01/02/2025 Mid-Day Fertilizer Market Update

International

- While we do not have official tallies, it looks like India is going to fall FAR from their 1.5M ton urea purchase goal

- The west coast sounds like it will be two offers playing a part

- One is Keytrade who set the L1 with a 53K ton offer

- The other I believe is Fertiglobe with a 90K ton offer

- The east coast, as expected, has seen every other offer above Medallion’s L1 value of $299 CFR turn down negotiations

- Also hearing that NFL might have have their worst-case scenario

- If they had allowed Medallion to fix their value, likely they could have secured a few hundred thousand tons

- Instead, sounds like the change is not allowed

- Now, the rumor is that Medallion will not supply the tons which means that India will not get any tons or the incredibly cheap vessel

- Again, none of this is confirmed. Still speculated…but sounding pretty firm

- The west coast sounds like it will be two offers playing a part

- To make matters worse, hearing reports that Indian urea demand in December was huge

- If true, this puts even more pressure on India to announce a follow-up tender

- Certainly will have offers/manufacturers/long positions smelling blood in the water

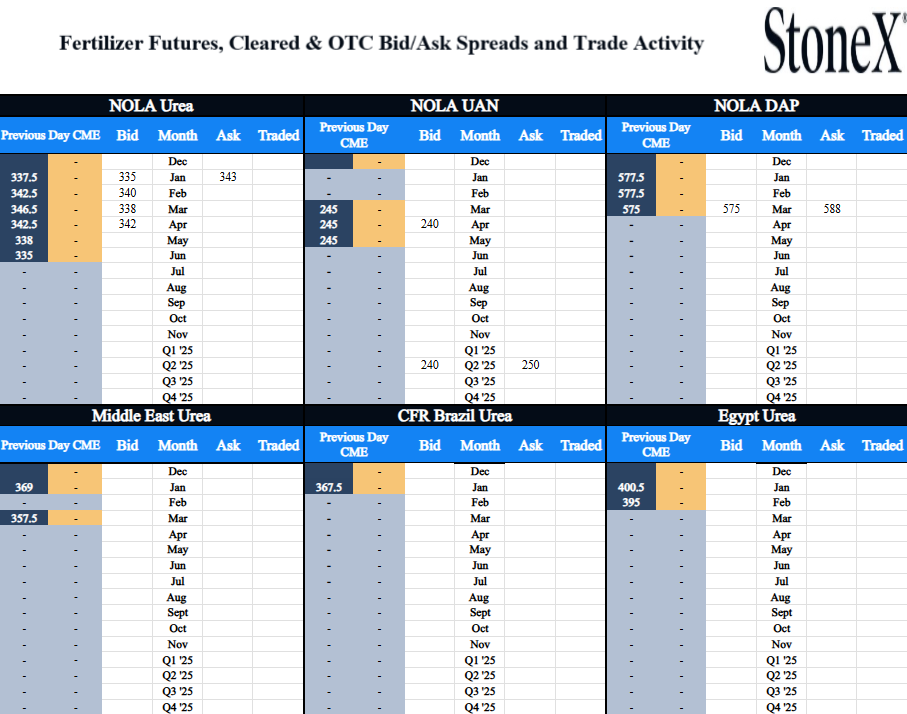

- Paper trades today

- No trades observed today

North America

- NOLA urea market needs to be watching global urea price trends very closely

- NOLA urea remains a discount to world replacement

- Global supplies continue to look tight from my perspective

- We have a lot of tons that need imported to meet our demand this spring

- Hard to see adequate imports coming if we are discounted in a tightly supplied marketplace

- If global values remained steady and we had to do the work, you could see NOLA jump $50

- We are currently around $25 discount to M.E. replacement

- Moving to a $25 premium (well within normal in recent years) makes that $50 not seem so large

- Again, that assumes that global values do not move higher on the back of India/other world demand

- Also, watch this cold system moving across the Midwest/U.S.

- Fortunately, it looks like some of the worst low temps for the south are being improved

- It looked like even as far as mid/south Florida was set to see low’s in the teens/20’s

- Still, it doesn’t mean the danger is gone

- If we see the cold set in for the south, their natural gas demand will skyrocket to stay warm

- That demand jump should see natural gas futures rise significantly (as it has in the past)

- We have seen this in the recent past where nitrogen manufacturers slow/stop production to sell their gas futures at a much higher profit

- That decision comes at the cost of less nitrogen supplies that were expected

- Again, the forecast is improving…but it points to a very real danger

- Spring isn’t that far away

-

-

- .

-

- Paper trades today

- No trades observed today

- Physical trades today

- January NOLA Urea at $330 (down $1 from Tuesday's trade)

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.