12/10/2024 Mid-Day Fertilizer Market Update

Weekly Video Link

https://stonex.wistia.com/medias/wqjeut19cj

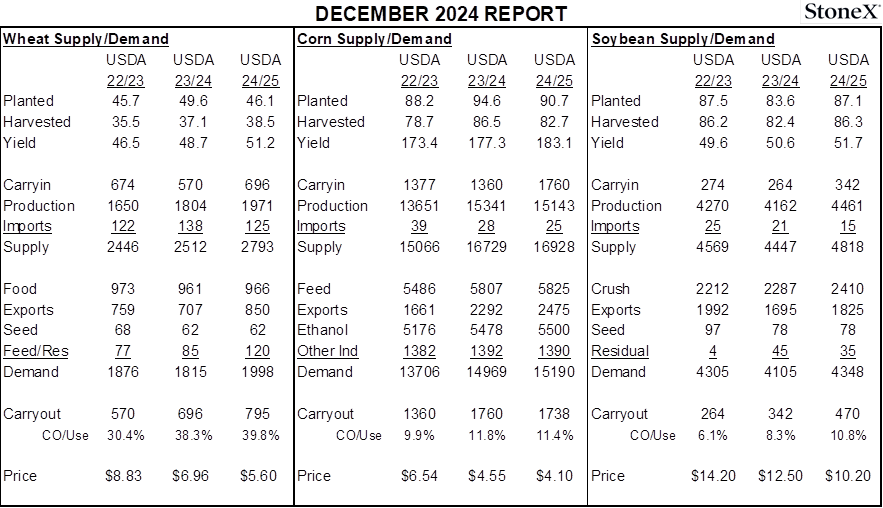

Also, December WASDE report was published this morning. Here are the details:

International

- North African nitrogen producers continue to take advantage of the bullish feel of the urea market

- Yesterday saw Egypt selling a high of $371 for January loading

- This morning has seen $374 and $376 for December and January loading

- None of these have been big tonnages that are going to wipe out any excess tonnages

- However, the higher trend is going to continue to be seen by the world

- Iran has been the other production origin point that has had tons to sell…and their production is suffering

- The government has been scaling back expectations for gas supplies

- As a result, nitrogen manufacturers there have either scaled back or completely stopped production until a better outlook appears

- While still a steep discount to the world, their price ideas have improved to over $300 once again

- So, the “world manufacturers are well sold” POV continues

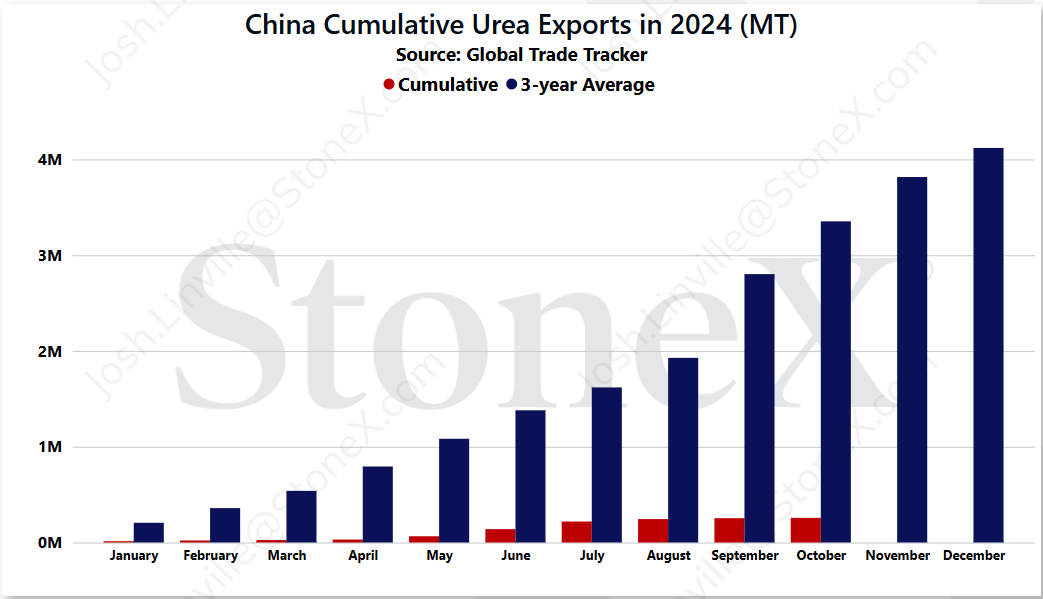

- Keep in mind that this is what Chinese exports look like for the year

- Also, European natural gas values are still high (winter months near $14MMbtu)

- Doesn’t give much hope on production rate outlooks

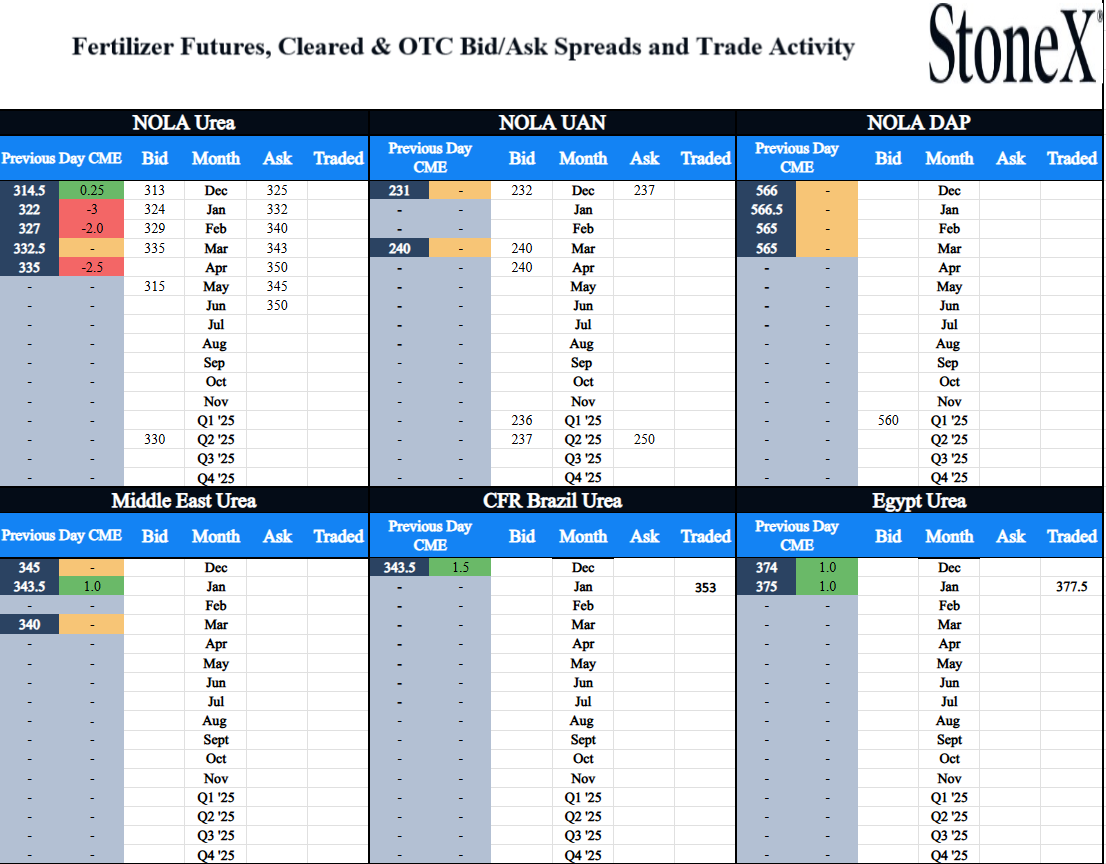

- Paper trades today

- January Brazil Urea @ $353 (last traded $342 on 11/26))

- January Egypt Urea @ $377.5 (up $2.5 from yesterday's settlement)

North America

- Started hearing that Mosaic has rolled out their winter fill program earlier than many expected

- With fall season still rolling on, many believed that they would wait until much closer to the end of the year…or the beginning of 2025

- This would give them ample time to meet just in time demand with current pricing

- That belief came from the POV that winter fill programs would be at least slightly discounted

- …it was not

- From what we have gathered, the program is $570 DAP & $610 MAP NOLA

- The DAP price is largely in line with where price ideas have been recently

- MAP is slightly higher than some recently traded barges, but a discount to what had been normal ($630’s)

- Honestly, this is not surprising

- U.S. is still struggling with imports (Russia/Morocco/China still blocked)

- Fall season has been much better than it looked in early November

- Likely going into 2025 with relatively low inventory levels…and a short calendar before spring begins

- Also, demand is still solid given the big yields out there

- So how does it shape up?

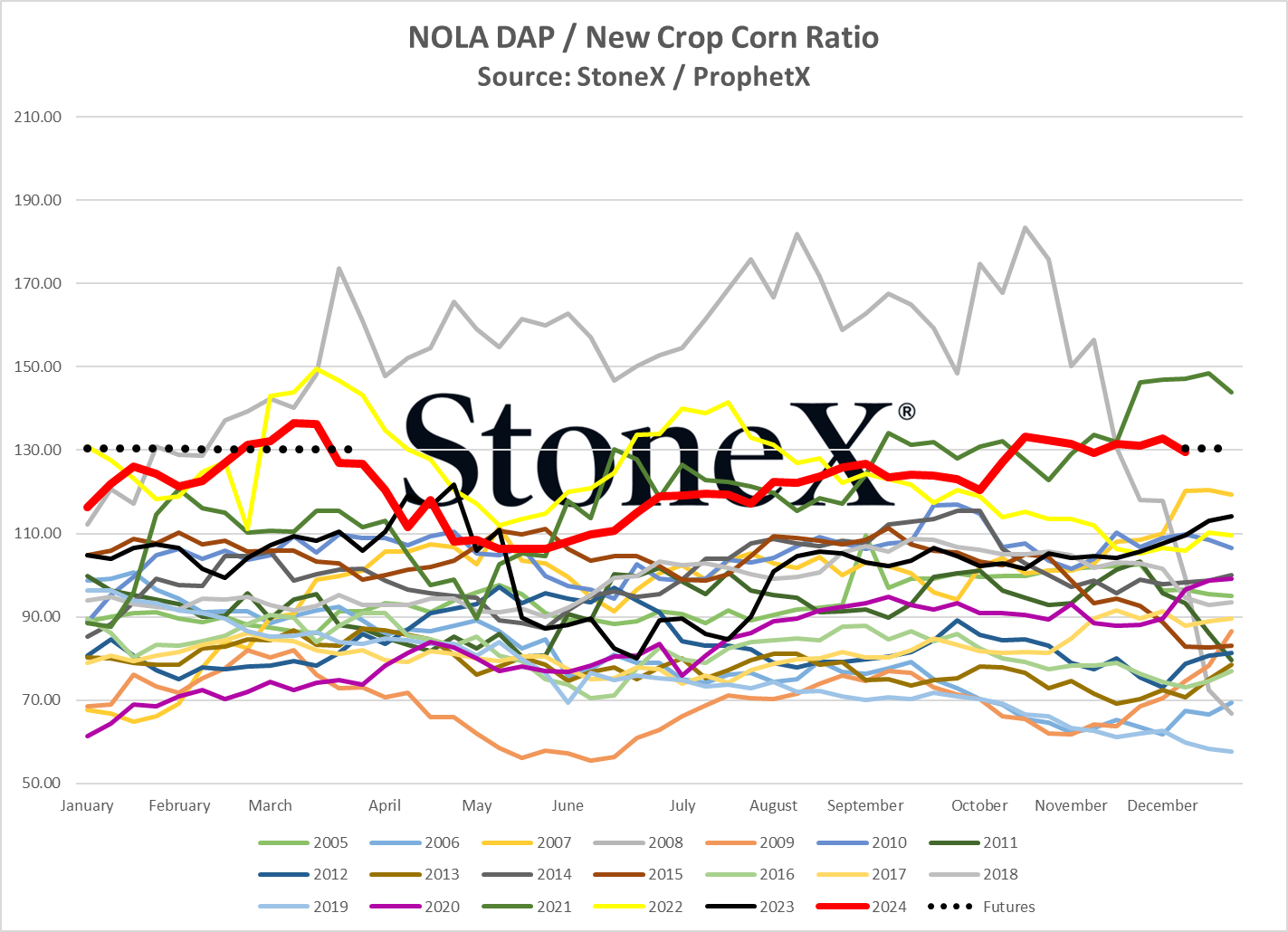

- First, if this holds in Jan/Feb, it will match and/or be the highest value to corn we have ever seen

- $570 DAP vs $4.38 Dec ’25 corn = 130 ratio

- 2008 and 2022 both saw worse values…but those were more spring/summer/early fall

- 2022 started at 130, but quickly fell off before recovering in spring

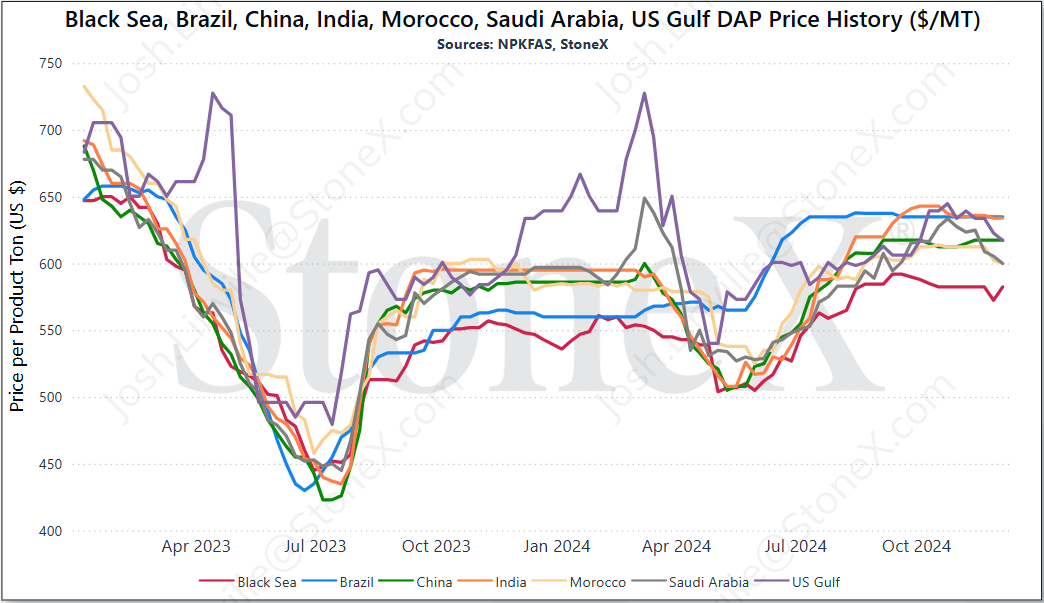

- Second, DAP at $570 is still solid vs the world

- Look at the 2nd chart below

- NOLA DAP in the $570’s is not the highest DAP price in the world

- In fact, it is a decent discount vs Brazil and India values

- Third, farmers are going to be upset but ultimately, they need it

- One of the biggest feedback points of harvest was “yields were bigger than expected”

- That does not mean everyone was trend line, but it was better than they thought it was going to be

- 2025 forecast for farmers still looks rough

- That means they need to maximize their yields to “grow their way out of the bad times”

- …you cannot do that in soil deficient of phosphate

- At the end of the day, phosphate is horribly priced…but it is only one of so many inputs that go into raising a crop

- Hard to spend the fortune to raise the crop, leave a single input short and then hurt the overall yield

- First, if this holds in Jan/Feb, it will match and/or be the highest value to corn we have ever seen

- Ultimately, I struggle with what the options are and if you believe demand will be there, hard to say no to it

- We should not see an influx of imports to compete, tariff’s have taken care of that

- Global values are still high / N.A. values are middle of the road in comparison

- Inventories are drawn down and March is 2.5 months away

- Easier call for those in the Cornbelt vs those on the fringes as those economics are more rough/demand more questionable

- Paper trades today

- No trades observed

- Physical trades today

- March NOLA Urea at $340

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.