Forex Seasonality – November 2024: Can USD/JPY and USD/CAD Rally Further?

- EUR/USD and GBP/USD have generally seen quieter price action in November since the Bretton Woods agreement

- USD/JPY is coming off its 2nd-strongest month in the last eight years, and November’s seasonal tendency hints that there may be more to come

- USD/CAD historically sees its strongest performance in November, opening the door for a potential breakout to 4.5-year highs

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market. As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy. In other words, past performance is not indicative of future results.

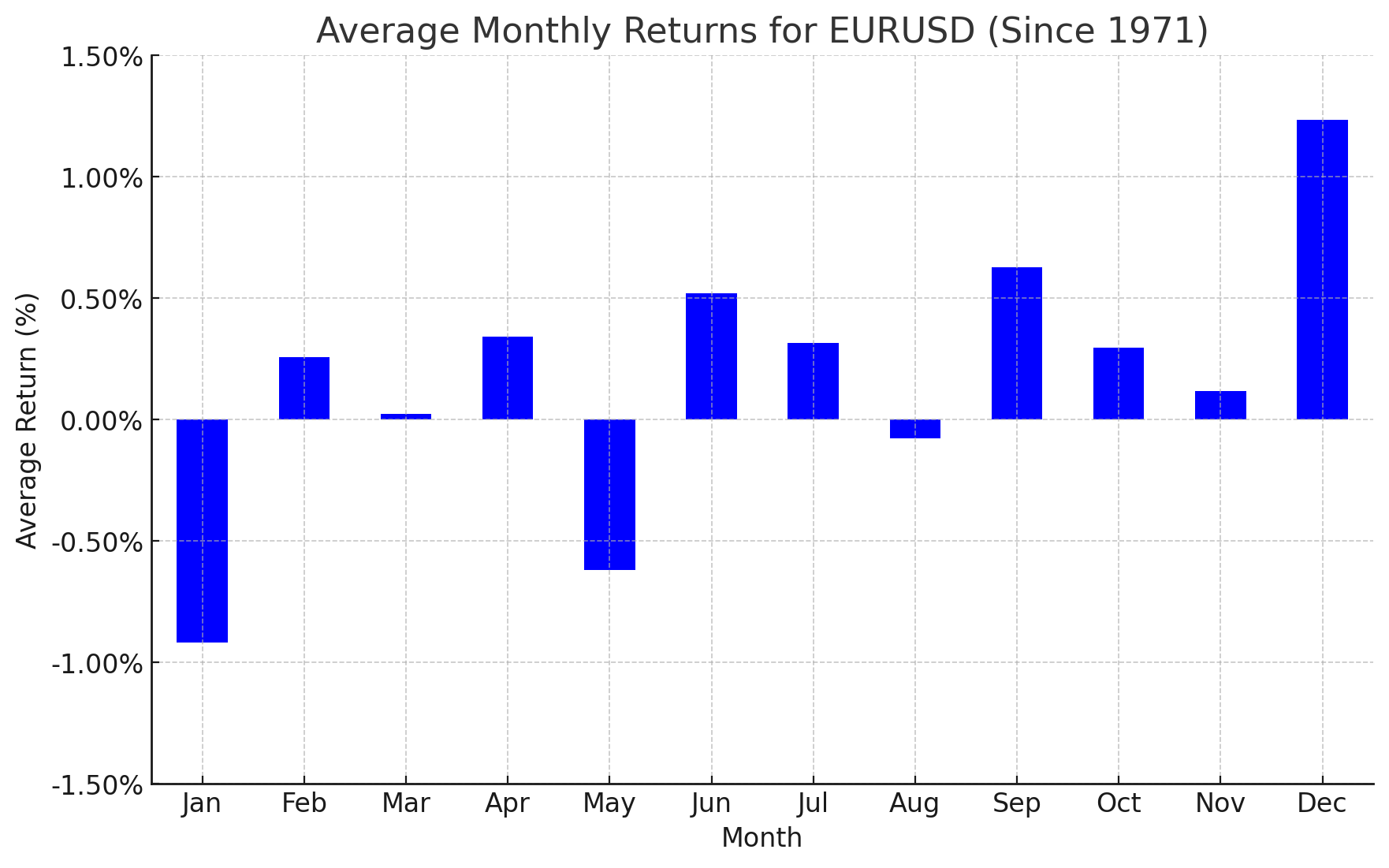

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Historically, November has been a modestly bullish month for EUR/USD, with the world’s most widely-traded currency pair sporting an average return of 0.12% over the last 50+ years. In October, EUR/USD fell amidst broad strength in the greenback, though it is notable that the single currency was the second-best performer among the majors. With EUR/USD testing a bullish trend line off the October 2023 lows as we go to press, bulls will be hoping to see strength sooner rather than later.

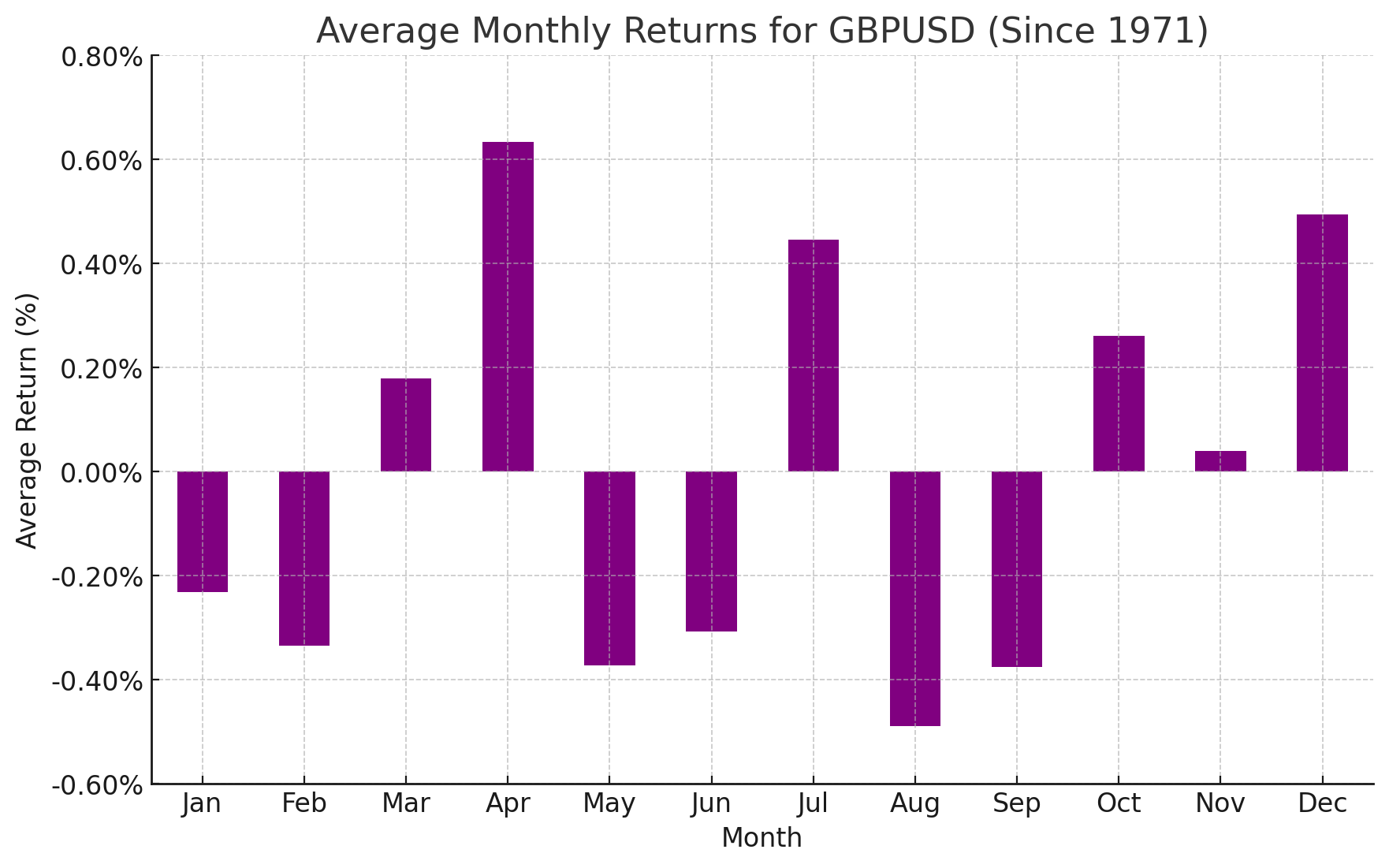

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX.Please note that past performance is not necessarily indicative of future results.

Looking at the above chart, GBP/USD has historically seen quiet price action in November, with average returns of around +0.04% since 1971. Cable is nearing a bullish trend line of its own as I write this, so the price action early in the month may well set the tone for the rest of November.

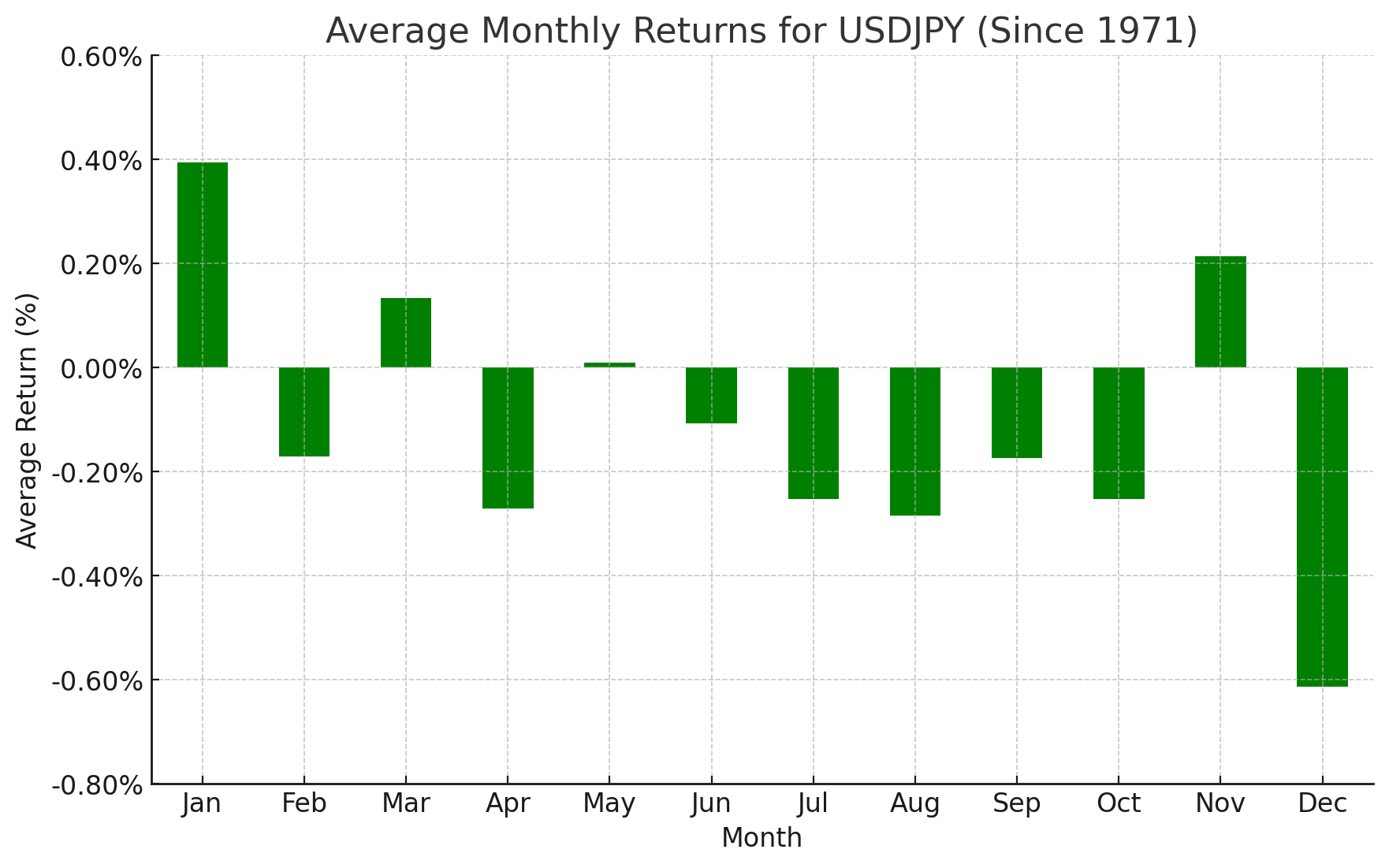

Japanese Yen Forex Seasonality – USD/JPY Chart

Source: TradingView, StoneX.Please note that past performance is not necessarily indicative of future results.

November has historically been a strong month for USD/JPY, with the pair rising by an average of 0.21% since the Bretton Woods agreement, the second-strongest performance of any single month over the last half century+. After seeing its best monthly performance since April 2022 (and the second-best in the last eight years), there’s certainly a case for a near-term pullback in USD/JPY. The US Presidential Election on November 5 will undoubtedly be worth watching closely for this event risk-sensitive pairing.

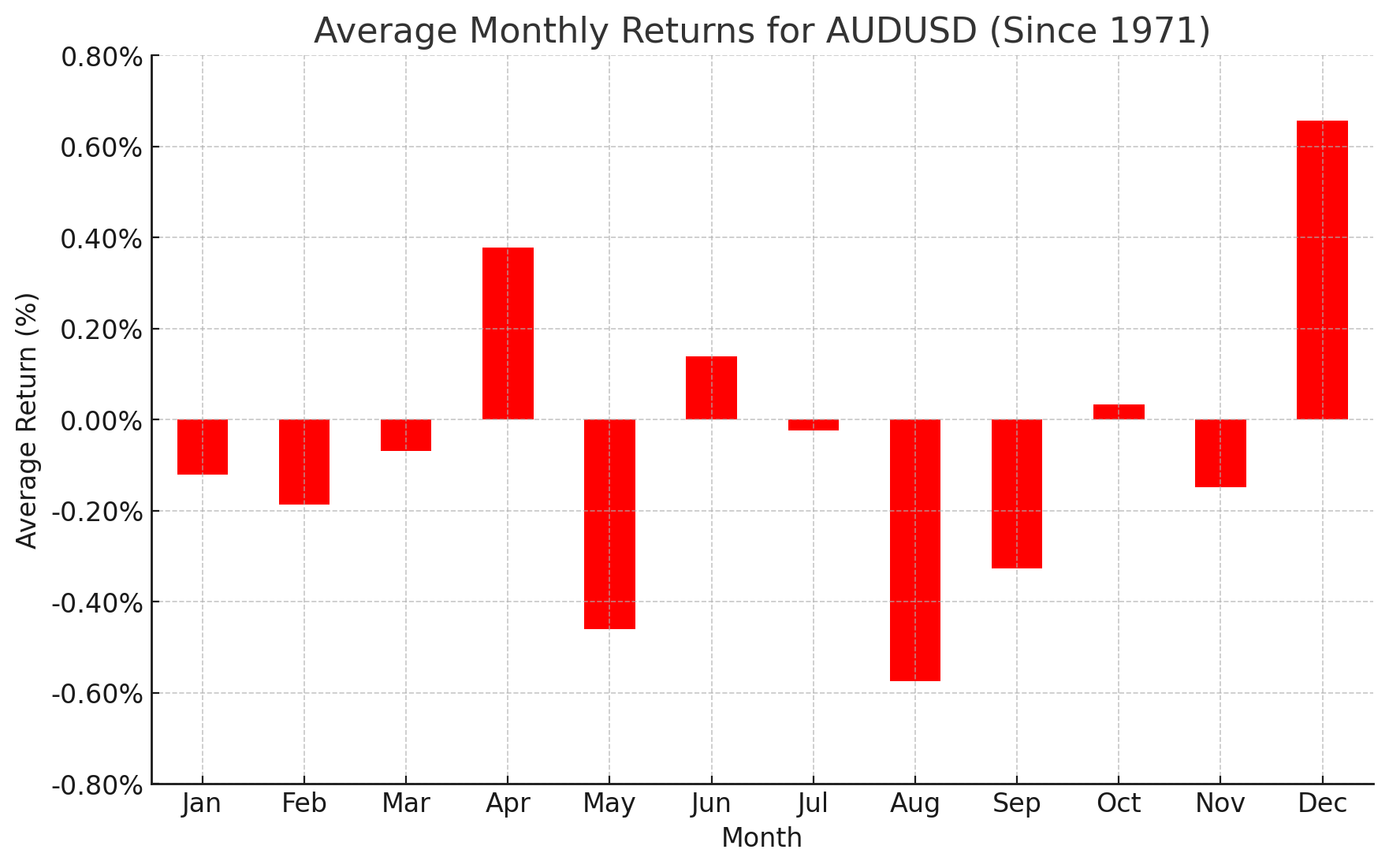

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Turning our attention Down Under, AUD/USD has seen historically slightly negative returns in November, with an average loss of -0.14% across the month. Last month, AUD/USD rolled over from its bearish trend line that dates back to 2021, disappointing longer-term traders who were hoping for a bullish breakout. In addition to the US election, this pair’s price action is likely to be driven by stimulus announcements from China, Australia’s biggest trading partner.

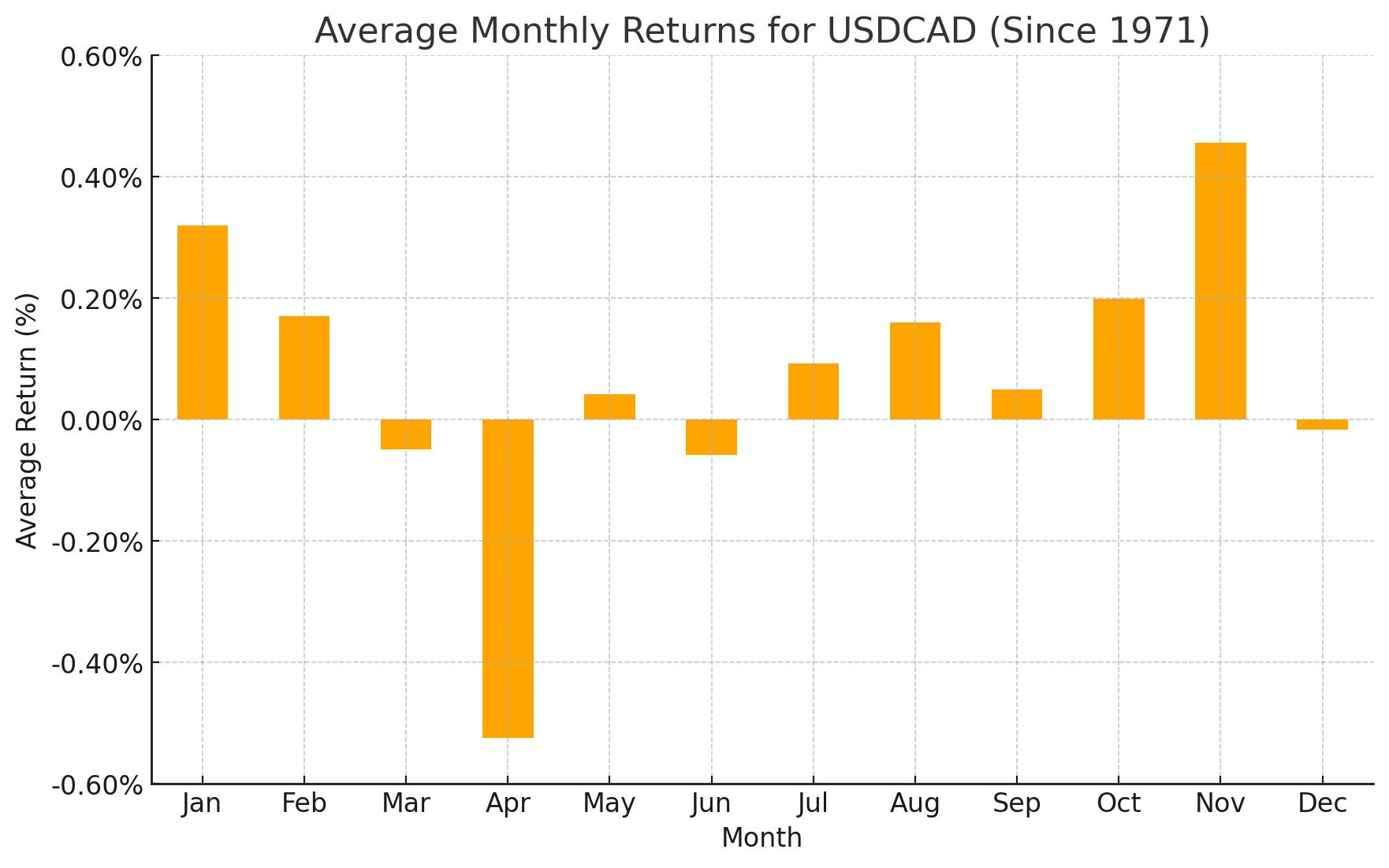

Canadian Dollar Forex Seasonality – USD/CAD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Last but not least, November has been the most bullish month for USD/CAD going back to 1971, with an average historical return of +0.46%. The North American pair is testing its 4.5-year high just below 1.40 after a strong October, so bulls will be looking for a topside breakout through that resistance level to signal a continuation higher throughout the month in alignment with the bullish seasonal tendency.

As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year – so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

-- Written by Matt Weller, Global Head of Research

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future; Past performance is not indicative of future results, as the information presented is for informational purposes only and does not mean or imply that these trends are guaranteed to occur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # 0339826). Forex.com is a wholly owned subsidiary of Stonex Group Inc.