Forex Seasonality – October 2024: Is the US Dollar Set for More Weakness?

October Forex Seasonality Key Points

- Most major currencies have seen quieter price action in October, though four of the five we track have historically strengthened against the US dollar

- GBP/USD’s bullish October tailwind blows in just in time to potentially support the break to 2.5-year+ highs

- The Loonie is the lone major currency to weaken against the US dollar historically – key support sits in the lower-1.3400s

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market. As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy. In other words, past performance is not indicative of future results.

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Historically, October has been a modestly bullish month for EUR/USD, with the world’s most widely-traded currency pair sporting an average return of 0.30% over the last 50+ years. Despite broader weakness in the euro, the greenback has seen even worse performance over the last few months, so bulls will be watching to see if the pair can break out to a 2.5-year+ high above 1.1275 if the historical bullish tailwind emerges.

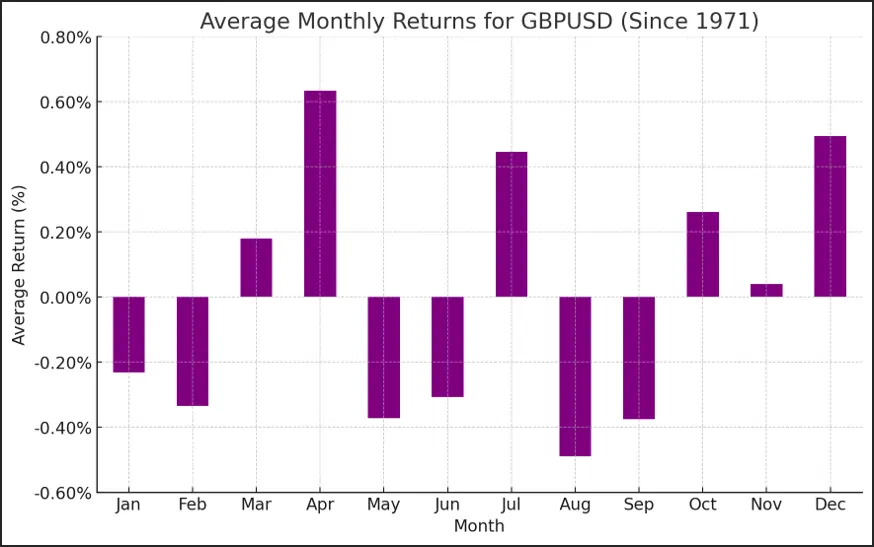

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Looking at the above chart, GBP/USD has historically seen solid bullish price action in October, with average returns of around +0.26% since 1971. Cable bucked its bearish seasonality in each of the last two months and is currently trading at 2.5-year highs above near 1.3400, carrying significant bullish momentum as we move into Q4.

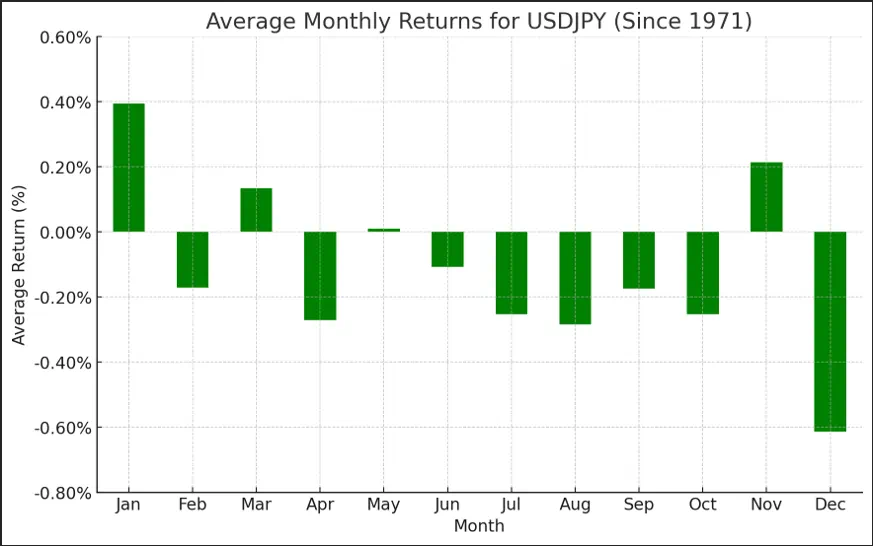

Japanese Yen Forex Seasonality – USD/JPY

Chart Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Octoberhas historically been a bearish month for USD/JPY, with the pair falling by an average of -0.25% in October since the Bretton Woods agreement. That said, this average return has been middle of the pack with USD/JPY falling in most months in the sample we track. As the chart above shows, the pair remains in its historically bearish entire late-summer/early fall window from June-October, and with the BOJ expected to be one of the only major central banks tightening monetary policy in the latter half of the year, a (continued) run of yen strength wouldn’t be surprising.

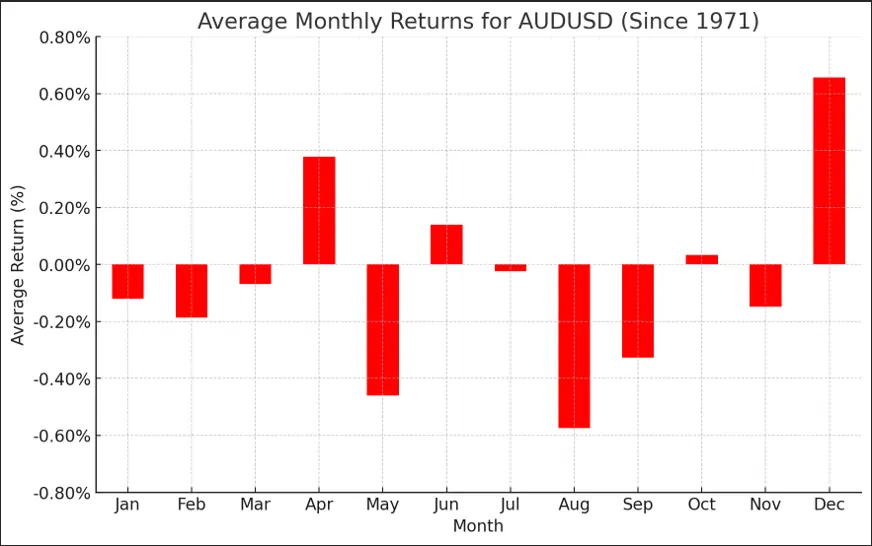

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Turning our attention Down Under, AUD/USD has seen historically lackluster returns in October, with an average net gain of +0.03% across the month. As we go to press, AUD/USD is on the verge of breaking out of a multi-year range and bearish trend line off the 2021 high, boosted by large stimulus announcements in China. If the bullish fundamental momentum can hold up, Aussie may outperform its typical ho-hum October return.

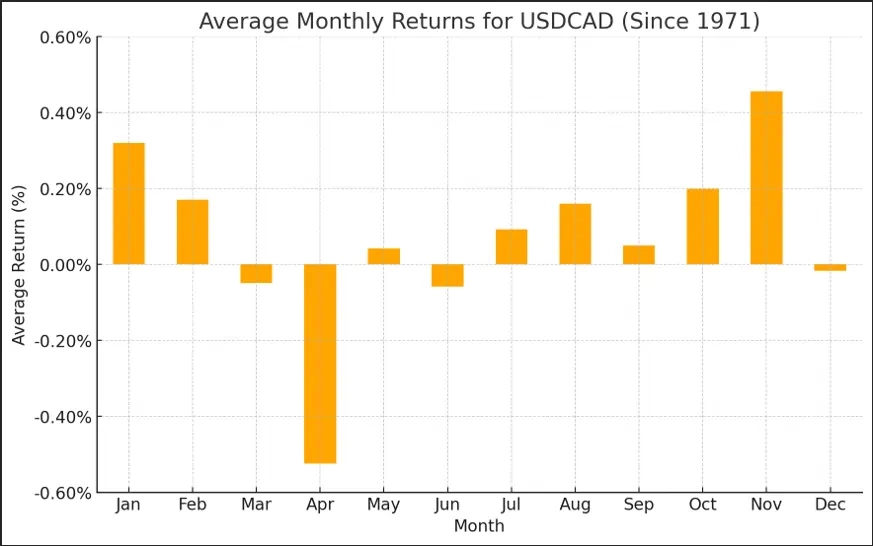

Canadian Dollar Forex Seasonality – USD/CAD

Chart Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Last but not least, October has been a fairly bullish month for USD/CAD going back to 1971, with an average historical return of +0.20%. The North American pair saw a quiet month in September, in-line with the historical seasonality, and the technical outlook could point to a bounce if buyers step in to buoy the pair in the key support zone in the lower 1.3400s. As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year – so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

-- Written by Matt Weller, Global Head of Research on Forex.com

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future; Past performance is not indicative of future results, as the information presented is for informational purposes only and does not mean or imply that these trends are guaranteed to occur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is a registered FCM and RFED with the CFTC and member of the National Futures Association (NFA # 0339826). Forex.com is a wholly owned subsidiary of Stonex Group Inc.