02/03/2025 Mid-Day Fertilizer Market Update

International

- Egypt has kept its foot on the gas in terms of urea pricing

- This morning, $442 was sold for February loading

- Hard to believe that in early January, Mopco set the low with $358 sold for 6K tons

- It has been an almost straight line higher since that point with global supplies as tight as they have been

- Dangote (Nigeria) also has gotten into the mix with a couple of vessels sold at $410

- Continue to believe we will see Iranian production back online in the coming weeks, though I have nothing official to point to

- China remains the biggest question mark

- If they return, it could certainly take all the winds out of the markets sails

- But as long as they are absent, the world is tight

- Paper trades today

- No trades observed

North America

- Tariffs – the biggest talking point of the morning

- Folks are freaking out about a possible tariff on potash

- All, potash is pretty low priced

- If there is a product that can withstand a tariff rate, it is potash

- A percentage of a small number is a small number

- There has been plenty of chance for folks to lock stuff up before all of this happened

- Now we wait

- So what is the tariff stories?

- Potash

- this will hurt the U.S side given its reliance on Canadian potash

- There simply isn’t enough time to shift U.S. import flows from elsewhere around the world

- We have to get everything left needed from Canada at this point

- Urea

- This will be a pain point for both nations farmers given that we “share” product in the west/east

- NH3

- There is a LOT of NH3 that flows south into the U.S.

- However, the vast majority of this is likely consumed by industrial buyers or N manufacturers needing it to upgrade

- Phosphate

- This would hurt Canadian farmers if Canada puts tariffs on U.S. products as retaliation

- A percentage of a big number is still a relatively big number

- Phosphate is the one fertilizer input that can ill afford a tariff

- Potash

- Ultimately, we still do not know the tariff story

- Mexico and the U.S. have already found common ground and have delayed the tariffs

- Mexico agreed to put 10,000 troops on the border

- Nothing new for Canada/U.S., but there is supposed to be a conversation between Trudeau and Trump

- Hopefully that conversation will bring at least a delay and hopefully put all of this behind us

- Mexico and the U.S. have already found common ground and have delayed the tariffs

- Paper trades today

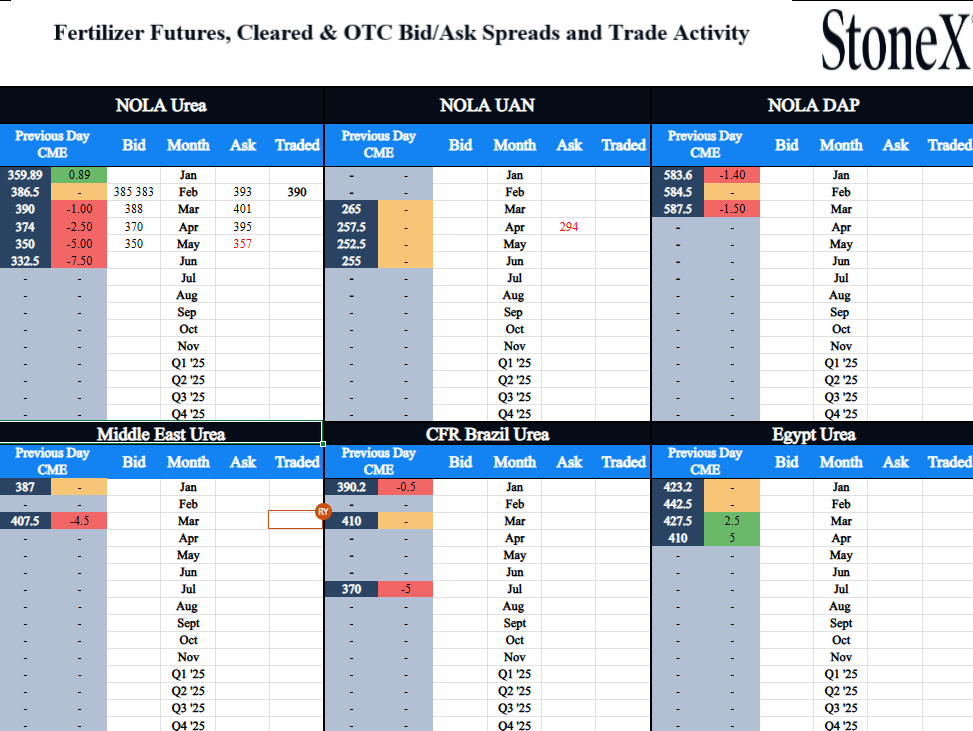

- February NOLA Urea at $390-$390 (up $3.5 from Friday’s settlement)

- Physical trades today

- February NOLA Urea at $380 (unchanged from Friday’s trade)

- February NOLA DAP at $588-$588-$588 (up $6 from Thursday’s trade)

- March NOLA Urea at $390-$390-$390-$390 (up $4 from Friday’s trade)

This material should be construed as the solicitation of an account, order, and/or services and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers.

The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. (“SGI”) disclaims any responsibility to update such views. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

References to certain OTC products or swaps are made on behalf of StoneX Markets, LLC (SXM), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (CFTC) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ and who have been accepted as customers of SXM.

StoneX Financial Inc. (SFI) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (SEC) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to certain securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to certain exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through SA Stone Wealth Management Inc., member FINRA/SIPC, and SA Stone Investment Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of SGI.

StoneX Financial Ltd (SFL) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (FCA) (registration number FRN:446717) to provide services to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised and regulated by the FCA under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the FCA.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

StoneX Financial Pte Ltd (Co. Reg. No 201130598R) (“SFP”) is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payment Institution (for cross-border money transfer service).

SFP may distribute analysis/report produced by its respective foreign affiliates within the StoneX Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations Recipients should contact SFP at (65) 6309 1000 for any matters arising from, or in connection with, this webinar.

StoneX Financial (HK) Limited (CE)No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX Financial Pty Ltd (“SFA”)(ACN: 141 774 727) holds an Australian Financial Service License and is regulated by the Australian Securities and Investments Commission (AFSL: 345646).

StoneX Securities Co., Ltd. (“SSJ”)(Co. Reg. No 010401047199) is regulated by the Japanese Financial Services Agency as a Type-I Financial Instruments Business Operator (Kanto Local Finance Bureau (FIBO)No.291’), is a member of the Financial Futures Association of Japan for dealing and broking FX and FX Option transactions, and is a member of the Japan Securities Dealers Association for dealing and broking stock indices and option transactions.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

The report/analysis herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

© 2025 StoneX Group Inc. All Rights Reserved.