12/20/2024 Mid-Day Fertilizer Market Update

International

- Got the 1st round of information regarding India’s urea purchase tender

- They were offered 2.6M tons

- That’s it

- That’s all the information that was shared

- Looks like the information should be released on Monday…

- 2.6M tons may seem like a big number, but bear in mind that they are looking for 1.5M tons

- 2.6M doesn’t feel like a surplus number of tons

- Still need to be patient and see what happens with awards

- If you haven’t had a chance, check Mike’s report on China and India trade activity for November

- For November, China exported a massive 2,220MT of urea

- This maintains the “China isn’t back” narrative

- Now, phosphate exports from China were decent

- Just over 800K tons “released”

- Much bigger than normal for November

- That brings their calendar year 2024 cumulative total to 6.2M

- Seems decent, until you remember they used to export 10M

- Their potash imports remain huge, with 1M ton imported

- Yet global values remain flat to soft

- Doesn’t inspire confidence in higher prices in the future

- For November, China exported a massive 2,220MT of urea

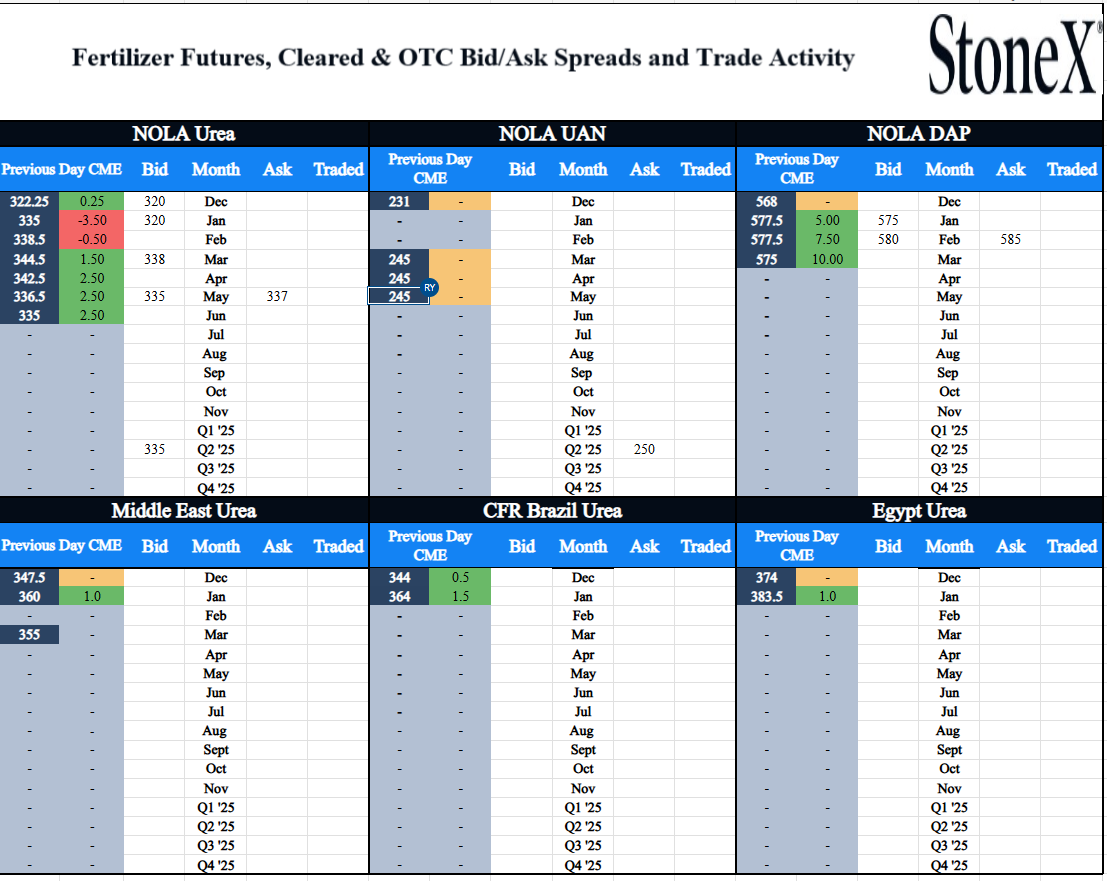

- Paper trades today

- no trades observed

North America

- Biggest shock to me in the last 24-hours is the announcement of further USDA grants into the fertilizer world to lower prices

- If you remember a couple years ago, it was announced that $250M worth of grants would be made available to help lower fertilizer prices

- Eventually, after everyone laughed, they pushed it to $500M

- Since then, we have seen:

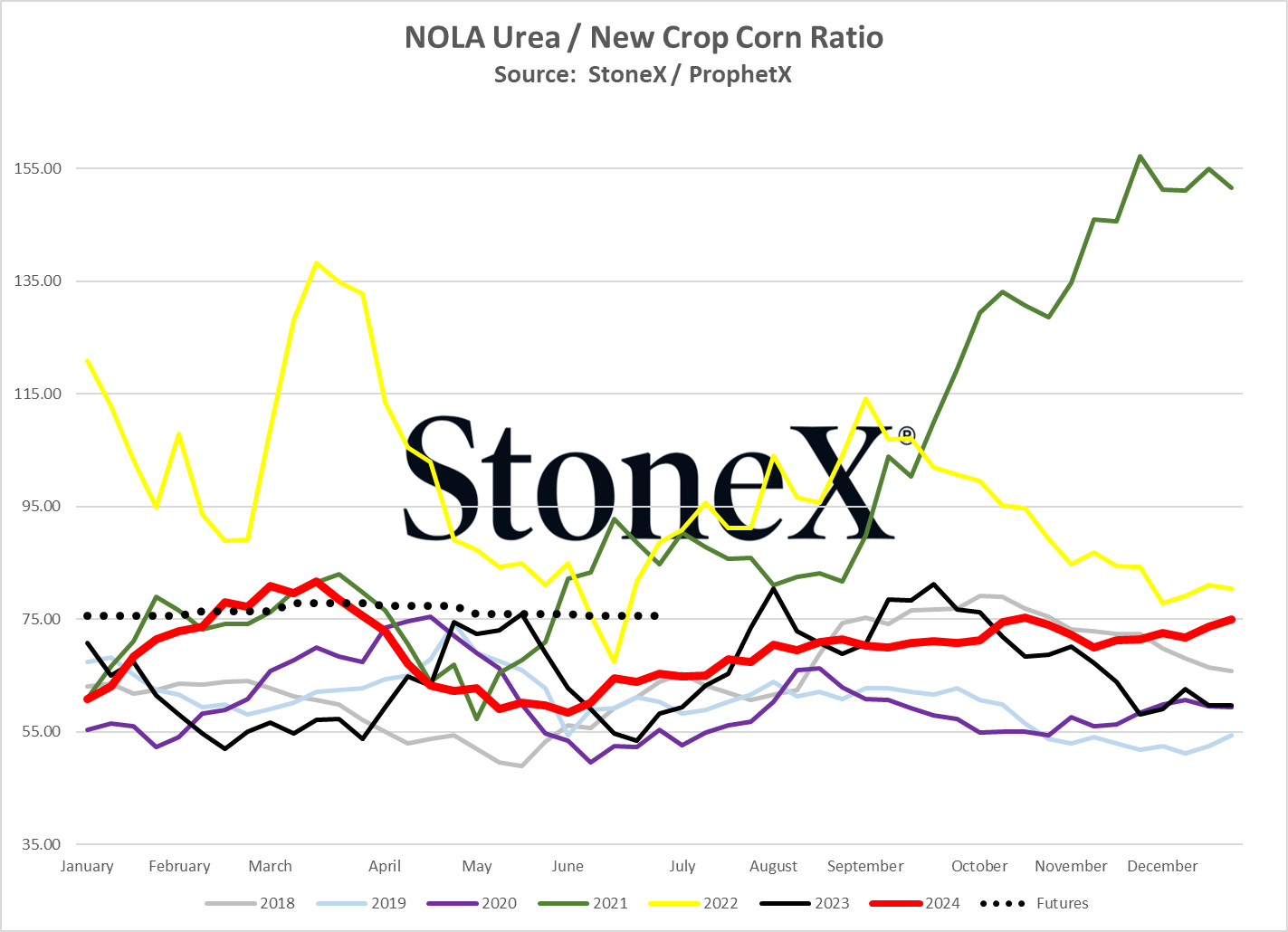

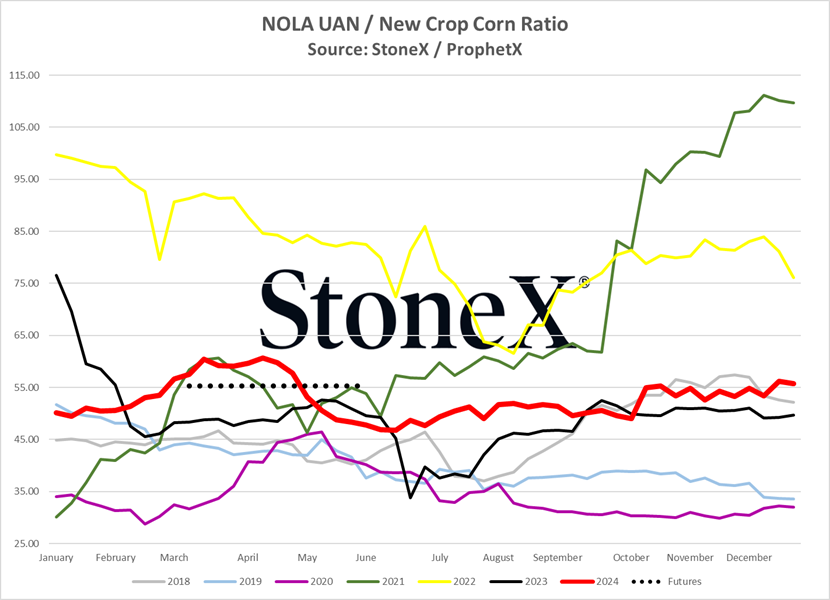

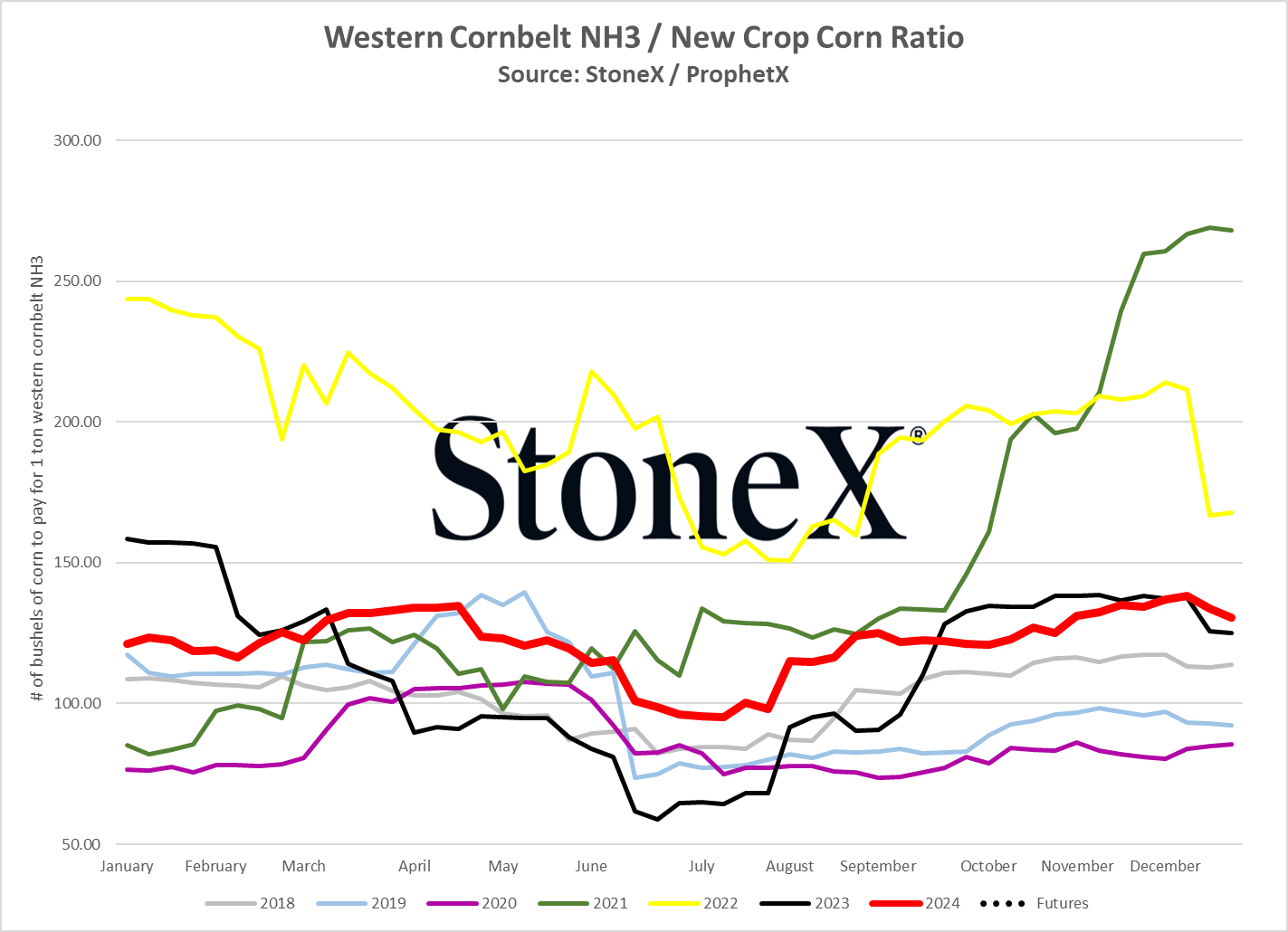

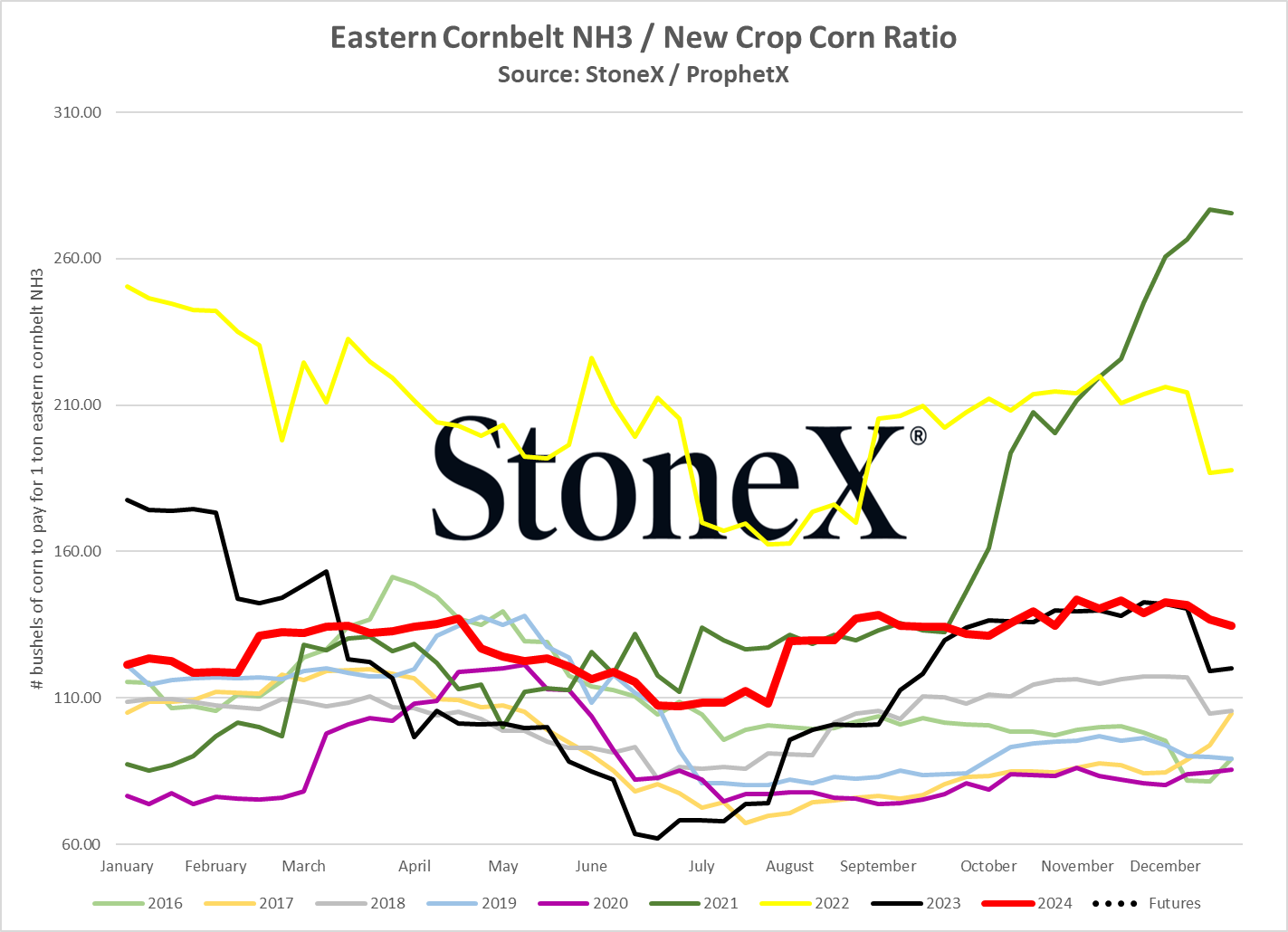

- Nitrogen values be volatile and currently high priced vs grains

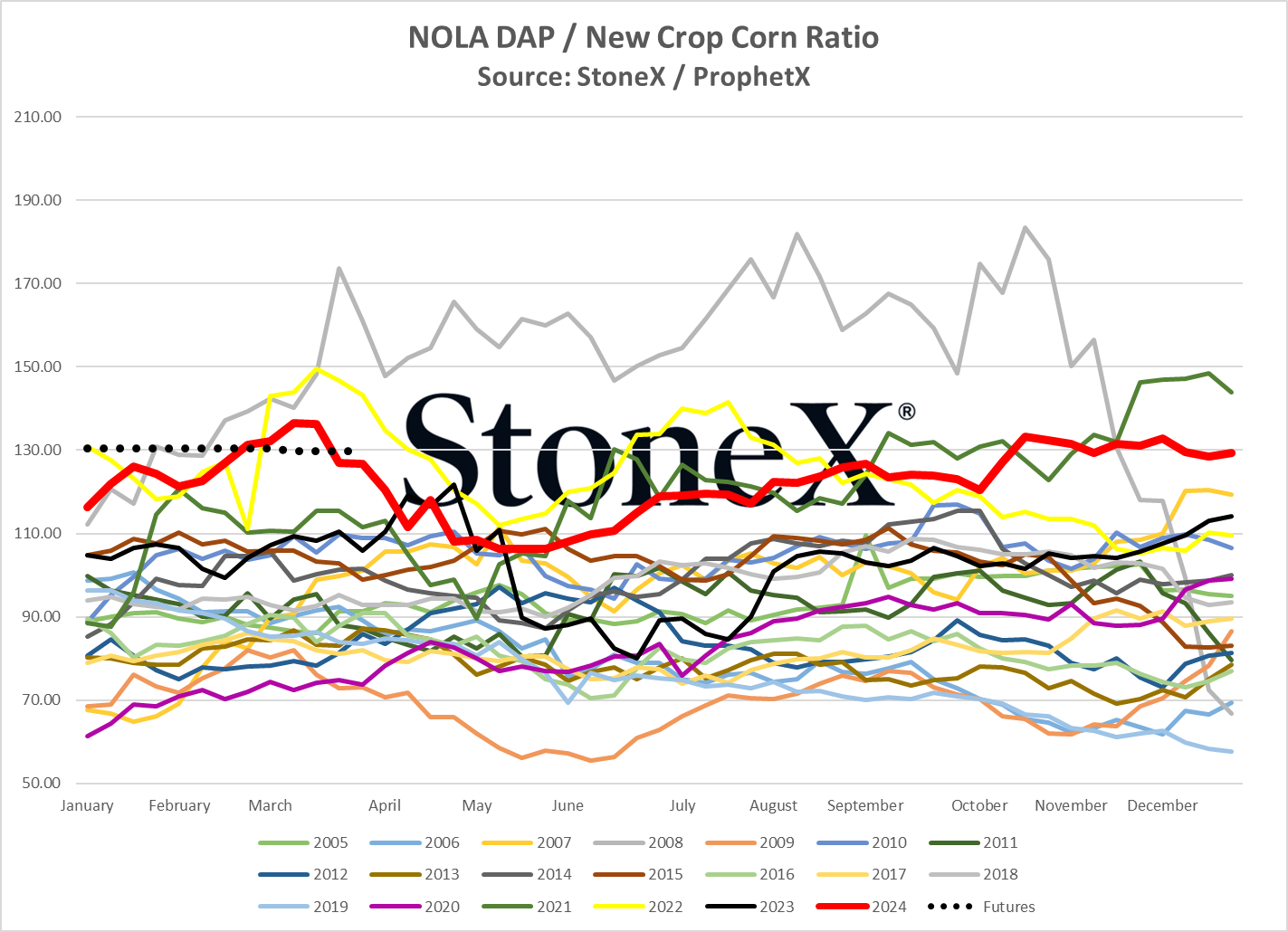

- Phosphate values be extremely historically high priced and look to set all-time high corn/DAP records for Jan/Feb

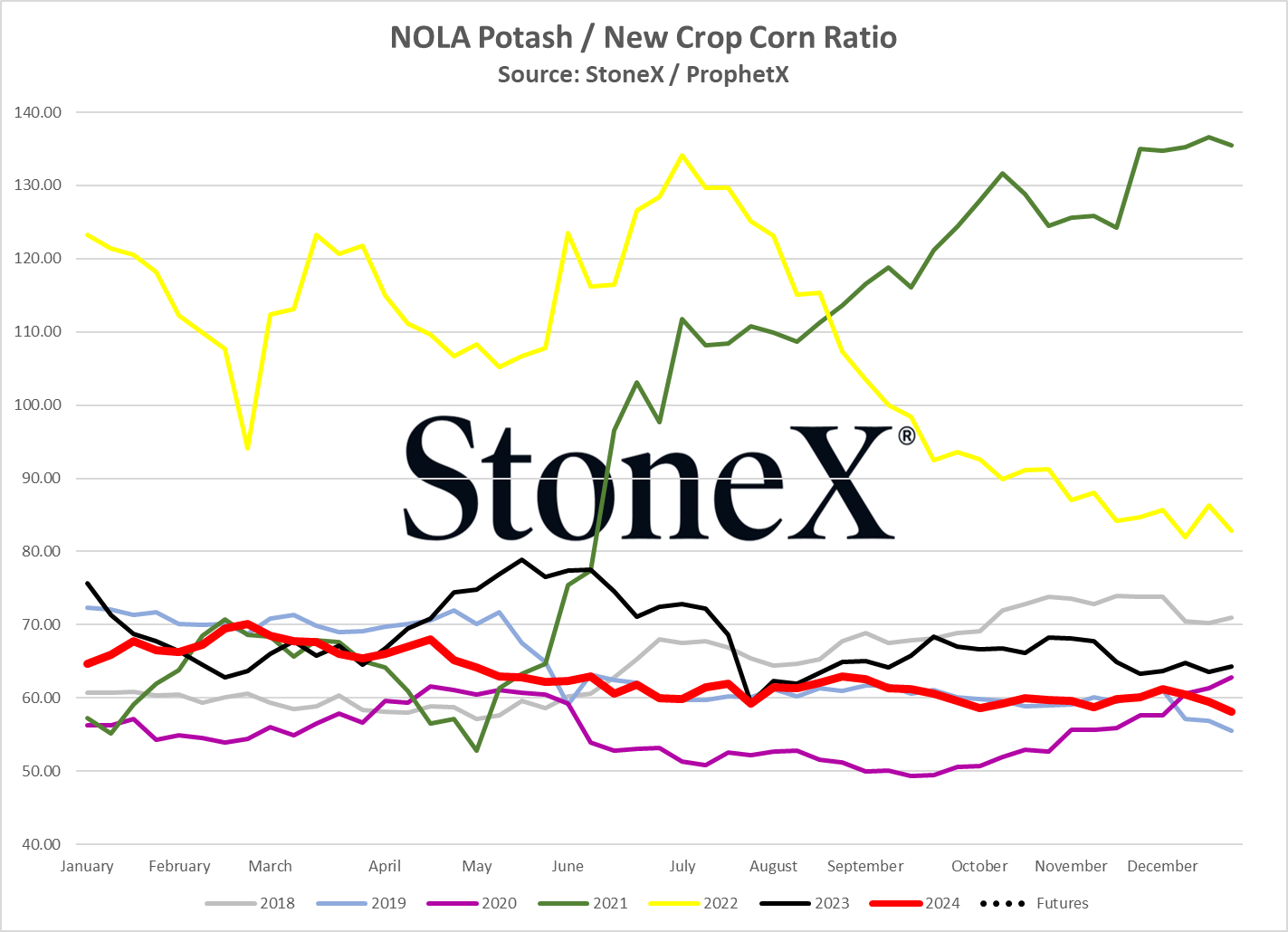

- Potash values cratered and have remained very well priced

- Guess which product an $80M grant was just announced…potash

- Now, this is great news for farmers in Michigan and surrounding areas

- My issue is the fact that potash is already well valued

- We also already have plentiful supplies in Canada

- We need major help in nitrogen and phosphate…

- Speaking of help

- Lower Florida production restrictions on expanding area

- Mosaic has proven that a responsible company will help reclaim the land after it is used

- They built one of the nicest golf courses around on top of old mining land

- We are also seeing Florida being willing to use the gyp stacks in road construction, so those will hopefully go away

- 85 – 90% of global production/export of phosphate lies with 5 countries

- Time to be less reliant on the world

- For nitrogen, N.A. has some of the lowest gas values in the world

- Why are we not producing more here with new entrants?

- If the environmental concern is stopping it, build it at home where we can control it

- If we allow the world to do it, it will be built using their environmental standards…or lack of

- We are a net importer. Should be making it here.

- Lower Florida production restrictions on expanding area

- Otherwise, aside from my rant, nothing happening today as the market waits on India

- Outside of that, hard to see much happening over the next two weeks with holidays

- I would keep a very close eye on the markets the week of January 6

- Everyone should be back from vacation

- The calendar will show 2025 which will make spring feel just around the corner

- I know I’ve already started thinking about when to open the pool!!!!

- Paper trades today

- no trades observed

- Physical trades today

- no trades observed

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.