the September 6 jobs report will weigh heavily in the Federal Reserve’s decision on interest rate cuts expected later this month. The Fed doesn’t rely on a single report; instead, it garners fresh insight from each report to gauge progress on its goal of a soft landing.

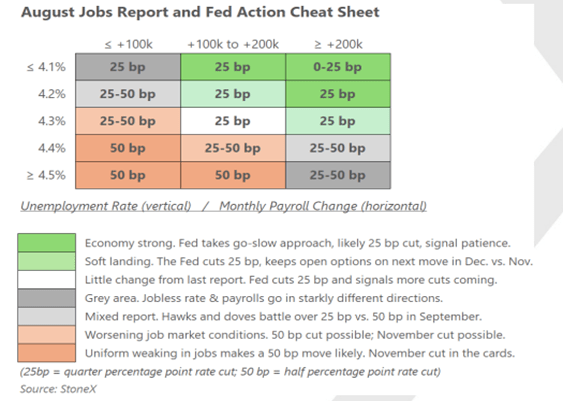

Below is a cheat sheet of likely Fed moves based on varying job numbers.

“This matrix summarizes our best estimate of how the Fed would weigh different outcomes,” said Rooney Vera.

“The two key numbers,” she said, “are the unemployment rate and the growth in payroll employment.” The unemployment rate is up from 3.4% in April 2023 to 4.3% in July. Fed Chairman Jerome Powell has stated he doesn’t wish to see further weakening in the job market, as a rising jobless rate would indicate. According to Rooney Vera, further weakening increases the odds of half percentage point interest rate cut in September.

Conversely, payroll growth is down from 250,000 new jobs per month in 2023 to 114,000 in July and 170,000 on average in the three months between May, June and July. If payroll expansion slows to below 100,000 monthly, Rooney Vera said that would indicate further weakening. “That would also increase the odds of a half-percentage point rate cut,” she added.

Since payrolls and the jobless rate are based on different surveys – one of businesses and the latter of households – Rooney Vera warned that the reports might “go in different directions.”

The jobs report, she said, will also frame how the Fed thinks about rate changes later in the year. “A rate cut in November – even though it’s close to the election – is possible if the jobs numbers fall within the red zone of this matrix.” Data in the green zone, she said, makes a November move less likely. “Red and green thus reflect the likely tone of Jerome Powell’s post-September-meeting press conference.”

“Of course,” Rooney Vera added, “the Fed looks at a wide range of data, including within Friday’s jobs report. Developments in wages, labor force growth, revisions, and other factors will play into the Fed’s decision in September.”

Dive Deeper: Access Kathryn Rooney Vera’s Analysis

For more in-depth analysis on global market trends and investment strategies, subscribe to "Macro Strategy by Kathryn Rooney Vera.” This comprehensive suite of reports offers expert insights on socio-economic and political trends influencing global markets, authored by StoneX's Chief Market Strategist.

Read the full article here.