Prices start 2025 strongly as 2024 beef exports smash records

Key Points

- 2024 sets the benchmark for beef exports, breaking the decade old 2014 record, despite cattle slaughter estimated to be lower by around 890,000 head compared to 2014’s 9.25 million head.

- The question for the first 4 months of 2025 is when does the supply arrive which was held back in late 2024? With growing conditions the way they are, I would expect relatively soon, in large numbers.

- Northern producer and feedlot demand generally has placed a floor in weaner sales this week, with both buyers dominating purchases.

2024 Beef Exports

- 2024 broke the previous record set a decade ago (2014) by 4.4% or 56,600 t to see 1.343 million tonnes shipped weight (swt) exported overseas in 2024.

- December 2024 itself was a monthly record, with 127,393 t shipped for the month.

- The monthly record last set in March 2015 (123k), was broken 3 times in 2024, in July (129k), October (130k) and December (127k).

- Country specific highlights for 2024 calendar year include:

- US exports highest since 2015 at 394,000 t

- Japan exports highest since 2020

- Indonesian exports highest on record at 84,000 t

- Canadian exports highest since 2015

- South Korea volumes highest on record at 200,545 t

- Based on my estimates for 2024 cattle slaughter being around 890,000 head lower than the 2014 total kill numbers, the 2024 export result is extremely impressive. Carcase weights are the major contributor to the higher production levels but with slaughter so much lower its still a feat.

US Market

- In the words of StoneX US Cattle Desk “ Futures strength continues to lag what’s taken place in the cash markets where most are expecting another higher trade there again this week” & “ While we haven’t heard anything from the USDA, there is one news source reporting that the US/Mexico border will resume feeder cattle trade beginning the week of Jan 20th”

- Why is this important?

- Both US Live (Fed cattle) and Feeder cattle futures have opened 2025 hitting new highs, with some cash markets (spot prices) reaching US$2/lb for fed cattle already, in AUD terms this equates to A$7/kg cwt à on a 430kg cwt steer thats A$3,070 / head.

- Furthermore, Mexican imports of feeder cattle following the detection of screwworm (parasite) were suspended in late November, flows of these cattle returning to the US market will assist with supply – to an extent as numbers run short.

- The latest heifer numbers on feed in the US for Q4 2024 was unchanged on Q3 in % terms at 39.6%, in actual terms QoQ – heifer numbers on feed increased by 120,000 head.

- This is one measure in an array of figures to demonstrate structural shifts towards rebuild or liquidation in the US, but with essentially unchanged numbers, the move towards rebuild looks to not have begun just yet.

Supply

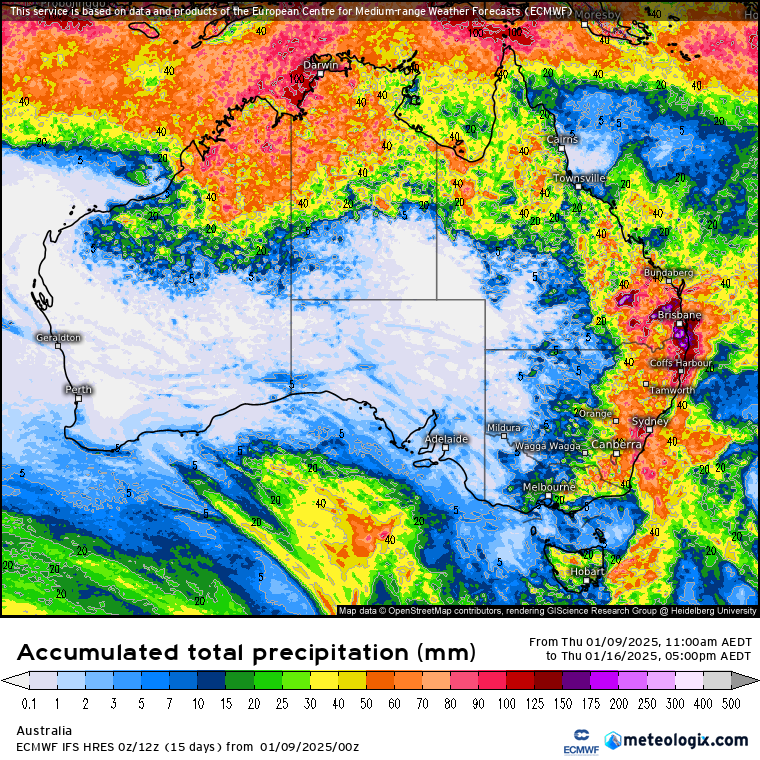

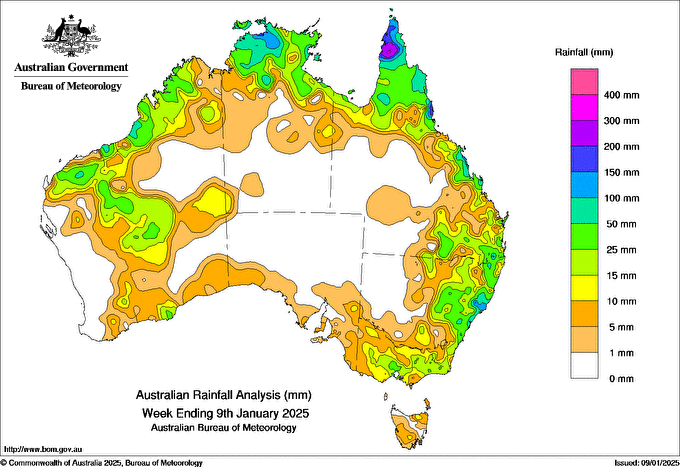

- Rain and everyone shaking off the holidays has amply assisted in a sluggish start to supply, numbers back on end of 2024 out of the yards.

- The question now becomes, when do the cattle held back last year begin to come to market, particularly the QLD supply with excellent growing conditions following a strong start to their summer season.

- Looking ahead – as more businesses and producers return to work, cattle supply will continue to ramp up through January, with weekly numbers rising. I’m expecting a sharp increase in February / March.

Demand

- With all the talk of 2025 and cattle prices really going to see upward price movements, this has permeated throughout the markets, via direct channels, in the yards and now the weaner sales.

- Its great to see some broader confidence come back following 2023 and large parts of 2024, but the demand pendulum remains squarely in the processor/feedlots favour and beyond that with dry weather, I do sense a soft underbelly to the cattle market.

- There’s two key themes from the weaner sales this week, that began in 2024 and I think will continue in 2025, #1 heifers discounted to steers remains very wide, on average 80c/kg lwt and #2 buyers continue to have a higher demand for cattle with weight.

- The northern and lot feeder demand for cattle at the weaner sales is keeping a floor in the market, with a lack of numbers staying local due to the difficult 2024 season many producers had.

Price

- Both the prime markets and weaner sales have started better than where they ended 2024, with feedlots continuing to drive markets higher.

- Producers are following the higher feedlot bids, without knowledge of what a feeder entry price will be at sale time… becoming exposed to the downside on feeder prices à which is why risk management is a fundamental discussion the beef industry must have in 2025.

- At the weaner sales, the demand for heavy cattle remains very strong, meaning price spreads between weights remains relatively tight.

Weather

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.