12/30/2024 Mid-Day Fertilizer Market Update

The fertilizer markets are going to be “off” tomorrow and Wednesday with the holidays (not that much has happened in the last week). Unless something happens, I will not send updates until Thursday after today.

International

- Still no official word from NFL/India regarding success/failure on their purchase tender

- Hard to see any success on this thing

- Both L1’s were simply too low vs all other offers

- As always, need to wait and see how it ends

- But it is hard to see it ending in any way outside of “meager participation/new tender announcement imminent”

- Otherwise, feels like the global markets are still on holiday

- Not much reported for sales

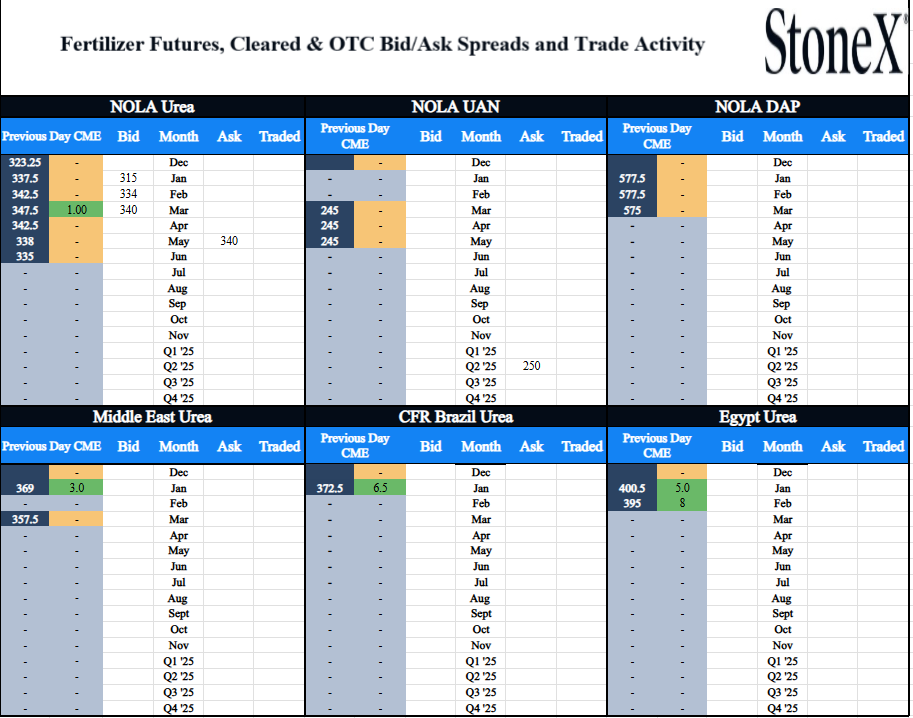

- Not much of anything seen in the paper markets

- Having Christmas and New Years on a Wednesday has to be the worst case scenario!!!

- Paper trades today

- No trades today

North America

- With little movement/activity globally, there isn’t much need for NOLA to move

- However, still things that need to be watched

- Nitrogen

- NOLA urea remains undervalued vs global replacement values

- Eventually that needs to “fix” to get imports coming

- That can happen with global values falling and NOLA holding value

- However, with the world setup, that doesn’t feel like the likely scenario

- UAN remains snug…and there is a cold snap coming

- Look at the coming forecasts

- There are some nasty low temps coming

- If those temps reach the deep south, we should see nat gas futures skyrocket

- Nitrogen producers can and probably will shut down production to sell their positions

- They make more money doing that…to the detriment of our markets

- Their positions…their calls to make

- N.A. UAN needs to worry about what Trump might do

- Russian imports has been the biggest competition to domestic manufacturers

- If Trump blocks them, we lose that competition

- Fall NH3 run looks like it was slightly short of our forecast but very near “normal”

- More on that in the coming weeks when we do the quarterly videos

- NOLA urea remains undervalued vs global replacement values

- Phosphate

- The DAP/MAP spread has narrowed back to historically normal differences

- Some have said this is due to poor overall fall demand

- I am not a believer in that POV

- We still see fall demand as near normal

- I see the price differential normalizing because the system switched when it was triple digits

- If MAP being a $100+ premium was the pendulum all the way to the right, it being where it is now is all the way to the left

- Have to assume that retailers/farmers will start switching back to MAP this winter

- …which should have the opposite effect…again.

- If NOLA DAP and Dec ’25 corn hold, we will set all-time high ratio records for January / February

- I do not say that to celebrate

- That sucks for everyone involved

- Unfortunately, NOLA DAP remains priced in line with other major buyers in India and Brazil

- This remains a global issue

- The DAP/MAP spread has narrowed back to historically normal differences

- Potash

- I got nothing here. It is well supplied. It is well priced.

- Nitrogen

- Paper trades today

- No trades today

- Physical trades today

- No trades today

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.