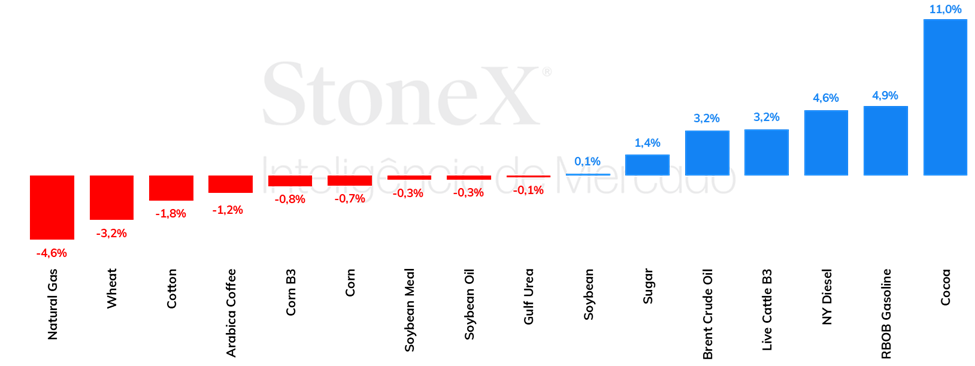

Fonte: StoneX cmdtyView.

The dollar traded in the interbank market ended this Friday’s session (Jan 3) at BRL 6.183, a -0.1% variation for the week. Meanwhile, the dollar index closed at 108.92 points, posting a weekly gain of 0.9%. The real/dollar pair ended 2024 near its all-time nominal high at BRL 6.179. For the year, the exchange rate showed a significant annual increase of 27.2%—its highest variation since 2020, when it advanced by 29%—making the real one of the most devalued currencies last year. The global strengthening of the U.S. dollar, which also recorded double-digit gains against the Argentine peso (27.5%), Mexican peso (21.9%), Colombian peso (13.7%), and Chilean peso (12.3%), coupled with concerns over the sustainability of Lula’s fiscal policies, were the main drivers behind this movement.

Soybean prices rose slightly by 0.2% last week, closing at ¢991.75/bu. Despite the increase, the oilseed remained below the ¢1,000/bu mark, reflecting the downward trend that has been guiding the market in recent months. Uncertainties regarding the Trump administration, which officially begins on Jan 20, continue to prompt cautious behavior among market participants, who are wary of tariffs, the pace of international trade for U.S. soybeans, and the biofuels policy in the U.S., which may be deprioritized in the Republican's new term. On the supply side, attention remains on the South American harvest, which is expected to be strong. The latest estimate from StoneX pegs Brazil’s soybean crop at a record 171.4 million tons. However, more recently, concerns about Argentine supply have emerged. Climate models suggest drier weather in the country, potentially impacting yields; nevertheless, it is too early to determine the actual effects on soybean availability in Argentina.

Corn Ends the Year Stronger but Eyes Are on the Second Crop in Coming Months

In recent weeks, corn futures have shown appreciation, closing at ¢450.75/bu (-0.7%) after reaching near ¢460/bu highs on Thursday. By comparison, on the last Friday before Christmas, corn closed at ¢442.50/bu. The market found support in strong demand for ethanol production in the U.S. and adverse weather in some Argentine regions. Additionally, while the development of Brazil's first corn crop remains favorable, the second crop dominates production, meaning the good Brazilian weather has a smaller impact on corn prices compared to soybeans.

On Brazil’s B3 exchange, March/25 contracts saw a stable weekly close after erasing weekly gains in Friday’s session, mirroring Chicago. The market remains focused on the real.

For StoneX clients, the Market Intelligence team has prepared a special report reviewing 2024 highlights and offering perspectives for 2025. Access it here.

> Click here for the full report.

Last week saw varying trajectories for vegetable oils. Soybean oil prices experienced mild fluctuations amid reduced liquidity due to the New Year holiday and uncertainties surrounding 45Z, a new U.S. biofuel subsidy program that has slowed the domestic market. The Mar/25 contract closed at ¢39.9/lb on the CBOT, down 0.2%. For the year, continuous soybean oil futures fell 16.8% from the 2023 close. Meanwhile, palm oil faced significant pressure as Indonesia began the year without an official decree increasing the biodiesel blend to 40%. The equivalent futures contract on Bursa Malaysia closed the week at USD 971/t, a weekly drop of 6.1%.

Since the last update released by StoneX, there has been little movement in CFR fertilizer prices in Brazil. Year-end festivities slowed trading activity, leading to minimal price changes. Urea prices rose by USD 3, with trades conducted at USD 363/ton. In the nitrogen market, expectations remain that resumed purchases in Northern Hemisphere countries, anticipated in the coming months, could support prices in the international market. Meanwhile, CFR prices for MAP and potassium chloride remained stable.

For StoneX clients, the Market Intelligence team has prepared a special report summarizing 2024's key sugar market themes and offering perspectives for 2025. Access it here.

Early 2025 was marked by a price rebound for hydrated ethanol in São Paulo’s spot market. After weeks of stagnation around BRL 3.15/L, prices rose to BRL 3.23/L PVU in the Ribeirão Preto region (SP) on Monday (Jan 6), driven by a considerable increase in distributor demand. According to a Cepea report, trading volume between Dec 30 and Jan 3 doubled compared to the previous period, reflecting distributor stock replenishment after year-end holidays and explaining the rapid price hike.

Last week saw mixed movements for coffee prices. Amid reduced liquidity due to the New Year holiday and a lack of fresh developments, arabica coffee fell by 1.2% on the New York exchange, with the March/25 contract settling at ¢318.65/lb. Meanwhile, robusta coffee, supported by reports of excessive rainfall impacting Vietnam’s harvest, ended the week up 0.3%, with the equivalent London contract closing at USD 4,968/t.

The CEPEA arabica coffee indicator finished the same period at BRL 2,233.34/bag, a marginal 0.1% decline. The robusta coffee indicator rose 0.8%, closing at BRL 1,832.57/bag.

Last week, between Dec 30 and Jan 3, exchange-traded cocoa reversed the prior week’s downtrend, posting new weekly gains. Over the past two weeks, cocoa markets experienced high volatility, particularly on Dec 27 and Dec 30, when prices sharply declined before recovering much of the losses. This atypical oscillation is likely tied to lower trading volumes during the year-end holiday season, when reduced liquidity tends to amplify price volatility. Recent market volatility also reflects mounting concerns over supply in West Africa, especially given irregular weather patterns in the region. Currently, the primary climate factor in focus is the intensification of the dry season.

For StoneX clients, the Market Intelligence team has prepared a special report summarizing 2024’s key themes for the cotton market and offering 2025 perspectives. Access it here.

Last week, Brent futures closed the period up 2.85%, trading at USD 76.51/bbl on Friday (Jan 3). Similarly, WTI futures rose 4.18%, closing at USD 73.96/bbl. Despite reduced activity due to the New Year holiday, futures sustained gains over five sessions, supported by expectations of a tighter global balance in 2025. Comments from Chinese President Xi Jinping reaffirming economic goals, anticipated sanctions against Russia and Iran, and strong demand in the U.S. contributed to this bullish outlook.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2025 StoneX Group Inc. All Rights Reserved.