12/19/2024 Mid-Day Fertilizer Market Update

International

- India urea purchase tender offers have been submitted…not that anyone knows any details

- NFL has yet to release any information

- I’m not talking about they haven’t released the comprehensive breakdown of offers

- I mean they haven’t released anything

- No tonnage total

- No L1’s

- Nada

- Sounds like the hope is that we will see total tonnage and L1’s tomorrow

- Might see breakout over the weekend

- I must run 20 miles on Saturday and 8 miles on Sunday

- My last big weekend before tapering and the races Jan 9/10/11/12

- I will most likely be too exhausted to watch for the info!!!

- Regardless of India, continuing to see price support

- Egypt sold higher once again, hitting $393 this time

- January AG futures traded up to $365

- Still no change on Chinese exports

- Still no change on European production rates

- Still no change on overall global demand

- I continue to get asked just how high it can go

- My POV is that the urea world is in worse supply shape today than it was in late ‘21/early ‘22

- Back then, there was a lot more emotion at play

- Folks were scared we would lose Russia, and many exporters were scaling back as a protective measure

- However, when breaking down actual S&D, many of the fears didn’t happen

- Today, actual production and exports are being lost, but has been largely ignored

- Hard to get overly excited about higher prices when grains keep stinking

- Just a wonder of what happens when the fundamentals take over…

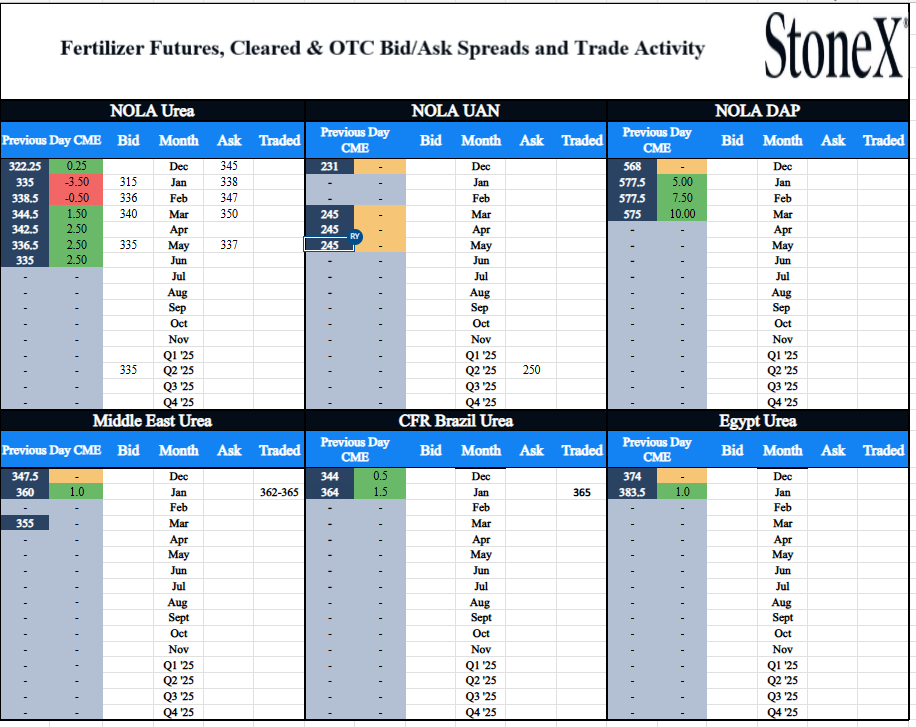

- Paper trades today

- January Middle East Urea @ $362/$362/$365 (up $5 from yesterday’s settlement)

- January Brazil Urea @ $365 (up $1 from yesterday’s settlement)

North America

- The most surprising thing to me regarding N.A. phosphate isn’t the high price

- Rather, it is the relationship between DAP and MAP

- We haven’t seen a lot of DAP trade recently, but would call NOLA barges $575 to $580

- However, we did see a pair of January ship MAP barges trade at $590

- That means the DAP/MAP spread has narrowed back to historic norms

- Heck, that is cheaper than historic norms (MAP $20 premium)

- Until import flows normalize, I think we continue to see that pendulum swing violently as the market shifts back and forth

- Moving between DAP and MAP is hard

- Many retailers only have so much space that is broken into only so many bins

- You must completely empty the bin to switch over

- Then you must tackle the issue of a product with a different analysis

- When MAP was $100+ premium, it made sense to bear the switch pain

- Now we must wonder how many will switch back to MAP

- Isn’t fertilizer fun?

- Another down day for grains

- December 2025 corn fell to a low of $4.31 before battling back to $4.32 as I write this

- Puts a lot of the ratio values high

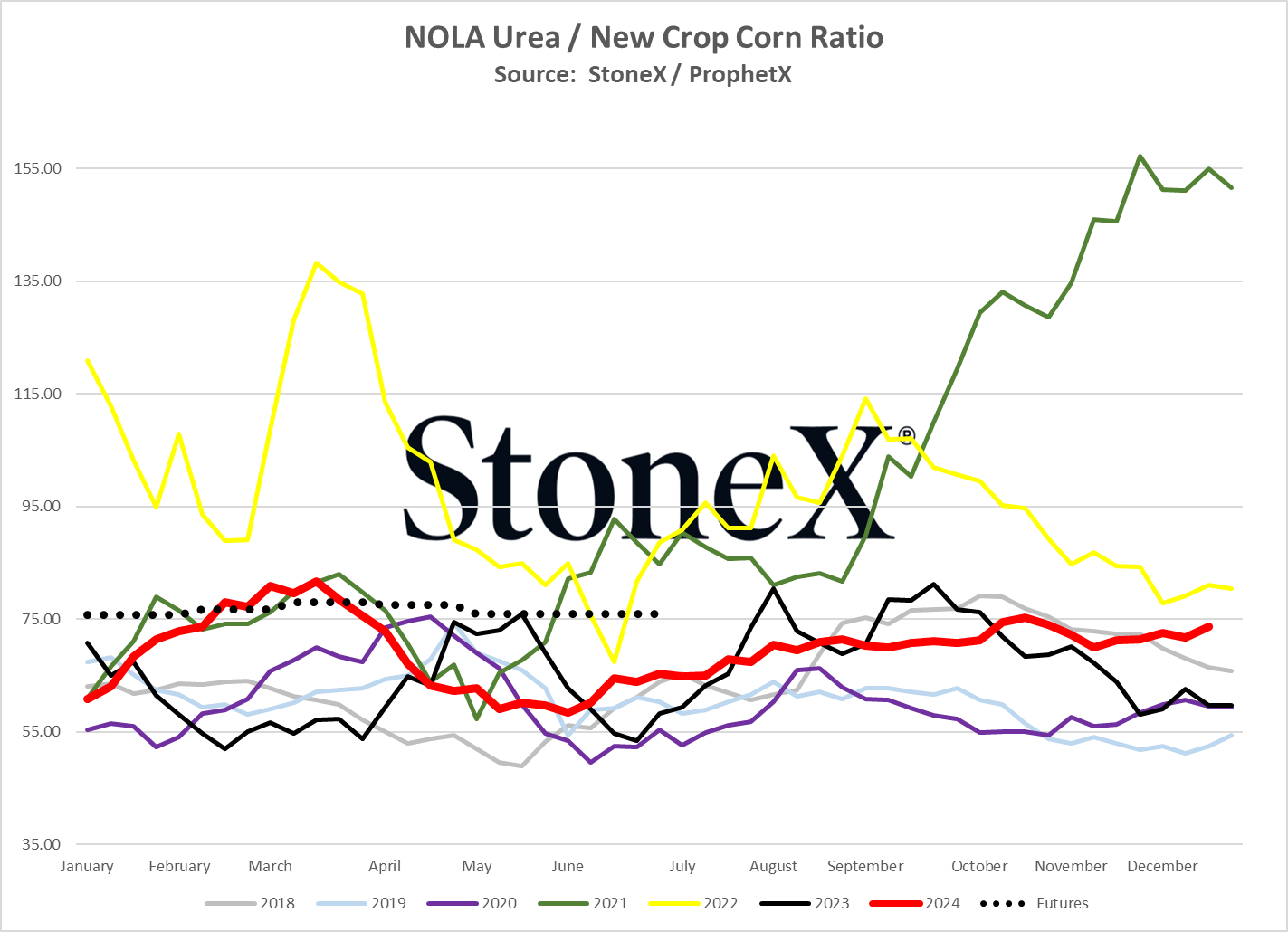

- Urea @ $327 = 76

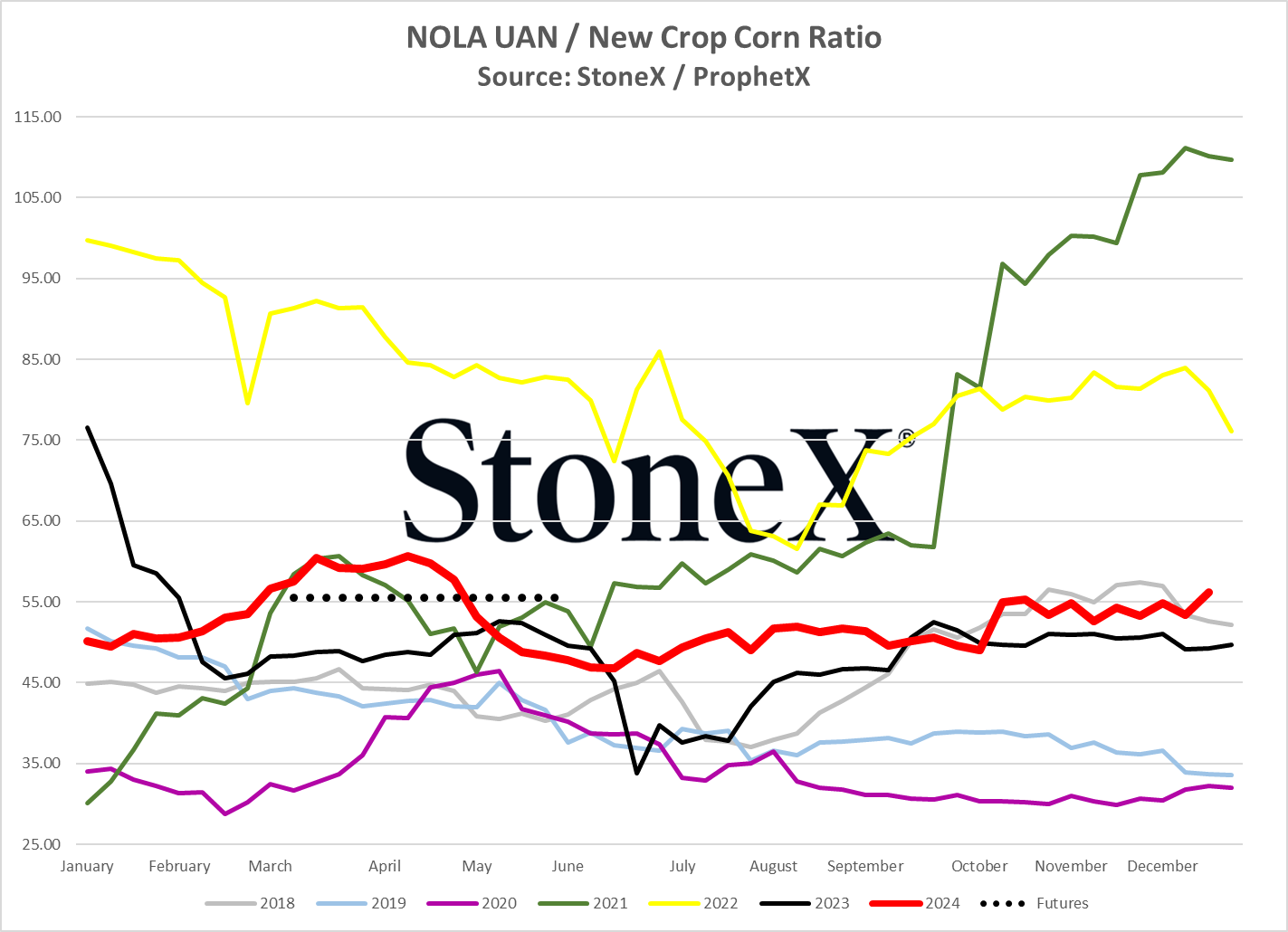

- UAN @ $245 = 57

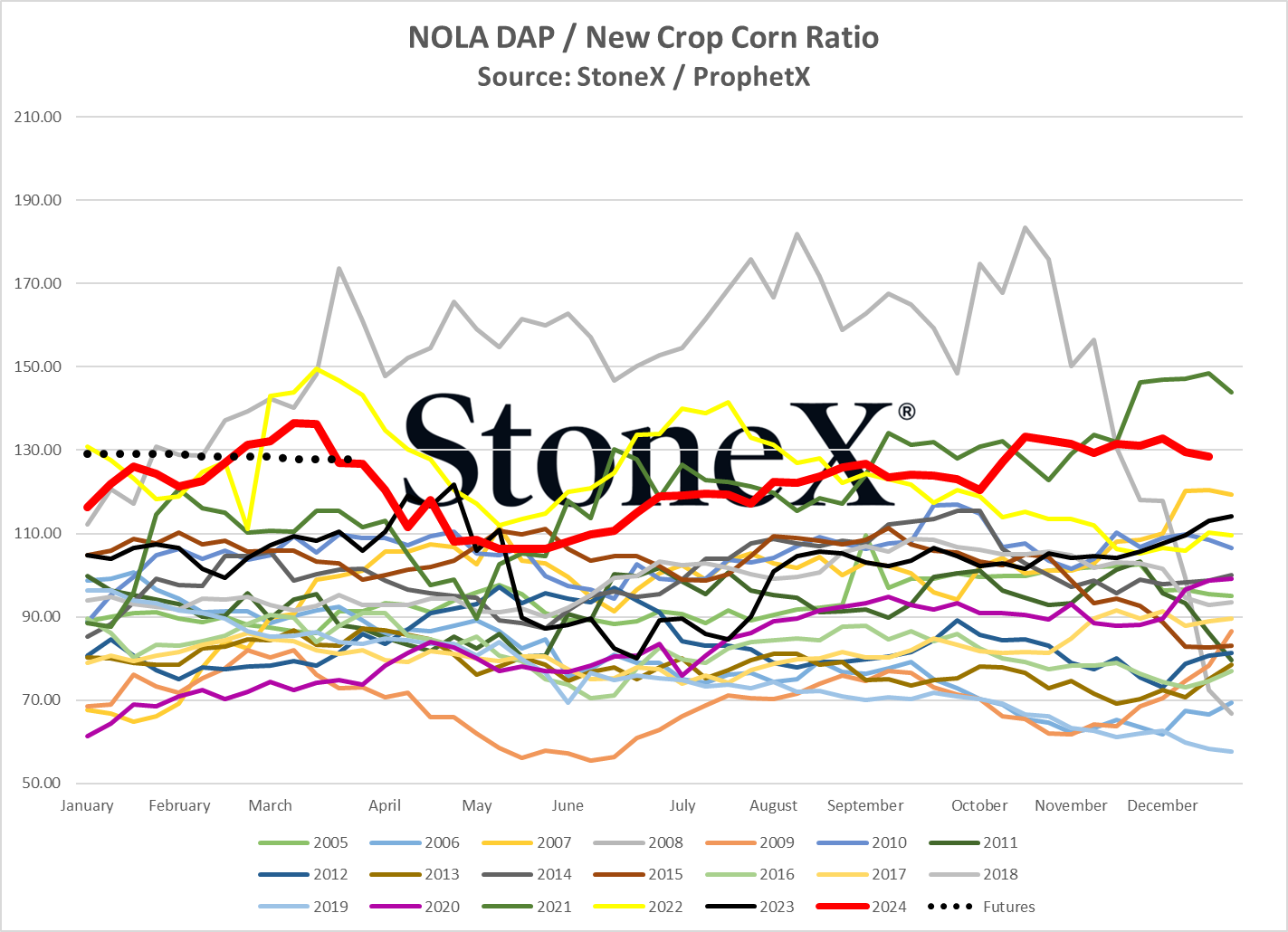

- DAP @ $580 = 134 ratio

- Graphs are below to make the comparison to what is considered “normal”

- I can save you time and just tell you they are all high

- Paper trades today

- No trades observed

- Physical trades today

- January NOLA MAP at $590/$590

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.