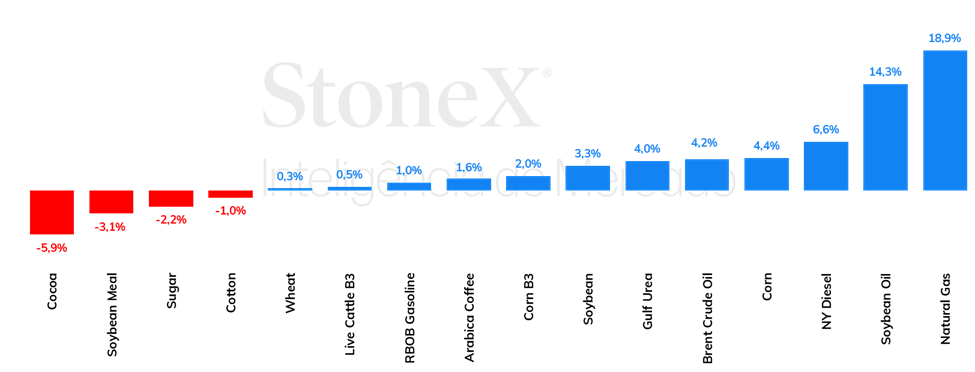

Fonte: StoneX cmdtyView.

This week was marked by a broad strengthening of the dollar against other currencies due to hotter-than-expected economic data from the U.S., cautious remarks from Federal Reserve officials, and concerns about tariff barriers with the start of the Trump administration. In Brazil, there was significant volatility, but with a partial reduction in the risk premium for Brazilian assets. The dollar traded on the interbank market ended this Friday’s session (10th) at R$6.103, with a weekly variation of -1.3% and a monthly and yearly drop of -1.2%. Meanwhile, the dollar index closed the session at 109.6 points, with weekly, monthly, and annual gains of 0.7%, 1.4%, and 1.4%, respectively.

Soybean futures experienced significant gains during the first full week of the year, with the March contract rising 3.4% to close at $10.25¼/bu. The week was marked by a revision in the USDA’s Supply & Demand balance, which boosted soybean futures on Friday. The new USDA figures revealed a reduction in U.S. soybean yields, cutting approximately 2.6 million bushels from production. This outlook for lower stocks supported prices in Chicago. The USDA has not yet revised production figures for South America. It is known that Brazil is expected to harvest a robust crop; however, concerns about drier conditions in southern Brazil and key regions in Argentina have reignited fears in the market. Last week, StoneX released an exclusive report for its clients, assessing potential soybean crop losses in Rio Grande do Sul.

Bullish WASDE keeps corn on an upward trajectory

Corn futures started last week higher as the market reacted to a Washington Post report suggesting that U.S. President Donald Trump might adopt a softer tariff policy initially focused on strategic sectors. The news pressured the dollar and bolstered agricultural commodities, with gains in soybeans (+0.45%), wheat (+2.03%), cotton (+1.55%), and corn. However, as the week unfolded, the market calmed down while awaiting January’s WASDE, which typically brings surprises. As usual, the surprises impacted prices, which rose 3% on Friday alone. Over the week, corn posted a 4.4% gain, closing Friday at $4.70½/bu in Chicago.

The major revelation from the USDA in the January WASDE was a revision to U.S. corn ending stocks. The U.S., the world’s largest corn producer, had been developing a strong 2024 crop, prompting the USDA to estimate record productivity of an impressive 11.54 tons/ha. However, the January report revealed that this forecast was overly optimistic, revising it to 11.25 tons/ha. This adjustment cut 7 million tons from the 2024/25 crop’s supply estimate, bringing ending stocks to 39.12 million tons (11.4% less than estimated in December), enabling corn to trade above $4.70/bu for the first time since 2023.

> Click here for the full report.

Vegetable oils rose sharply last week, with soybean oil stealing the spotlight, surging an impressive 14.1% and closing Friday (10th) at $0.456/lb. This was the largest weekly increase for the first expiration since 1988. Several factors influenced this trend. Early in the week, a sharp decline in meal prices, amid favorable production prospects in Argentina, positively impacted oil prices, helping crush margins remain balanced for producers. On Friday, when CBOT recorded a daily increase of 6.6%, soybean oil prices were driven by a sharp rise in oil prices and, notably, the release of initial guidelines for the Clean Fuel Production Credit (CFPC), a new U.S. biofuel incentive program.

In the international urea market, bullish fundamentals have gained strength. Contributing factors include a new round of urea imports in India, reduced nitrogen production in Iran, and expectations of increased fertilizer consumption in countries like the United States. In this context, urea CFR prices rose in Brazil. In the phosphate market, little change was observed: a slight decline in MAP prices and stability in other products. Lastly, a new increase in potassium chloride prices also marked the week.

The second week of 2025 saw price increases in most regions for finished cattle, coinciding with higher replacement values. As typical during cyclical transitions, the scarcity of animals ready for finishing directly affects negotiated prices. This is expected to persist throughout the year, as each cycle takes at least three years to rebuild herds. Another closely monitored factor will be Chinese demand, as the government announced investigations into meat imports. In 2024, China accounted for over half of Brazil’s beef exports. However, China’s domestic supply remains insufficient to meet its demand, meaning the effects of these sanitary decisions on international trade will unfold in the coming weeks.

In the futures market, slight stability was observed, with modest gains for January contracts, now trading at R$328.3/@, and February contracts at R$329.5/@.

Raw and white sugar prices saw declines again last week. The most liquid contracts in New York and London, with March expirations, experienced weekly drops, closing at 19.22¢/lb (-2.2%) and $503.5/ton (-2.1%), respectively. Bearish supply-side fundamentals continue to influence the market, even with a 4.1% increase in oil prices during the week – which usually supports sugar prices.

Optimistic indicators for the 2025/26 crop in Brazil’s Center-South region and in Northern Hemisphere producers are exerting downward pressure despite some bullish influence from other markets, such as oil appreciation and the strengthening of the Brazilian real.

After closing 2024 near R$ 3.17/L, ethanol prices rose 18 cents within days, reaching R$ 3.35/L this week.

The rapid price increase reflects strong off-season sales from mills, distributor stock replenishment following year-end holidays, and an anticipated price surge expected in February. February will see a 10-cent/L rise in gasoline taxes at the pump, favoring ethanol prices.

Coffee futures prices ended last week with mixed results. After a decline the previous week, Arabica futures closed higher, with the most active contract rising 520 points (+1.6%) to 323.85¢/lb. In London, the most active contract showed a slight USD 2/ton decline, resulting in minimal variation for the week.

This Monday, prices showed significant volatility, with divergent performances across markets: New York recorded a 315-point increase (+0.97%) at 327.00¢/lb, while London fell by USD 49/ton (-0.99%), priced at USD 4,917/ton. Price fluctuations mainly reflect technical factors and speculative trading activity.

Last week, cocoa futures reversed the upward trend recorded in previous weeks, closing with losses. The weekly decline interrupted the valuation trajectory initiated in October 2024 when irregular weather conditions and the onset of the dry season drove prices to historical nominal highs.

In recent weeks, cocoa futures have shown particularly pronounced volatility. Analysts attribute this to portfolio rebalancing by investment funds, a common practice at this time of year, and the anticipation of global grinding data, which may lead speculators to hedge against potential surprises.

The USDA’s latest global Supply & Demand estimate revised U.S. cotton production upwards while lowering export figures. This increased ending stocks to 1.05 million tons, the highest volume since the 2019/20 harvest. The news prompted bearish market reactions, with March 2025 futures in New York dropping to 67¢/lb.

In Brazil, soybean harvesting is underway, paving the way for second-crop cotton planting. However, heavy rains in the central-west region have delayed initial fieldwork, which, if prolonged, may affect cotton planting within the optimal timeframe.

Last week, Brent crude futures closed with a 4.25% gain, trading at $79.76/bbl on Friday (10). WTI futures followed a similar trend, rising 3.53% to $76.57/bbl.

The main factor supporting prices last week was the announcement of stricter U.S. sanctions targeting over 180 entities involved in the trade of Russian oil, gas, and derivatives. The move may impact the short-term buying behavior of several countries, particularly India and China, and puts pressure on the global oil supply balance.

Last week, the most active NY Harbor ULSD contract closed with a significant 6.6% increase, ending Friday (10) at $2.5017 per gallon. This morning (13), diesel futures maintained the upward trend, surpassing $2.56 per gallon for the first time since July 2024.

The rise was mainly influenced by new U.S. sanctions against over 180 entities transporting Russian oil, gas, and derivatives. Additionally, expectations of increased demand for heating fuel in the U.S. during upcoming cold waves further supported prices.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.