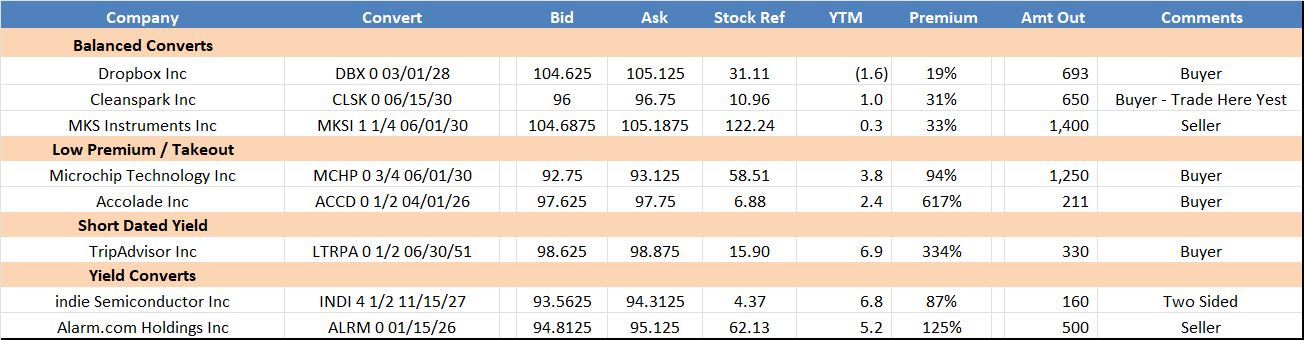

Top Axes:

Trading Recap:

Last week, the StoneX convertibles traded the following: ACCD 0 ½ 04/01/26, AWK 3 ⅝ 06/15/26, CBRL 0 ⅝ 06/15/26, DBX 0 03/01/28, ENPH 0 ¼ 03/01/25, EXPE 0 02/15/26, EQXCN 4 ¾ 10/15/28, GRPN 1 ⅛ 03/15/26, GRPN 6 ¼ 03/15/27, INDI 3 ½ 12/15/29, INDI 4 ½ 11/15/27, LBRDA 3 ⅛ 03/31/53, LCID 1 ¼ 12/15/26, MCHP 0 ¾ 06/01/30, NOVA 2 ⅝ 02/15/28, RWT 7 ¾ 06/15/27, TRIP 0 ¼ 04/01/26, and XRX 3 ¾ 03/15/30.

US equities were positive and 2-10yr Treasury yields were 1-6bps tighter across the curve. PAR Technology Corp (PAR) announced a $100.0mm New Convert (see below for UW assumptions). We were active in ALTR 1 ¾ 06/15/27, a risk-arb play trading on a mid-80s delta here. Reach out for current markets and deal timelines estimations. There was a large outright buyer around in MKSI 1 ¼ 06/01/30 – bonds were trading 65-67D, and we closed 104.75-105.1875 vs. $122.24. Short-term yield remains active, now yielding tighter than 5.5% inside of 6-months (SQ 25, PEGA 25, OKTA 25).

PAR Technology Corp (PAR) Prices $100mm Cvt on the Rich End.

- No upsize

- 1% coupon v 1-1.5% marketed

- 32.5% Premium v 27.5%-32.5%

- UOP: Repay $90mm term loan, GCP

- Assumptions: GC

- UW: 300 / 40

- StoneX 375 / 40

- Fair Value:

- UW: 100.5

- StoneX: 98.9

Description: Enterprise software focused on fast food companies.

Balance Sheet @ 3Q & PF for November 2026 Cvt Exchange:

Cash: $118.4mm

Debt:

Acquisition Term Loan $90.0

- 1L Secured. 7/5/29 Maturity with Spring on 1.5% 2027 Cvt maturity. S+500 rate.

Cvt 2 ⅞ 4/26 $20.0

- Nov 21, company exchanged $100mm of 2026 Cvt for 2.4mm shares = 182.5 using 11/20 close of $76.06

Cvt 1.5% 10/27 $265.0 Last implying 279 v 42.5

Total PF Debt $375.0

Mkt Cap: $2,767.6

- Consensus 2024 EBITDA Loss $7.3mm. Consensus 2025 EBITDA $25mm

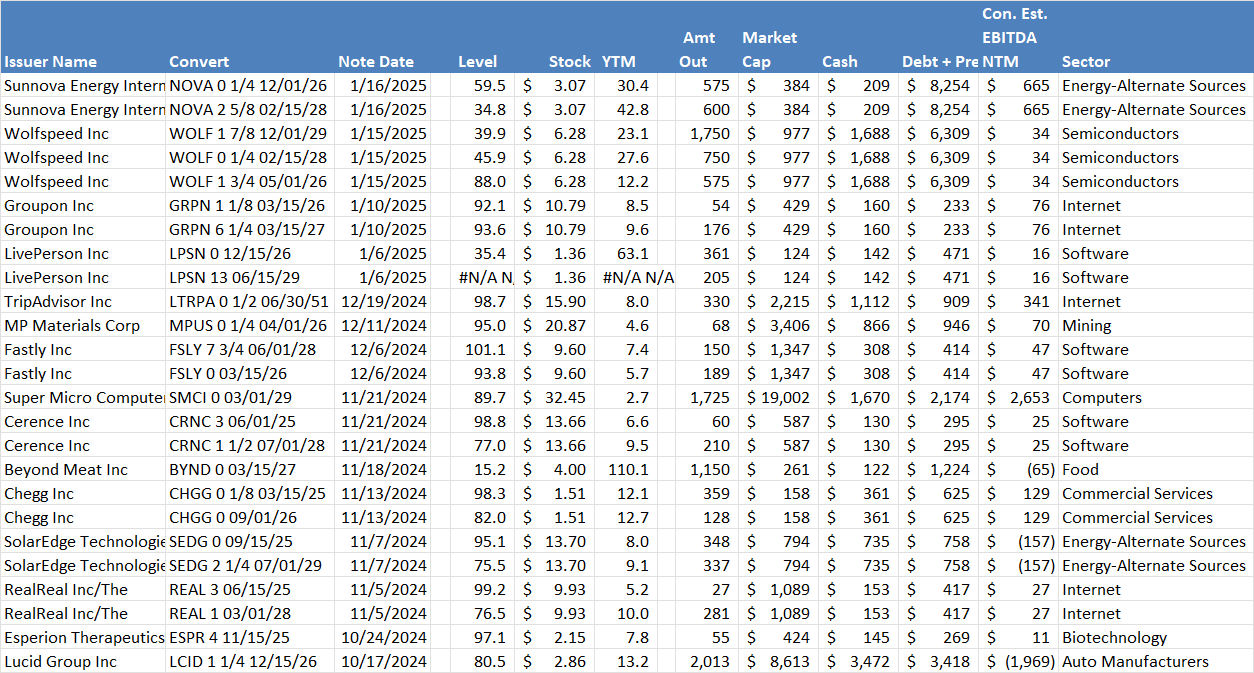

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.