| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.31% | 4.84% | 4.52% | 4.44% | 4.44% | |

Inflation reenforces a “wait and see” Fed

-

A sigh of relief from markets following the CPI report this morning

-

April CPI rose 0.3%, just below estimates, but in-line with the expectations of 3.4% over the past 12 months

-

Core CPI rose the same 0.3% last month, in-line with estimates as well, and bringing the annual change down from 3.8% to 3.6%

-

-

The good developments on the inflation front:

-

We’re finally seeing some real relief at the grocery store. The index for meats, poultry, fish, and eggs fell 0.7% in April. Egg prices alone fell 7.3%. Overall food price inflation has largely normalized back to pre-pandemic levels

-

The price of new and used cars is falling. The index for new and used car/trucks fell 0.4% and 1.4% respectively last month. Overall, the two meaningfully contributed to overall good prices staying in deflationary territory (-0.1% in April and -1.3% annually)

-

-

The bad and ugly developments on the inflation front:

-

Despite some relief in household energy costs (electricity and utility gas), gasoline prices rose again in April – back up to a national average price per gallon of $4.06

-

Shelter costs just refuse to fall quick. The index for shelter has risen at or above 0.4% for 6 consecutive months now. Annually, shelter costs are 5.5% higher today than they were in April 2023. And assuming a straight-line continuation of this pace of disinflation, rising shelter costs will not return to pre-pandemic normal levels until…summer 2025

-

Car insurance costs are getting out of control. Up another 1.8% in April and are 22.6% more expensive today than they were a year ago

-

And today’s 3.4% CPI figure marks the 11th month and counting of inflation running at 3% or higher. In fact, on a 3-month annualized basis, inflation is running at a 4.6% pace - the fastest since November 2022 (~18-month highs)

-

source: Bloomberg

-

As it relates to the Fed, about the only thing to get excited about is that nominal inflation figures moved down again. Real rates are a bit higher today than they were yesterday. But under the hood, it’s a sobering reminder that taking 3-4% inflation down to 2% will take lots of time

-

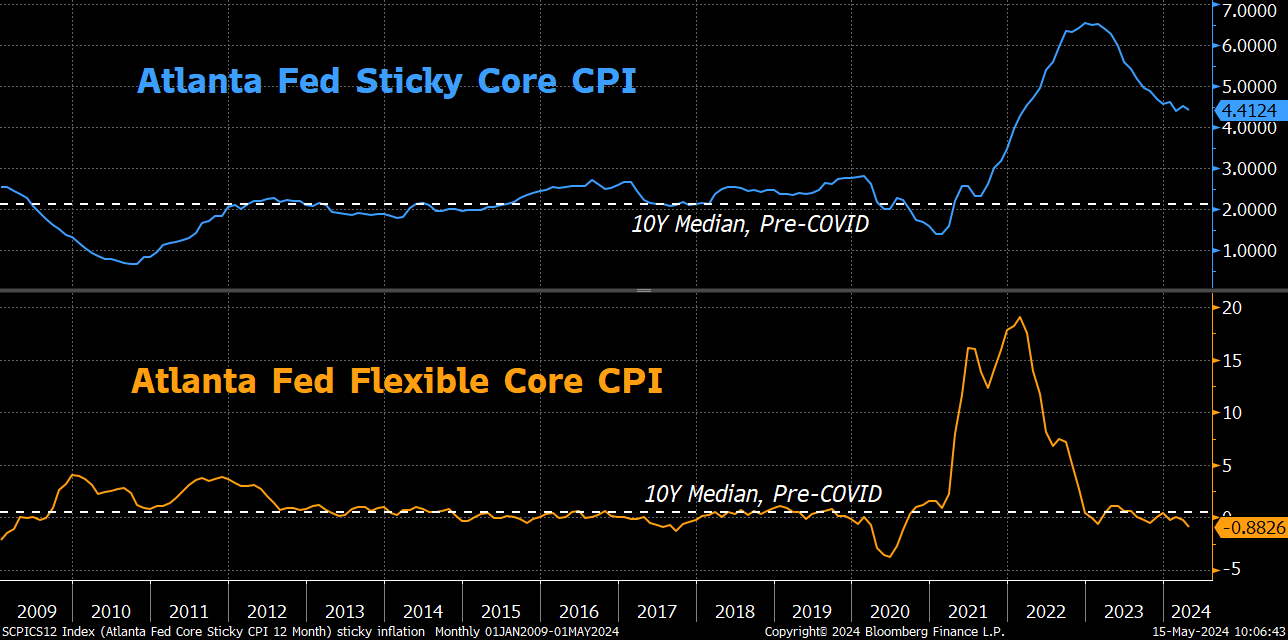

Car insurance, shelter, and categories with slow-moving price adjustments are still running well above what would be considered “normal” and are generally 2.5x above 10-year median levels

-

-

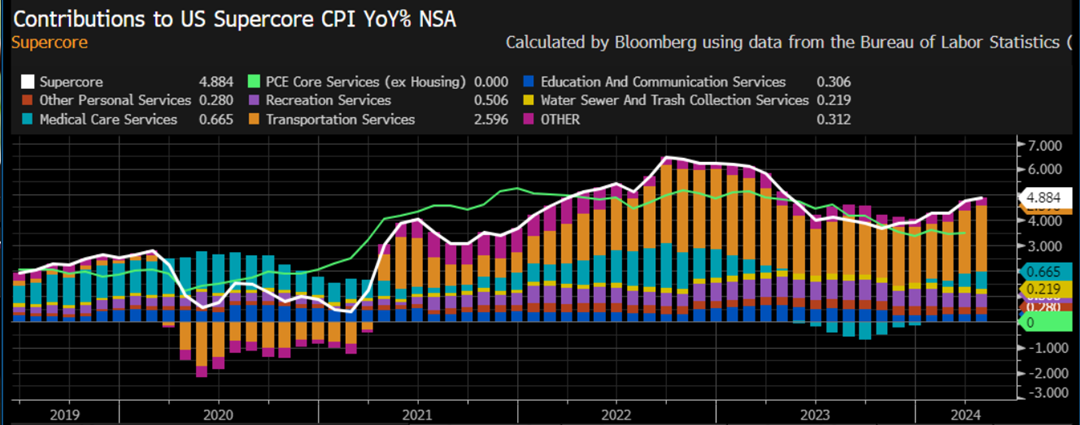

Supercore inflation, a Powell favorite when looking at services inflation without the noise of housing involved, is now the highest it’s been in over a year

-

Take an obscure category like recreation services for example. Historically, we never worried about inflationary pressures there – yet today, it’s still running twice as high as it was in 2019 and is the third largest category in supercore inflation. Clear evidence of the sticky nature this remaining leg of inflation has to it

-

-

Unless unemployment spikes, I find myself in the camp that we see no rate cuts this year. If we do, its 1 and done – perhaps just to get out in front of the election and to maintain 2.5% real rates

source: Bloomberg

Source: Bloomberg

Powell has gone back to the “higher for longer” message

-

Yesterday, speaking at the Foreign Bankers Association, Powell went back to the all too familiar song and dance of: “The bank is in a wait and see mode” aka “higher for longer”

-

Today’s inflation report looks to have reenforced that too

-

Powell framed inflation, rates, and future moves from the Fed like this:

-

“I expect inflation will move down. I would say my confidence in that forecast is not has high as it was, having seen the readings in the first three months of the year”

-

“I don’t think that its likely (to hike), based on the data, and I think it’s more likely that we’ll be in a place where we hold the policy rate where it is”

-

“We think it’s probably a matter of staying at current policy rate for longer”

-

“Homeowners and businesses have locked in lower rates, so policy isn’t hitting economy as strongly as otherwise”

-

Curious he made this acknowledgement but generally dismisses financial conditions during FOMC press conferences

-

Feels like a soft acknowledgment that the early rhetoric pivot last year (that sent 10Y rates below 4% and triggered a rush of cheap borrowings) was a mini policy mistake

-

-

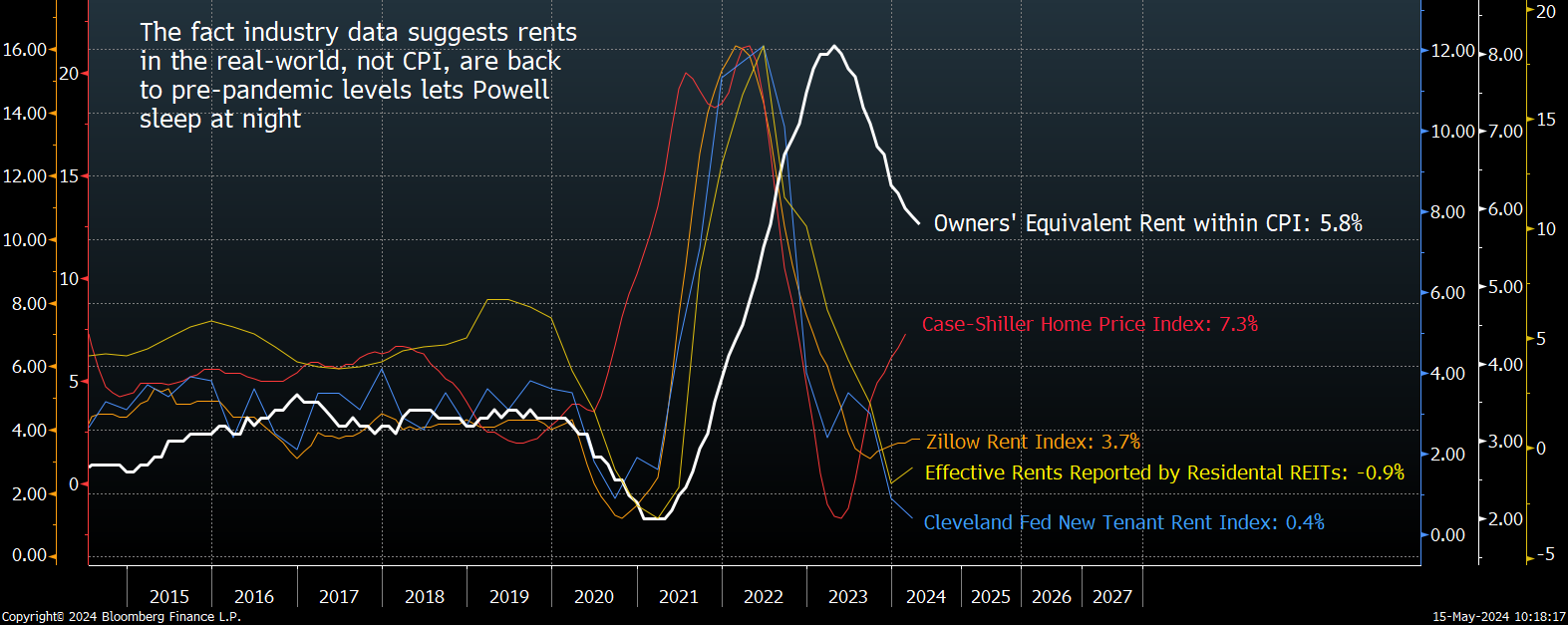

And notably: “Housing inflation has been a puzzle, because current rents have been low for some time but have not shown up in Owners’ Equivalent Rents…it will show up, it’s just a matter of when, but the lags from current rents to CPI is taking longer than we thought”

-

Time to dust this graph off again...

-

-

source: bloomberg

Then...from the Fed's summer beach vacation - they say rates are going nowhere fast

-

Specifically, from the Atlanta Fed's annual conference in Amelia Island, FL

-

Among the speakers, Fed officials made it quite clear where the stand on rate cuts: not now and not anytime soon

-

Jefferson: "It is too early to tell whether the recent slowdown in the disinflationary process will be long lasting"

-

Barr: "Disappointing price data in the first quarter has not provided enough confidence to support cutting borrowing costs"

-

-

And the one that stands out the most:

-

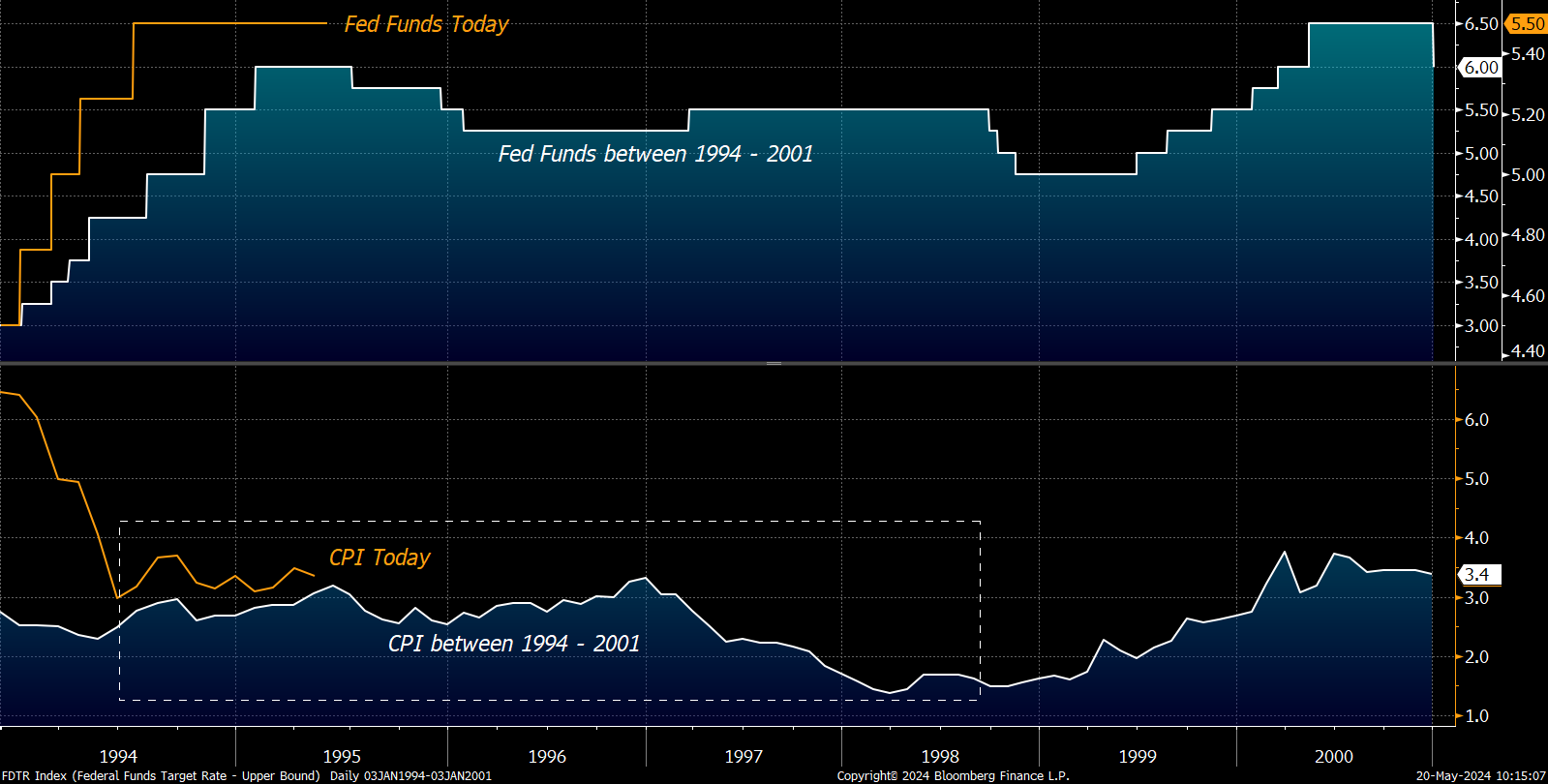

Bostic: "The steady state for US interest rates will probably be higher going forward than in the recent past, and could even be as high as it was in the 1990s and 2000s"

-

-

This is an interesting comparison because if this next chapter in Fed policy is shaping up to look like the 90s, then rate cuts are going to be a rare thing

-

Looking back:

-

Once rates peaked in 1995, Greenspan attempted to ease with a few cuts only for inflation to come right back up

-

Then, even with inflation below 2%, rates were held steady until 1998 when...cuts preceded inflation coming right back up

-

Not related, but my favorite Greenspan quote of that period: "The gut-feel of the 55-year old trader is more important than the mathematical elegance of the 25-year old genius"

-

-

So roughly over a 4-year period, the Fed was only able to cut rates 2, 3 times at most. Not until the dot com bubble did rates significantly fall

-

Why does this matter?

-

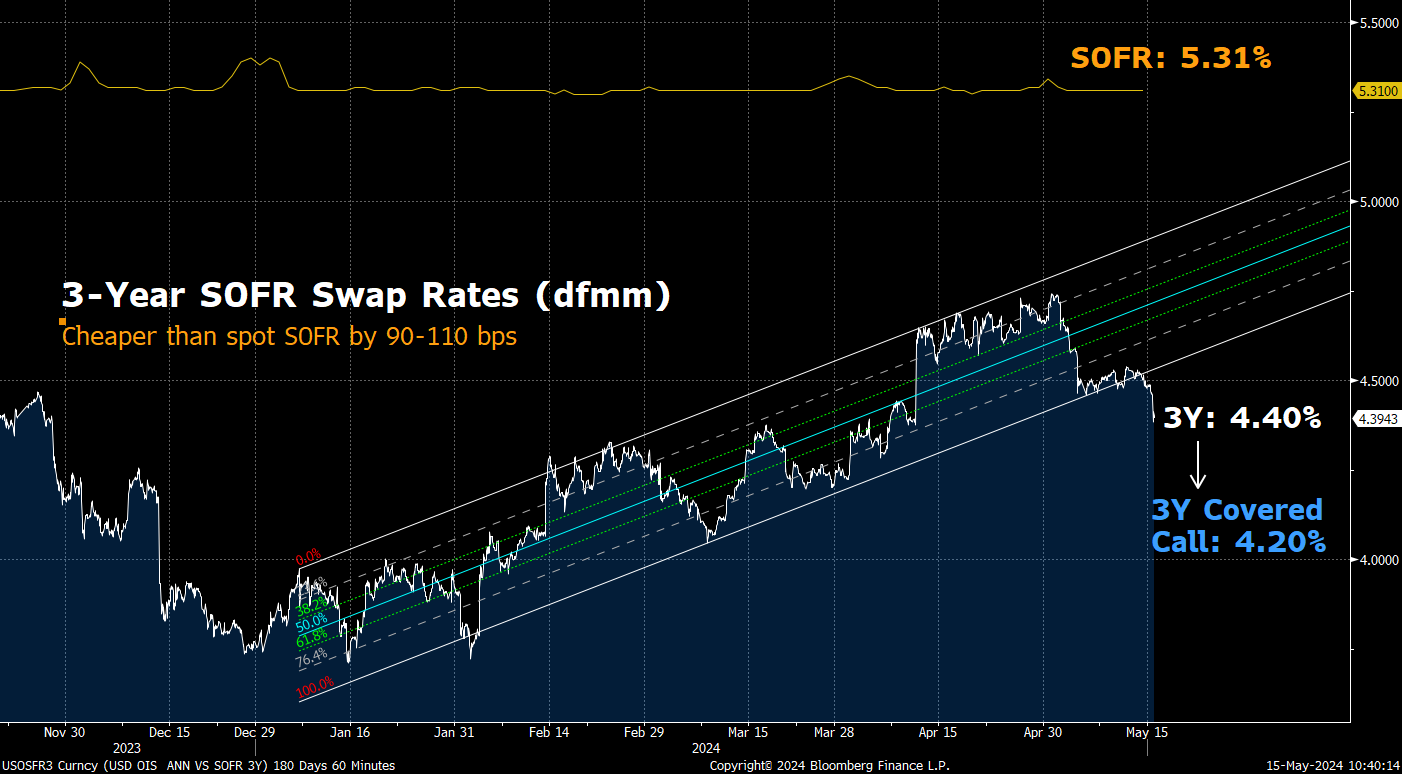

Maybe history repeats itself, maybe it doesn’t. But 3-year and 5-year swap rates are trading 75-100 basis points below spot SOFR today. Meaning, swap rates today are effectively allowing borrowers to pull forward those rate cuts and realize them all upfront

Source: bloomberg

source: bloomberg

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.