02/10/2025 Mid-Day Fertilizer Market Update

International

- ICIS reporting that a fresh urea vessel has been sold out of the Middle East

- March shipment

- “High $430’s” fob price

- Yet another indication of a continued bullish marketplace that is struggling with supplies

- Lot of paper activity as you will see below between AG and Egypt

- Egypt sees February hit a fresh recent high of $460

- Hard to believe that $500 is no longer out of the question

- If rumored gas supply issues were to play out, seems plausible

- Middle East values reach a fresh recent high of $421

- Still a discount when compared against the physical reported sale

- But still driving higher

- Egypt sees February hit a fresh recent high of $460

- As always, lot of bullishness out there…but still feels like the knees can be taken out with China

- Fundamentally, even if China were reported to be returning, I’m not sure how much it would make a difference

- It isn’t as though they can export millions of tons on day 1

- However, their mere presence can change the market

- Their stockpiles continue to be discussed at record levels leaving the market wondering what is next?

- Will they just keep building stockpiles?

- Will they lower production rates?

- Will they allow exports?

- Fundamentally, even if China were reported to be returning, I’m not sure how much it would make a difference

- Also, for those of you trading physical internationally, be weary if China does start exporting

- Think about some of the product quality issues in the past for normal product

- Now, think about Chinese product that has been sitting in storage for a long time

- I’m not saying there will absolutely be issues

- However, there is a reason that Chinese products are typically discounted…and urea doesn’t store well normally

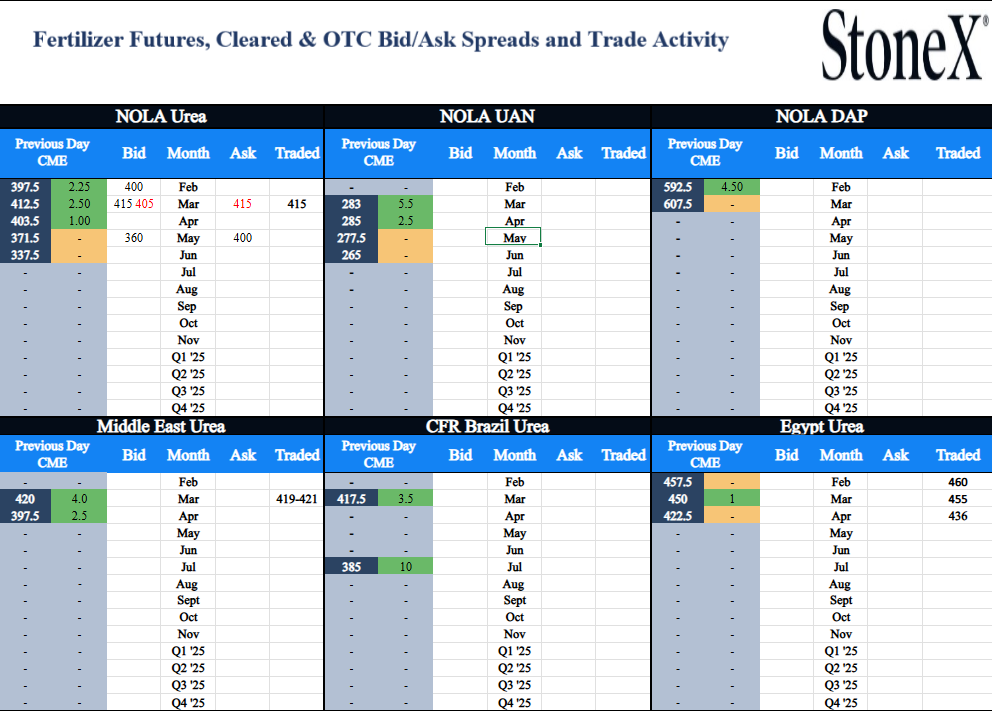

- Paper trades today

- March Brazil Urea at $417 (up $3 from yesterday’s settlement)

- March AG Urea at $425 (up $9 from yesterday’s settlement)

- July Brazil Urea at $385 (up $10 from yesterday’s settlement)

North America

- Urea price ideas are jumping once again this morning with March trading at $417

- That is a huge number, but is still a discount

- Upper $430’s (let’s use $437.50) equates to roughly $430 loaded NOLA urea barge

- So, NOLA is STILL trading $10 - $15 less than replacement

- Put yourself in the shoes of an international trader/manufacturer

- Why would you send extra product to N.A. today?

- Global supplies are tight

- You control more of negotiations as a result

- Several large buyers stacked up needing product

- If N.A. values are less than other global options, why send it? You can make more elsewhere.

- Time is getting thin on imports…

- Phosphate finally saw the price bump we had been watching for late last week

- Corn acres rising means more demand

- Import/export flows have not helped N.A. supplies

- Continue to believe that N.A. operating rates are still poor vs “normal”

- We are practically on an island at this point with it getting too late to call on additional imports to meet demand

- Basically, what we have is what we have

- Potash prices have been firming since the tariff fears from a week + ago

- I think this is more manufactures taking advantage of a stressful situation

- I have heard folks say it is “because of the tariffs”

- That would hold water…if contracts didn’t basically state that the buyer would pay for any tariffs incurred on the export

- You cannot push the flat price higher AND force the buyer to pay the tariff with the explanation that “it is tariff’s”

- This is a situation where the supply side is taking advantage of the confusion and turmoil

- However, no one can say they didn’t get the opportunity

- The price of potash had been historically cheap and extremely cheap vs grains

- The market was begging for demand

- Paper trades today

- March NOLA Urea at $415 (up $2.5 from Friday’s settlement)

- Physical trades today

- February NOLA Urea at $410 (up $6 from Friday’s trade)

- March NOLA Urea at $417 (up $17 from Thursday’s trade)

This material should be construed as the solicitation of an account, order, and/or services and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers.

The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. (“SGI”) disclaims any responsibility to update such views. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

References to certain OTC products or swaps are made on behalf of StoneX Markets, LLC (SXM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ and who have been accepted as customers of SXM.

StoneX Financial Inc. (SFI) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to certain securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to certain exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through SA Stone Wealth Management Inc., member FINRA/SIPC, and SA Stone Investment Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of SGI.

StoneX Financial Ltd (SFL) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (FCA) (registration number FRN:446717) to provide services to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised and regulated by the FCA under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the FCA.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

StoneX Financial Pte Ltd (Co. Reg. No 201130598R) (“SFP”) is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payment Institution (for cross-border money transfer service).

SFP may distribute analysis/report produced by its respective foreign affiliates within the StoneX Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations Recipients should contact SFP at (65) 6309 1000 for any matters arising from, or in connection with, this webinar.

StoneX Financial (HK) Limited (CE)No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX Financial Pty Ltd (“SFA”)(ACN: 141 774 727) holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646).

StoneX Securities Co., Ltd. (“SSJ”)(Co. Reg. No 010401047199) is regulated by the Japanese Financial Services Agency as a Type-I Financial Instruments Business Operator (Kanto Local Finance Bureau (FIBO)No.291’), is a member of the Financial Futures Association of Japan for dealing and broking FX and FX Option transactions, and is a member of the Japan Securities Dealers Association for dealing and broking stock indices and option transactions.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

The report/analysis herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

© 2025 StoneX Group Inc. All Rights Reserved.