Mortgage basis tightened following yesterdays CPI and Fed decision. 2-4.5s performed the best with 5-5.5 slightly tighter and 30yr 6-6.5s essentially unchanged.

Since the start of June, the market has felt like it was on hold with little trading opportunities. We had some flashes of widening into the end of May, but since the wides, the mortgage basis has been a one way train tighter.

We come in this morning leaning net sellers of lower CPNs and belly. This is heavily based around the fact that little has changed around the narrative of slower consumer spending, falling inflation, and clarity around rate cuts into the back portion of 2024.

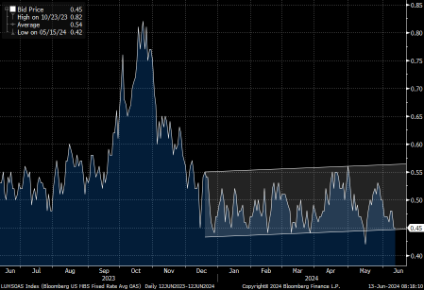

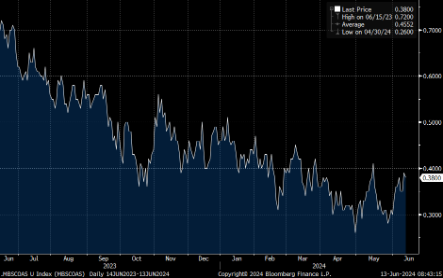

For almost the entire year, mortgage basis has found sellers when basis has reached ~44-45bps on the Agg. This has been especially true when credit has failed to tighten in the same period. Below is Credit-MBS OAS in the agg. We saw this exact set up in March and May which was followed by selling of the MBS basis to bring the relationship back into range.

Fed is stuck between this 25-50bps cut scenario for the rest of 2024. Some would argue if inflation data wouldn't have been the same day, Dot plots would have been lower into the end of 2024. This narrative in our mind fails to give the Basis the catalyst it needs to break this trading range. It likely further supports fading the belly and lowers and moving UIC to collect near term carry

In the simplest form, assuming 30yr 2.5s remain UNCH vs hedges for the next 6 months, 30yr 6s would need to widen 18.75 to be in the same spot given the carry in that 6 month period. Extreme case but pushes OW 5.5-6.5 and neutral/reducing OW in 2.5-5s.

|

CPN |

carry |

6 months |

|

2.5 |

-2.875 |

-17.25 |

|

6 |

0.25 |

1.5 |

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.