Cattle held back in 2024 begin to flow, pressuring prices

Key Points

- A wedge of US feeder steers sold in the Oklahoma Stockyard sale on Monday averaged A$7,880/head in liveweight value on an average weight of 370kg/head lwt and made A$9.60/kg lwt.

- November/December 2024 QLD cattle now beginning to flow, coupled with heat and dry weather there is further downside to this market into February if widespread rain doesn’t eventuate.

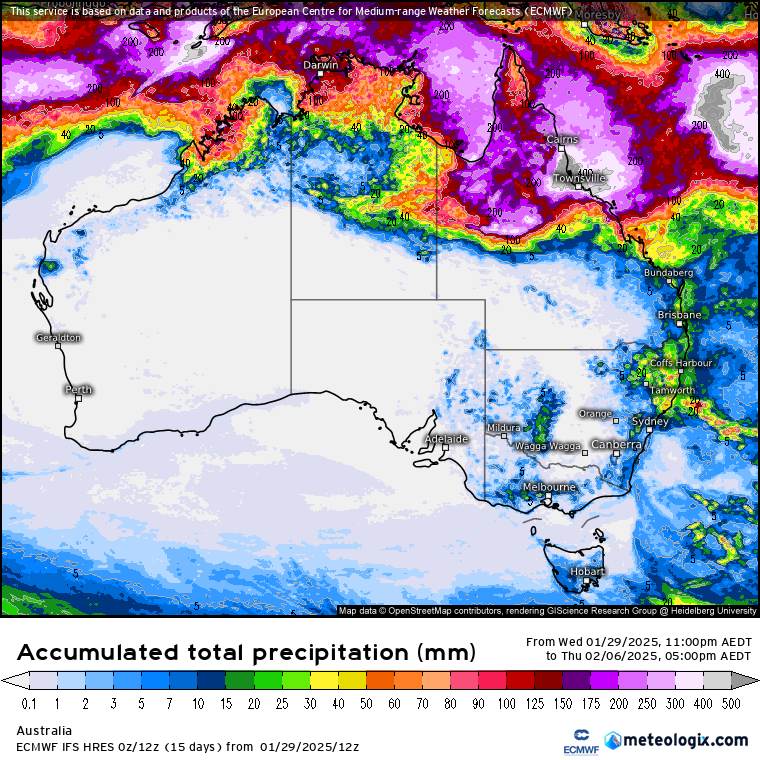

- The northern tropics are the weather focus for the next week, good rains forecast for major cow herd regions of the Gulf and eastern Barkly.

Supply

- In Tamworth NSW, 2 major feature sales are being held, one of which occurred yesterday, producers prioritise these in their calendars, so not unsurprising to see Northern NSW supply tighten and the surrounding supply area.

- More broadly, paddock cattle numbers continue to move as more producers return from holidays and school goes back, explaining the continued softening in feedlot and OTH grids as larger numbers of paddock cattle are presented.

- Last week, National yarding’s of prime cattle (fat sales) was at its highest since the 3rd week of November 2019, which was the peak of the drought.

- The lead drafts of the cattle held back in late November and December from the QLD rains are now coming forwards in larger numbers, with good weight and condition.

Demand

- No surprise to see numbers soften whilst prices also took a step back as demand weakens, producers are watching a sharp reduction in both finished and feeder grids and in turn are reducing their appetite for cattle which is influencing restocker interest.

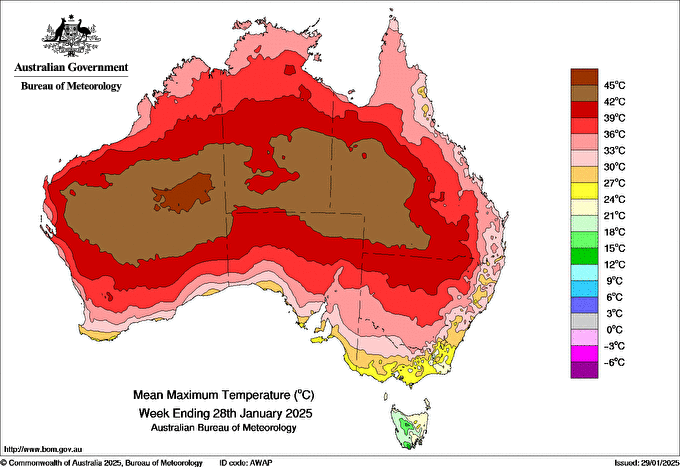

- Compounding the above is hastening dry and very hot conditions in large areas of WA, NT, SA, NSW & QLD which is impacting grass budgets, soil moisture and in some instances water availability, see the BOM’s mean 7 day maximum temperature map below;

- As I’ve often referred to, the cattle cycle has moved from a producer driven market to a buyers’ market (of which producers can participate in, if the season and finances allow), but fundamentally, that means a market for feed lotters, live exporters and processors.

Price

- A draft of 830 feeder steers sold in the Oklahoma National Stockyards (the sale I saw when I was over there last February), which weighed 823lb’s or 370kg/head lwt, averaged US2.71c/lb or A$9.60/kg lwt – equating to an average value of A$7,880/head in liveweight.

- The supply and demand dynamics as above (in a snapshot) are the reasonings behind this sharp fall in prices from the first fortnight of the year, it also suggests the market may have overheated itself.

- With rainfall forecasts isolated to Northern Australia in focus as its monsoonal season begins, and dry conditions forecast for the rest of the country other than scattered thunderstorms, further price pressure should be expected into February as buyers supply chains fill up, we may see 10c/kg lwt or more yet on most classes unless rain events in a widespread nature eventuate.

Weather

- The northern tropics across the Kimberely, top end of the NT and large areas of the Gulf due for their first genuine monsoon to start 2025 – a system to keep a close eye on as to whether the forecast rains deliver for these key cattle regions.

- Last week’s conditions with heat and dryness covered earlier, don’t discount these for a contribution to a gradual pullback from producers attitudes towards market prices and demand.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.