12/12/2024 Morning Fertilizer Market Update

International

- Global urea markets continue to heat up as distributors work on their India offers

- Egyptian producers have now sold $380 January ship, destined for Europe

- A Middle East producer is understood to have sold upper $350’s, destined for Australia

- January Middle East urea paper has traded at $364 this morning (vs $359 settlement yesterday)

- January Egypt urea paper has traded at $383 this morning (vs $382.50 settlement yesterday)

- Now, none of these values are screaming higher (as in double digits or more)

- However, the trend has been moving higher

- I am still sticking to the tight supply situation due to EU and China supply problems

- Still nothing indicating that Chinese exports are resuming…though I know that can always change

- EU gas values are still high and the political climate has not changed

- Just hard for me to see the short fall in available inventory from both locations and think that this rally wasn’t coming

North America

- This morning has already seen physical price ranges moving a bit higher with global values

- December has been $326//$330

- January is still wide at $325//$334

- February is sitting at $330/$338

- March is bid at $335 but no sellers arriving at this time

- Those price ranges, vs where global price ideas today, are still “cheap”

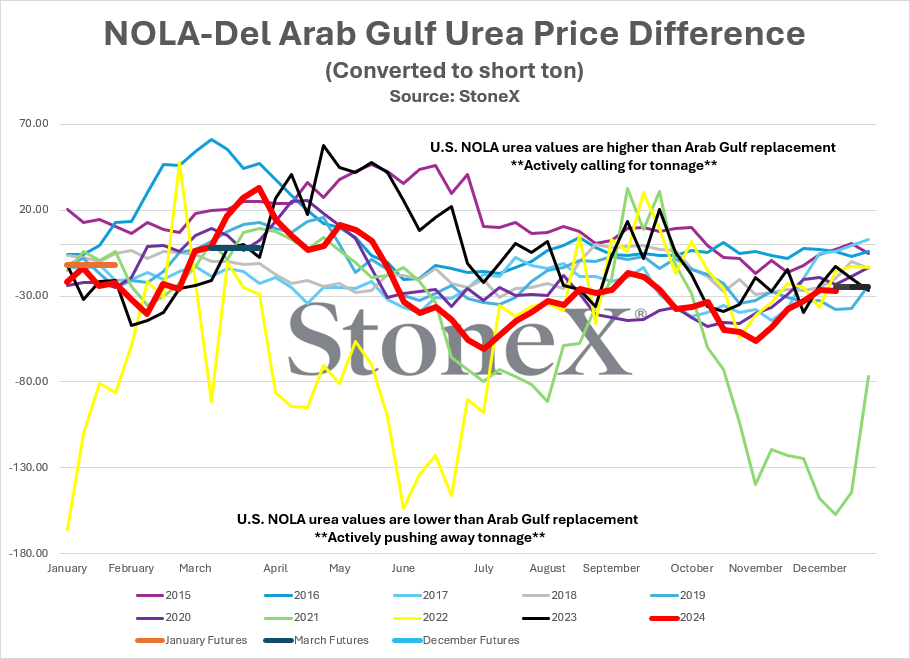

- With vessel freight rates where they are, one can assume that the FOB Middle East price is effectively the same fob loaded NOLA urea price

- With January Middle East paper at $364, that is around $364 loaded NOLA

- Even if we think March is near last done ($340 on Tuesday traded), that is still a $25 discount

- That is not going to call on spot tonnages needed to reach our import forecast

- NOLA still has more work to do in relation to the globe

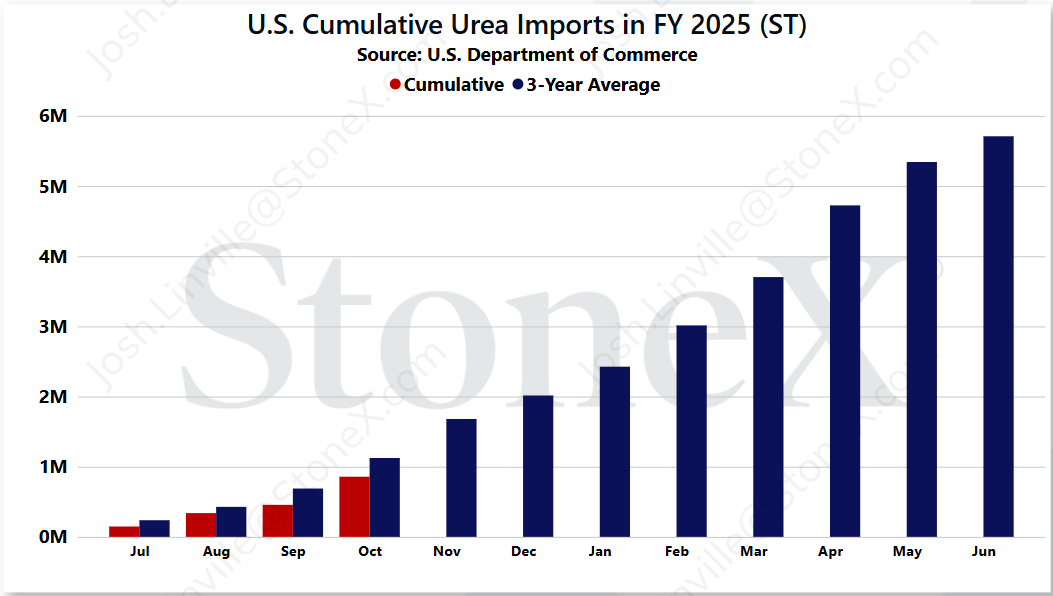

- Now, let’s back this up and keep one thing in mind, and that is our import urea needs for FY 2025

- Some folks are going to look at our imports, compare it the average, and say we are behind

- That is an absolute true statement, but it misses a point

- Thru October, we have imported 857K vs the 3-year average of 1.1M

- Not a huge differential…but it is behind

- However, the 3-year cumulative total import average is 5.7M

- WE ARE NOT FORECASTING NEEDING 5.7M TONS OF IMPORTS

- Our forecast continues to sit in the 5.1 – 5.2M ton range for the fertilizer year

- That assumes 92M acres of corn and all other crops falling in behind

- That assumes a little carryover from last year

- It assumes some production hiccups, though we are considering whether production was impacted more than we expected

- All that is to say that we are where we need to be today (October)…but we have A LOT of work to do

- That is where that Middle East / NOLA comparison comes into play

- Every month will see imports regardless the price differential

- Every month has contractual tonnages that come to the U.S. regardless of price

- However, there are “spot” tonnages that are needed to reach our needs

- That is where you see NOLA move to even money or a premium vs the world to get those tons purchased

- Some years see those flows come even with NOLA a discount because inventories are long and they need to go somewhere

- However, with the China/EU situation, it just doesn’t “feel” like that will be the case this year

- This year feels like we will need to “buy” the tons…and why would a manufacturer sell a tight market at a discount?

- Now, all of this can change as it always can

- Chinese exports can resume with a decision by the government

- Grain prices could fall hard and change the acreage outlook

- There are always risks in the marketplace but based on what I see today, it is hard to see a lot of downside potential out there

- This is the POV that we have been riding for a while now

- Now…watch the market prove me an idiot!!!!!!

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.