Oil, Gold: The War Bid Abates, for Now

Oil, Gold Talking Points:

- Both oil and gold markets have shown stark reversals over the past week, with each running into resistance over the past day.

- While there’s been much going on with rates and recession forecasts, it was the recent entrance of heightened geopolitical tension that pushed the long side for both markets. With that taking a step back, so has price.

Heightened tensions in the Middle East can have a bullish impact on both gold and oil and that was on full display as we came into this week. And before that, both markets were down on the prospect of recession, which pushed a bid into Treasuries as rates quickly fell.

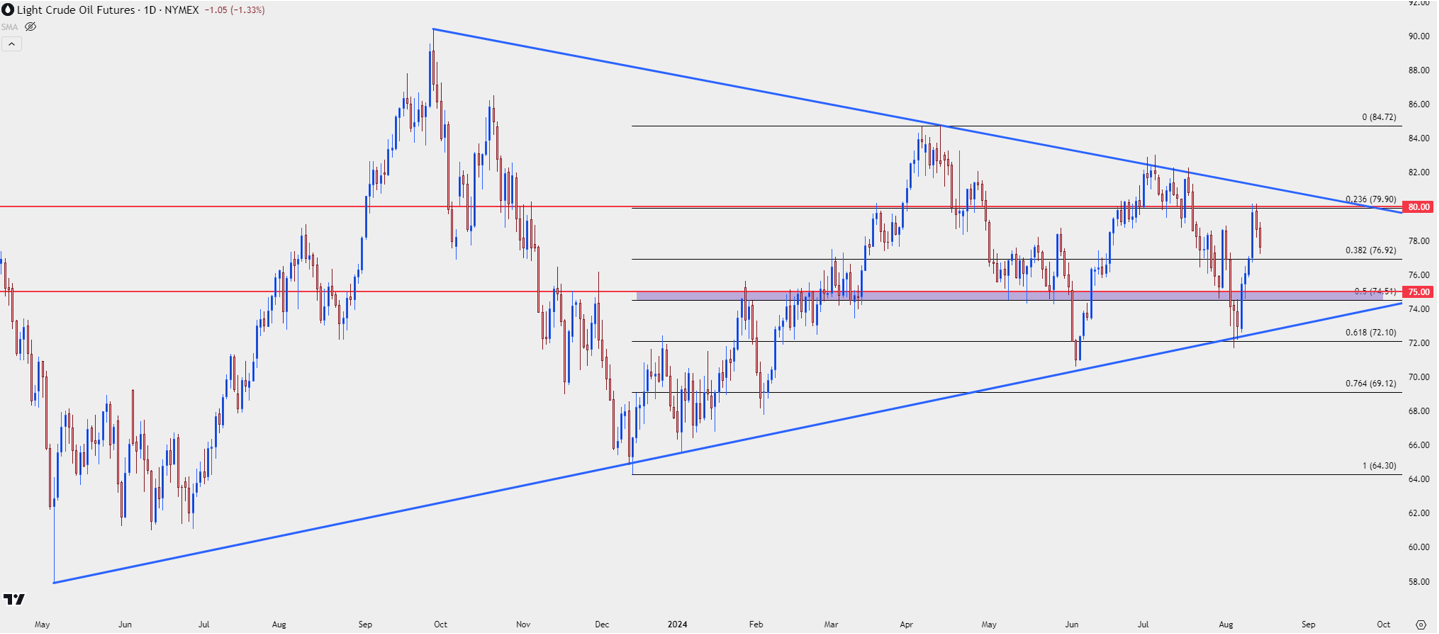

WTI Crude Oil

In WTI crude oil, support showed at a key Fibonacci level last Monday as panic was peaking. The turn wasn’t immediate, as sellers remain in-control on Tuesday but by Wednesday, the tide had started to turn. That led to a strong four-day rally that held through this week’s open, only for resistance to play at the 23.6% retracement from that same Fibonacci setup. That price is confluent with the 80-handle so at this point, it looks like a pullback from a confluent spot of resistance.

There’s support potential at the 38.2% retracement of that same setup, just inside of the $77-level, with a confluent zone a little lower around the 75-handle.

WTI Crude Oil Futures Daily Price Chart

Source: Tradingview; StoneX

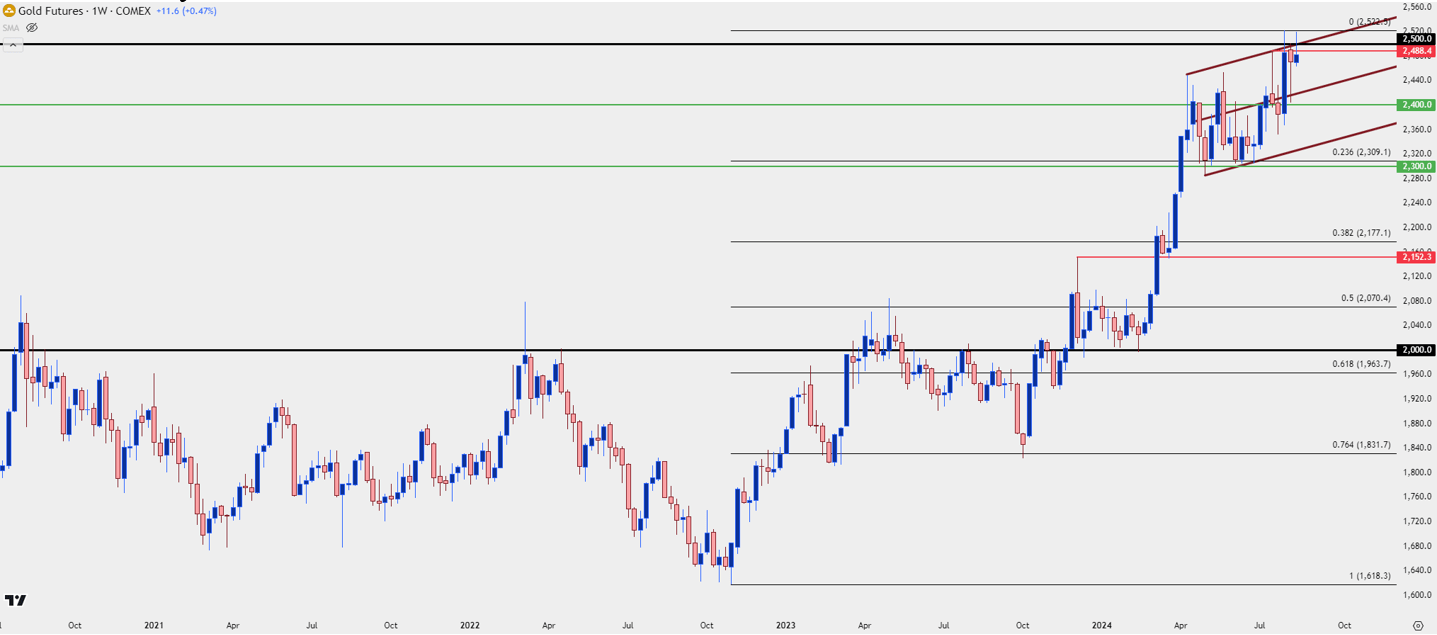

Gold

In gold, prices continue to test the $2,500 psychological level and the prospect of increased tensions in the Middle East kept the door open for breakout potential. But, as that fear has taken a step back, so have gold bulls.

The last major psychological level was a significant stumbling block for buyers, as the $2k handle helped to hold resistance for more than three years before turning into support earlier this year, leading to the breakout to current levels. Normally after a run of that nature there would be some profit taking from buyers that had ridden the move higher but, at this point, bulls have continued to hold higher-low support. In Q2, that happened at the $2,300 minor psychological level, even as bulls were failing to gain acceptance above $2,400.

More recently, buyers have shown increasing acceptance of the $2,400 price while still struggling to push through $2,500. The latter level is vulnerable if we do see tensions flare but, if we don’t, there’s motive for profit taking from bulls that have held on to long positions through the current rally.

In that even, the big question is whether we see buyers return on a re-test of $2,400, which would keep bulls in position to go for another shot at the breakout. And if they fail, the look then goes back down to $2,300 and if they can’t hold that – the expectation would be for greater profit taking in the longer-term bullish theme. In that scenario, $2,150 is the level of interest.

Gold Weekly Price Chart

Source: Tradingview; StoneX

Written by James Stanley, Senior Strategist for Forex.com

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.