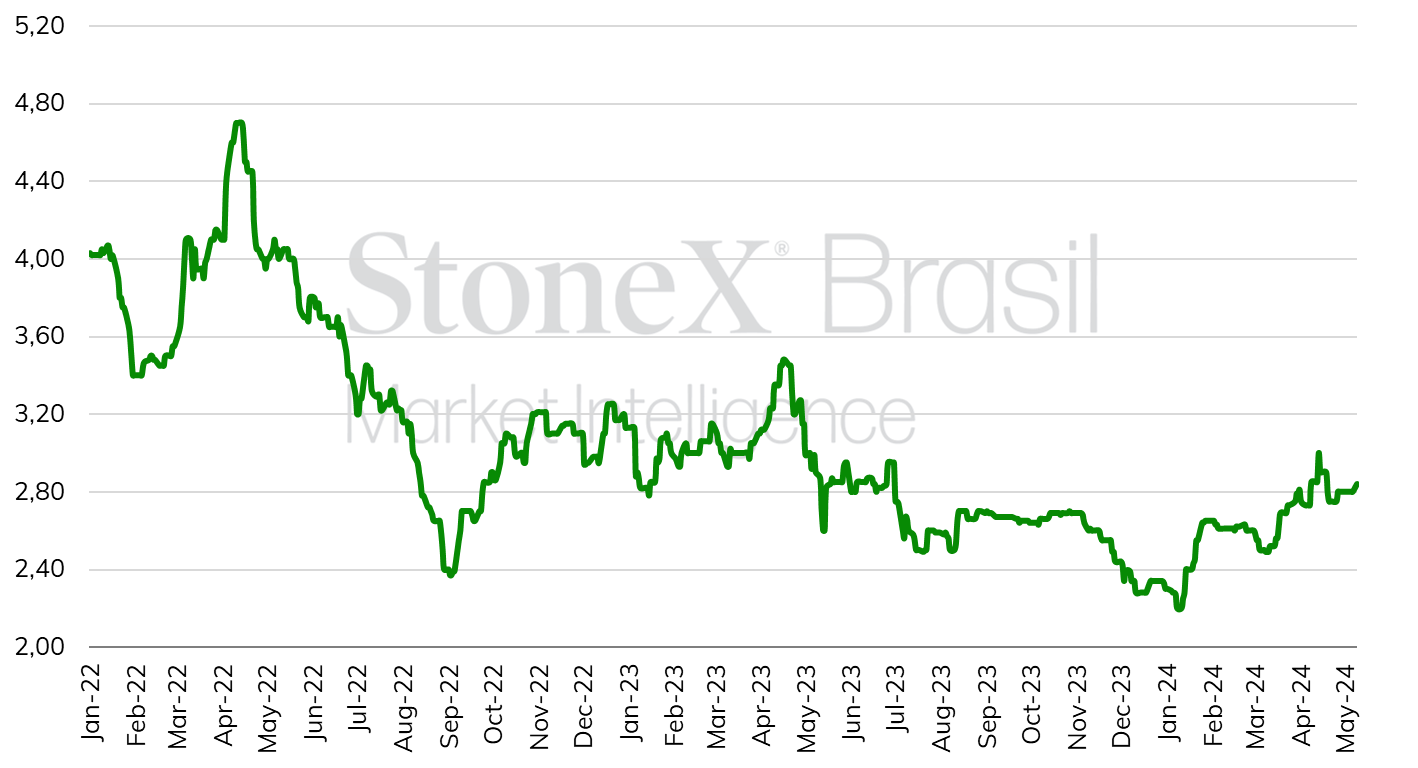

Hydrous ethanol prices on the physical market in the state of São Paulo maintained their support amid competitive parity and strengthened demand. After rising sharply since the beginning of April, last week saw stability, maintaining the values traded in the previous week, with the fuel ranging from BRL 2.80/liter to BRL 2.85/liter.

Ex-mill hydrous ethanol price - Ribeirão Preto/SP - (BRL/liter)

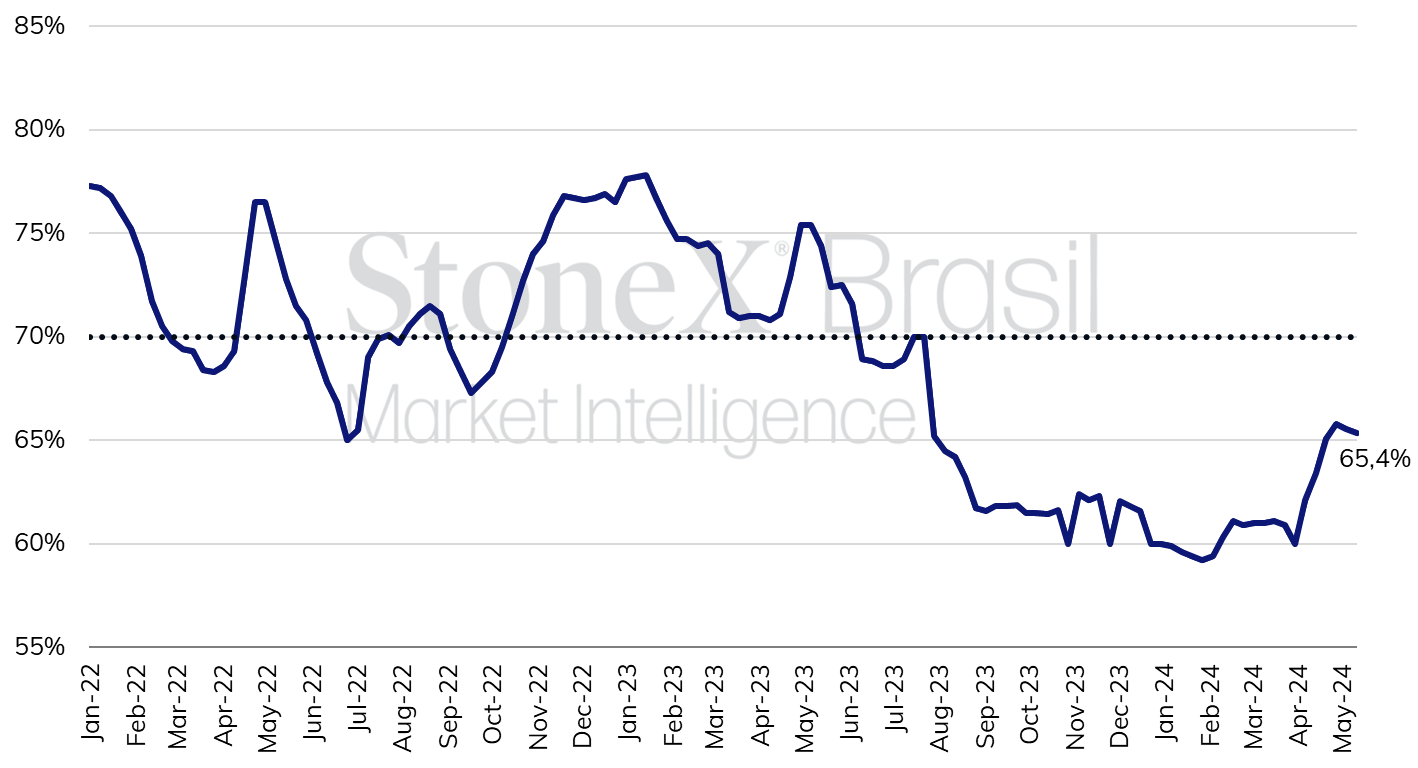

On the resale side, the biofuel also did not register a significant variation in the weekly average, closing at BRL 3.70/liter in São Paulo, therefore maintaining a parity of around 65%. Within the Center-South states, the ones with parity below 70% are: Minas Gerais (67.9%), Mato Grosso (61.6%), Goiás (65.7%), Paraná (66%) and Mato Grosso do Sul (65.1%).

Parity between ethanol and gasoline in the state of São Paulo (%)

Source: ANP. Design: StoneX.

Source: ANP. Design: StoneX.

Despite the strengthening of demand due to the start of the 2024/25 crop (Apr-Mar) in the Brazilian Center-South continuing to increase the biofuel supply, prices should remain under downward pressure, limiting further increases by the mills. This is because stocks ended the harvest at high levels and there is an expectation of a still voluminous crop, albeit smaller. StoneX estimates point to a crushing volume of 602.2 million tonnes during the 2024/25 cycle (Apr-Mar) in the Center-South.

Analyzing the outlook for ethanol pricing, it is estimated that the parity in the state of São Paulo should continue to favor ethanol in the coming months, remaining between 64% and 66% until August. After this period, with a reduction in sugar cane crushing and consequently a drop in ethanol supply under still strong consumption, the parity should gradually increase until it exceeds the 70% mark in November/24.

As a result, consumption is expected to remain high until September. StoneX estimates that the hydrous share should grow by around 3.0 percentage points in the 2024/25 crop compared to the previous season, totaling 29%. As a result, consumption is estimated at 18.4 million m³ in the Center-South, an annual increase of 13.6%. Anhydrous consumption is expected to total 8.5 million m³, an annual decrease of 2.7%.

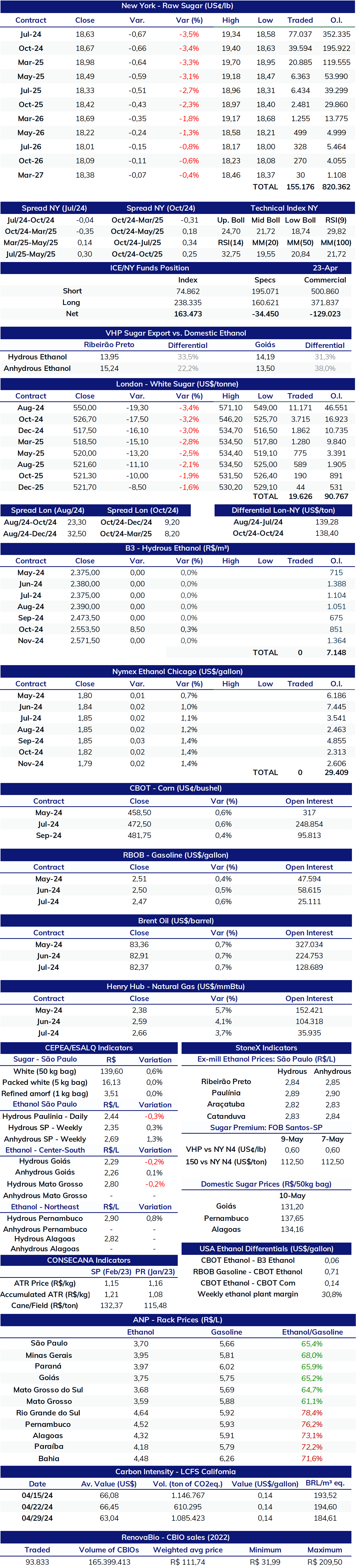

Daily recap

On Monday (13), the prices of raw and white sugar recorded a day of retraction on the futures markets. The most active contract for raw #11 SBN4 ended the day at US¢ 18.63/lb (-3.47%), while the equivalent contract for white #5 ended at US$ 550.0/t (-3.39%). Directing the market, it is worth mentioning the influence of a more abundant outlook on the supply side. StoneX estimates a global sugar surplus of 3.9 million tonnes in 2023/24 (Oct-Sept) and, for the next cycle, the outlook is that the scenario will remain at positive levels, which would lead to a 2024/25 balance of 2.5 million tonnes with a recovery in production by international players and a still high supply of sugar in the Brazilian Center-South.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.