12/23/2024 Mid-Day Fertilizer Market Update

International

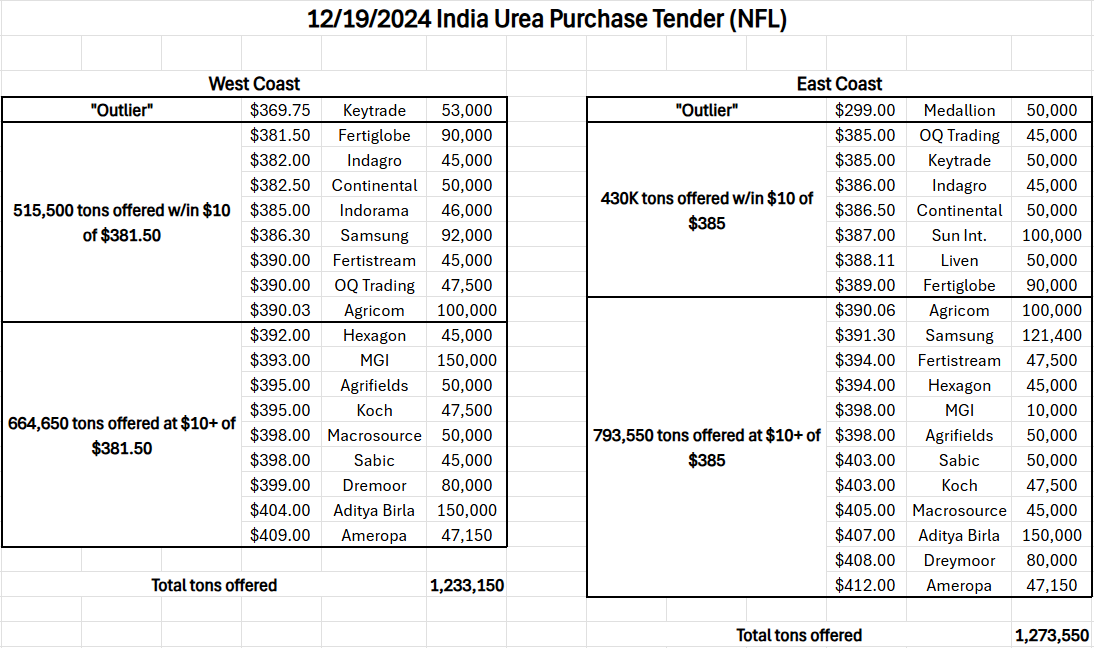

- Dear NFL/India, you made us wait several days for this?

- Couple surprises as India urea purchase tender offer information was released

- Keytrade set a decently lower L1 for the west coast, nearly $12 lower than the next lowest value

- Many were left scratching their heads on the “miss”

- The next layer saw just over 500,000 tons offered in a relatively tight price range

- I suppose it is possible that offers will decide to drop their price idea, but it doesn’t look likely today

- Medallion set a substantially lower L1 for the east coast, coming in at a huge $86 lower than the next lowest price

- This appears to have been a typo on the offer submission

- However, it sounds like India is going to hold their feet to the fire and force them to participate

- Practically impossible to imagine them receiving anything more than 50K for the east coast

- So, it looks like a follow up purchase tender announcement will be imminent following the conclusion of this one

- That will certainly help the market get more excited…

- Not that this makes a difference, but does it make sense for India to for Medallion to sell at $299?

- The next lowest offer was $385 or $86 higher

- $86 x 50,000 tons = $4,300,000 differential

- Huge hit for Medallion and huge savings for India…if the market doesn’t firm

- But a follow up tender will put India further into Q1 and further into competition with other global buyers

- There were around 430,000 tons offered w/in $4 of the next lowest offer

- That means if India only secures 50,000 tons and the market firms by more than $10 on their next, they will be “under water” on the decision

- Egypt continued to take advantage of the India situation, selling to a new high of $403

- That is nearing the recent high’s that were set not long ago

- With 2025 looming and supplies looking tighter than normal, seems like this has a better chance of sticking

- Suppose the global urea market will have something to look forward to in order to start 2025

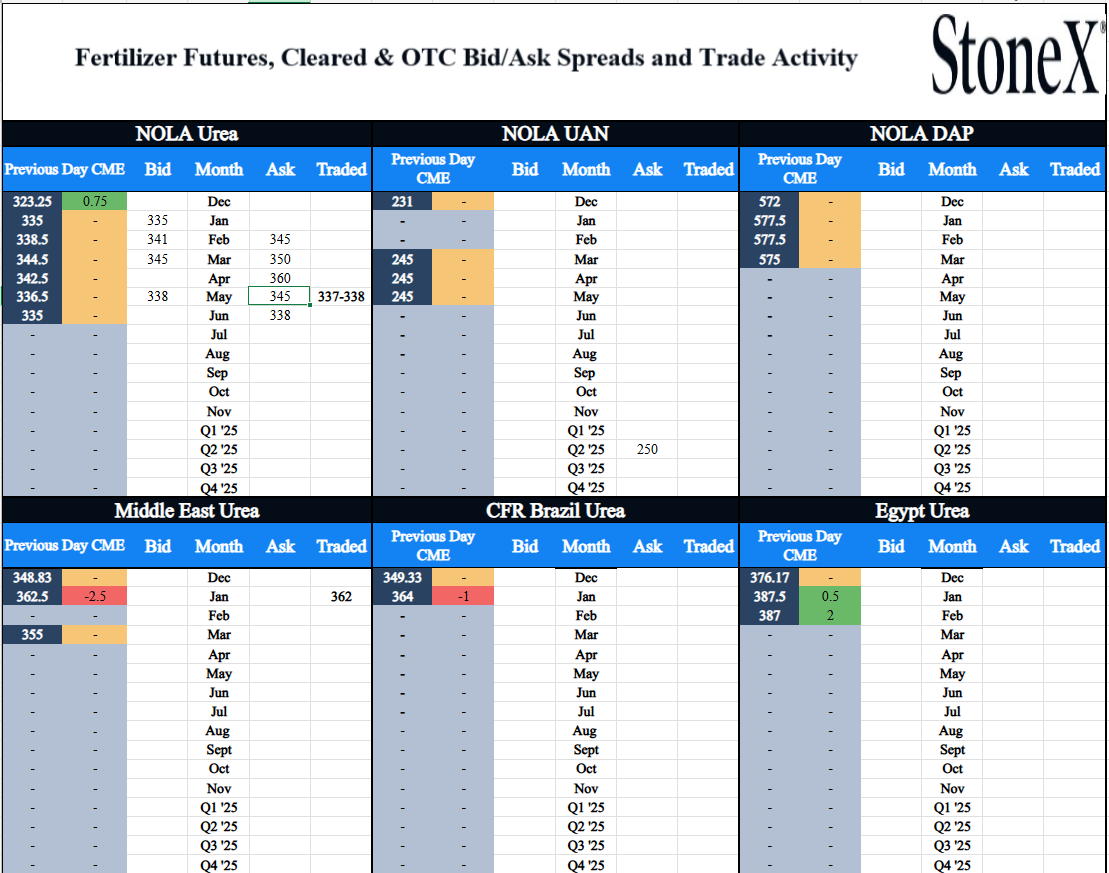

- Paper trades today

- January Middle East Urea @ $362/$362/$362 (down $.5 from Friday’s settlement)

North America

-

North America

- Surprising amount of trade this morning as the fertilizer market prepares for 3 days of “standing down”

- I would have figured that most would be taking vacation

- However, I didn’t anticipate India playing out like it has so far

- Sure looks like we will start the New Year on a hot streak

- If we ignore Keytrade’s L1 and instead focus on Fertiglobe’s as the “market price” for west coast (given it is much closer to all other offers):

- $381.50 CFR west coast India equates to roughly $365 Middle East

- $365 Middle East equates to roughly $365 loaded NOLA urea barge

- This morning, December physical NOLA traded $330 while February traded $340

- That is a $35 and $25 discount to replacement

- We are still seeing 2025 crop mixes relatively steady to last forecast…if not slightly bullish corn acres

- The world is entering 2025 relatively tight on supplies given Chinese export flows (or lack of) and continued EU production issues

- We are not in a “worry” period yet…but we will need to start the inflow of imports to meet spring demand

- Tight global supplies + significant NOLA discount to replacement DOES NOT entice imports

- Keep an eye on everything nitrogen…

- Paper trades today

- May NOLA Urea @ $337/$338/$338 (up $1.5 from Friday’s settlement)

- Physical trades today

- December NOLA Urea @ $330

- February NOLA Urea @ $340

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.