Six key takeaways from Arlan Suderman’s July Commodity & Economic Outlook

Talking Points:

- Uncertain weather remains a focal point for supply

- Inflation trends are moving into the commodity space

- Output from US and Russian wheat production is an important benchmark

Here are the take-home points from Suderman’s comprehensive analysis, available for streaming

USDA Confirms Ample Supplies of Major Crops

The USDA's latest report confirms abundant supplies of corn, soybeans, and wheat:

- Corn: 2024-25 ending stocks estimated at 2.097 billion bushels (USDA) vs. 2.289 billion bushels (StoneX)

- Soybeans: 2024-25 ending stocks projected at 435 million bushels (USDA) vs. 468 million bushels (StoneX)

- Wheat: 2024-25 ending stocks forecast at 856 million bushels (USDA) vs. 789 million bushels (StoneX)

These figures suggest comfortable supply levels, and Suderman's detailed breakdown of production estimates and market dynamics offers valuable insights for traders and producers alike.

Black Sea Region Under Close Scrutiny

While U.S. and South Russian wheat yields are exceeding expectations, Suderman emphasizes the need to monitor Black Sea spring wheat and corn production closely. This region's output could significantly impact global supply dynamics, making it a crucial factor for market participants to watch.

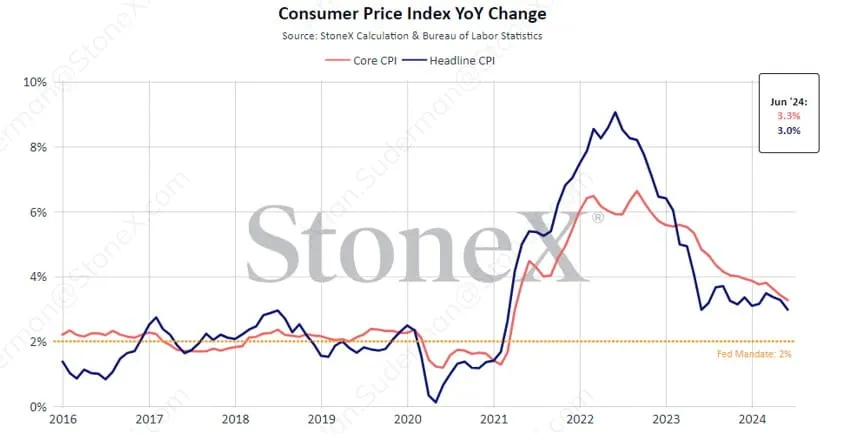

Inflation Perspectives Shift Away from Reinflation

Suderman highlights a significant change in the inflation outlook.

A strong correlation (0.87) exists between the StoneX Commodity Index and both inflation expectations and U.S. CPI Year-over-Year.

This shift in perspective could have far-reaching implications for commodity markets and economic policies, which he explores in depth during the July Outlook.

Commodity Deflation Fund Trade Emerges

As a result of the changing inflation outlook, Suderman identifies an emerging commodity deflation fund trade in the near term. This trend could significantly influence market dynamics and trading strategies.

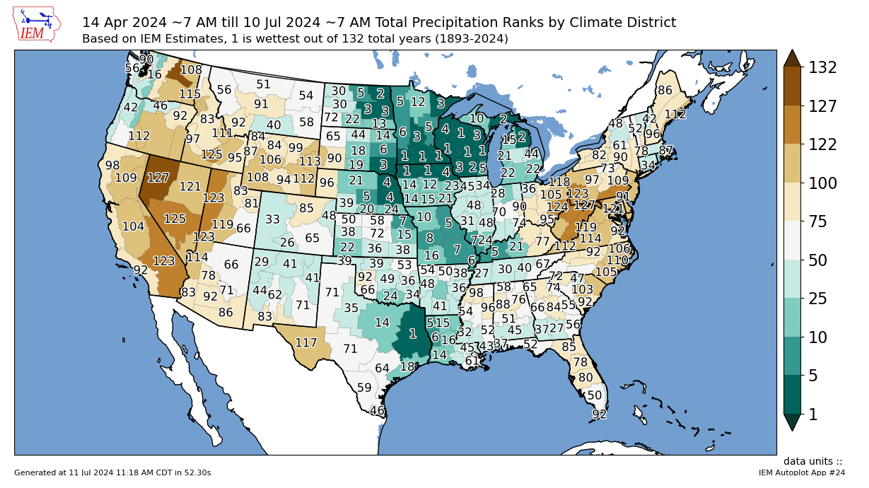

Balance Sheets Remain Vulnerable to Weather Risks

Despite ample supplies, Suderman cautions that balance sheets are not immune to weather problems. He provides a comprehensive analysis of current weather patterns and their potential impacts on crop production, including:

- Rainfall patterns since March 1st

- Temperature anomalies

- El Niño effects and forecasts

Understanding these weather risks is crucial for accurately assessing potential market movements.

Weather Remains the Primary Near-Term Focus

Given the vulnerability of balance sheets to weather issues, Suderman emphasizes that weather patterns remain the primary focus for commodity markets in the near term. He offers in-depth analysis of:

- Global agricultural monitoring data

- Long-range weather forecasts

- Potential impacts on crop yields and quality

Suderman's Outlook provides a wealth of information for anyone involved in commodity markets or agricultural production. From detailed supply and demand figures to expert analysis of weather patterns and economic trends, this presentation offers valuable insights to help navigate the complex world of commodities. For a more comprehensive understanding of these critical factors and their potential market impacts, listen to the full July Commodity and Economic Outlook.

Don’t miss another Commodity and Economic Outlook briefing from Arlan Suderman

Register today and receive advance notification before the next Market Outlook live webinar.

The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss. Past results are not necessarily indicative of future results.