Top Axes:

Trading Recap:

So far this week, the StoneX convertibles desk has transacted in the following: ABR 7 ½ 08/01/25, CHGG 0 ⅛ 03/15/25, GWRE 1 ¼ 11/01/29, HASI 0 05/01/25, IDCC 3 ½ 06/01/27, INDI 4 ½ 11/15/27, LCID 1 ¼ 12/15/26, GKOS 2 ¾ 06/15/27, MCHP 0 ⅛ 11/15/24, PRGS 1 04/15/26, PRFT 0 ⅛ 11/15/26, SHOPCN 0 ⅛ 11/01/25, and Z 1 ⅜ 09/01/26.

Notable Movers and Themes

- LCID 1 ¼ 12/15/26 was active early as common stock took a dive following a $1.67B capital raise and guidance of larger realized losses (detailed balance sheet analysis available here). We were actively trading the converts in a range of 76.75-77.25.

- CRNC 1 ½ 07/01/28 traded 55.00-55.25 918.67% YTM, axed here.

- JBLU 2 ½ 09/01/29 were lifted 138.013 vs. $7.37 on swap (86D), now up ~two pts $ ntrl since early September.

- Company sold 262.4mm shares to the public and the Saudi Public Investment Fund (PIF) bought another 374.7mm shares (27.5% dilution). Stock priced at $2.66.

- The PIF investment vehicle is the Ayar Third Investment Company ("Ayar") which is the holder of the existing PIF stock investment. With this stock purchase Ayar expects to maintain its approximate 58.8% ownership of Lucid's outstanding common stock.

- This follows an August 4th PIF investment of $1.5bil total, half in the form of a new series of convertible preferred stock and the other half from a delayed draw term.

- At 6/30 Lucid had $3.9bil in cash and $4.3bil in total liquidity. At 2Q they expected that liquidity get them into the fourth quarter of 2025, past the start of production of the Gravity SUV.

- Between the August investment and this raise the PF cash would be $7.1bil.

- Company is expected to burn $2bil in 2H24 and $3.2bil in 2025.

Balance Sheet @ 2Q:

Cash: $3,904.1

Debt:

Finance Lease 83.6

GIB Facility 68.2

MISA Agreement 194.6

$1bil ABL undrawn

Cvt 1.25% 12/26 2,012.5

Total Debt $2,358.9

Cvt. Preferred: $1,045.4

Mkt Cap: $7,153.8

Liquidity:

Cash $3,904

ABL 178

GIB Facility 198

Total $4,280

Quick Overview:

- The Company completed the first phase of the construction of its Advanced Manufacturing Plant-1 in Casa Grande, Arizona (“AMP-1”) in 2021 and has since transitioned general assembly to the AMP-1 phase 2 manufacturing facility.

- LCID began commercial production of its first vehicle, the Lucid Air, in September 2021 and delivered its first vehicles in late October 2021. The Air sedan has a maximum estimated range of up to 516 miles, making it among the longest-range electric vehicles around the globe.

- Their next program is the Gravity SUV which is scheduled for start of production in late 2024.

- A midsize platform is scheduled for late 2026.

- LCID completed the semi knocked-down portion of its Advanced Manufacturing Plant-2 in Saudi Arabia (“AMP-2”) in September 2023.

- In June 2023, Lucid entered into a partnership with Aston Martin to integrate and supply Lucid's electric vehicle powertrain and battery systems to the car maker.

- The Company continues to expand AMP-1, construct the completely-built-up (“CBU”) portion of AMP-2, and build a network of retail sales and service locations.

Saudi Investment Vehicles:

- PIF: Public Investment Fund, the sovereign wealth fund of Saudi Arabia

- Ayar: Ayar Third Investment Company, an affiliate of PIF and the controlling stockholder of the Company

- PIF via Ayar owns 60% of LCID stock

- SIDF: Saudi Industrial Development Fund

- GIB: Gulf International Bank is a bank incorporated in the Kingdom of Bahrain. GIB is a related party of PIF, which is an affiliate of Ayar.

- MISA: Ministry of Investment of Saudi Arabia a related party of PIF, which is an affiliate of Ayar

Please reach out to the desk for details.

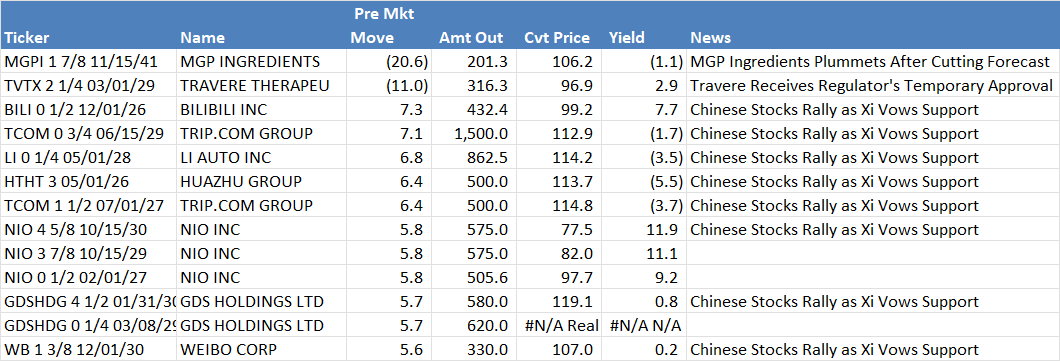

Pre-Market Convert Stock Movers:

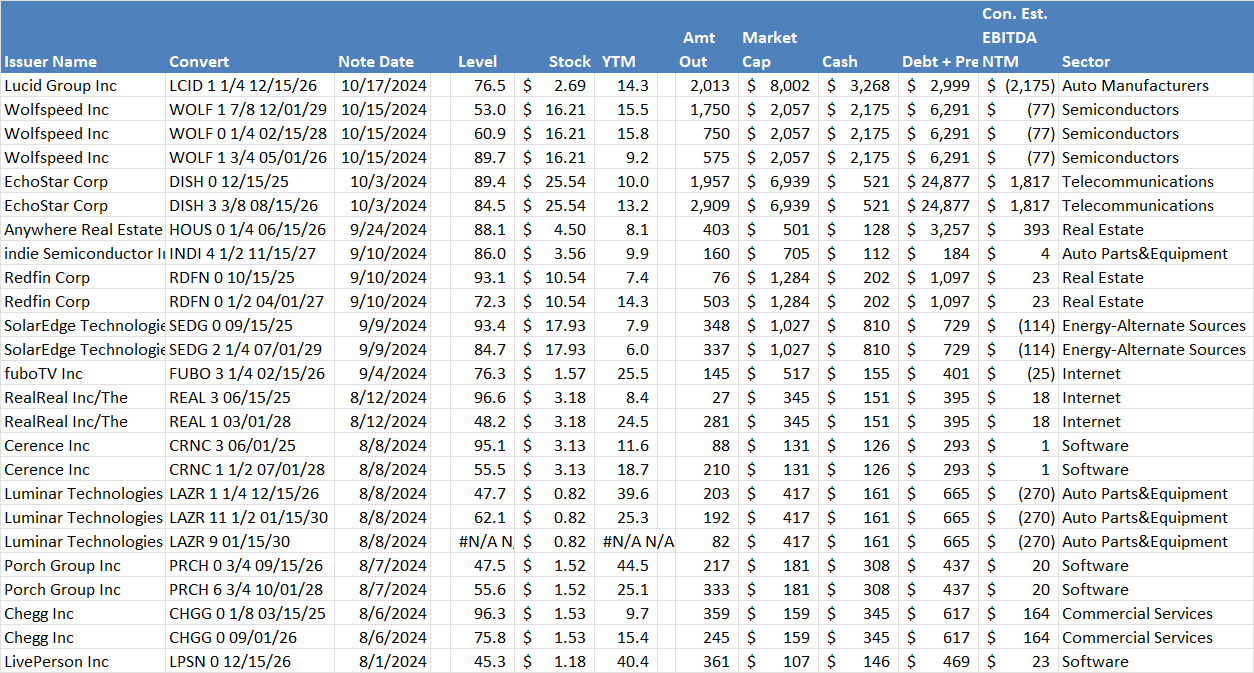

Recent Notes – By Date

Desk Contacts:

Dave Sposito (Head of Desk) – 212-692-5172 – [email protected]

Zach Johannes (Trading) – 973-222-6189 - [email protected]

Denise Dalonzo (Sales) – 917-699-1630 - [email protected]

Walter McNulty (Sales) – 203-219-5837 – [email protected]

Chris Frascella (Sales) – 203-912-7535 – [email protected]

Rob Weaver (Strategist) – 203-399-7023 – [email protected]

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.