-

Weekly roundup for StoneX Bullion 23 September 2024

-

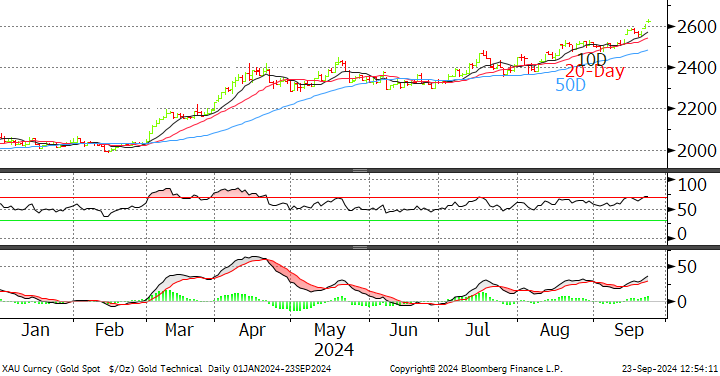

Gold’s bull run continued last week after a small correction and crested $2,600 at the end of the week, largely on momentum

The rally has taken gold up by 6% this month

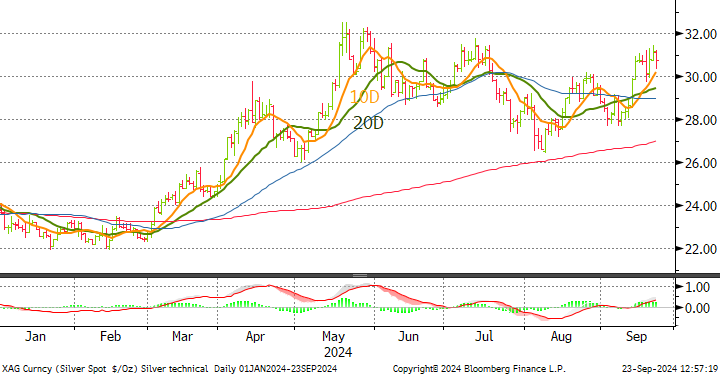

Silver’s major move was on 12/13th September and last week was a question of backing and filling between $30.0 and $30.3

Silver’s change on the month, +11.0% at the peak, net 8.4% as we write

Both metals have been helped by improved technical formations, notably from the Moving Averages. Our inhouse technical expert is citing Fibonacci resistance at $2,657

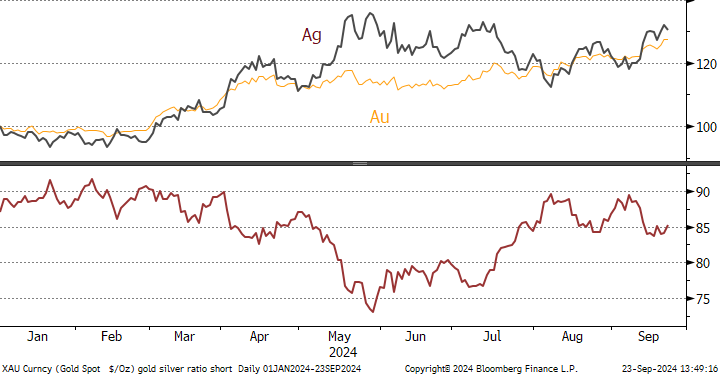

The ratio has picked up again, edging back towards 85

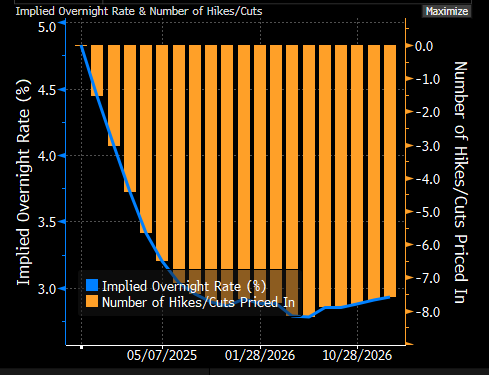

Powell: while all FOMC members are expecting further cuts this year, do not assumed that 50-point cuts are enshrined in policy. The FOMC will remain data dependent and take it meeting by meeting.

Gold State of Play: a Cheat Sheet

)Outlook; with geopolitical tensions worsening and the official monetary authorities getting towards full swing over the rate cycle the tailwinds for gold continue to exceed the headwinds and there is still plenty of upside scope. Some of the speculative froth needs to be blown off, though, as the CFTC numbers (below) demonstrate. A similar argument applies to silver.

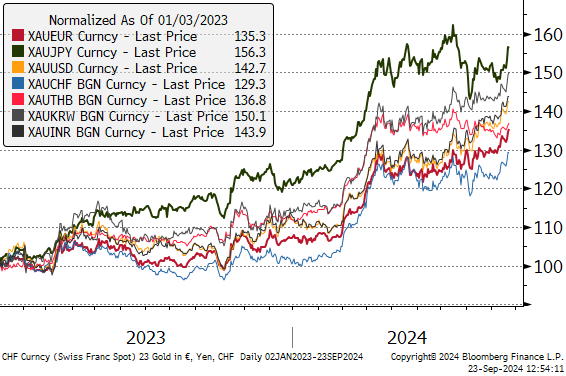

Gold in key local currencies

Source: Bloomberg, StoneX

At Jackson Hole, Fed Chair Powell made several key points, of which the two most important were

“The time has come for policy to adjust”

And

“We do not seek or welcome further cooling in labor market conditions.”

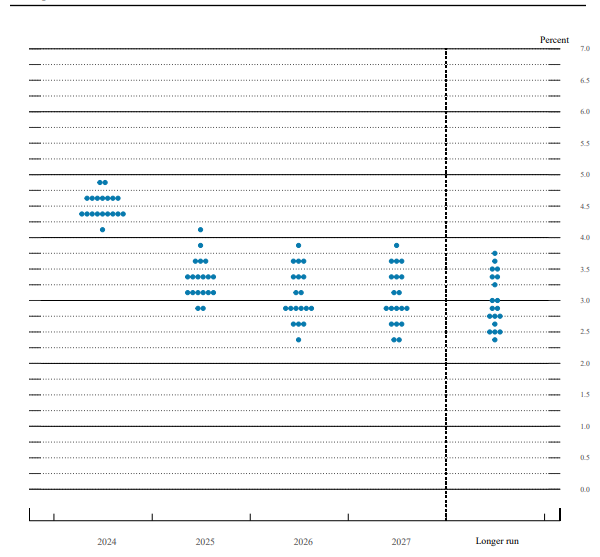

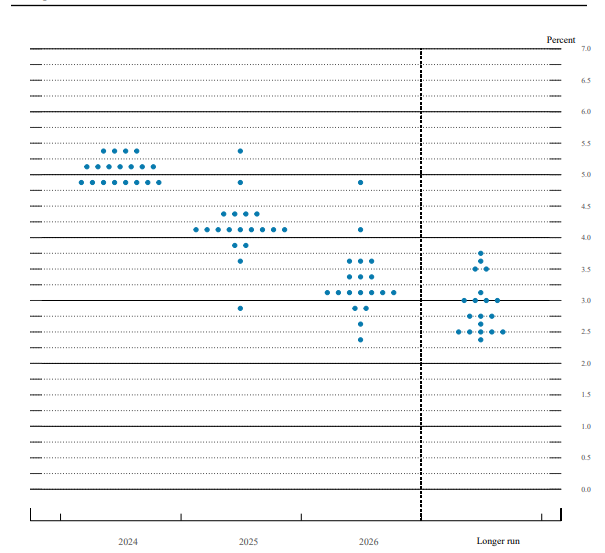

Now we have had the September meeting of the FOMC and, importantly, the Q&A session with Chair Powell immediately thereafter. The Fed cut the federal funds target rate by 50 basis points, and the dot plot, which marks where each FOMC member expects the rate to be at the end of this year, next year and thereafter, was especially informative. Probably the most important point that Chair Powell made in the Q&A was that all 19 members were expecting more cuts this year, with seventeen members expecting three or more and ten of them, four or more. He may have been referring to units of 25n points in this instance, as there are only two more meetings this year.

Dot Plot September

Dot plot June

In response to a couple of key questions, Mr. Powell made the point that “we have made a good strong start”, reflecting the FOMC’s confidence that inflation is coming down; and that “We don’t think we’re behind and we think that this is timely, but I think that you can take this as a sign of our commitment not to get behind. We’ve been very patient about reducing the policy rate and that patience has really paid dividends and allowed the strong start today. I do not think that any-one should look at this and say “this is the new pace”.

This view is borne out by economic data from the States last week that were better than expected.

Gold trading towards the end of last week reflected speculative and institutional interest internationally, and with particularly heavy volume on Friday, while the speed of the move teased out physical selling in the price-elastic regions of the Middle East and Asia. Note that it is almost invariably the speed of a move in gold (and silver) that affects physical market activity rather than absolute levels. Silver encountered some early selling as it looked to consolidate, and the physical market has weakened here, too, as should be expected after its sizeable rallies. The technical picture remains constructive, though, with support from the key moving averages at $28.8 up to $30.1.

With geopolitical tensions worsening and the official monetary authorities getting towards full swing over the rate cycle the tailwinds for gold continue to exceed the headwinds and there is still plenty of upside scope. Some of the speculative froth needs to be blown off, though, as the CFTC numbers (below) demonstrate. A similar argument applies to silver.

Gold, year-to-date; technical indicators supportive

Source: Bloomberg, StoneX

Silver, year-to-date; technical indicators positive; the 20D move above the 50D spurred the rally

Source: Bloomberg, StoneX

Gold:silver ratio, year-to-date

Source: Bloomberg, StoneX

The swaps market is pricing in two more 50-point cuts – one in November and one in December. As usual, more benign than the Fed

Source: Bloomberg

Tailwinds for gold exceed the headwinds

For the longer term, the tailwinds substantially outweigh the headwinds and are summarised in this note that we published at the end of August: Precious Metals Talking points 083024: Gold: state of play and key influences going forward

Key points from this note are as follows

Current tailwinds include: -

-

Geopolitical risk – not just the overt international tensions (Ukraine, Middle East, potential Taiwan issues, etc) but the number of elections around the world this year, which has been generating uncertainty.

-

Increasing trade tensions

-

Stresses in the banking systems in the three major regions, notably in the small-to-medium sized sector, and especially exposure to property, and (in the US) Commercial Real Estate.

-

Emergence of the Shadow Banking sector i.e. unregulated transactions), reminiscent of the Sub-Prime issues in 2007 that led to the Global Financial Crisis in 2008

-

The equities rout of early August (now more than recovered) may be a signal not to be too complacent about equities valuations

-

Continued strong Official sector purchases – not just because they are taking tonnage off the market but because of the signal that it sends to the markets because the Official Sector dislikes uncertainty

-

Retail investors in Asia are chasing the market higher in the expectation of yet higher prices

-

And so are some High-Net-Worth individuals, Family offices and other professionals who are back in the market for the long haul.

-

Headwinds:

-

Reduction in international political or trade tensions; Harris more of a bearish influence than Trump on this score

-

Any strong inflationary forces and / or associated expectation thereof could force a reversal in monetary policy

-

Official sector going on the retreat (unlikely)

-

Investors’ conclusion that risks have declined (likely to take a matter of years, compare GFC of 2008); it wasn’t until 2013 that professionals bailed out of gold (over 300t of ETF metal went straight into private hands in China)

-

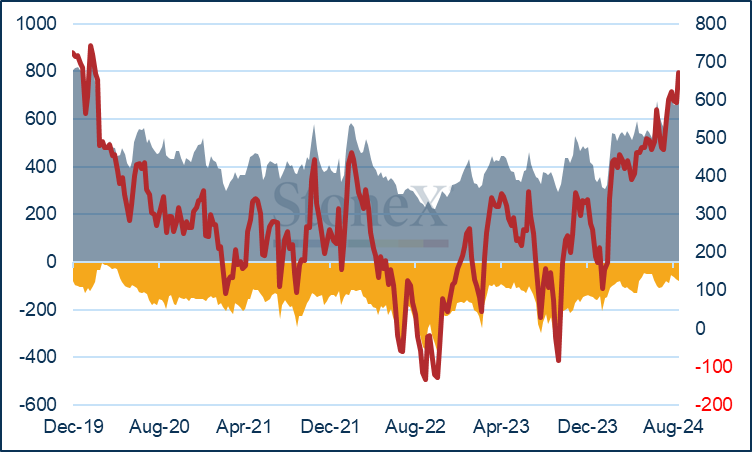

Gold; more optimism; longs up 13.3% (88t) to 753t, shorts up 12% (7t) to 79t Net long was up 14%5t to 673t vs a 12M average of 458t and the market is looking toppy

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

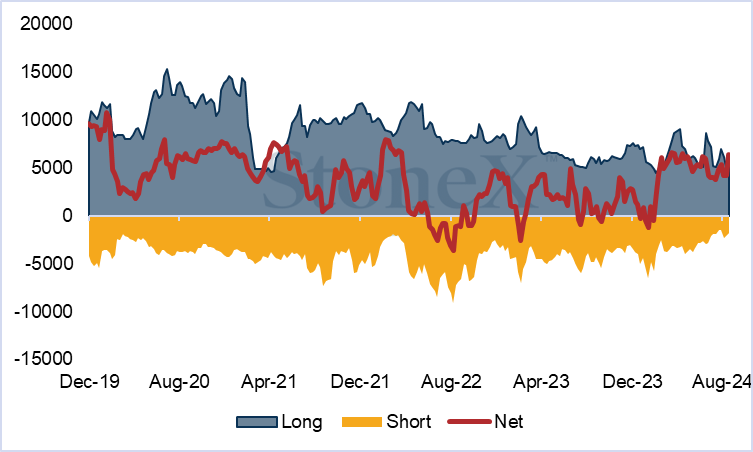

Silver; very lively; longs up a massive 29% (1,866t) and shorts down 341t (15%). Net long up 53% (2,206t) to 6,429t vs a 12M average of 3,332t. Also due a correction

COMEX Managed Money Silver Positioning (t)

-

Source: CFTC, StoneX

23 September 2024 Previous week % change Year-to-date Range Jan 2022 onwards Range as % Min Max Gold (pm LBMA price) 2,605.85 2,575.10 1.19% 26.04% 1,628.75 2,605.85 59.99% Silver (LBMA price) 31.32 29.97 4.51% 30.78% 22.08 32.01 45.01% Platinum (pm LBMA price) 988.00 996.00 -0.80% 0.00% 850.00 1,065.00 25.29% Palladium (pm LBMA price) 1,067.00 1,061.00 0.57% -3.09% 852.00 1,221.00 43.31% S&P 500 5,702.55 5,626.02 1.36% 19.55% 4,117.37 5,713.64 38.77% $:€ 1.1162 1.1075 0.79% 1.06% 1.0536 1.1192 6.23% Source: Bloomberg, StoneX

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.