Weekly roundup for StoneX Bullion 9 December 2024

Rhona O'Connell, Head of Market Analysis, EMEA & Asia

Tel: +44 203 580 6115 / mobile +44 7384 833897

Gold still marking time while the Chinese central Bank collars the headlines (some of them)

-

Geopolitics and banking stresses remain supportive; Syria in the spotlight

-

People’s Bank announces a small increase in gold reserves after a reported “pause” of a few months; see below

-

US Labour market was solid on Friday, points to a 25-point cut

-

While the key nuances will as ever be in Jay Powell’s Press Conference next Wednesday

-

The Fed Beige Book last Wednesday also implicitly points to a 25-point cut

-

CFTC numbers show improved sentiment towards gold in the week to 26th November

-

While the reverse was true (to a smaller extent) in silver

-

Purchasing Managers’ Indices are improving, although the Eurozone is still struggling

-

Further rate cuts do not sit comfortably with the ECB Governing body but they may have no choice

-

President-elect Trump has implicitly acknowledged possible inflationary forces as a result of some of his policies

-

Year-to-date gold is up 29% and silver, 34%

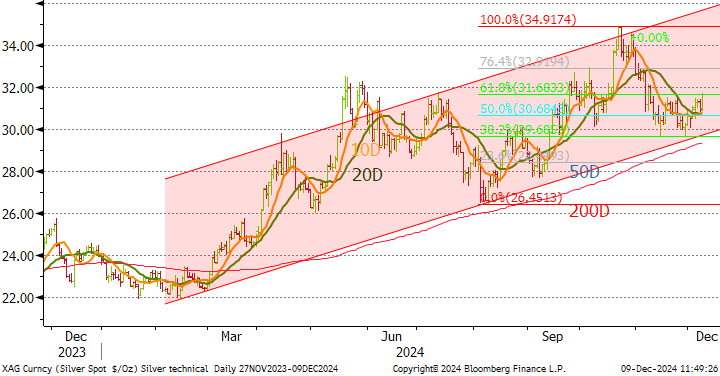

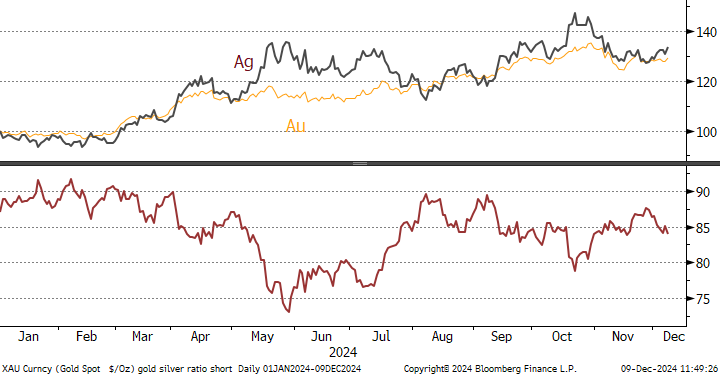

Outlook; again, little has changed for the medium-term view. The economic and political background is supportive for gold, while silver still has to face the persistent economic weakness in Europe and China and the ratio between the two metals is likely to widen towards 90, although silver Is meeting some support at the $30 level.

The toppling of the French Government commanded the headlines in the middle of last week, but was then overshadowed by the regime changes in Syria over the weekend, with the 50-year-old Assad dynasty being overthrown. Establishing a new constitution may be complicated and take a while and it throws another element of uncertainty into the problems in the Middle East.

Probably of more immediate significance to the mood in the gold market, at least, comes from the People’s Bank of China. The PBoC reported on Saturday an increase in China's gold reserves of 160,000 ounces (5.1t) during November. I take the Chinese six-month "pause" with a pinch of salt as it is public knowledge that the PBoC has a history of reporting no purchases and then declaring a massive quantum leap in recorded holdings. It is possible though, this time, that they did hold off from purchases from the international market at high prices may have distorted the ratio of gold to total FX and signalled a cessation, especially as the reported increase in November was moderate.

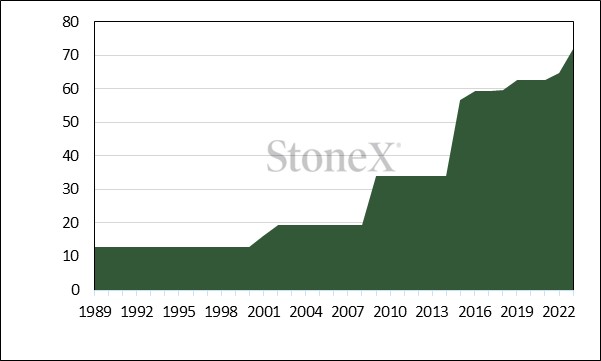

Reported PBoC gold reserves, 1989-2023, annual; tonnes

Source: IMF, StoneX

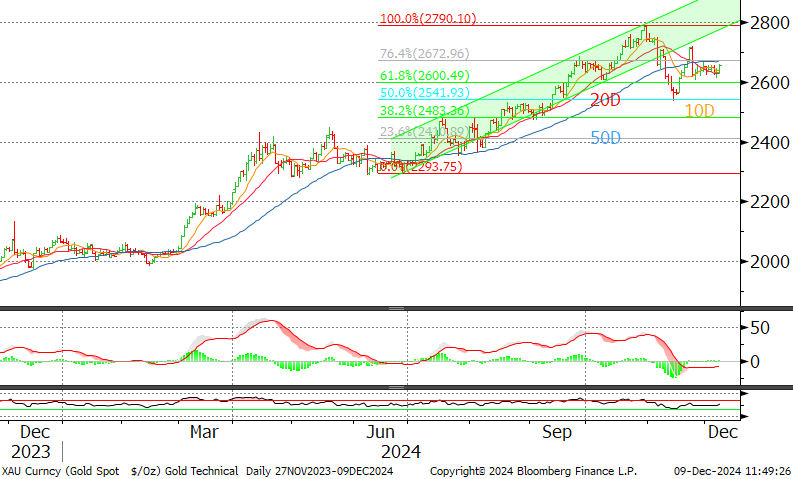

The actual tonnage is neither here nor there, given that global gold spot market turnover is typically more than 70 times global mine production. The significance is the psychological impact on the market. That said the rally has not broken new ground and the price remains in consolidation phase.

Gold, one-year view; resistance at $2,670

Source: Bloomberg, StoneX

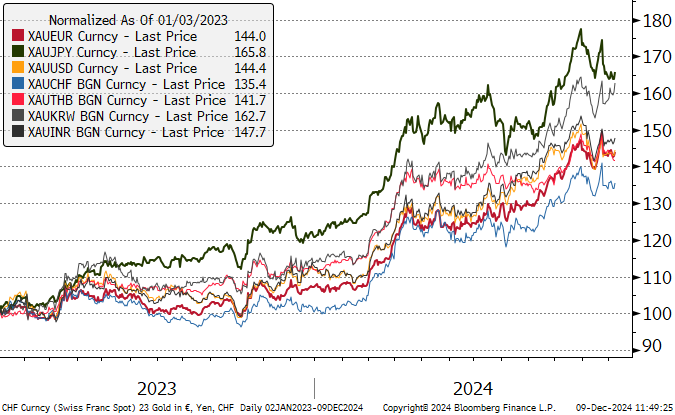

Gold in key local currencies

Source: Bloomberg, StoneX

Silver, short-term; also under some pressure with resistance reaching up to $31.

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

In the background:

Source: Bloomberg

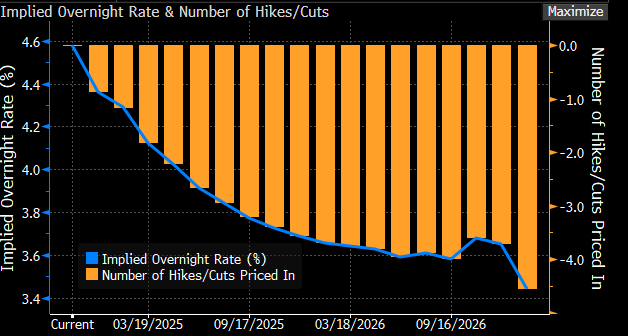

The next FOMC meeting is 17-18 December; the swaps markets are now pricing in an 87% likelihood of a 25-point cut in the target rate at that meeting. The Beige Book, which is an important parameter for FOMC decisions, underscores this expectation; released last week and covering November, it reported a slight increase in activity in most Districts, and flat or slightly declining in two others. Expectations for growth rose “moderately across most geographies and sectors. Business contacts expressed optimism that demand will rise in coming months. Consumer spending was generally stable. Many consumer-oriented businesses across Districts noted further increases in price sensitivity among consumers, as well as several reports of increased sensitivity to quality” while interest rate volatility means that mortgage applications were mixed, and Commercial Real Estate lensing was also subdued. In the labour markets, “Employment levels were flat or up only slightly across Districts. Hiring activity was subdued as worker turnover remained low and few firms reported increasing their headcount. The level of layoffs was also reportedly low. Contacts indicated they expected employment to remain steady or rise slightly over the next year, but many were cautious in their optimism about any pickup in hiring activity”.

The Nonfarm payroll figures were generally in line with or slightly above expectations, while the University of Michigan Consumer survey, which always tends to colour market sentiment, was mixed. Current conditions were seen as healthy, although there has been a downturn in expectations. The expectations for one-year inflation reflects the expected impact of Mr Trump’s policies, although the view for 5-10 year inflation eased slightly to 3.1%.

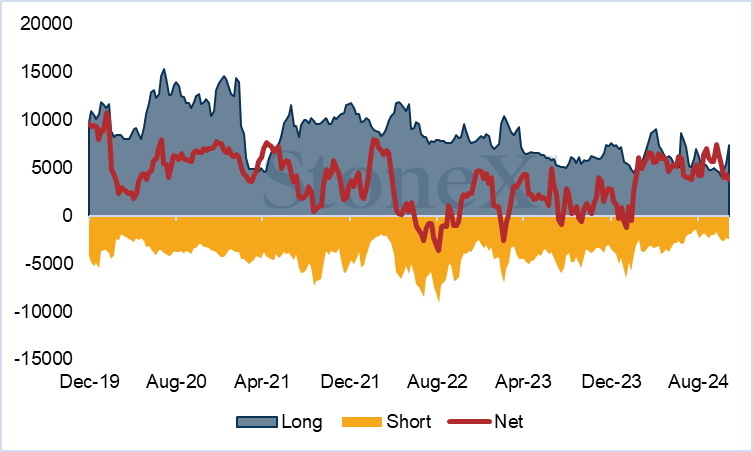

CFTC:

Gold long-side losses in mid-November were reversed in the final week to stand again at 644t. Short-covering has been plentiful, though, dropping from 118.8t to 75.6t in just one week, to stand at the lowest level since 10th September. Silver saw some light long liquidation, however, with a 5% decline in longs while shorts increased by 5%, shedding 338t and adding 114t respectively to 62,067t and 2,410t.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

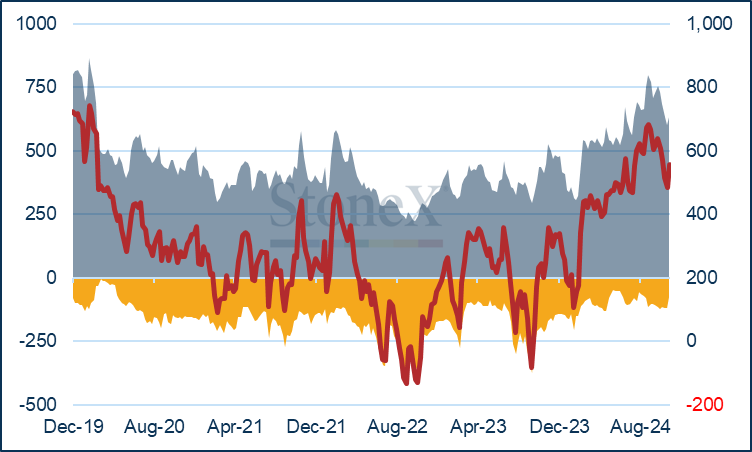

ETFs:

Gold: in November gold ETFs saw their first monthly outflow (29t) since April, with only North America reporting net inflows. In dollar terms the net outflow was $2.1Bn. Holdings in the year to end- November dropped by 10.5t with Asian holdings rising by 51% of 69.5t to 207.5; North America added 0.8% or 122.8t to 1,655.2t; while Europe lost 7.0% or 97.6t to 1,287.9t (all numbers from World Gold Council). Bloomberg numbers for early December show a combined net loss of 5.5t.

Silver: there was a very small amount of bargain hunting in November and in early December, but for November overall silver ETFs lost 307t or 1.3% to a total of 22,832t at month-end. The first week of December saw a further net erosion of 23.4t to 22,808t. Global mine production is ~26,000t.

|

|

9 December 2024 |

Previous week |

% change |

Year-to-date |

Range Jan 2022 onwards |

|

Range as % |

|

|

|

|

|

|

Min |

Max |

|

|

Gold (pm LBMA price) |

2,637.30 |

2,651.05 |

-0.52% |

27.56% |

1,628.75 |

2,777.80 |

70.55% |

|

Silver (LBMA price) |

31.11 |

30.70 |

1.34% |

29.92% |

22.09 |

34.51 |

56.26% |

|

Platinum (pm LBMA price) |

936.00 |

940.00 |

-0.43% |

-5.26% |

872.00 |

1,065.00 |

22.13% |

|

Palladium (pm LBMA price) |

967.00 |

983.00 |

-1.63% |

-12.17% |

852.00 |

1,222.00 |

43.43% |

|

S&P 500 |

6,090.27 |

6,032.38 |

0.96% |

27.68% |

4,688.68 |

6,090.27 |

29.89% |

|

$:€ |

1.0568 |

1.0577 |

-0.09% |

-4.32% |

1.0418 |

1.1192 |

7.43% |

Source: Bloomberg, StoneX

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are still relevant, and as follows

Current tailwinds include: -

-

Geopolitical risk.

-

Increasing trade tensions

-

Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US and to a lesser extent) Commercial Real Estate.

-

Emergence of the Shadow Banking sector (i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

-

Continued strong Official Sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

-

Widespread investor interest, notably from High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

Headwinds:

-

Reduction in international political or trade tensions; Scott Bessant could well be instrumental here

-

Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

-

Official sector going on the retreat (unlikely)

-

Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 800t of ETF metal went straight into private hands in China).

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.