ESG Investors Are Winning Their Unintended War on People

In the May 2020 installment of his Monthly Flow report, Vincent Deluard, Global Macro Strategist for the Broker Dealer Division of StoneX Financial Inc., writes that Environmental, Social, and Governance (ESG) investing is an idea whose time has come, but not for the reasons their champions might think. In fact, he argues, the recent strong performance of ESG funds is being driven by an unintended dark side: their preference for companies that develop or rely on machines and intangible assets over human contributions. In this case, ESG funds could end up driving or exacerbating the very excesses of winner-take-all capitalism that they were originally conceived to help moderate.

Bottom Line:

- ESG ETFs have outperformed benchmarks in Europe, Asia, and the U.S. this year and trashed “smart beta” funds

- Flows have followed: equity ESG ETFs are doubling every year and fixed income ESG funds are taking off

- ESG ETFs overweigh technology and healthcare stocks and have a general tilt towards “quality growth”

- ESG ETFs massively overweight companies with few workers: algorithms have no carbon footprint and labor disputes!

- ESG unintendedly spreads the most dangerous ills of our time: winner-take-all capitalism and a jobless future

“Nothing is stronger than an idea whose time has come” observed Victor Hugo. As someone who ardently backed the absolute monarchy in his youth, became a lord under the Bourgeois regime of Louis-Philippe, admired Napoleon’s despotism, but was exiled by his much more moderate nephew, Napoleon the Third, and eventually embodied the ideals of the French Republic, Victor Hugo knew the power of big ideas – and the necessity to change them at the opportune moment.

Environmental, Social, and Governance (ESG) investing is one of these ideas whose time has come. I must re-assure my already-yawning reader: this research piece will abruptly deviate from the boring script of “doing well by doing good” and tedious discussions of “best-in-class” metrics to present the unintended dark side of ESG funds.

The first part will discuss the success of ESG funds. In a year in which vicious selloffs and rebounds have decimated seasoned global macro managers and in which “smart beta” strategies have been anything but smart, ESG ETFs have quietly outperformed their benchmarks in Europe, the U.S., and Japan. ESG investing, which has already been widely adopted in Europe and Japan, is also taking off in the U.S. Flows into ESG ETFs have gone parabolic this year: ESG ETFs posted inflows in the March bear market, when almost everything else got liquidated.

The second part will attribute ESG’s good fortune to its tilt towards healthcare and technology, as well as its focus on “quality growth” companies, with strong balance sheets, healthy margins, and high valuations.

This return attribution process will uncover the dark secret of ESG investing: the single most salient characteristics of these funds is that they favor machines and intangible assets over humans. The average company in the ESG basket has 20% fewer employees than the median Russell 3,000 company. This tilt explains their success in a year which has rewarded biotech firms and tech platforms and punished employee-heavy sectors, such as airlines, retailers, and cruise lines. Companies with no employees do not have strikes or labor disputes. There is no gender pay gap when production is completed by robots and algorithms. Financial networks have no carbon footprint.

Despite its noble goal, ESG investing unintendedly spreads the greatest illnesses of post-industrial economies: winner-take-all capitalism, monopolistic concentration, and the disappearance of jobs for normal people.

ESG Funds Are Winning the Flow and Performance Race

ESG funds have been one of the few bright investing spots of 2020. As shown in the chart below, the major ESG funds have outperformed their benchmarks in the U.S., emerging markets, Europe and Japan. ESG funds have even delivered alpha on the fixed income side, as illustrated by the strong outperformance of European corporate bond UCITs.

The especially strong returns of European ESG funds may owe to the strong flows into the sector as European pension funds and institutional investors were the first to adopt ESG mandates.

The strong performance of ESG funds in 2020 is all the more remarkable as most active managers have been wrong-footed by the market’s wild gyrations: the Eurekahedge Macro Hedge Fund Index is down 2.6% for the year. So much for the hopes that the return of volatility would reward the kind of big macro bets that the industry is famous for.

ESG funds’ performance also shines in comparison to that of their cousins – smart beta ETFs. The main multifactor ETFs, which supposedly harvest several anomalies to deliver consistent alpha over market cycles have cratered this year. With their typical irony, financial markets have rewarded the strategies which were not designed for performance (ESG) and punished the ones which were solely designed to beat cap-weighted benchmarks.

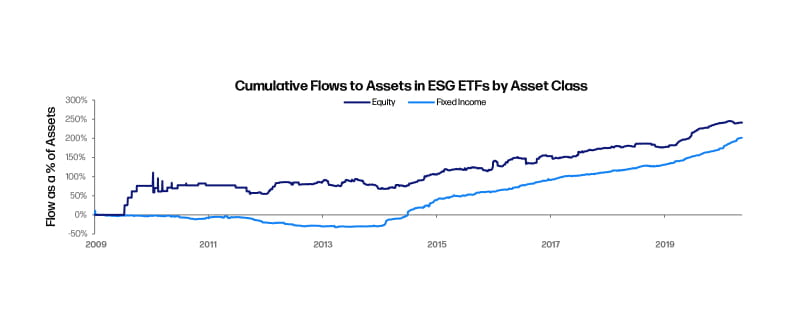

ESG’s success has been even clearer in terms of flows. ESG equity ETFs managed $35 billion last year: their assets have doubled in the past twelve months, solely because of flows. Growth has been even more rapid for fixed income ESG funds: the industry, which managed just $3.5 billion at the beginning of 2019, took in $4.4 billion in the past year and a half.

Source: Bloomberg

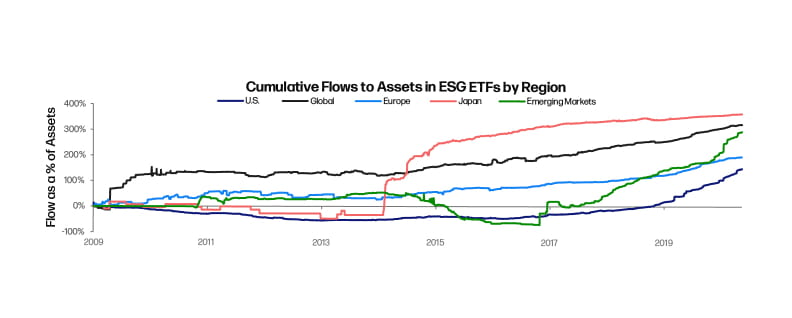

At the regional level, ESG investing picked up in Japan when the Japan Exchange Group launched the Nikkei 400 index to reward high quality companies with shareholder-friendly practices and governance structure. Flows into EM ESG funds took off in 2017, a year after the iShares MSCI Emerging Markets ETFs was launched. The U.S. was a relative laggard in the ESG ETF space, but flows have gone parabolic in the past twelve months.

Source: Bloomberg

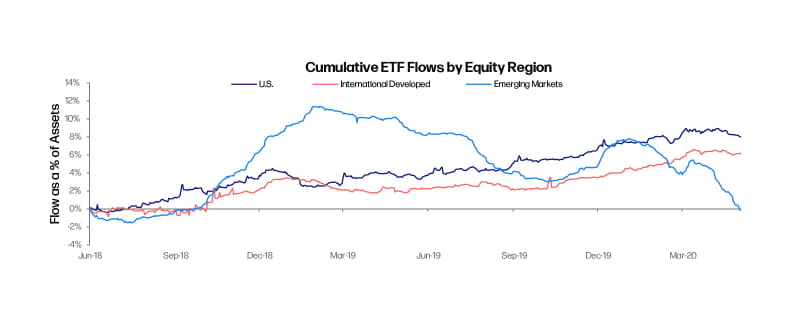

The growth of ESG ETFs goes far beyond the steady rotation of assets from active funds into ETFs. Covid-19 and the 2020 bear market have slowed the rotation into U.S. equity ETFs and have led to massive redemptions from international equity ETFs. On the contrary, money has kept pouring into ESG funds, even at the worst of the March 2020 selloff.

Source: Bloomberg

A Quality Tilt and Something Darker

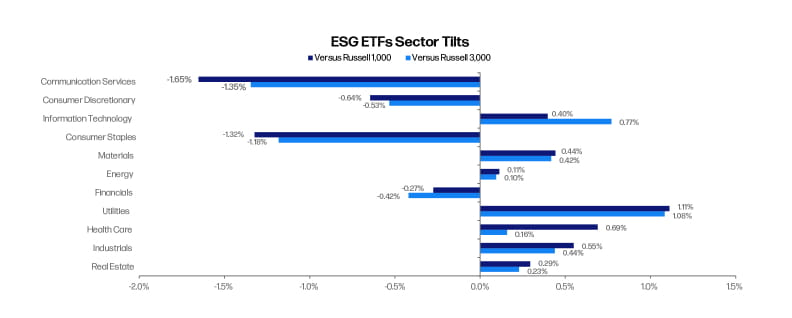

Where does the performance of ESG funds come from? Return attribution looks at how a basket of stocks deviates from market cap weights and tells whether alpha comes from sector bets, individual stock picks, or style tilts. I started by creating a representative ESG portfolio by taking the average weights of the Russell 3,000 index stocks in the ten largest U.S. equity ESG ETFs and comparing them to their normal market cap weight. At the sector level, the ESG basket is overweight technology, utilities and healthcare. Technology and healthcare have been the two best-performing sectors this year. Communication Services is ESG’s biggest underweight but the sector is poorly constructed: it is an aggregation of the old telecommunication stocks (AT&T, T-Mobile, Verizon), which ESG funds underweight, and entertainment platforms, such as Walt Disney and Electronic Arts, which ESG fund overweight.

Source: Bloomberg

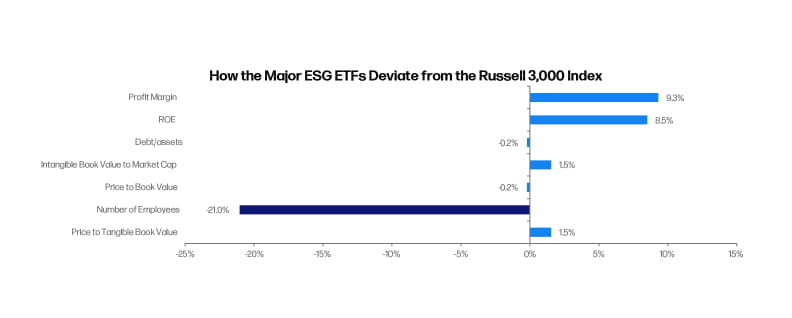

I ran the same analysis on traditional quant factors, such as margins, return on equity, leverage, price-to-book value, and intangible assets. The deviations all point to a general orientation to quality: companies favored by ESG ETFs have higher margins, better profitability, lower leverage and more intangible assets. This is of course consistent with ESG’s sector tilt towards healthcare and technology and explains the strong performance of these ETFs in recent years: “quality growth” has been the theme of the decade, at the expense of traditional factors, such as value and size. I thought this insight was good enough to be the conclusion of this quantitative study, until I accidentally stumbled upon a much larger and problematic feature of ESG ETFs: ESG criteria effectively screen out companies with a lot of employees! This effect dwarfs all the other tilts: the average company in the ESG basket has 20% fewer employees than normal.

Source: Bloomberg

ESG’s Unintended War on Normal People

ESG’s bias against employees is like the subconscious mammary theme in McDonald’s yellow arches: once you see it, it is impossible to see anything else. Sure, qualities like strong margins, profitability, and balance sheet strength were helpful in 2020, but by and large, the best strategy would have been to do exactly what ESG ETFs unconsciously do: sell companies with lots of employees, and buy ones with lots of robots, patents, and intellectual property.

ESG’s bias against humans is probably unconscious, but it is a feature, rather than a bug. Companies with no employees do not have strikes or problems with their unions. There is no gender pay gap when production is completed by robots and algorithms. Biotech labs where a handful of PhDs strive to find the next blockbuster molecule have no carbon footprint. Financial networks which enjoy a natural monopoly in processing payments can have the luxury of ticking all the boxes of the corporate governance check list.

This reminded me of the fundamental difference between the digital world, in which the managerial class thrives, and the real world. For example, a Martian would correctly describe my job as “moving bytes”: sending emails, organizing webinars on Zoom, consuming research to come up with investing insights, coding to backtest these ideas, and eventually putting them together using a word processor. I often find the process very frustrating: why is there no python function to do what I need? Why does Bloomberg not collect this data field?

The problems of moving bytes are very annoying to me indeed, but the real world is worse. I was reminded of that when I was trying to remodel my bathroom: tubes do not fit. Angles are crooked. Wood rots. Termites eat walls. Door latches break. In the digital world, I can troubleshoot my code, erase my faulty line, and start over. In the real world, fixing mistakes requires multiple trips to Home Depot, and quite often taking down what took days to build.

This brings me back to the backtest I ran in “The Negative Value Anomaly”. I created a portfolio of companies with negative tangible book value, i.e., physical assets, such as cash, plants, and buildings are worth less than the liability side of the balance sheet. Despite the fundamental tenet of value investing (“buy things on the cheap”), my metaphysical strategy of buying things with no tangible existence steadily outperformed the Russell 3,000 index, and the gap has widened this year.

ESG investing was originally designed as a response to the flaws of capitalism, as a way to turn the profit motive in a force for good. However, ESG filters unintendedly reward the greatest illnesses of post-industrial societies: winner-take-all capitalism, monopolistic concentration, and the disappearance of jobs for normal people.

As Saint Augustine observed in the 5th century in “the City of God”, the physical world is messy, chaotic, and sinful. ESG’s insistence of virtue is ultimately orthogonal with humans’ fallen nature. Only angels and robots never sin. ESG investors unwillingly pave the way for a perfect world which has no place for humans.