11/7/2024 Mid-Day Fertilizer Market Update

International

- Hopefully we will start next week with decent India urea purchase tender news

- With IPL handling the tender, they usually do well at getting the information out quickly

- Going to be interesting how it plays

- Targeting 1M tons

- West coast focus

- Shipment thru December 25

- ...is there enough at these current lower prices to fill their need or will they fall short and we immediately start discussing yet ANOTHER tender?

- Paper trades yesterday

- November CFR Brazil Urea Paper - $351

- December CFR Brazil Urea Paper - $352.50

- Paper trades today

- December CFR Brazil Urea Paper - $345 / $348 / $348

- December Egypt Urea Paper - $356

North America

- Now that the Department of Commerce phosphate vote is completed, seems a lot of the discussion is now revolving around what fertilizer looks like under the Trump administration

- For tariff's, it isn't great

- Remember that it was the Trump administration that placed a 25% tariff on all Chinese fertilizer imports

- He sees tariffs as a very powerful economic weapon/tool

- No reason to believe that will change

- So if tariffs start being a bigger discussion point, what gets hurt the worst? What is the worst case scenarios?

- China

- Fortunately, anything multiplied by zero is still zero

- There are no Chinese imports into the U.S. marketplace today

- So fresh increased tenders there do not change the fundamentals

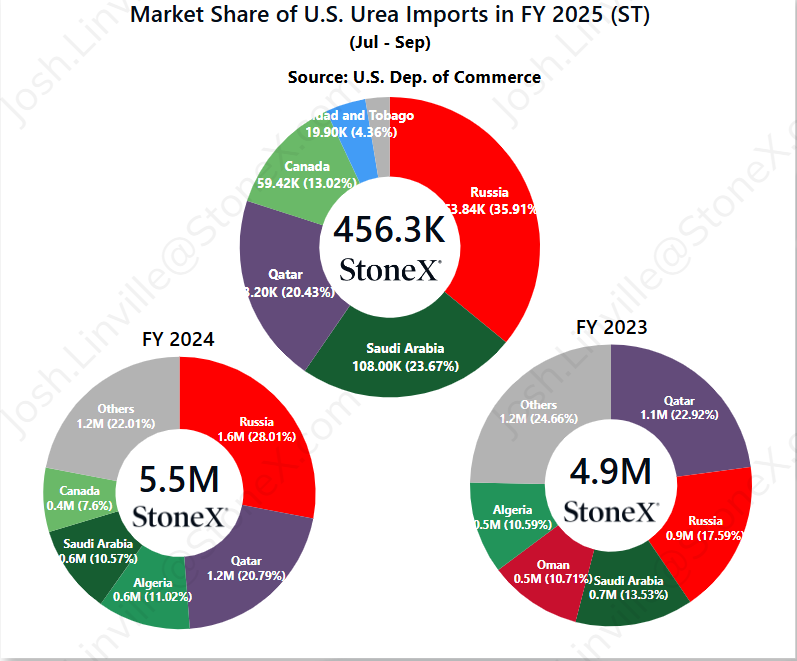

- Russia

- Fortunately, Trump and Putin seem to have a better relationship than with the Biden administration

- That does not mean they are friends, but there is a mutual respect

- The question in my mind is how is that relationship going to work in respect to Ukraine

- If common ground can be found, no issue

- But if not and tensions rise further, how does that affect fertilizer?

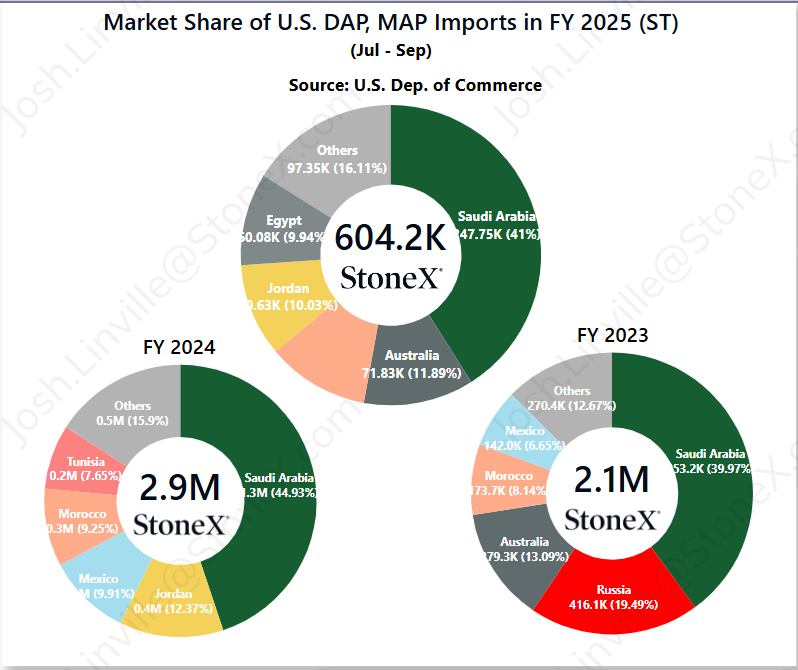

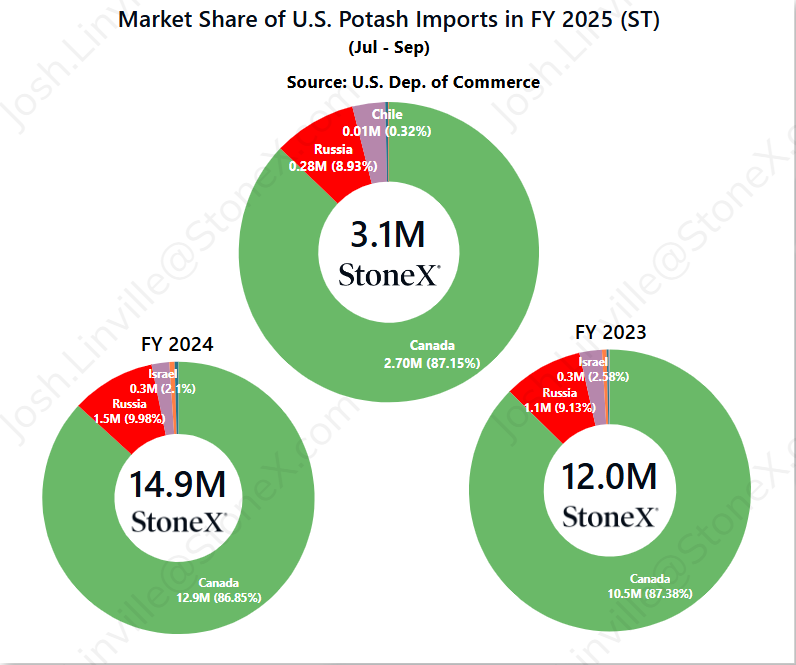

- If the U.S. imposes fertilizer tariffs on Russia, it affects N, P and K

- However, then it comes down to whether Russia can find other homes outside of the U.S.

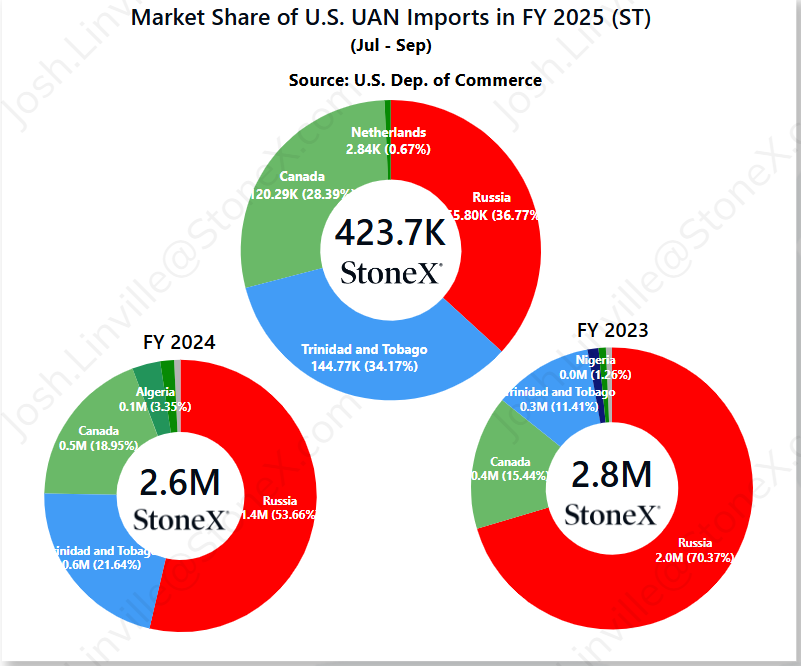

- Sure seems like that is the case in all things...except UAN

- UAN is the one that would spook me for N.A. farmers

- U.S. manufacturers have enjoyed having the European market open to their product due to production rates being lower

- However, UAN price ideas need to stay competitive with Russian imports keeping them honest

- If Russian UAN gets tariffed to the point it can no longer come, U.S. companies will celebrate

- They then have the opportunity to sell either Europe or N.A.

- ...and they do not need to worry about import competition

- I've put images of U.S. imports of the major fertilizers below to show Russia's participation (or in phosphate's case, lack of)

- Paper trades yesterday

- December NOLA Urea Paper - $320

- January NOLA Urea Paper - $325

- February NOLA Urea Paper - $328

- March NOLA Urea Paper - $335

- April NOLA Urea Paper - $335

- Paper trades today

- January NOLA Urea Paper - $321

- January NOLA DAP Paper - $575

- Physical trades yesterday

- November NOLA Urea Physical - $308 / $308 / $308

- Physical trades today

- November NOLA Urea Physical - $308 / $308 / $308 / $308

- Dec 15 - Jan 15 NOLA Urea Physical - $317 / $317 / $317

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.