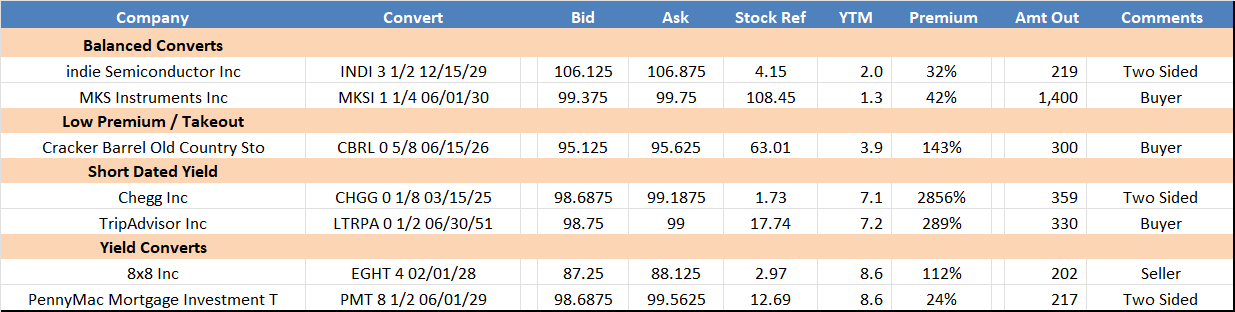

Top Axes:

Trading Recap:

Initial Jobless Claims Data (207k vs. 225k Survey) and Continuing Claims (1858k vs. 19025 Survey) arrived weaker than expected yesterday. However, the biggest intraday rate moved arrived towards the end the trading day as President Trump commented XRX 3 ¾ 03/15/30 traded down 3+ pts outright 76.25-76.50 (9.67% YTM for 4.55yrs). SHOPCN 0 ⅛ 11/01/25 was particularly active, closing 105.375 – 105.875 vs. $119.18. We were active in LITE 1 ½ 12/15/29 (140.25 - 140.9375 vs. 83.98), which seems interesting given profile, high realized vol. 4.9 yrs to maturity with 16.6% premium, realized vol is large in this name >75. Eps 2/6 = 14% implied move, and shorter LITE .5% '28 are modeling 238 Implied /47 vol.

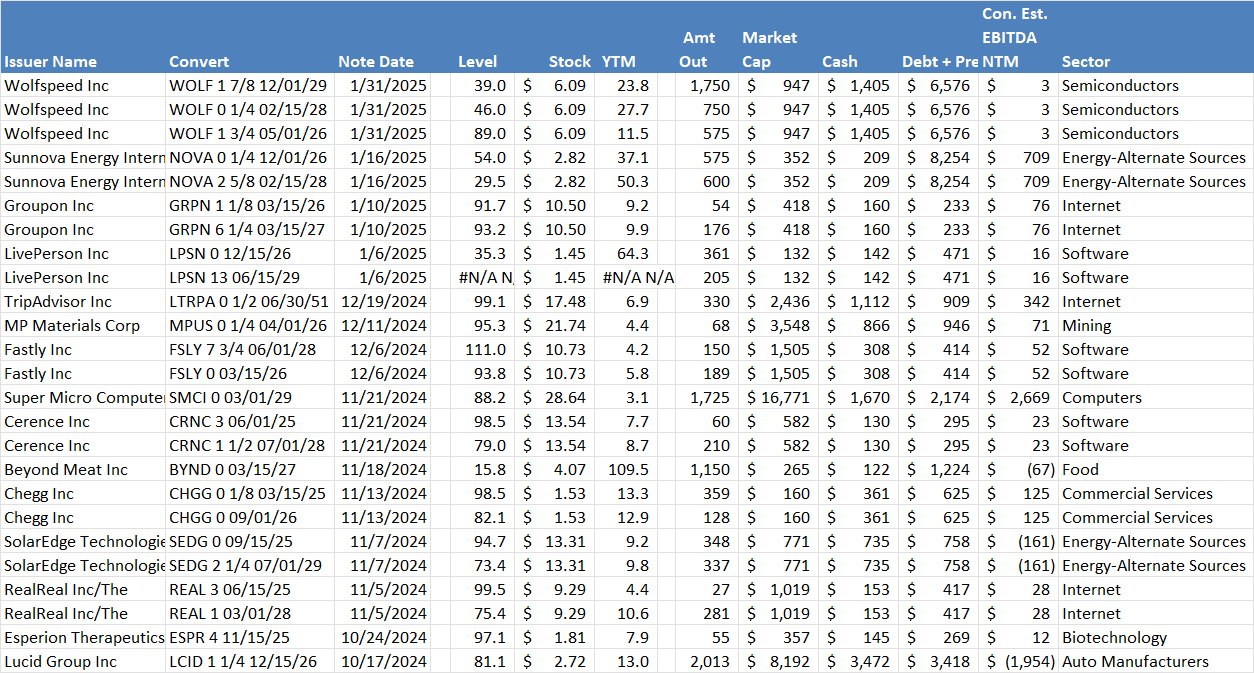

Notes Below:

- Wolfspeed, Inc. (WOLF) F2Q Results

- CHGG: 2025 Cvts mature in 43 days. $358.9 v $534.8 in PF cash

Wolfspeed, Inc. (WOLF) F2Q Results

2Q Results:

- Revs in-line at $181mm

- $91mm from devices ($52mm from Mohawk Valley), $90mm materials.

- Adj Gross Margin beat at 2% v 0.88% consensus

3Q Guide:

- Revs $170 to $200 miss $194 consensus.

- Mohawk Valley to contribute $55 to $75mm.

- Guide reflects lower expected materials revenues over next several Qs due to lower end market demand.

Balance sheet commentary:

- “Continuing to work on plans to address convertible notes and expect to complete this work in FY25 3Q”

- Addressing the cvts is a condition of receiving CHIPS funding.

- Company is confident in ability to receive CHIPS funding (but was questioned on the call by analysts).

Description:

Wolfspeed is the world’s leading producer of silicon carbide (SiC) materials and a manufacturer of SiC products including the first commercially available fully qualified SiC MOSFET. SiC products are a leading application for EVs and alternative energy due to their higher voltage and heat tolerances. SiC is an extremely difficult and expensive substrate to manufacture and their investment in 200mm capacity gives them a first mover advantage.

The company has made major investments in US facilities and capacity. To help fund the investments, the company sold its LED business in 2021 and radio frequency business in 2023. Major investments include NY Mohawk Valley Fab the world’s first automated 200mm SiC device fabrication facility which began revenue production in 4Q F2023, Building10 an expanded materials factory in Durham, NC currently producing 200mm wafers and the The JP a new materials manufacturing facility under construction in Siler City, NC which will be the world’s largest 200mm materials facility.

Summary:

The long cycle of investment and problematic production ramp has tried investor patience as the underlying SiC market has been challenged by competition from China and weakening EV and alternative energy demand.

Financial Summary: $1.4bil in cash, $6.6bil in total debt of which $1.5bil is secured. $947mm mkt cap. Consensus FCF burn of $1.6 bil for F2025 (June 2025) and $234mm for F2026.

Convert / Credit Positives:

- Domestic US SiC production capacity has been described as “strategic” likely continuing political support and potentially benefitting from tariffs.

- Company recently announced $1.5 billion in potential funding from CHIPS Act and private investors.

- Funding requirements include the restructuring or refinancing of all the converts at specified intervals prior to their respective maturity dates.

- Early in 2024 a well-known activist investor took a close to 5% stake in the company and wrote management a letter advocating actions including a possible sale of the company.

- The recent resignation of the CEO potentially increases the probability of a sale.

Credit Negatives:

- New Administration may rescind / restructure the CHIPS Act funding.

- SiC demand could take another leg down should EV buyer incentives be repealed.

- $1,500mm in secured debt ahead of converts, agreement for $500mm additional.

Recent Events:

11/18/24 CEO resigns

10/15/24 Announces $1.5 billion in potential funding from CHIPS Act and Private Investors.

- $750mm in CHIPS Act funding to support N. Carolina and New York expansion

- Non-binding preliminary memorandum of terms (PMT) for up to $750 million in proposed direct funding under the CHIPS Act.

- Disbursement of funds conditioned upon the achievement of certain operational and construction milestones and other requirements including:

- $750mm in incremental secured funding.

- Raised $250 in 2Q from group that funded their existing secured debt with an agreement to raise $500mm more.

- Restructuring or refinancing its outstanding 2026, 2028 and 2029 convertible notes at specified intervals prior to their respective maturity dates.

- Company expects to address in 3Q.

- Deferring a total of $120 million in cash interest payments due prior to June 30, 2025 under the existing customer financing agreement.

- Modified agreements in 3Q

- Raising up to $300 million of additional capital from non-debt sources over the next 12 months.

- Full amount raised: $100mm in 2Q, $200mm in January.

- Non-binding preliminary memorandum of terms (PMT) for up to $750 million in proposed direct funding under the CHIPS Act.

- WOLF also expects to receive $1 billion in cash tax refunds under the CHIPS Act (section 48D) over the next several years.

- $2.5 billion in total expected funding.

Balance Sheet @ 2Q (12/31/24):

Cash: $1,405

Debt:

Secured Note 6/30 $1,506

Cvt 1.175% 5/2026 575

Cvt 0.25% 2/2028 750

Cvt 1.875% 12/2029 1,750

Customer Financing 2,000

Total Debt $6,581

Mkt Cap $947

Near Term Expected Cash:

- ATM Raise $109mm (Out of $200mm total completed in Jan)

- Section 48D Tax Refunds 186

- Non-core asset sale 150

Total $336

Cash Flows:

2Q25 1Q25 2024 2023 2022

CFO (195) (132) (671) (102) (125)

Invest (403) (396) (2,101) (799) (503) Net of reimbursements under incentive agreements

FCF (598) (528) (2,772) (901) (628)

Non-Convert Funding:

- Secured notes:

- 1L on all assets, including capital stock of subsidiaries, with a carveout for potential grant-based financing.

- Issued 6/23

- Coupon 1st 3 yrs 9.875%, 4th yr 10.875%, 11.875% thereafter

- Maturity 6/30 with spring in 9/29 if more than $175mm out on 12/2029 cvt

- Can issue an additional $500mm subject to certain conditions.

- Bond subject to CoC make whole and Par+ repayment provisions on certain events.

- Cash maintenance covenant of $500mm until Mohawk Valley @ 30% utilizations and producing $240mm of revenue. Required cash reduced until 50% utilization and $450mm revs, eliminated.

- Customer Financing

- Customer is Renesas

- Unsecured, refundable deposit by customer. Deposits are due 7/2033.

- Guaranteed by operating subsidiaries, so structurally senior to converts.

- Interest at 6%, increasing to 10-15% under failure to supply minimum levels under a ten-year wafer supply agreement with the customer. $120mm in interest switched to PIK in Oct24.

CHGG: 2025 Cvts mature in 43 days. $358.9 v $534.8 in PF cash

3Q Balance Sheet:

- Cash $152

- ST Investments 209

- LT Investments 270 (Corp debt & UST’s)

Total Cash $631

Nov 2024 2026 cvt repurchase

- Repurchased $116.6mm for $96.2 (82.5 price)

PF Total Cash $534.8

0 ⅛ 03/15/25 358.9

PF Cash for 2025 Maturity $175.7

Remaining 0 09/01/26 $127.9

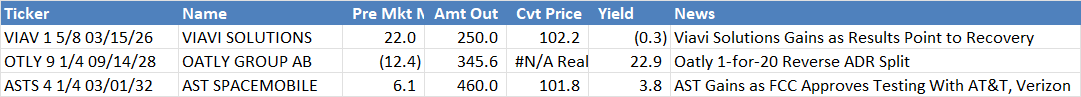

Pre-Mkt Convert Stock Movers:

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.