12/13/2024 Mid-Day Fertilizer Market Update

International

- The week is ending as the week started with higher urea sales being reported

- Monday had seen Egyptian sellers hitting $374 - $376 on small blocks

- This morning, hearing $384 - $387 has set current volumes

- Now, there needs to be a question of how long demand will stay persistent

- If buyers start to shy away, will prices hold and/or decline?

- Or will manufacturers be sold enough to be patient?

- Lot of that might come down to how India plays out

- Speaking of India, offers are due the 19th so we should get news starting next Thursday

- Should be interesting to see how next week plays out

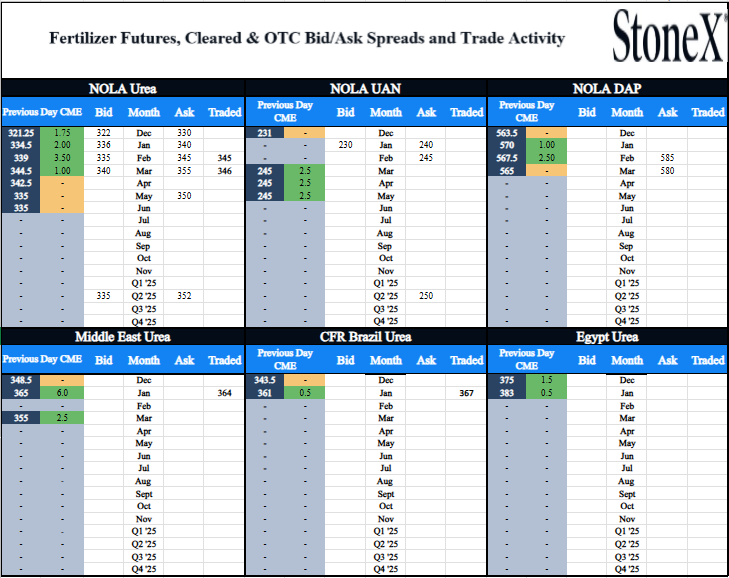

- Paper trades today

- January NOLA AG @ $364 (down $1 from yesterday’s settlement)

- January Brazil Urea @ $367 (up $6 from yesterday’s settlement)

North America

- Nothing terribly exciting, but nitrogen prices end the week continuing to climb

- Keep in mind that even with this week’s strength, it still doesn’t change the NOLA/Middle East price comparison

- NOLA is merely keeping up with Middle East price appreciation

- NOLA is still a discount to the world

- When supplies are more than adequate, you can expect some spot vessels to arrive even when we are a discount

- However, if global supplies are as tight as we think they are going to be, then manufacturers/traders can be choosy

- In that case, why send excess vessels to a discount market?

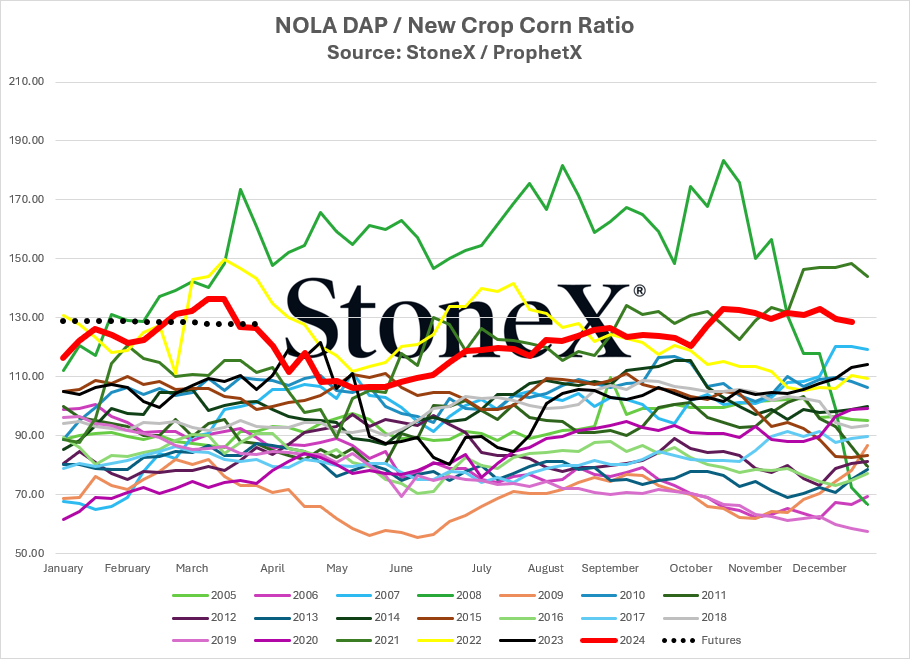

- Our outlook on phosphate isn’t one that is hugely bullish, but I still struggle with much to any bearishness

- Global supplies are still tight given Chinese export programs which could get worse/tighter

- NOLA DAP continues to be a discount to India/Brazil

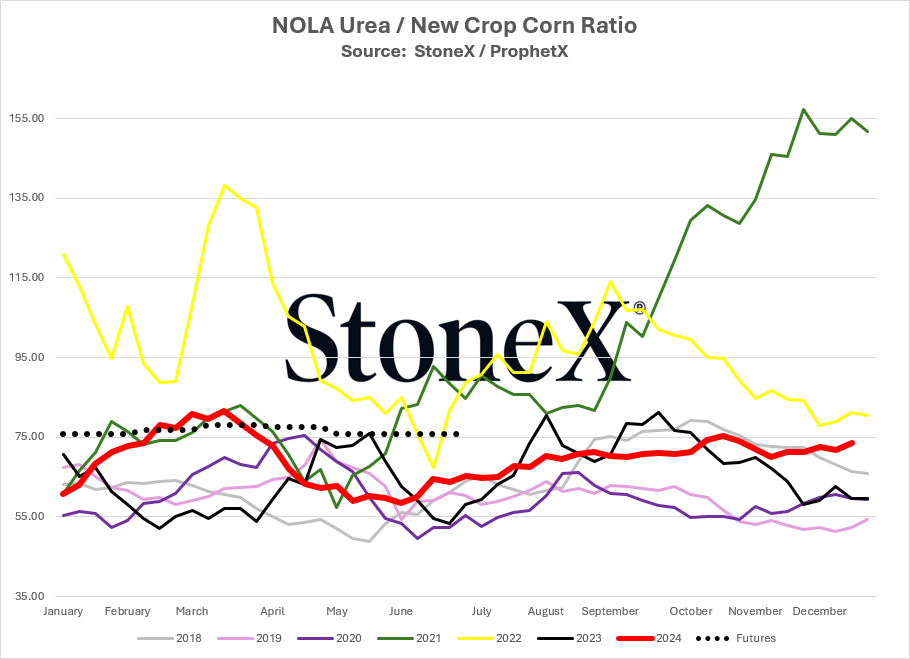

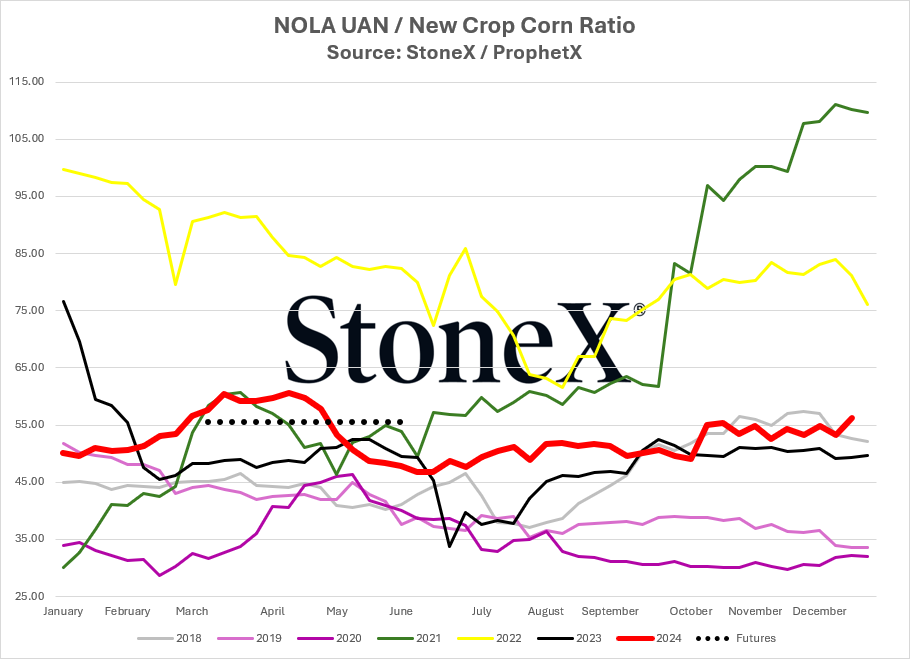

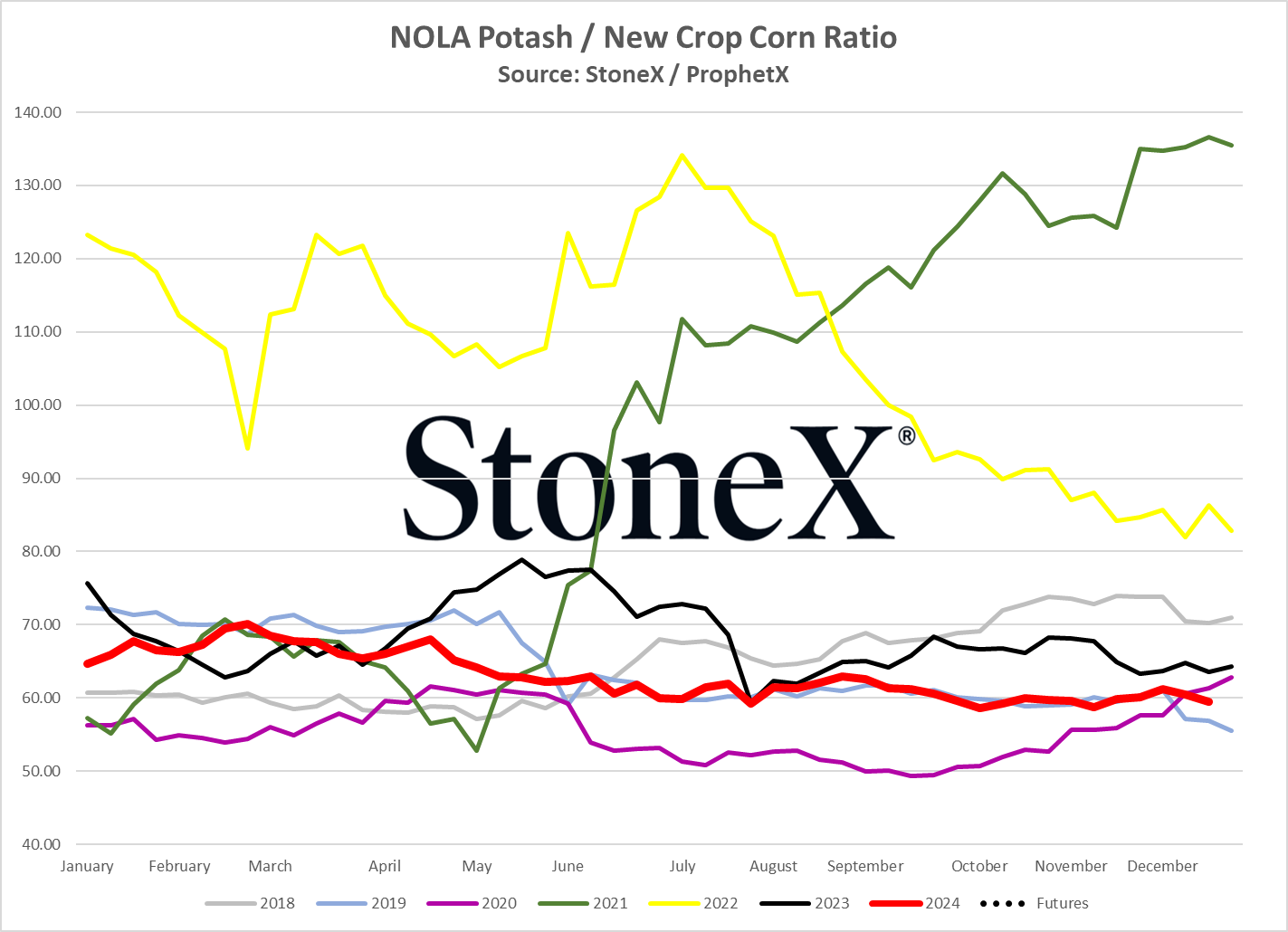

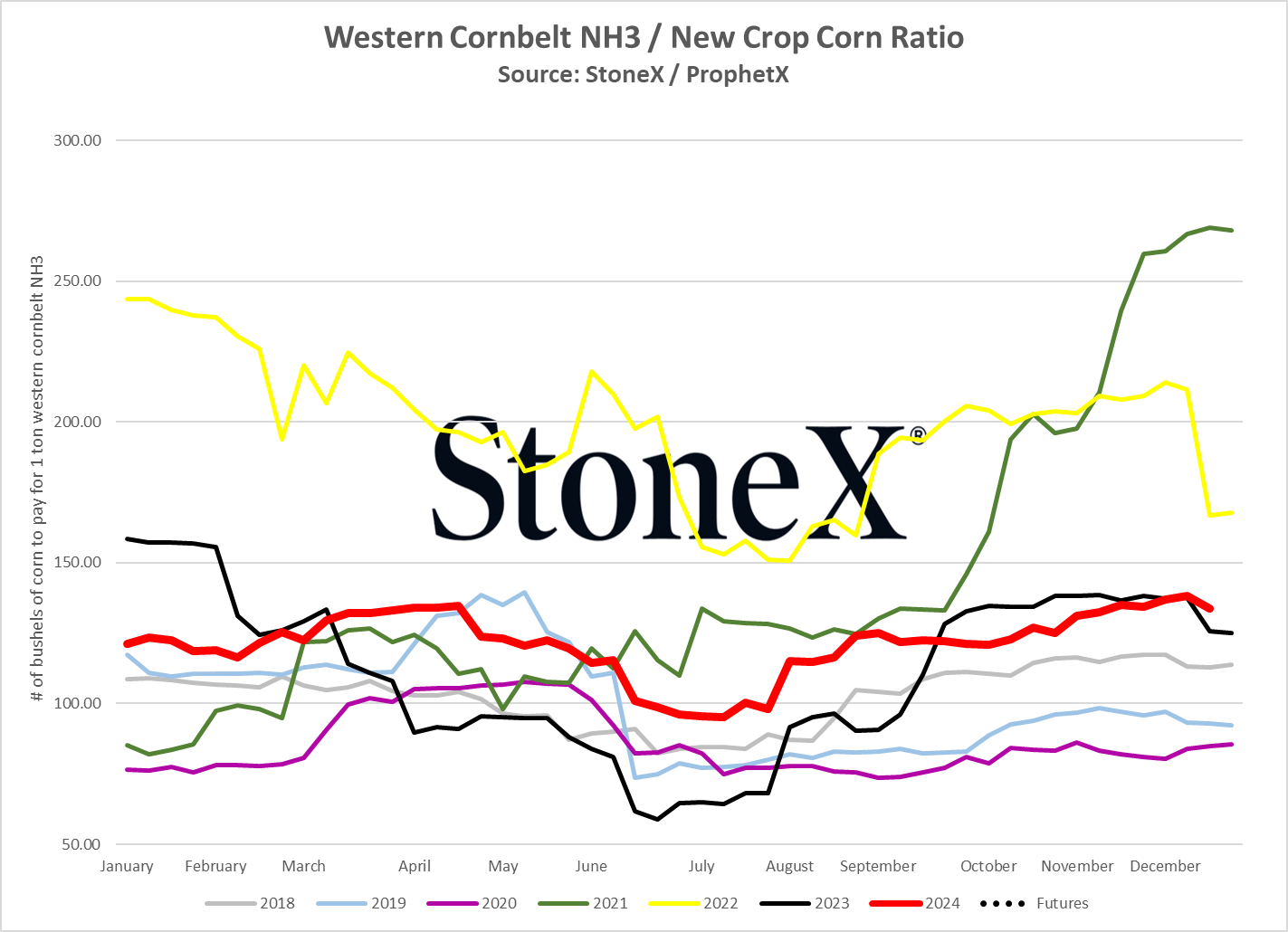

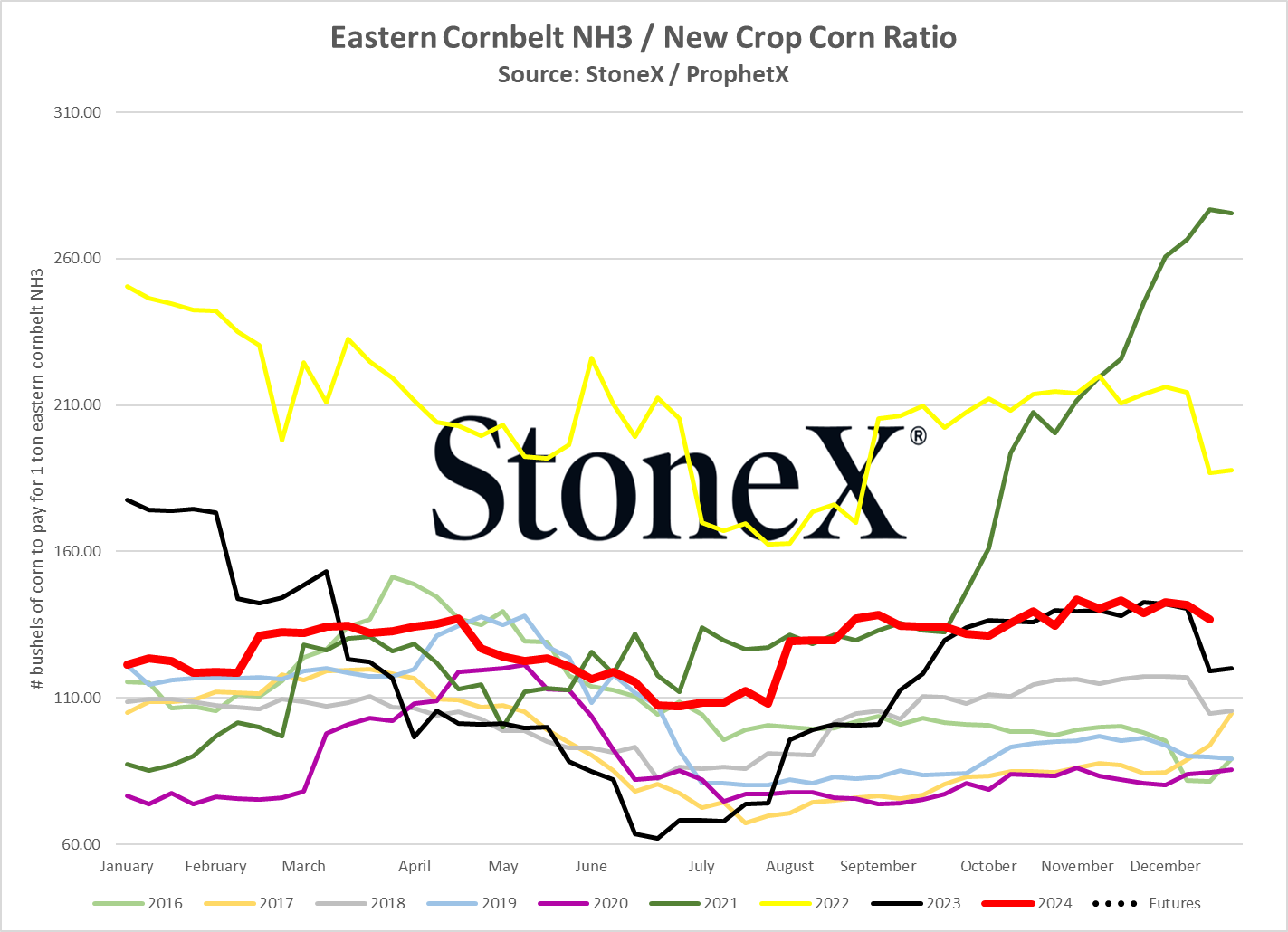

- While current values vs next year corn prices are setting some of the highest Jan/Feb values ever seen, demand doesn’t seem to be backing off

- Just seems like there are a lot more bullish avenues than bearish

- Otherwise, fall application continues for a lot of the Midwest. Might have been odd timing this fall…but at least we are getting our window.

- Paper trades today

- February NOLA Urea @ $345 (up $6 from yesterday’s settlement)

- March NOLA Urea @ $346 (up $1.5 from yesterday’s settlement)

- Physical trades today

-

- December NOLA Urea @ $333/$335/$335/$335/$338 (up $8 from yesterday’s trade)

- January NOLA Urea @ $334/$335/$337/$337/$338/$338 (up $8 from yesterday’s trade)

- March NOLA Urea @ $345 (up $2 from yesterday’s trade)

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.