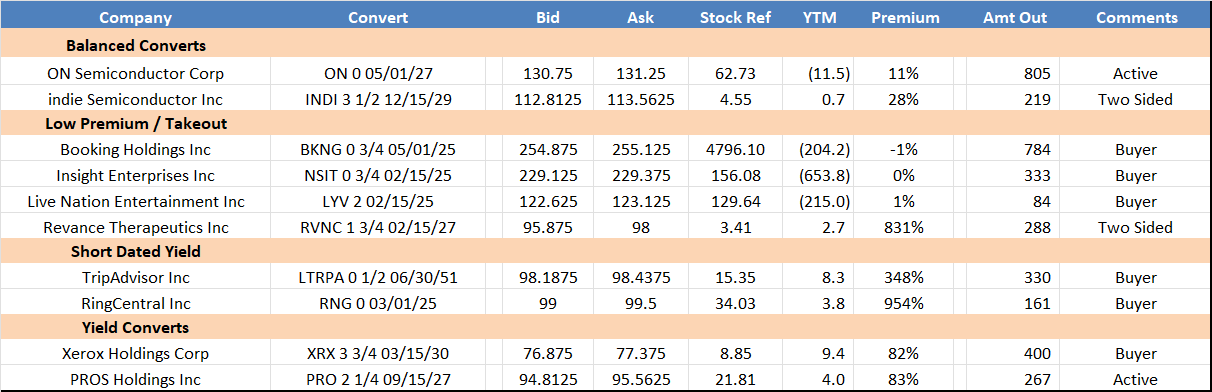

Top Axes:

Trading Recap:

Friday’s blowout jobs report started a selloff in treasury yields as investors now are projecting a 93% chance that the Federal Reserve will leaves rates unchanged on 1/29. As a desk, we were generally active in shorter-term yield converts (ALRM 26, ACCD 26, GRPN 26, ENPH 25, FVRR 25, and LTRPA 51). There was a large trade in PRO27 Friday, trading on a mid 40s delta (95.00-95.375 vs. 21.75 context). We remain active here. INDI 27 also traded higher (92.75-93.00 vs. 4.28).

Groupon, Inc. (GRPN 6 ¼ 03/15/27)

Longer Dated Cvt View:

- Our prior view was that the news’ were offering better value than the olds’ post exchange. That is still the case with news having security and a marginally better outright yield for one additional year.

- On their own the news are worth looking at. At 96 they offer an 8.30% outright yield and a 550 implied spread using 45 vol. Premium is 140%.

Current Fundamentals:

- The turnaround story has clearly stalled as the transition to new systems and adjustments to the business model are creating greater issues with the retention of existing customers than pickups in new users. Mgmt’s soft guide on the last call focused on this issue saying legacy customer losses would likely be a headwind to “future financial performance.”

- Additionally, the strong performance of the economy and consumer spending has likely deferred the “return to discounting” thesis

Positives:

- While the return to discounting thesis may be deferred it still has relevance for stressed consumers.

- The 25% equity holder of GRPN and their management representatives (CEO, CFO) still seem committed to the company. Recall they backstopped an $80mm rights offering in November 2023.

- In addition, the company believes it can generate $90mm in proceeds from non-core assets sales, largely through the sale of their remaining SumUp (Private) shares.

Other Negatives:

- Italian Tax Issue: Company believes they will lose their 2nd level appeal. Will continue appeal. They have exited that sub and believe losses will be limited to the sub assets.

- Negative working capital: GRPN is a negative WC company. Current deficit ex cash and STD is $177mm, which limits the company’s ability to draw down cash.

Convert Exchange (Nov 2024)

- $176.26 1.125% Olds due 2026 exchanged 1:1 for $176.26 6.25% New Secured Cvts due 3/15/2027.

- Additional new money purchase of $21mm new cvts for $20mm in proceeds (95%).

- Total of $197.26mm new cvts issued.

2024 Guide:

- Revenue $486 to $493mm

- EBITDA $65 to $70mm

- FCF Positive

Soft 2025 Guide (from C-call commentary)

- Revenue: “flat or up to low single-digit growth, with the first half down and the second half year up”

- EBITDA: “similar or better than 2024”

- FCF: “positive”

Balance Sheet @ 3Q & PF

3Q Exch. PF

Cash: 159.7 20.0 179.7

Old Cvt: 230 (176.3) 53.7

New Cvt: 197.3 197.3

Total Debt 230 21.0 251.0

Market Cap 484

New Note Terms:

- 6.25% Coup, $30.0 Cv Price. (165% premium to 11/12/24 close).

- Potential additional interest of 2.5% if by Nov 2025 the SumUp investment is not pledged to security of the notes or 2/3 sold with proceeds pledged directly to the new notes.

- Secured by 1L security interest in substantially all of the assets of Groupon and the Guarantors

- Guaranteed by certain material domestic subsidiaries

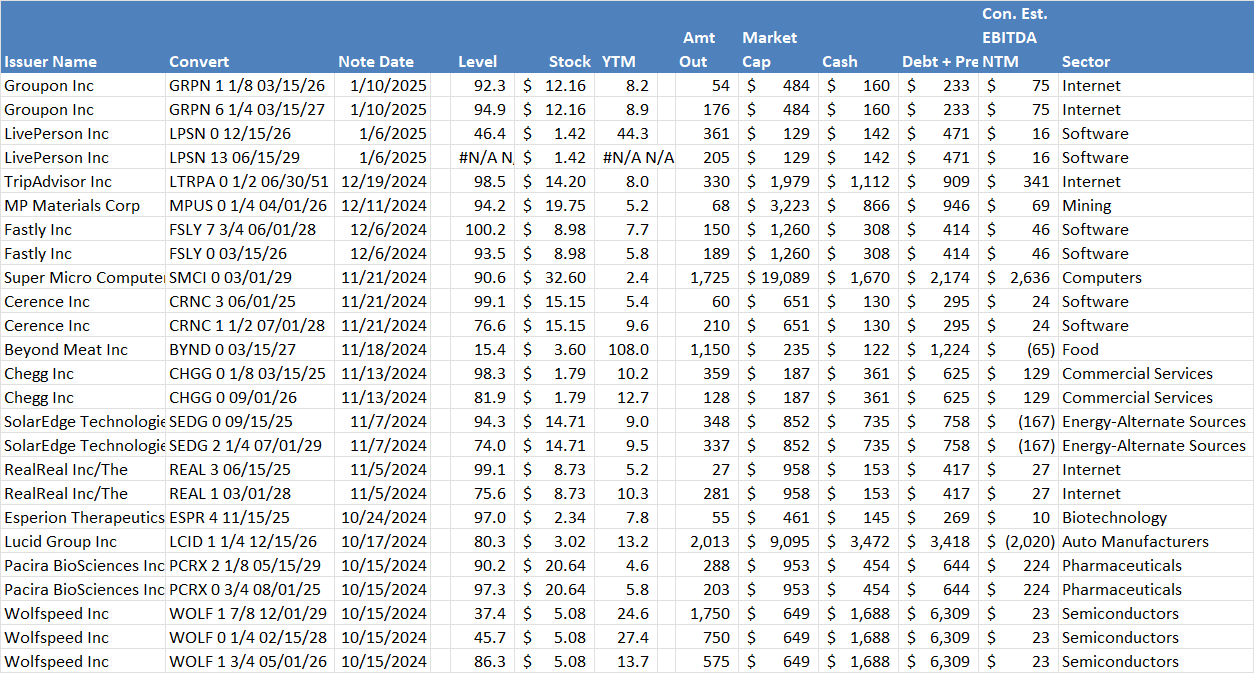

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.