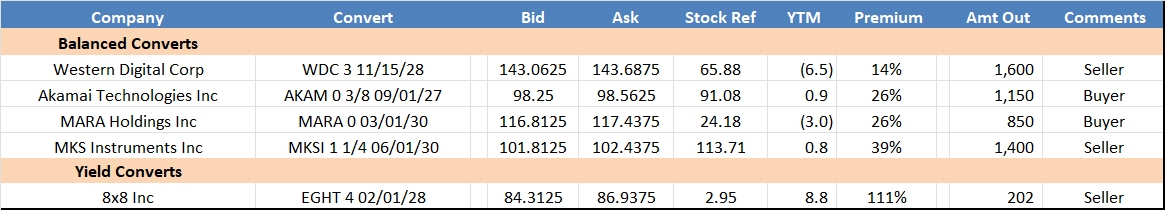

Top Axes:

Trading Recap:

- So far this week, StoneX has traded AKAM 0 ⅜ 09/01/27, ETSY 0 ¼ 06/15/28, EXPE 0 02/15/26, F 0 03/15/26, GLXYLP 2 ½ 12/01/29, MARA 0 03/01/30, MDB 0 ¼ 01/15/26, MKSI 1 ¼ 06/01/30, PEB 1 ¾ 12/15/26, SMCI 0 03/01/29, TREE 0 ½ 07/15/25, TRIP 0 ¼ 04/01/26, TWO 6 ¼ 01/15/26, and WT 5 ¾ 08/15/28.

Notable Movers and Themes

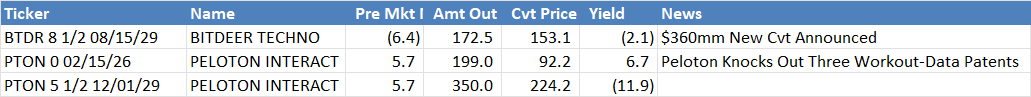

- - Crypto focused convertible bonds remain on top of TRACE this week, with MSTR 0 12/01/29 slipping below par as MSTR common swung over 25% intraday. First due MSTR 27 expanded over 1.5pts to the downside, trading 98-99D. GLXYLP 2 ½ 12/01/29 also began trading (active here). Bitdeer Technology also announced a $360M convertible bond due 2029.

- - We were active across all three AKAM converts, trading AKAM 27 97.05-97.10 vs. 87.96 (mid 45-47D).

- - SMCI 0 03/01/29 moved steadily higher throughout the day as the common rallied over 15%. Bonds close 86.00-86.75 vs. close.

- - LEU 2 ¼ 11/01/30 are back above par, with bonds lifted 108.86 vs. $81.00 on a 74 delta.

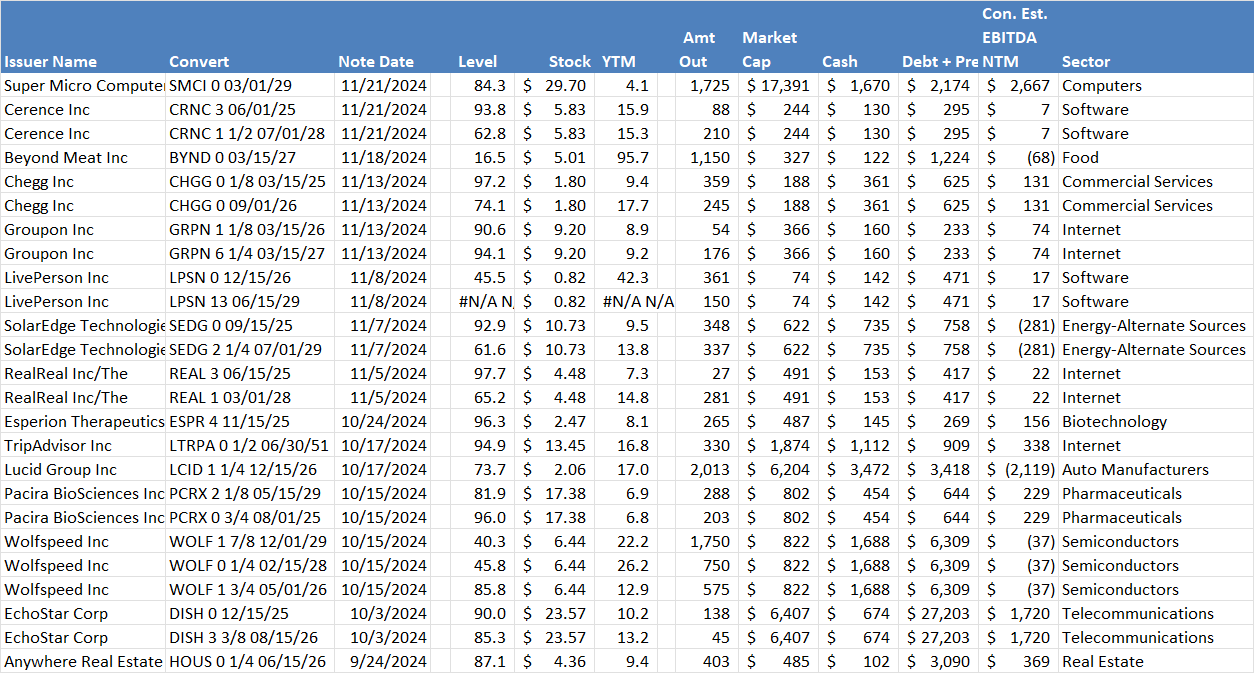

Notes Below: SMCI, CRNC

Super Micro Computer, Inc. (SMCI 0 03/01/29): Veradigm Inc. (MDRX 0 ⅞ 01/01/27) offers a comparable situation

- MDRX time to delisting was 350 days from final SEC due date of 2022 10K. Company still had appeals available at time of delisting but chose not to pursue.

- Cvts still outstanding under revised indenture that eliminated filing acceleration. Delisting triggered Fundamental Change Put but no holders exercised.

MDRX Timeline:

2/28/23: “due to an expansion of year-end audit procedures”, the Company filed with the SEC a Form 12b-25, extending 2022 10K due date by 15 days to 3/16/24

3/20/23: Company received a notice from Nasdaq indicating that the Company is no longer in compliance with filing listing requirements under Rule 5250(c)(1). Pursuant to the terms of the notice, the Company had 60 days to file its Form 10-K or to submit a plan to regain compliance (5/19/23).

5/18/23: Company submitted to Nasdaq its compliance plan.

5/19/23: Company received 2nd notice it was not in compliance with Rule 5250(c)(1).

6/13/24: Receives Approval from Nasdaq of Plan to Regain Listing Compliance granted the Company an exception until 9/18/23 = to +180 days from 3/22/23.

9/18/23: Company is unable to file by deadline. Receives Delisting Notice. Company appealed and requested a hearing and temporary stay.

10/6/23: Company receives notice from Nasdaq granting them a hearing on 11/16/23 and a temporary stay until the hearing and panel decision.

11/17/23: Company receives another notice of non-compliance. Panel had not yet made a decision so company still under stay.

12/13/23: Nasdaq panel grants request for continued listing through 2/27/24 = 76 days.

2/5/24: Company reaches agreement with Convertible bond holders obtain waivers under any defaults and indenture revised to (i) provide for biannual repurchase rights at the option of the holders beginning on January 1, 2025 at the accreted prices set forth in the First Supplemental Indenture; (ii) make certain changes to the table in the Indenture setting forth the number of additional shares by which the conversion rate applicable to Notes surrendered in connection with make-whole fundamental changes will be increased; and (iii) provide for an accreting value for Notes purchased upon the occurrence of a Fundamental Change (as defined in the Indenture) on or after February 2, 2024.

8K Link:

https://www.sec.gov/Archives/edgar/data/1124804/000119312524023388/d711633d8k.htm

2/27/24: Company still unable to file reports. Expects delisting notice 2/28/24.

2/28/24: Receives desilting notice. Stock too be delisted 2/29/24. The company still had the right to request a review of the decision but chose not to ask for one.

2/29/24: MDRX delisted from Nasdaq. Moved to OTC Expert Market.

3/14/24: Company delivers Fundamental Change Company Notice setting put date as 4/5/23.

4/5/23: No holders exercise put right.

Current: Bonds still outstanding. Company still has not filed financials.

Cerence Inc. (CRNC) Stock up 40+% on 2025 Guide that beat estimates.

- 2 Busted Cvts

- 3% Due 6/25 Last 93 94 (has not traded since June) 15.3% ytm, 1084 z

- 1.5% 7/28 last 55.5 (last not traded since Oct) vs 19.1% ytm

- Total par amount of both issues is $297.5mm. Cvts are the only debt drawn debt. Mkt Cap is $155mm. 2025 Cvts have gone current. Company stated they intend to refi a portion and use cash on the remainder. On issue of the 1.5% 28 Cvts in 2023, $87.5mm of the 2025 cvts were repurchased for $102mm in cash.

- Cerence provides voice recognition systems to auto OEMs. Company claims > ½ of production cars use some components of their systems. Business is undergoing a technology disruption as cars become “smartphones on wheels”, creating both opportunities and risks for the company. CRNC is developing new offerings including a recently introduced LLM. The company has extensive patents and an incumbent position with OEMs who are highly focused on engaging drivers with in-car systems.

4Q Results:

- Revs $54.8, -32.2%yy, beat ests $47.5

- EBITDA ($1.9) v $16.6 yy, beat ests ($15.4)

1Q 25 Guide:

- Revs $47 to $50 miss consensus $56.9

- EBITDA ($9.0) to ($6.0) miss consensus ($1)

2025 Guide:

- Revs $236 to $247 beats consensus of $232

- Includes $20mm in fixed contracts at mid.

- EBITDA $15 to $26, beats consensus of $2.5

Financial Performance:

There is a large disconnect between EBITDA and operating cash flow due to high deferred revenue recognition ($61mm in 24’, $21.5mm in 23’, $28.3mm in 22’, $45.6mm in 21). The current deferred revenue balance is $167mm. The deferred revenue results from their Connected Services business where they generally are paid the subscription fees for the entire term up front.

Financials in 2024 have been distorted by the cancellation of a legacy contract that had been on the books for years but largely inactive. The cancellation of the contract resulted in the recognition of $87mm in deferred revenue.

Balance Sheet @ 4Q:

Cash: $130.5

Debt:

$50mm 1L Rev undrawn. Maturity is 4/26 with Spring 91 days before 2025 Cvts.

Cvt 3% 6/25 87.5

Cvt 1.5% 7/28 210.0

Total Debt $297.5

Mkt Cap: $156mm

Please reach out to the desk for details.

Pre-Market Convert Stock Movers:

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.