12/09/2024 Mid-Day Fertilizer Market Update

First, a correction to this morning’s update. I had said that offers were due on the 12th. I did the American thing and looked at it wrong. It was listed as 19/12/2024. Offers are due on the 19th!!!!

International

- Not much in the way of market news outside of the India purchase tender announcement

- Was a bit surprised to see that Egyptian urea price ideas had firmed to just over $370 to finish last week

- They had been one of the major manufacturing points that still had 2024 tons to sell

- As their prices had fallen, it really seemed to weigh on global price ideas

- Now that they have found their footing and appear to be selling tons into January, it should help clean up that side

- Outside of some “special” places like Iran, that should mop up most of 2024

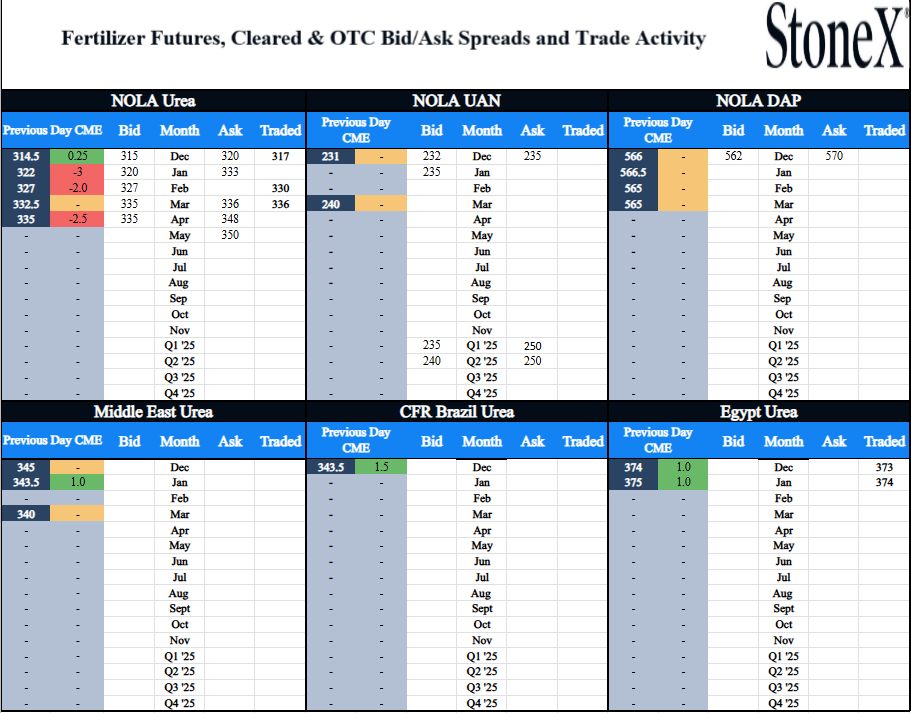

- Paper trades today

- December Egypt Urea @ $373 (down $1 from Friday's settlement)

- January Egypt Urea @ $374 (down $1 from Friday's settlement)

North America

- Surprised to see an MAP barge in the gulf trading at $600

- Those price ideas have been closer to $630 in recent weeks/months

- However, NOLA DAP prices have remained relatively unchanged with bids at $565 and offers at $570 for January

- Nice to see that gap closing much closer to “normal”

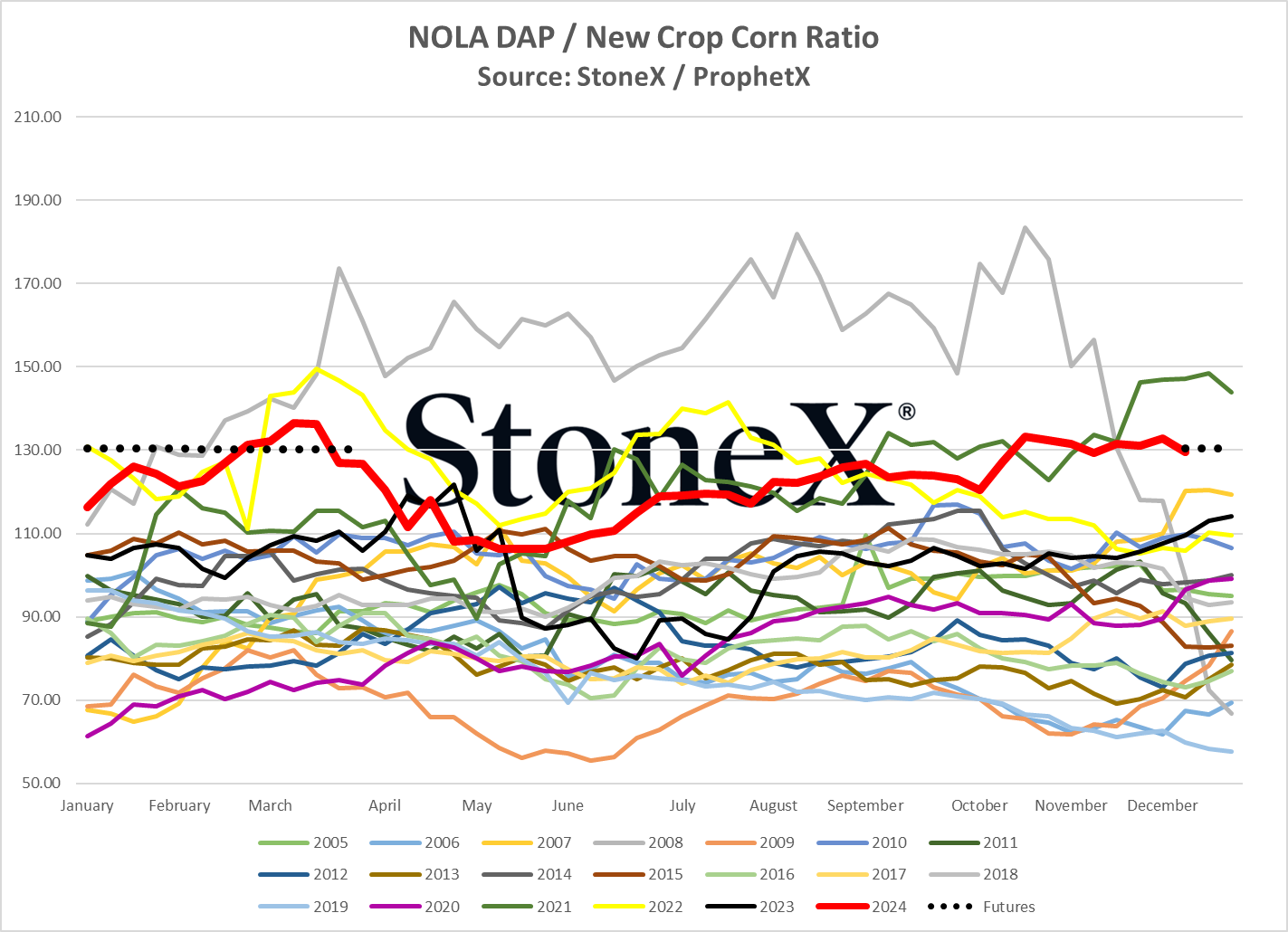

- However, there is still nothing great about phosphate values

- These are still some of the worst values ever seen when compared against corn values

- That does NOT mean that demand has been severely impacted

- For a lot of feedback, the opposite has been true…where they can run

- Just helps to show how out of line values are today

- Lastly, NH3 has made up GREAT ground in the last week

- Here at home, we are done with our ground and only have a few more days of custom application

- Looking at the forecast, we are going to get to our finish line

- It certainly was not a normal route, but we will take the wins where we can get them

- Overall, for the market, feels like we are around 75% of our forecasted 2.1 – 2.2M tons

- Glancing thru a lot of Midwest forecasts, it doesn’t look like there is going to be much of a hiccup to the run

- Going thru to the end of the long-range outlook shows Sunday/Monday in the upper-40’s/lower 50’s here in KC

- We may not hit 100%...but looks like we are going to be one heck of a lot closer than we feared only a few short weeks ago

- Paper trades today

- December NOLA Urea at $317/$317 (up $2.5 from Friday's settlement)

- February NOLA Urea at $330 (up $3 from Friday's settlement)

- March NOLA Urea at $336 (up $3.5 from Friday's settlement)

- Physical trades today

- December NOLA MAP at $600

- January NOLA Urea at $320

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.