| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.32% | 4.93% | 4.64% | 4.64% | 4.64% | |

Powell is coming back to return the Christmas presents

-

The FOMC left policy rates unchanged again today

-

Unanimous vote to keep the Federal Funds target range at the current 5.25% - 5.50%

-

Two bullet points that I may copy and paste for the foreseeable future

-

-

One key line from the statement to note:

-

“In recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective”

-

-

And the reduction of the Fed’s balance sheet has taken its first step in slowing: from a $60b a month runoff to just $25b starting in June. A bit quicker than expected

-

But of course, it’s the press conference that moves markets

Powell giveth and Powell taketh away

-

“It is likely that gaining the confidence needed to lower interest rates will take longer than previously expected”

-

“We are prepared to maintain the target of the Federal Funds rate for as long as possible”

Yet, Powell is still hanging onto an easing bias with two likely paths for rates: hold for as long as needed, or eventually cut

-

“It’s unlikely that the next policy rate move will be a hike”

-

“We will return inflation to 2% over time”…adding “the Fed’s policy stance is appropriate to do that”

-

“The policy discussion was about holding the current level of restriction”’

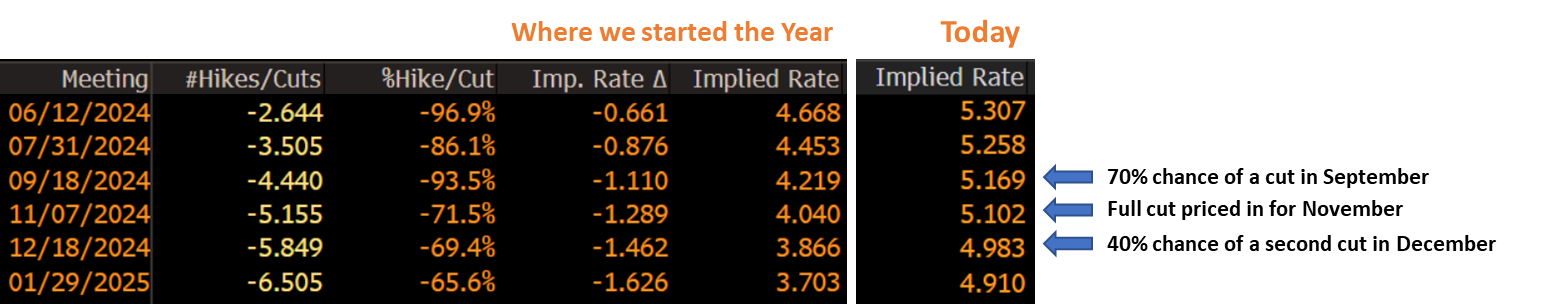

Markets, having seen the writing on the wall, began to prepare for a less dovish Fed - going as far as pricing in a 20% chance of a hike in SOFR options. But Powell failed to meet those hawkish leaning expectations and rates are pulling back from key technical levels across the curve

-

2-Year falling back from 5.00% after spending two weeks on either side of it

-

10-Year pulling back from 4.65% after marching toward 4.75% with little standing in its way

-

Swap rates have followed suite, and now reflect a forward curve that has a 70% chance we see 2 cuts this year

source: Bloomberg

Source: Bloomberg

source: Bloomberg

September or 2025

-

The economic necessity for rate cuts just isn’t there. Plain and simple

-

GDP is strong

-

Corporate earnings are solid

-

We’re averaging 235k monthly jobs

-

The unemployment rate is at 3.8%

-

Wages are rising faster than inflation (all of which will be refreshed on Friday)

-

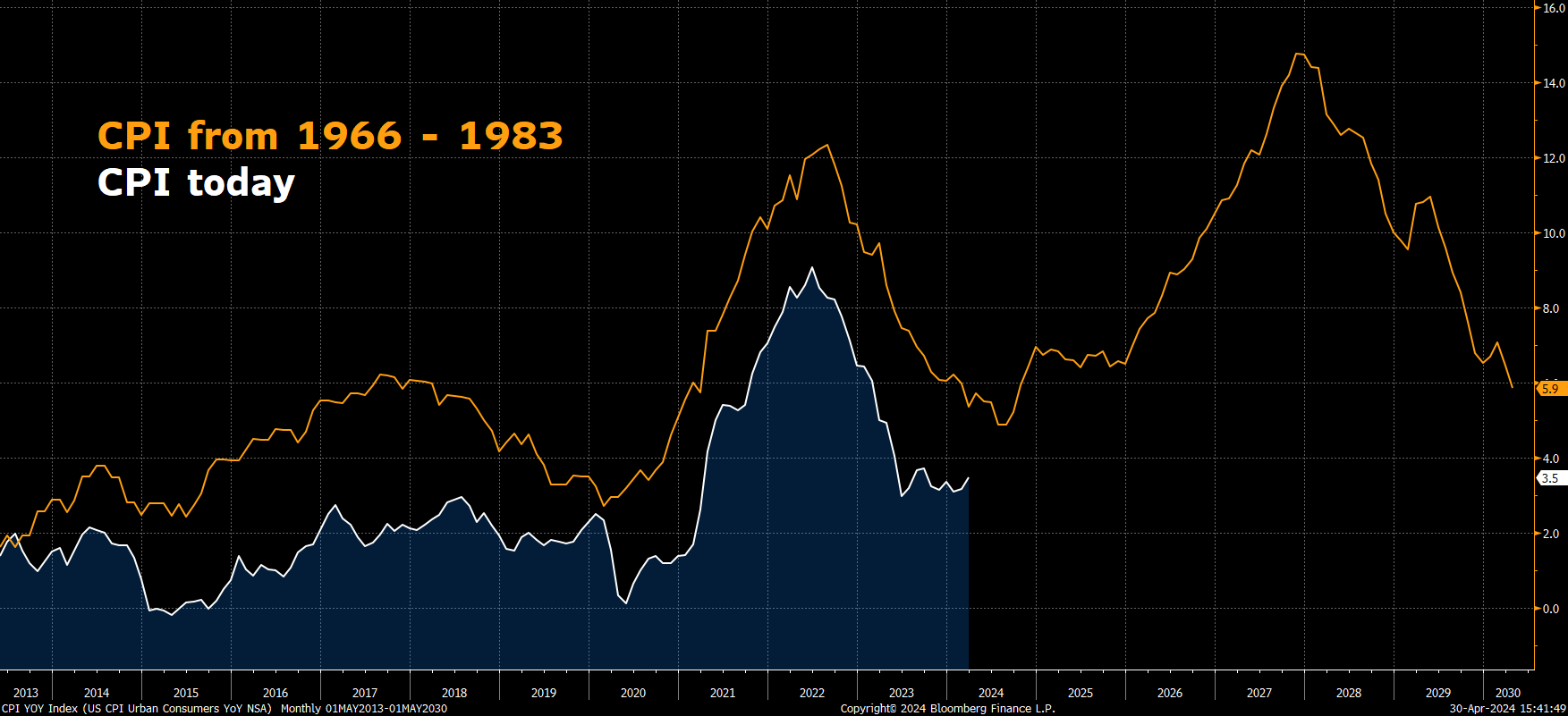

But most importantly, inflation progress is slowing, if not completely halted

-

-

In addition, timing this year is especially tricky given the November election. And I am sure the barrage of critical Trump tweets back in 2019 are still fresh in Powell’s memory

-

This one comes to mind for me: “The Fed is like a powerful golfer who can’t score because he has no touch – he can’t putt!”

-

So, to avoid tying the first rate cut into politics, its more than possible the Fed takes the November meeting off the table

-

Before that, we’ve got June, July, and September. Given that the “needed confidence inflation is moving sustainability toward 2%” clock has effectively been restarted – June and July are conceivably off the table as well. Leaving September as a reasonable window of opportunity

-

-

If they skip September, I’d submit we don’t see the first cut until 2025 - when the election dust settles, and new fiscal stimulus intentions are laid out

-

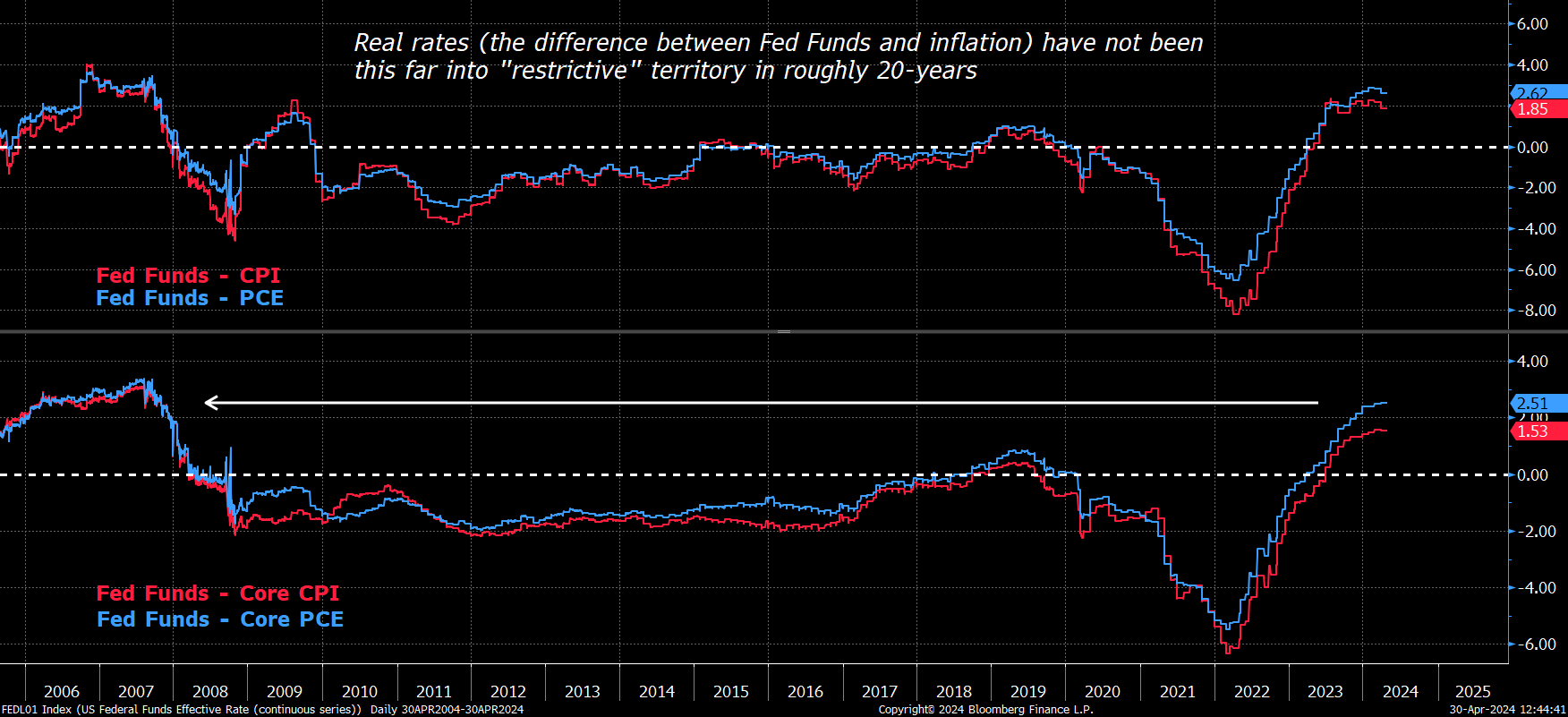

In September – as long as the labor remains on solid footing – Powell may frame the cut as a way to recalibrate policy to maintain a 2.50% spread over inflation.

-

That is, to keep rates pegged to inflation so that they are not applying too much of a breaking effect on the economy. A 10-20 bp improvement to PCE over the summer gets us there

-

Because again, there really isn’t an economic necessity to lower interest rates anytime soon

-

source: bloomberg

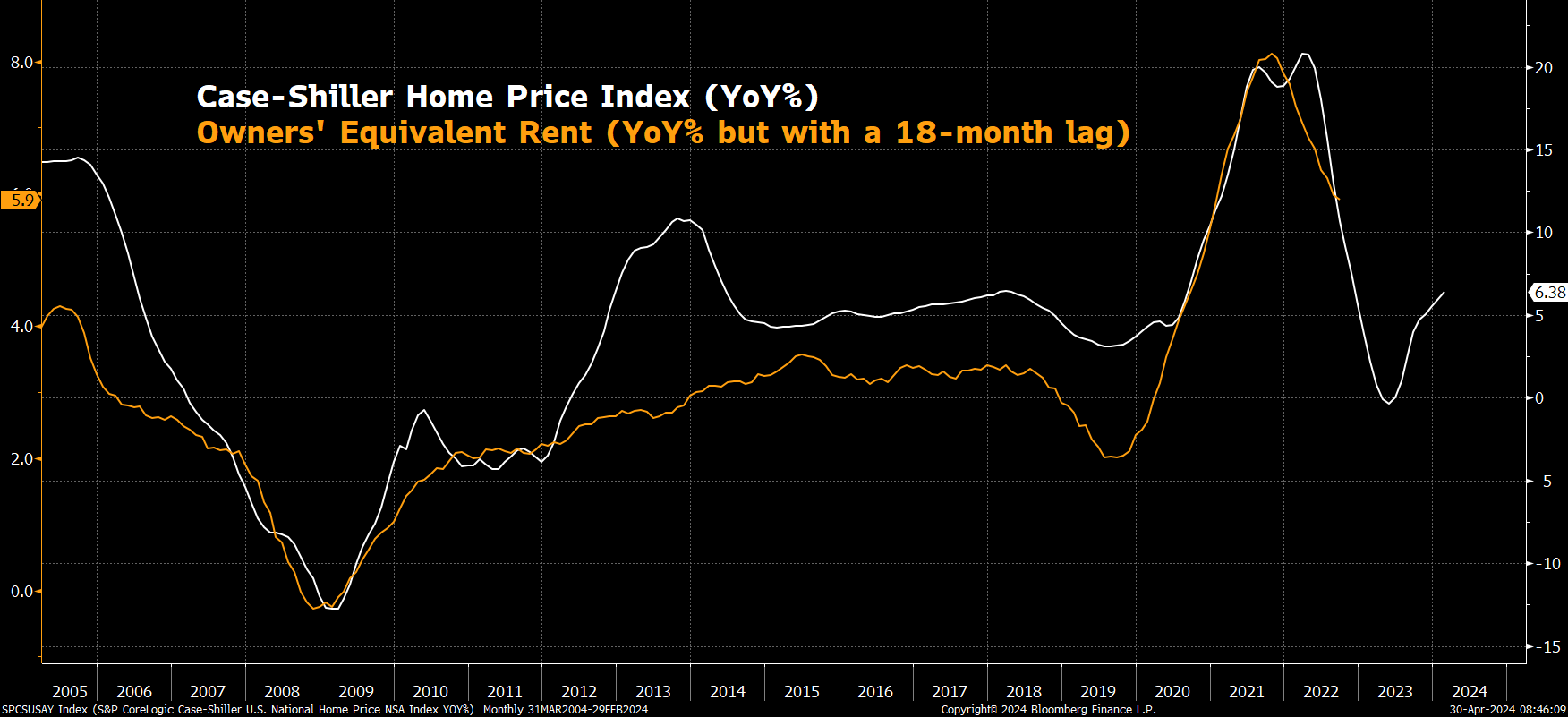

How do we get there by September? Well, shelter costs are coming down…for now

-

The shelter component of CPI alone accounts for 33% of the overall index, and roughly half of Core CPI

-

The good news is that contrary car insurance and other services related categories, shelter inflation is generally improving each month (albeit at a snail’s pace)

-

Powell today even brought it up as evidence to maintain an easing bias: “There are lag structures built into the economy…housing is one of them. As long as market rents remain low, I am confident it will show up in the data”

-

-

The bad news is that the Case-Shiller Home Price Index is once again re-accelerating

-

Thanks to the backwards methodology the BLS uses to calculate rental inflation, Owner’s Equivalent Rent is highly correlated to home prices (85% correlated over the past 20 years)

-

And historically, Owners’ Equivalent Rent lags changes in homes prices by about 18 months

-

-

So, if that relationship holds true – one of CPI’s largest categories may have just 7 to 8 months left of downward momentum. Thereafter, look out for inflationary pressures to come right back around

-

In short, the argument that 1 cut leads to 2,3,4…is wishful thinking, but lots of what-ifs to consider

Source: bloomberg

-

But don’t overlook the Prices Paid component that was released this morning from the ISM report. Coming in well above estimates at 60.9 vs 55.8 in March. This marks the highest level of input price pressure in manufacturing since June 2022 and was the leading indicator of the inflationary spike in 2022 and the cooling of inflation in 2023

-

And of course, correlation is not causation, but man does this graph look eerie given both of those leading(ish) indictors of inflation

source: bloomberg

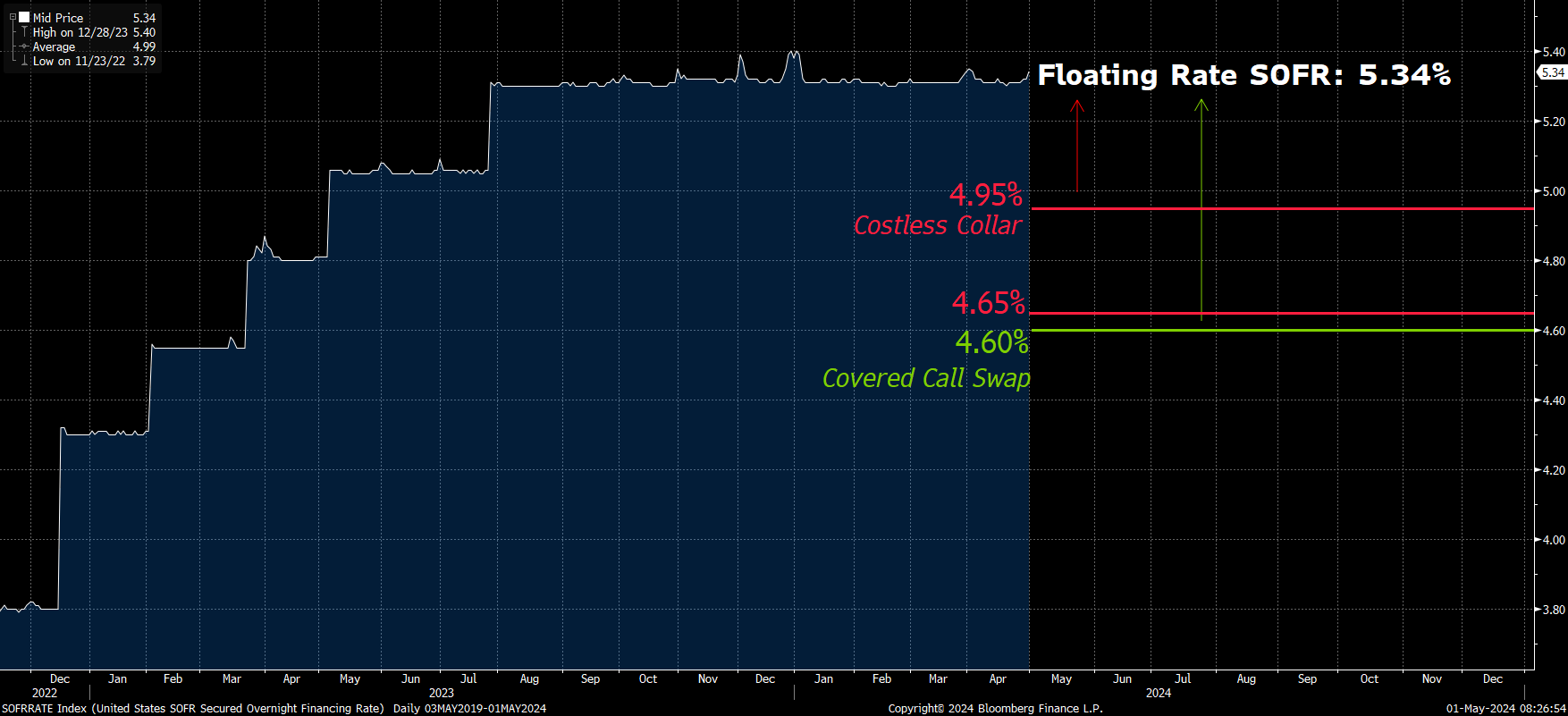

Commercial clients navigating this market

-

Swap rates across the curve are trading in the money and commercial clients with floating rate debt are increasingly using them to their advantage. With conservative , short-dated hedging strategies dominating the common trades seen on the desk

2-3Y Costless Collars

-

4.95% Cap (cheaper than floating SOFR by ~40 basis points, producing that difference as monthly cashflows)

-

4.65% Floor (allowing a borrower to float down with rates until the Fed cuts at least 4 times)

-

$0 option premium

2-3Y Covered Call Swaps

-

Sell the risk of another hike, and pick up an even lower fixed swap rate

-

3Y trades at ~4.60% - just below the bottom of the above collar

-

Improving interest expense savings (aka positive monthly cashflows) to ~75 bps and is cheaper than floating SOFR until the Fed cuts at least 5 times

-

And is effectively resetting floating rate interest expense back to January 2023

source: bloomberg

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.