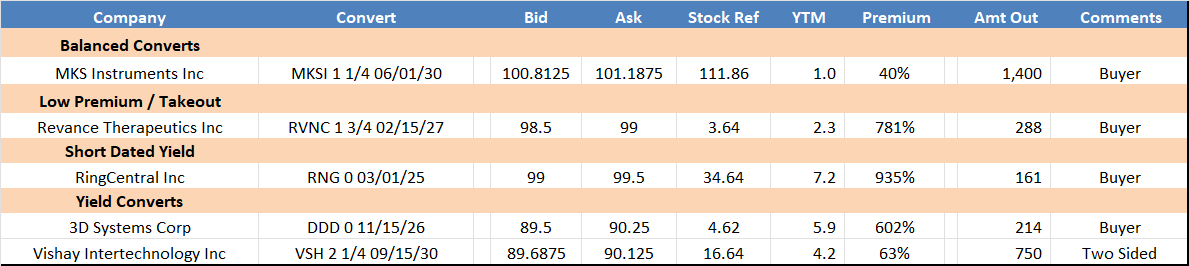

Top Axes:

Trading Recap:

Earnings continue this week with Alphabet dropping 6.8% after hours yesterday. Snapchat reported a strong quarter, with 1Q Rev forecast of 1.33B-1.36B and daily active users at 459M. SNAP 0 05/01/27 remain active, with bonds trading at bond floor (185 over). NOTV 3 ¼ 10/15/27 was active yesterday, with bonds trading 41.25-41.50 (two sellers, four buyers). Longest dated NOVA 2 ⅝ 02/15/28 traded higher yesterday, 28.00-28.25 (52.34% YTM).

3D Systems Corp (DDD)

DDD 0 11/26 89.5-90.5 $214mm outstanding down from $460mm, more below.

Risks: Bonds are tight on yield relative to market cap

Positives: Stock has rallied materially on Daimler 3D parts printing contract and company has bought back in past

- $214.4mm remaining following 2 partial buybacks of 53% of the issue following a failure in 2023 to buy competitor Stratasys Ltd. (SSYS).

- 89.50 bid outright, 6.35% ytm in 1.8 years, 236/70 credit vol pairing it a touch tight using an elevated vol. DDD did have a strong stock rally on 1/23 (graph below) after announcing a collaboration with Daimler Truck for 3D printed parts.

- In December 2023, bought back $135mm out of $460 (29%) at 74

- In March 2024, bought back $110mm (33.9% of remaining) at 78.

3Q Results / 4Q Guide:

Revenues: 2023 yy 1Q 2Q 3Q yy

Industrial $275 (0.7%) $57 $64 $58 (19%)

Healthcare 213 (18%) 45 49 55 +5%

Total $488 (9.3%) $103 $113 $113 (9%)

- Industrial: Impacted by lower printer sales, offset by stronger international.

- Medical: Strong growth in materials and dental.

Gross Margin down 720bps to 37.6%, Normalized for impacts below, down 250bps to 40.2%

- Impacted by $3mm inventory reserve. 2023 3Q boosted by one time gain.

EBITDA loss of $14.3 v profit of $4.7mm in 3Q23.

- Lower revenue and higher opex.

- 2023 boosted by one time (milestone payment) gain.

2024 Guide:

Revs $440 - $450 - Midpoint down 8.8%yy

GM 38 - 40%

4Q EBITDA to see “Sequential improvement”

Balance Sheet @ 3Q

Cash: $190

Cvt $214.4

Mkt Cap $591

Mgmt 3Q Commentary on “plans for convertible … coming due in 2026”

it's been … a lovely debt instrument for us. We obviously went to market at a great time, and it's a zero-coupon piece of paper. … we're looking at how do we do that with the most traditional methods we can… we're looking at how we can really reduce that debt. … want to deal with it as early as possible and not get into -- get toward maturity dates. So, you'll hear a lot more about that in '25, okay?

Description:

3D provides comprehensive 3D printing and digital manufacturing solutions, including printers for plastics and metals, materials, software, and digital design tools. Most of the materials used in their printers are proprietary. The printer business is low volume but high value. Company has a long history in 3D printing with their founder an originator of the technology.

Two reporting segments: Healthcare Solutions and Industrial Solutions. Healthcare Solutions includes dental, medical devices, personalized health services and regenerative medicine. Industrial Solutions includes aerospace, defense, transportation and general manufacturing.

Healthcare / Dental

A major healthcare application has been supplying machines to Align Technology, Inc. (ALGN) to “mass customize” clear aligners. 3D intends to expand this business with a new jetted denture solution. Additional healthcare applications include skull surgery implants and titanium spine cages. The company has ambitions to create implants for joints and is working to create a lung scaffold.

Industrial

End markets are aerospace, defense, transportation, and general manufacturing. Applications in include parts for semiconductor manufacturing and manufacturing replacement parts for remote locations like oil rigs and ships at sea.

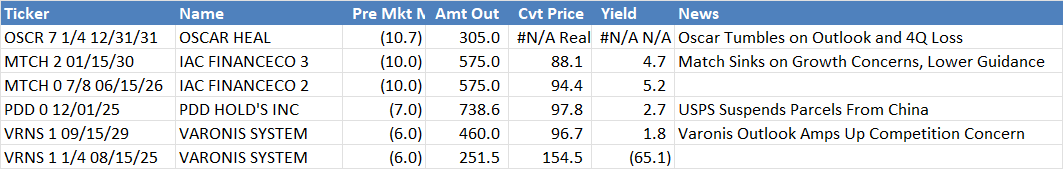

Pre-Mkt Convert Stock Movers:

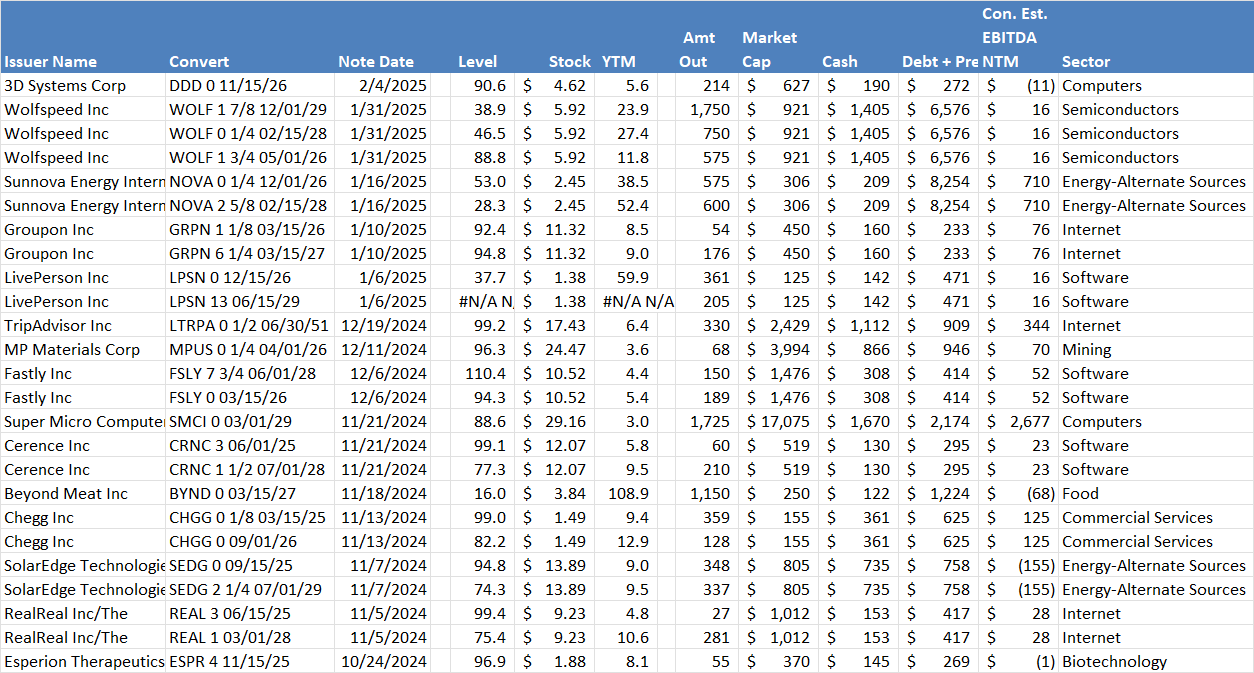

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.