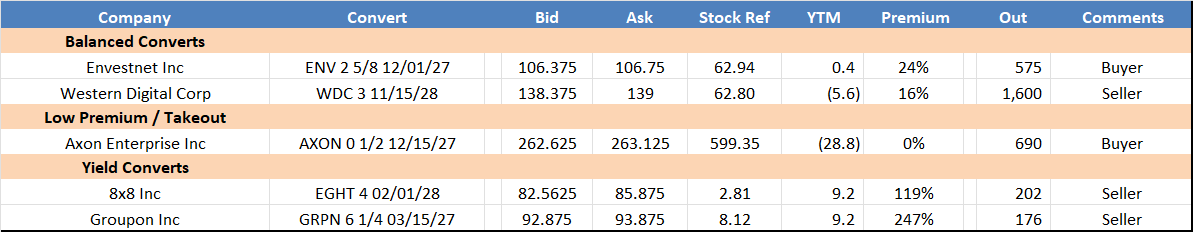

Top Axes:

Trading Recap:

- Last week, the convert desk traded BKNG 0 ¾ 05/01/25, ENV 2 ⅝ 12/01/27, EQXCN 4 ¾ 10/15/28, GRPN 1 ⅛ 03/15/26, GRPN 6 ¼ 03/15/27 *, MGPI 1 ⅞ 11/15/41, PCT 7 ¼ 08/15/30, PLUG 3 ¾ 06/01/25, SMCI 0 03/01/29, SPOT 0 03/15/26, SYNA 0 ¾ 12/01/31, UBER 0 ⅞ 12/01/28 2028, and UPST 1 11/15/30.

Notable Movers and Themes

- - US equities finished the week lower, led by QQQ which ended the week down 3.42%. US Treasury yields were wider across the curve as traders now a 50% chance for a rate cut on December 18th.

- - Last week, it was a busier week in the convertible new issue market with all deals trading higher $ ntrl in their first day of trading (UPST 1 30, SYNA .75 31, and AHLC 4.25 29, which was a stand-out amongst new issues this year).

- - As a desk, we saw activity across all convert profiles including high-dollar BKNG 0 ¾ 05/01/25, risk-arb scenarios such as ENV 2 ⅝ 12/01/27, as well as earnings focused movers such as PLUG 3 ¾ 06/01/25. For current markets, reach out to the desk.

Spirit Airlines, Inc. (SAVE) Files for CH11 with RSA

The company disclosed a restructuring support agreement (RSA) with a supermajority of its loyalty and convertible bondholders. A $350 million backstopped equity investment from existing bondholders and the equitization of $795 million in funded debt. Additionally, bondholders are providing $300 million in DIP financing. Expects to emerge from Chapter 11 in the first quarter of 2025.

Prepetition Debt:

Revolving Credit Facility $300.0 million

8.0% Senior Secured Notes due 2025 $1.11 billion

Aircraft Debt $1.5 billion

Total Secured Debt $2.9 billion

4.750% Convertible Senior Notes due 2025 $25 million

1.000% Convertible Senior Notes due 2026 $500 million

Unsecured Term Loans due 2031 $136 million

Total Debt $3.6 billion

Treatment of Loyalty Bonds and Convertible Bonds:

8.0% Senior Secured Notes due 2025 (Loyalty bonds) = $1.11 billion

- 76.0% of the New Equity

- subject to dilution by the Equity Rights Offering

- $700 million of the Exit Secured Notes (63 cents)

Convertible Notes Claims = $525 million

- 24.0% of the New Equity

- Subject to dilution

- $140 million of Exit Secured Notes (27 cents)

Please reach out to the desk for details.

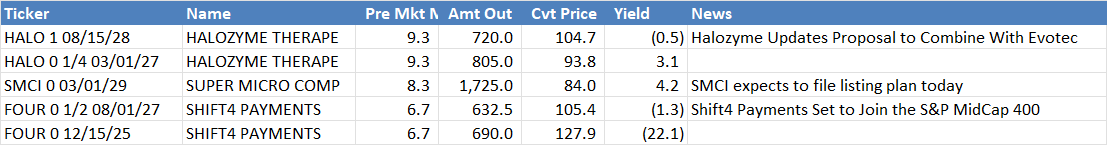

Pre-Market Convert Stock Movers:

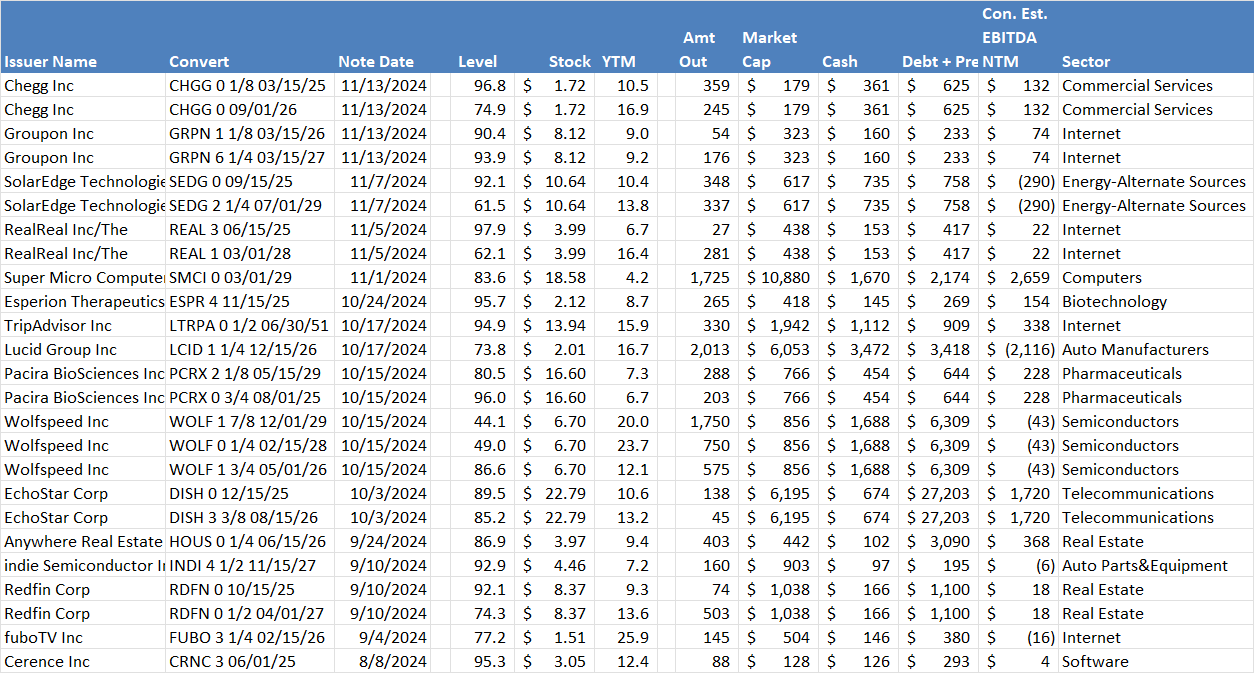

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.