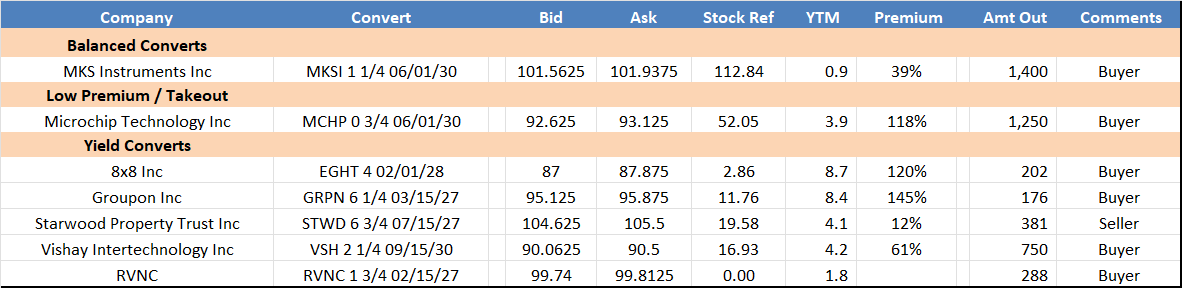

Top Axes:

Trading Recap:

It was a slow start to the week with the post Superbowl lull in full effect. BABA 0 ½ 06/01/31 was the big mover, with bonds traded up over five points outright (close 126.50-126.875 vs. 111.32). BABA common closed up 7.55% as David Tepper increased his stake in both JD and BABA last quarter, with Chinese stocks and ETFS now account for more than 37% of his portfolio. SMTC 1 ⅝ 11/01/27 expanded 1.25 pts ntrl to the downside, with converts closing 125.625-126.25 vs. 37.60. Short/Mid-Term yield converts remain tight, with XYZ 0 05/01/26 trading 94.125-94.25, a 4.90% YTM for 1.22 yrs

RealReal (REAL) 2028 Cvt Exchange for New 4% Cvts Due 31 and Preannounces 4Q Results and 2025 Guide.

- REAL 4 02/15/31 v $8.03 98-101. Offerside using 47.5 vol = 1,000 implied spread. 31.6% Premium.

- REAL 13 03/01/29 105-106. Offerside 10.3% YTW (10/1/26).

Opportunity: $147mm new issue with 25% premium and an 80% delta on a 6 year convert on a company (On-line luxury consignment and resale )with common stock up 163% since 11/2024 on a material beat for the 3Q:

WHY DID THE STOCK MOVE HIGHER back in November 2024?

3Q Results: (Company pre-announced last week)

- Revs $147.8mm, up 11%yy, beat ests $140.3

- EBITDA $2.3mm, v ($7.0mm) yy, beat ests BE

- GMV $433.1mm, up 6%yy, beat ests $426.2mm

Risks: 6 year bond, using mid-point of $25mm in EBITDA results in mid-teens gross debt to EBITDA leverage and 1/3 of debt stack via $137mm REAL 13 03/01/29 first liens

Today’s announced Exchange:

- Company exchanged $183mm (65% of outstanding) of 1% 2028 Cvts for $147mm new 4.00% Convertible Senior Notes due 2031 = 79.9 price. We see that as a 527 / 47.5 pairing.

- The exchange new 4% bonds were guided to 850 / 47.5 for a 104.25 valuation on Friday’s close ($8.37).

- For 6-year exposure we believe an 850-credit spread (100bps wider than where the 1L 2029’s last traded) represents a bull case.

- We think a mid / bear case valuation of 950 credit could be justified. Using same vol, valuation would be 102.8.

Valuation Matrix of New 4% ‘31 convert announced today v $8.37(credit spread on x axis, vol input on y axis):

800 850 900 950 1000

45.0 104.2 103.4 102.6 101.9 101.2

47.5 105.0 104.2 103.5 102.8 102.1

Valuation range fundamental views:

- The Bull Bear case comes down to the company’s ability to scale expenses given every item sold needs to be individually appraised to prevent fakes and accurate price.

- Bear Case: On the 2025 guide the company will produce a mid-point of $25mm in EBITDA for mid-teens gross debt to EBITDA leverage. Still far from sustainable and with 1/3 of the debt stack secured ahead of the converts.

- Bull Case: Mgmt argues that AI informed by their history of photographic examination and highly granular understanding of brands and production series (often exceeding the brands themselves) is creating an authentication system that will deliver scale.

- The process includes 3-4 micro photographs that analyze the materials used, matching them to the history of the production runs for each product and year produced. Other factors analyze where the item was sourced from and the history of the seller.

- Pro cyclical or anti cyclical: People within the company debate that question. Theirs is a supply driven business. During periods of high spending their customers and suppliers are “turning over their closets,” selling items to buy the next item. In downturns selling is more pronounced but at some point demand becomes an issue. A prudent credit spread assumption should reflect the potential effects of a recession within that duration.

Pre-Announcement: Beat for 4Q. 1Q and 2025 mixed.

4Q:

- GMV: $503.5 v $484-$500mm previous and $491 consensus.

- Revs: $163.1 - $164.1mm v $158.0 - $165.0mm previous and $162.8mm consensus

- EBITDA: $10.7 – $11.2mm v $6.5 - $9.5mm previous and $8.6mm consensus.

1Q Guide:

- GMV $484 - $492mm ($488 mid) Inline v $488.5mm consensus

- Revs $157 - $161mm ($159 mid) Miss v $161.5 consensus

- EBITDA $3.0 - $4.5mm ($3.75 mid) Beat v $1.4mm consensus

2025 Guide:

- GMV $1.96 - $1.99 bil ($1.975 bil mid) Beat v $1.965 bil consensus

- Revs $645 - $660mm ($652.5 mid) Inline v $$652.3 consensus

- EBITDA $20 - $30mm ($25mm) Miss v $26.4mm consensus

Results / C-Call Date: February 20, 2025

Balance Sheet @ 3Q & PF for Exchange

3Q PF

Cash: $153.2 $153.2

Debt:

1L 13% 3/29 137.9 137.9

Cvt 3% 6/25 26.8 26.8

Cvt 1% 3/28 281.0 (183) 98

Cvt 4% 2/31 147 147

Total Debt $445.7 (36) $409.7

Mkt Cap: $880.8

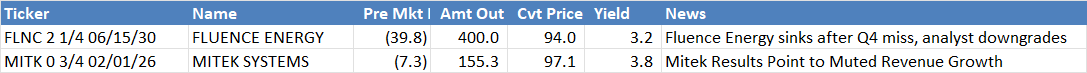

Pre-Mkt Convert Stock Movers:

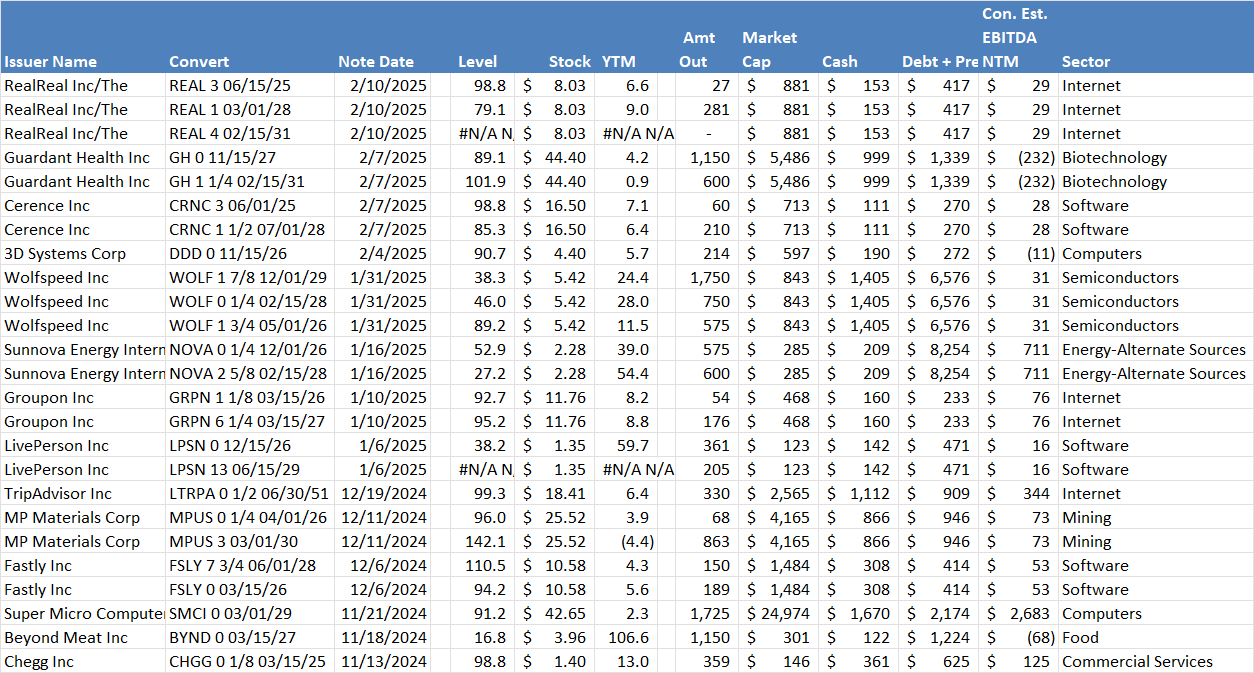

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.