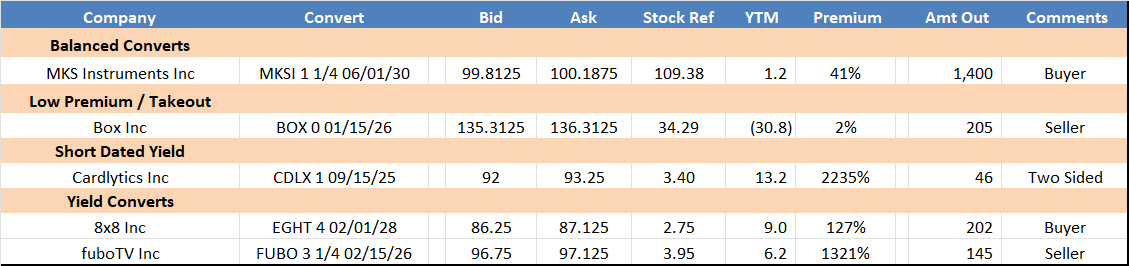

Top Axes:

Trading Recap:

UST yield declined last week (10-YR UST fell 8bps to 4.54%, 2-YR fell 7bps to 4.20%) driven by concerns of dwindling forward growth guidance, increase AI competition from China, and tariff related uncertainties. Economic data remains mixed, with strong manufacturing data conflicting with weaker-than-expected job openings. Friday’s trading volumes were bolstered by MUX 5 ¼ 08/15/30, which traded up over 5 point outright intraday (active here). BILL 0 04/01/30 also was active following last week’s 30+% move in common stock, with bonds expanding over ½ pt $ ntrl and closing 88.25 vs. 62.13. In Risk-Arb, RVNC 1 ¾ 02/15/27 solidified their takeout timeline, moving bonds swiftly higher and closely slightly earlier than expected (Currently: 99.72-99.85). For updated markets, reach out to the desk.

Guardant Health, Inc. (GH 0 11/15/27) Exchange

Company exchanging $659.3mm (out of $1,150mm) 0% 11/27 Cvts for $600mm aggregate principal amount of 1.25% 2/31 Cvts = 91 price.

- Initial Premium 35%

- Company buying back $45mm of shares from exchange participants.

Balance Sheet @ 3Q & PF For Exchange

PF PF

Cash: $999 (45) $954

Debt:

Cvt 0% 11/27 $1,150 (659) $491

Cvt 1.25% 2/31 600 600

Total $1,150 (59) $1,091

Mkt Cap $5,528

Description: Company develops and sells blood and tissue tests for cancer detection, monitoring and treatment optimization.

Guardant and Exact Sciences (EXAS) are market leaders, but competition is expected to increase.

Financials

24 Guide 2023 2022

Rev 720-725 564 450

Yy 28%-29% 25.3% 20.3%

FCF (265)-(275) (346) (387)

Comp v Exact Sciences Corp. (EXAS)

2024 Guide GH EXAS

‘ – Revs 723 2,740

‘ – FCF (270) 165

Mkt Cap 5,528 9,977

Debt 1,091 2,596

Debt /D+Mkt Cap 16.5% 20.7%

2031 Cvts Implied Credit

EXAS 1.75% 4/31 286 using 45 vol

GH 1.25% 2/31 418 using 50 vol

- We believe 325 is appropriate

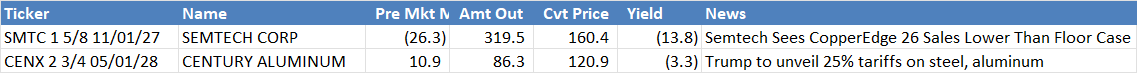

Pre-Mkt Convert Stock Movers:

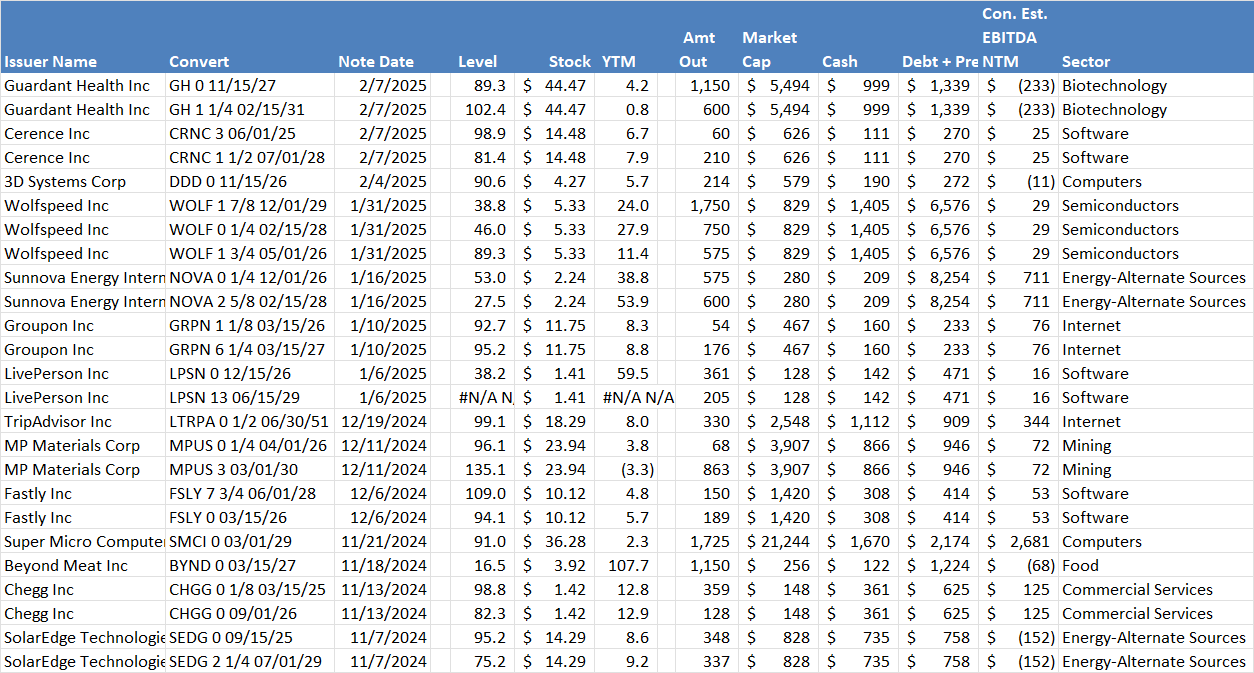

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.